In the multifaceted Chinese cosmetics market, the makeup segment occupies a significant share of the transactions. The landscape is not dominated by any particular brand, in fact, it is a multipolar system with ongoing competition between foreign and Chinese makeup brands.

As of 2023, while international brands generally still hold the lead, there is a noticeable shift in taste among the younger generations, who appear to be growing more interested in domestic production.

A closer look into makeup’s standing in China’s cosmetics market

In China, the cosmetics industry grows at a speed of 9.1% a year and is expected to generate RMB 516.9 billion in 2023. Among the many sectors it comprehends, the makeup segment in China constituted more than 17% of the market’s value in 2021.

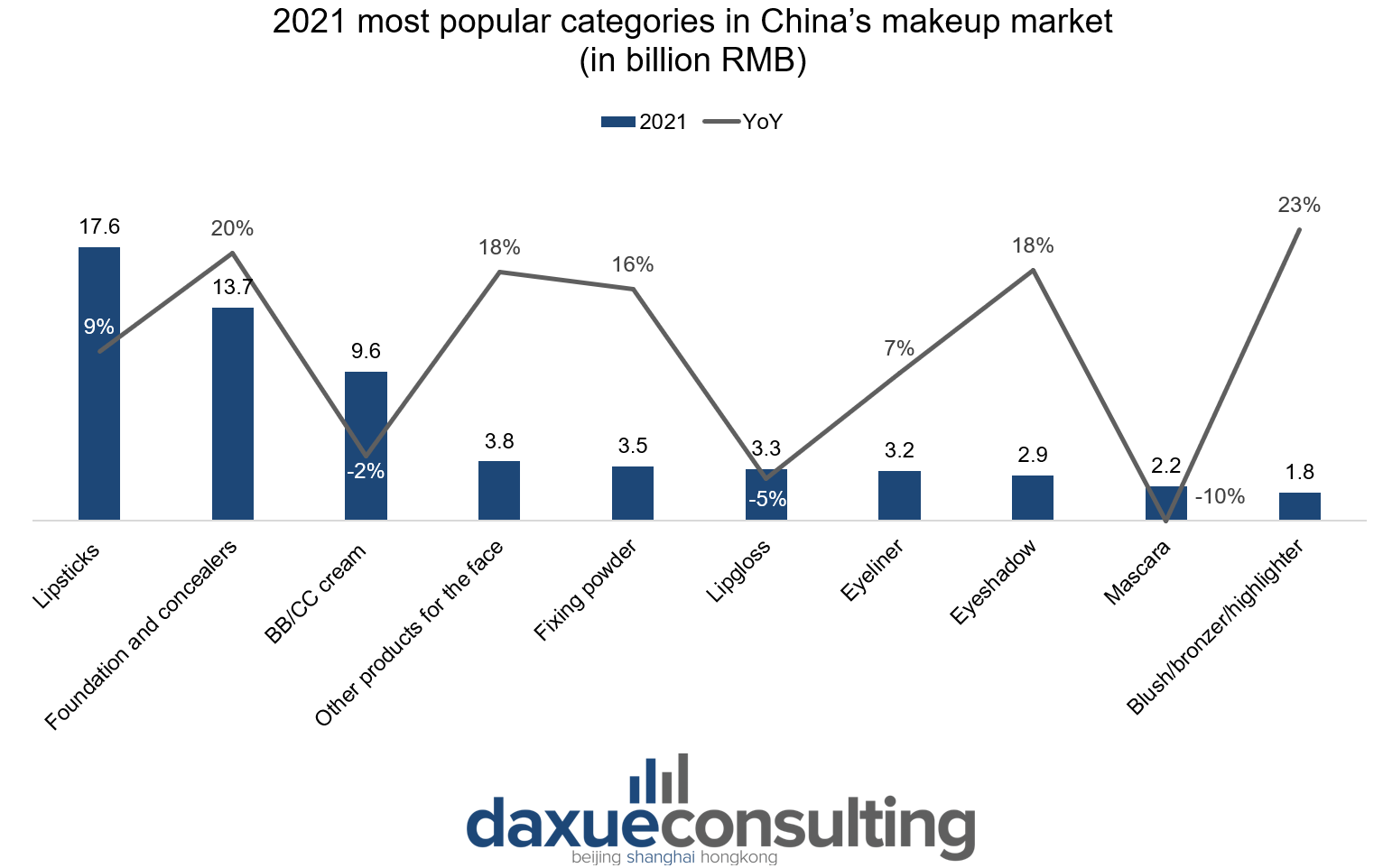

Ocean Engine’s data reveals that in China’s makeup market, the top categories in 2021 are lipstick, foundation, and BB/CC creams. However, the most significant year-on-year variation was observed in the blush/bronzer/highlighter and eyeshadows categories. The pandemic further fueled interest in eyeshadows due to reduced lipstick usage caused by face masks, leading to a heightened emphasis on the upper half of the face.

