The scale of the Chinese sports and fitness industry is exploding. According to data compiled by the Chinese General Administration of Sports, from 2016 to 2025, the number of athletically engaged people in China will grow by 39%, from 360 million to 500 million. Not only will there be more athletes and fitness fans, but the expenditure per capita is also set to increase. Because of the expected development of exercise habits in China, we investigated what specific sports and fitness perceptions and habits Chinese people embrace.

The survey answers two main questions: one, what is the perception of fitness and the importance of exercise in their lives; two, what forms of exercise do Chinese prefer. The data collected stems from 1,354 respondents, 85.8% of them between 18 and 24, and 88.5% of them being women. Therefore, this survey is not necessarily representative of the Chinese population as a whole, it gives a sense of exercise habits of young Chinese adults, especially women, which is often the target market of fitness brands.

Through this survey, we found that the respondents view exercise as important, but there is room for their habits to further develop, in terms of length of time exercising and engagement. Our Chinese respondents prefer to exercise alone and often outdoors. Also, they prefer convenient and low-cost activities like running and walking outside. Despite having a huge fitness market, expenditure per capita in the Chinese fitness market is still low. So it is not surprising that compared with western countries, both gym memberships and advanced fitness nutritional supplements like protein powder and creatine powder are consumed less in China. For fitness-related food to enter the country, marketing and price compression are important.

Chinese view exercise as important

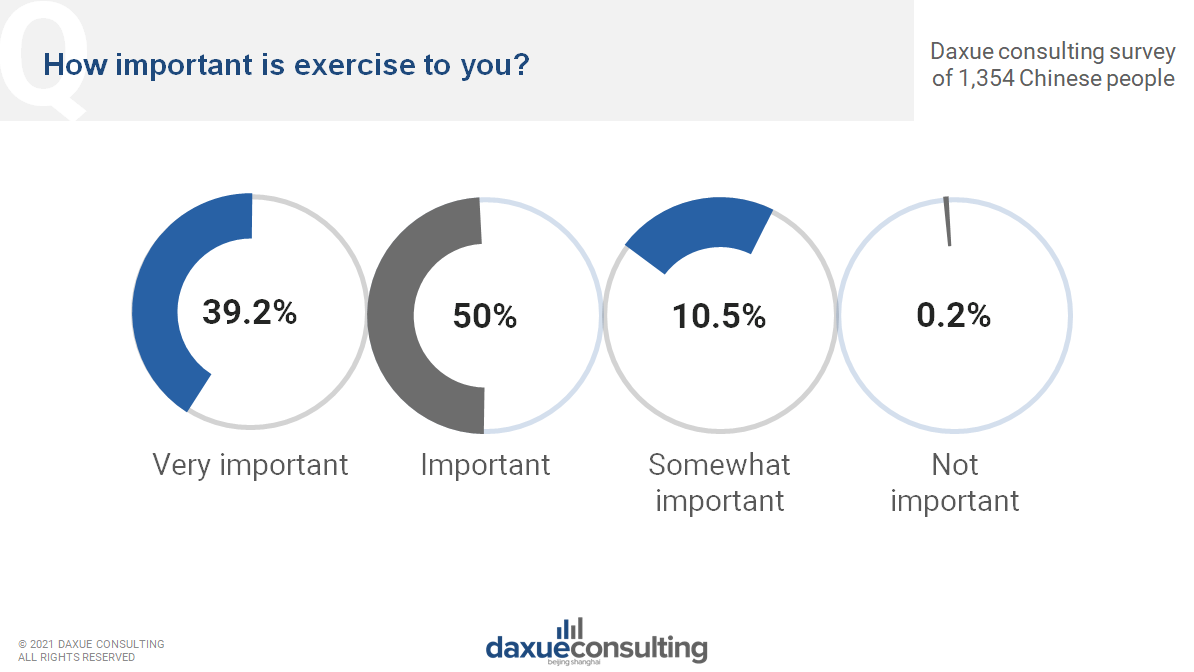

Most Chinese attach great importance to exercise. In the survey, 89.2% of people think exercise is of great importance to physical and mental health, but only a little over half exercise more than once a week.