The last couple of years have witnessed the rise of domestic ones in the makeup sector. Some foreign companies even left the market, like the low-priced American brand E.L.F., which announced its withdrawal in February 2023.

The reasons behind the slow downfall of international brands and the accelerated rise of domestic ones are to be referred to two important factors.

First and foremost, Chinese consumers are currently strongly influenced by the Guochao trend, which consists of the revival of Chinese cultural references in products. Chinese people are growing more interested in buying locally-produced goods which are perceived to be more suitable for their features and needs.

Secondly, international brands often face a challenge in adapting their products to suit Chinese skin types and preferences. While Westerners may prefer bold and vibrant makeup looks, Chinese consumers lean towards a more natural appearance, with an emphasis on white and glowing skin and light-colored eyeshadows.

Download our white paper on China’s beauty industry

New trends and C-beauty standards influence consumers’ makeup choices

New trends among the younger generations reveal a shift in beauty standards and makeup looks. In particular, two new styles among Chinese women are starting to emerge: the “split femininity” (or chunyu,纯欲) and the “nationalist femininity”, influenced by the Guochao trend.

The chunyu trend, meaning in Chinese “purity and desire”, consists of a makeup look which appears to be both innocent and attractive, mirroring the old cultural stereotypes of a woman who is desirable but pure. The second one originates instead from a fusion of Chinese culture and modern beauty standards. It readapts traditional makeup looks, like the one of the Peking Opera, into modern new tastes, mixing old and new.

Naturally, Chinese consumers are not repulsive to international styles. In fact, multiple foreign influences can be found embedded in other Chinese makeup looks, like the Thai thick and bold eyebrows and the Western heavy eyeshadows use.

Unveiling C-beauty standards

Chinese brands have a clear advantage in understanding market trends and consumer preferences, enabling them to design products that captivate attention.

When designing new makeup products, it is important to align with C-beauty standards, which emphasize white skin and a natural yet sophisticated makeup look.

A popular trend in China involves using eyeshadows and pencils to make the eyes look bigger. In fact, Chinese consumers are placing greater emphasis on their eyes, and to further enhance their gaze, colored contact lenses are becoming increasingly popular.

Chinese makeup brands take inspiration from the country’s traditions and multiculturalism

After widely discussing the reasons behind Chinese makeup brands’ surge in popularity, it is time to navigate the variegated landscape and introduce the major domestic brands.

In the first half of 2023, the C-beauty brand Proya has probably been the one experiencing the most obvious growth. During 2023 Women’s Day (3.8 妇女节), it registered an increase of 56% in sales. Furthermore, during 2022 Douyin’s Double Eleven, its umbrella brand Timage (彩棠) ranked 10th among the best-selling makeup brands throughout the whole event. The reasons behind its success are an effective marketing strategy, rich in both online and offline events, and a clever positioning as a low-priced makeup brand emphasizing Chinese beauty. The founder, the makeup artist Tang Yi, invented the “blank” style, which readapts the traditional art technique liubai (留白) of Chinese paintings to the makeup sphere. By applying light makeup, his purpose is to use the “blank” areas to emphasize the person’s facial characteristics.

Florasis’ attractive designs draw inspiration from Miao ethnicity’s culture

Another hot brand in the makeup sector surely is Florasis (花西子), which in recent years has also been capturing the attention of the international audience. Florasis is a brand of affordable products which drives inspiration from the peculiar designs of the Miao ethnicity. Their products’ appearance and packaging suggest the company’s elegance and refined tastes. Thanks to their uniqueness, they successfully ranked first in 2022 Double Eleven on Douyin and are now among the most popular Chinese brands both inside and outside the country.

Mao Geping as a premium brand mastering lights and shadows

In the high-end market, the dominating domestic player is undoubtedly Mao Geping (毛戈平), founded in 2000 by the renowned makeup artist bearing the same name. Mr. Mao Geping is known for being a master in dosing the lights and shadows in his makeup creations: the brand concept revolves around his unique aesthetic system, which reshapes the form of the face and perfectly adapts to the skin of Asian women.

The brand had opened 367 counters across the country by the end of 2022 and registered a revenue of RMB 46 million in the same year.

Other players and Perfect Diary’s recent downfall

In the fiercely competitive makeup market, companies’ positions remain unstable and subject to constant change. Among the other prominent Chinese makeup brands are Meikang Fendai (美康粉黛), Judydoll (橘朵), Pechoin (百雀羚), Carslan (卡姿兰), Herborist (佰草集) and Inoherb (相宜本草). These last two brands incorporate Traditional Chinese Medicine (TCM) into their products’ recipes, catering to consumers’ who seek sustainable and safe cosmetics.

Special attention should be given to the brand Perfect Diary (完美日记) which, after a swift rise in popularity, soon encountered an equally swift setback.