Data source: daxue consulting survey on exercise habits in China, importance of exercise to Chinese

Despite enthusiasm for exercise, most Chinese respondents do not meet doctors prescribed exercise amount

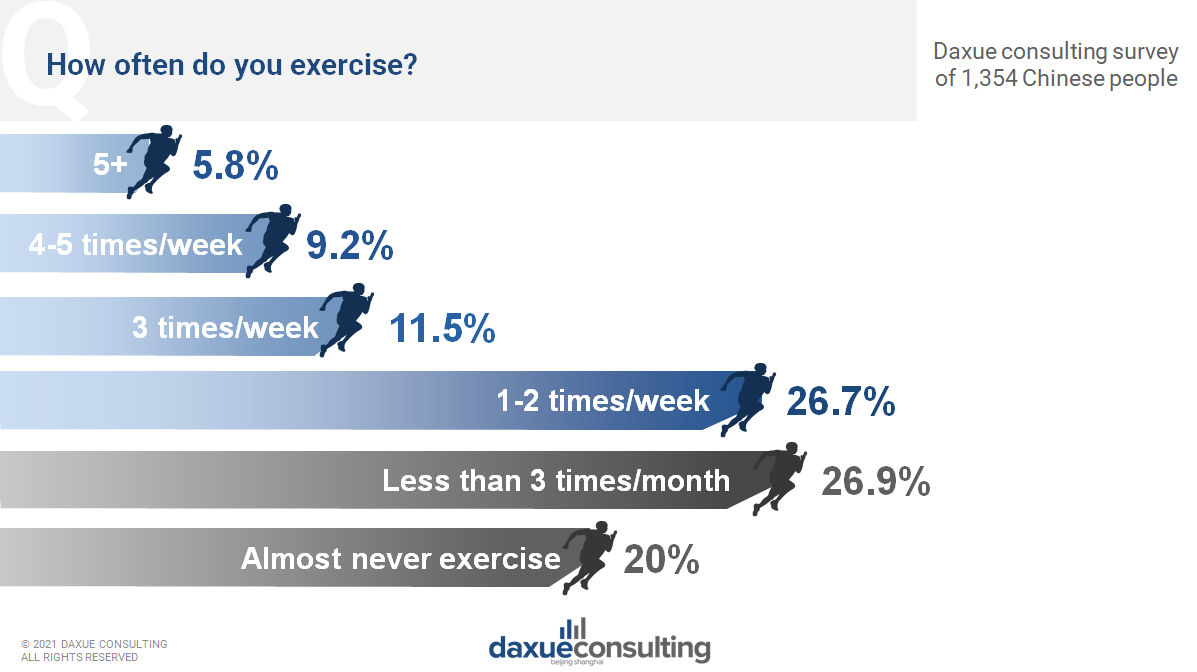

In addition, the young Chinese tend to have much insufficient exercise time and. According to Harvard Health Publishing, for health, doctors “prescribe” at least 30 minutes of moderate exercise or 15 minutes of intense exercise a day, which is between 105 minutes and 210 minutes per week. Only 44.9% of respondents report exercising up to 120 minutes a week, while 20% of respondents report almost never exercising.

Data source: daxue consulting survey on Chinese exercise habits, the exercise frequency for Chinese