Until 2020, it stood as one of the best-selling in the sector, ranking 1st during 2020 Double Eleven event on Douyin. Their remarkable success came from well-planned marketing campaigns, strategic collaborations with influential Key Opinion Leaders (KOLs), and a focused target audience – the younger generations.

However, low investments in the R&D sector led to perceptions of poor product quality. With the rise of their prices in 2020, the web ridiculed them for the seemingly unjustified high price of their last Xiaoxihe (小细跟) lipstick, costing RMB 79.9.

Perfect Diary’s case serves as an example of the potential negative consequences that arise from overemphasizing marketing efforts over product quality.

Capitalizing on social media to enhance the brand’s position in the Chinese makeup market

Leveraging social media platforms to advertise brands’ products is crucial, especially since the driving force of the cosmetics sector, the Gen Z, is highly active on most of them. They are an ideal channel to connect, engage, and build authentic relationships with consumers, fostering brand loyalty, and rapidly reaching a wider audience through shareable and viral content.

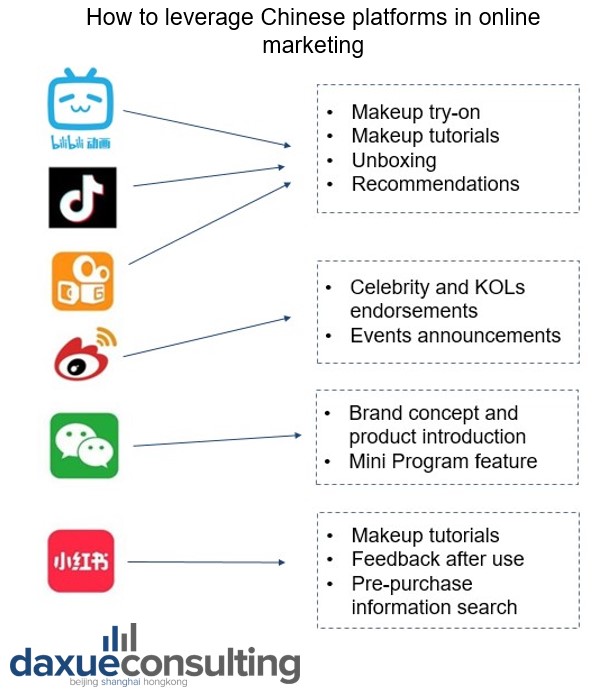

The Chinese digital landscape is vast and offers plenty of opportunities for connecting with the audience, but it is necessary to know how to make the best use of each channel.

Multichannel marketing

Each Chinese platform offers diverse opportunities for content marketing, depending on the flow of users and their consuming habits. For instance, on the short-video streaming apps Douyin and Kuaishou, brands can collaborate with KOLs to showcase makeup try-ons, tutorials, and unboxings. Weibo typically focuses on celebrity endorsements, while WeChat provides the opportunity for companies to set up their own official accounts and provide in-depth product and brand visions introductions. On Little Red Book, brands and KOLs share tutorials and product reviews; furthermore, the comment section provides discussion spaces where users can share feedback and personal experiences with the products.

Embracing these platform-specific approaches enables brands to effectively engage with their target audiences and build a strong presence in the Chinese social media landscape.

Although all of these channels surely have their importance, the most profitable digital platforms to work on in the makeup segment are probably Douyin and Little Red Book. Young consumers, in fact, tend to seek products reviews and suggestions there and directly buy on them through in-app purchase services.

Douyin in particular offers great opportunities thanks to the popularity of its online events and its tendency to set new trends among the younger generations.

What to do to remain relevant in China’s makeup market

To stay relevant in the dynamic Chinese makeup market, it is advisable to adopt a multifaceted approach, combining both online and offline stores to enhance accessibility and reach a broader customer base. Investing in R&D might also improve the company’s positioning in the market: the more a brand is perceived as technologically advanced, the more attractive it appears in the eyes of the tech-savvy Gen Z and Millennials consumers. For instance, some foreign brands like L’Oréal have introduced Advanced Reality (AR) and Artificial Intelligence (AI) technology into their marketing strategies to give consumers a more personalized experience of their products.

By embracing R&D and keeping in mind the Chinese audience’s characteristics, makeup brands can thrive in this competitive market and maintain their relevance.

Empowering domestic makeup brands: trends and strategies for success in China’s makeup market

- The makeup market in China is projected to generate RMB 516.9 billion in 2023 and it hold 17% of the share in the cosmetics industry.

- Although the market is still dominated by international companies, Chinese makeup brands are becoming more popular.

- Key players in the market include Proya’s brand Timage, Florasis, and Mao Geping.

- Social media, especially platforms like Douyin and Little Red Book, are crucial for engaging with Gen Z consumers in the cosmetics sector.

- To remain relevant, brands should have a strong presence both online and offline, invest in R&D and adopt advanced technology in their marketing strategies.

Author: Chiara M. Barbera