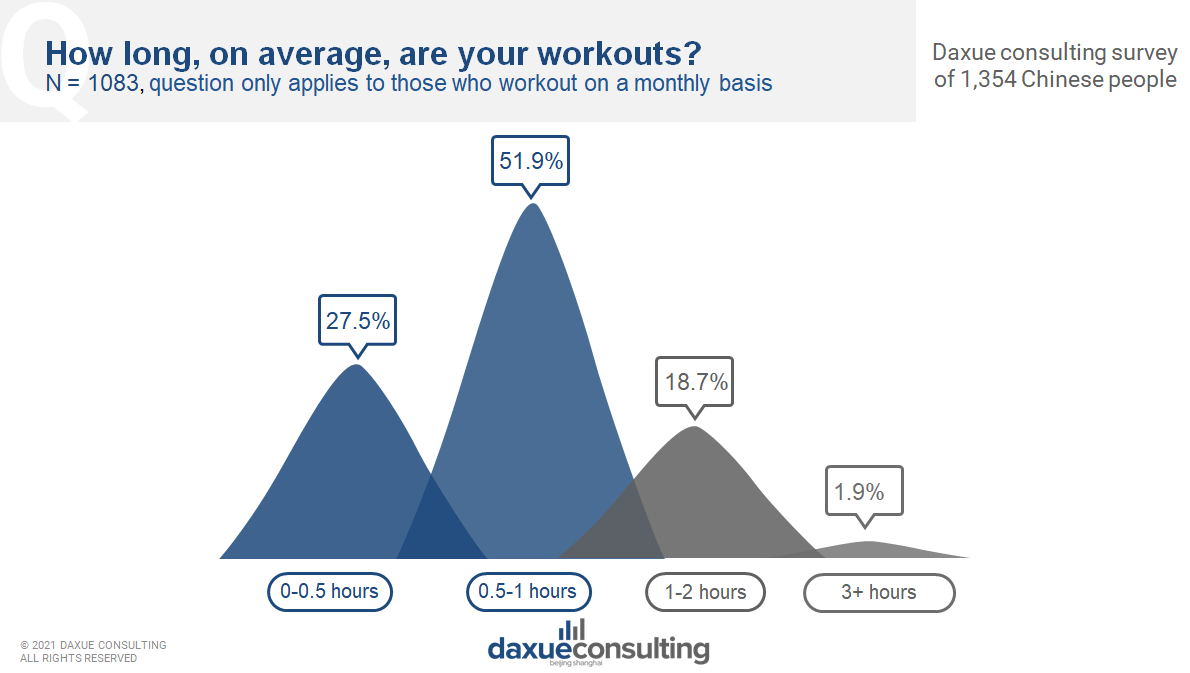

Data source: daxue consulting survey on exercise habits in China, average duration of exercise per session

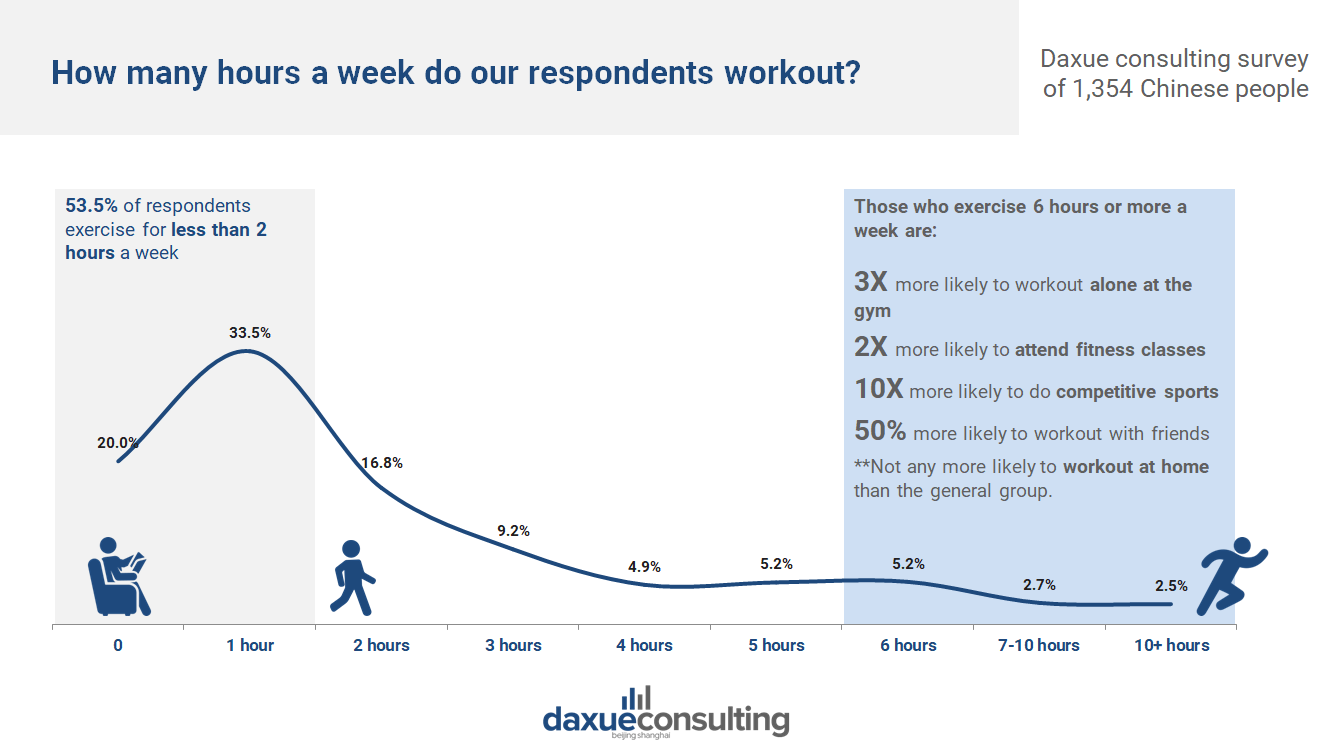

Data source: daxue consulting survey, how many hours a week respondents work out and what workouts they prefer.

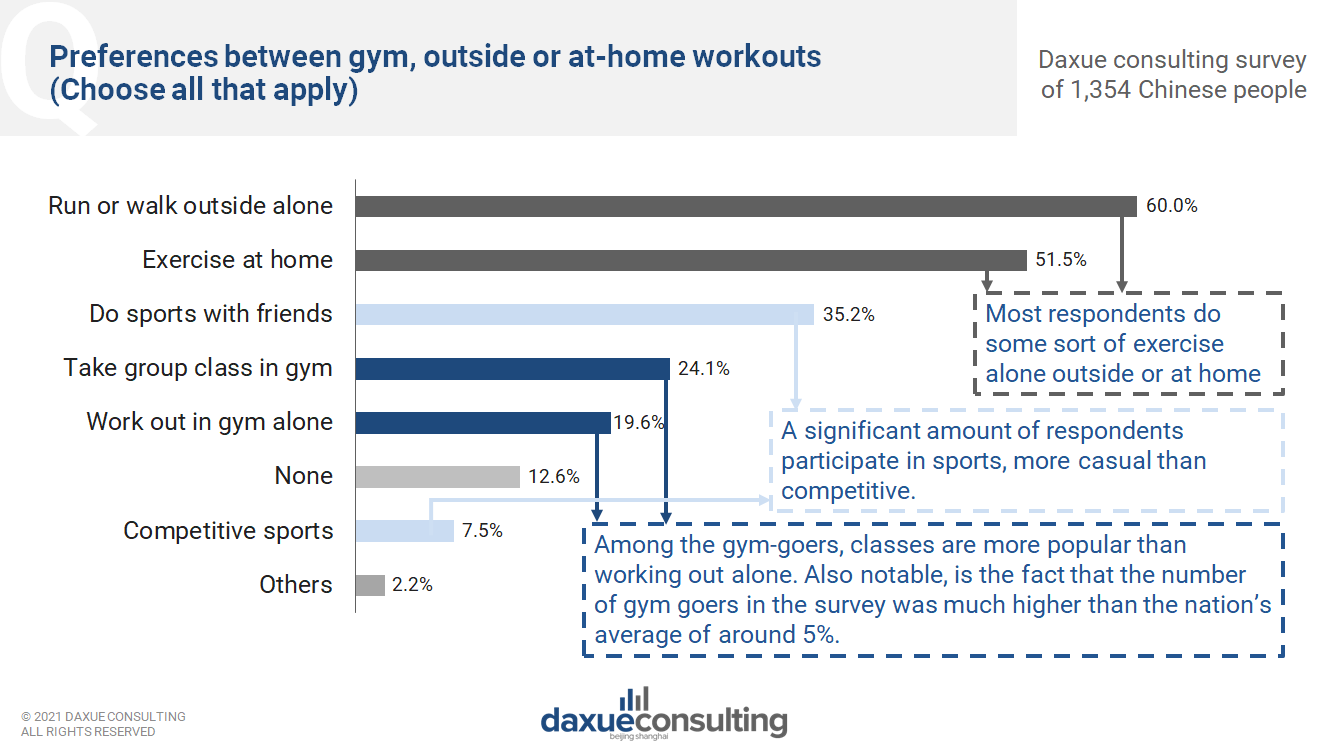

Over half of our respondents work out for less than two hours a week, and on the other end, more than 10% of respondents report exercising six or more hours a week. Those who work out more frequently are 10 times more likely to do competitive sports, 3 times more likely to work out alone at the gym, and 2 times more likely to attend fitness classes. However they are only 50% more likely to work out with friends, and not any more likely to workout at home. This shows that at-home workouts are not anymore popular among serious fitness fans, and they can be marketed towards the general population.

How do our Chinese respondents prefer to workout?

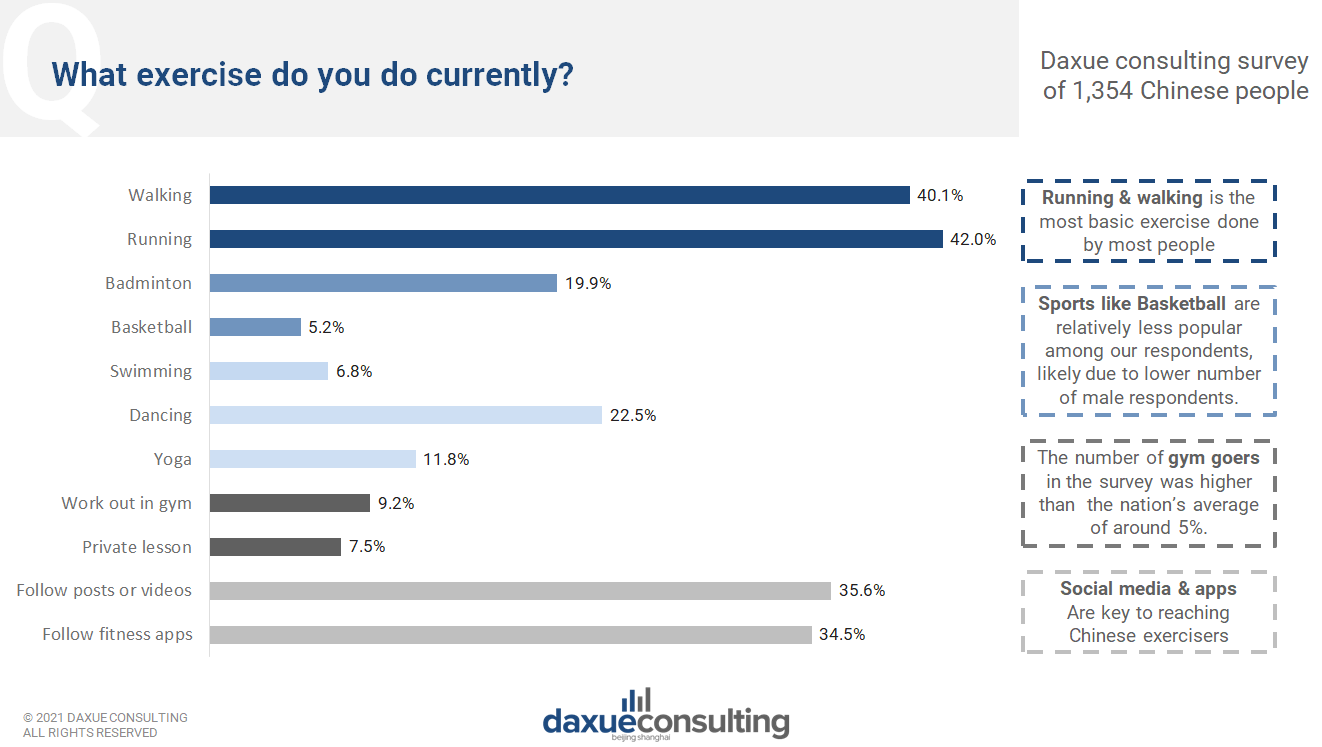

Although the exercises are diversifying, Chinese still prefer the ones with low cost and easy access. Around 40% of the respondents include running or walking in their daily exercise, compared with 23.0% for running and 17.0% for walking in UK in 2016.

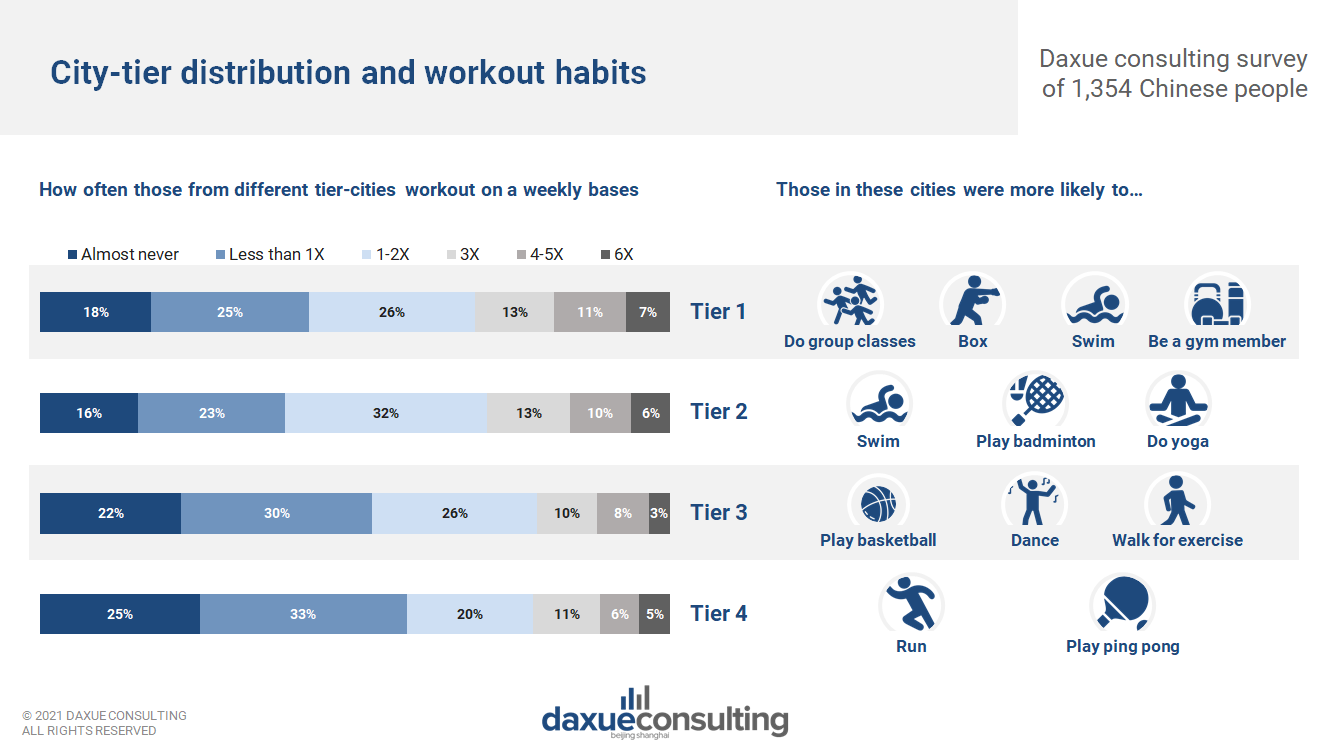

The preferred exercises vary by city-tier, as different city tiers represent different levels of market maturity and economic development. As expected, higher tier city residents are the most active and most likely to engage in high-cost exercises like boxing and group classes. With a lower penetration of gyms in tier-4 cities, more people default to running or activities like Ping-Pong for exercise.

Chinese prefer to exercise outside or at home over gyms

Our survey results indicated that Chinese prefer to exercise alone, either outside or at home. However, while serious exercisers (those who exercise more than 6 hours a week) are much more likely to be gym members, they are not any more likely to workout at home. This breaks open the market for at-home workout brands.

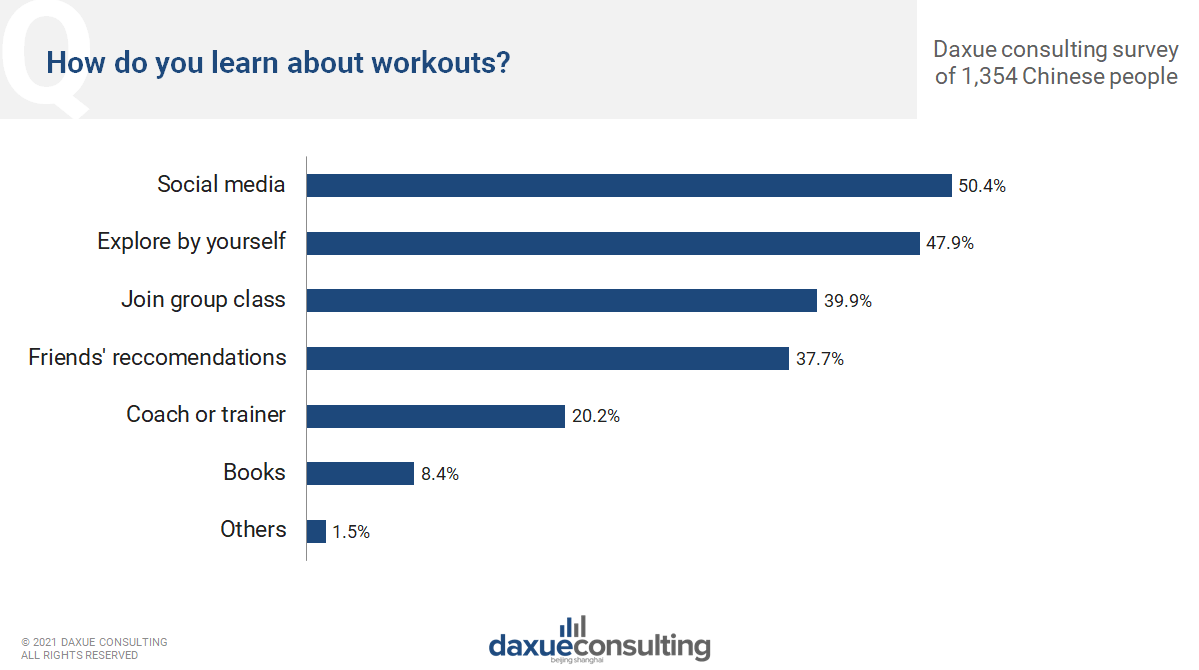

60% of respondents prefer to run or walk outside alone and 51.5% of the people like to exercise at home. When asked about how you prefer to get to learn about fitness, 51.4% of the participants browse posts or videos in social media apps like Xiaohongshu and Bilibili, and 47.9% explore the activities by themselves. All the ways mentioned give them a more private space and allow them to exercise without anyone’s attention and judgment.

Data source: daxue consulting survey on exercise habits in China, what ways do Chinese prefer to exercise

Data source: daxue consulting survey on Chinese exercise habits, what way do Chinese prefer to learn about workouts

As new sports and exercises are entering the market, many Chinese fitness consumers are in the learning stage of their fitness journey. Social media is not only very important in China because of the digitalized market, but also to use as a channel to teach consumers about products and exercises they might not be familiar with.

Chinese expenditure on fitness products

Altogether 70% of the participants choose to follow fitness apps like Keep and fitness videos published on social media like Bilibili. Only 6.2% of the app or platform users pay for the content or courses in fitness app or social media, while the rest view free material.

Low average per-capita expenditure on exercise

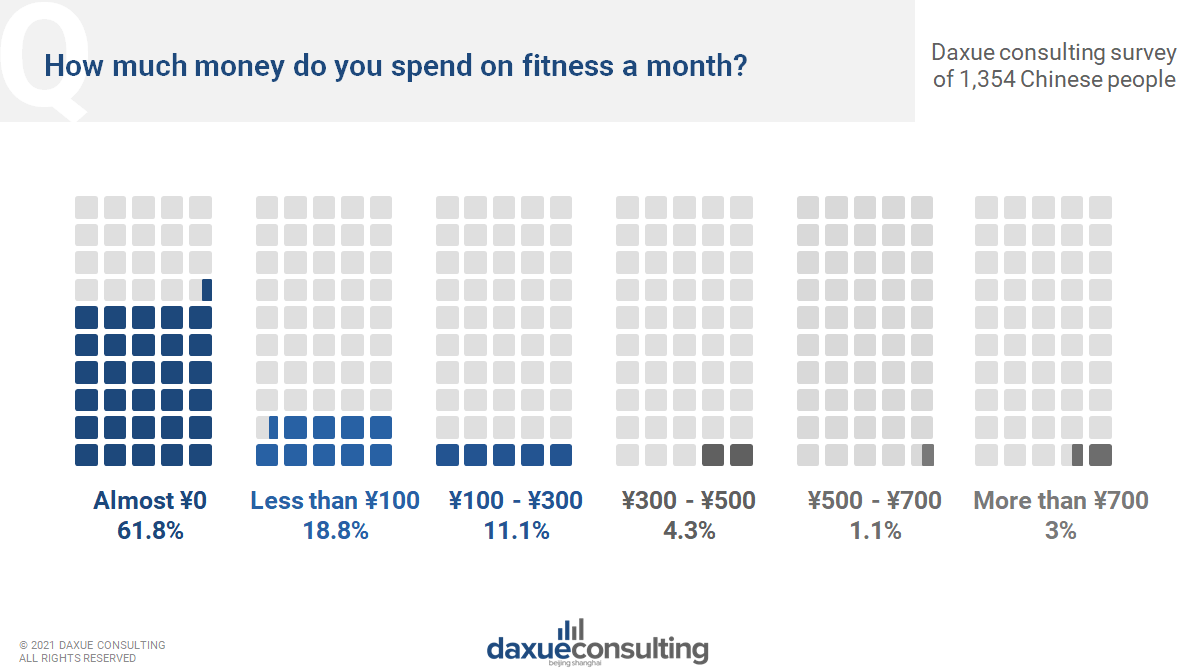

In our survey, the Chinese respondents preferred inexpensive exercise, there is still a lot of room for growth. 91.7% of the participants spend less than ¥300 every month, with 61.8% of them spend almost nothing. Much lower than £176 (approximately ¥1,591) mean expenditure per month in UK even in 2016, for comparison.

Data source: daxue consulting survey on Chinese exercise habits, how much money Chinese spend for fitness per month

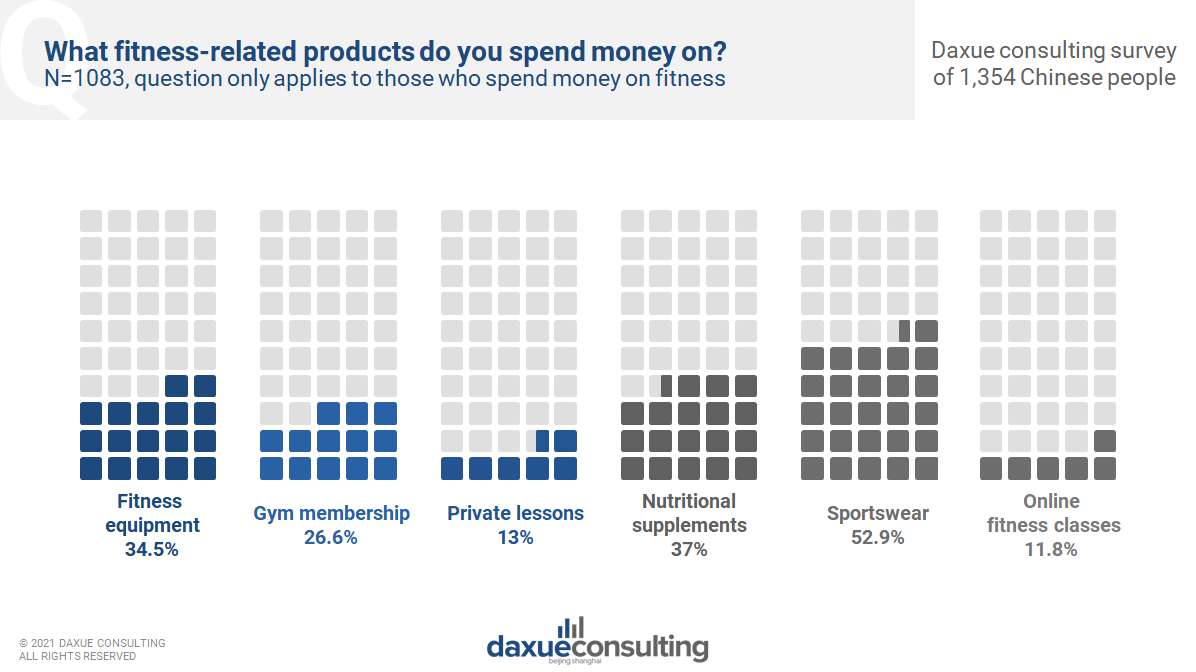

For the 38.2% of people who invest in fitness on a monthly basis, 52.9% and 37.0% of them report buying fitness clothing fitness nutritional supplement respectively. Also, 26.6% of them pay for the gym memberships, with half of the members taking private lessons. 34.5% of them invest in fitness equipment.

Data source: daxue consulting survey on Chinese exercise habits, where do Chinese spend money on fitness

More potential room for Chinese fitness nutritional supplement market to grow

Quoted from Beijing International Sports, Health and Nutrition Industry Development High-level Forum, in 2018, the overall size of China’s fitness nutritional supplement market was US $329 million. In the past five years, the compound annual growth rate of industrial retail sales was as high as 40%, which was much higher than the 11% of the global industry. One of the main driving forces behind the market growth comes from the rapid expansion of the fitness population.

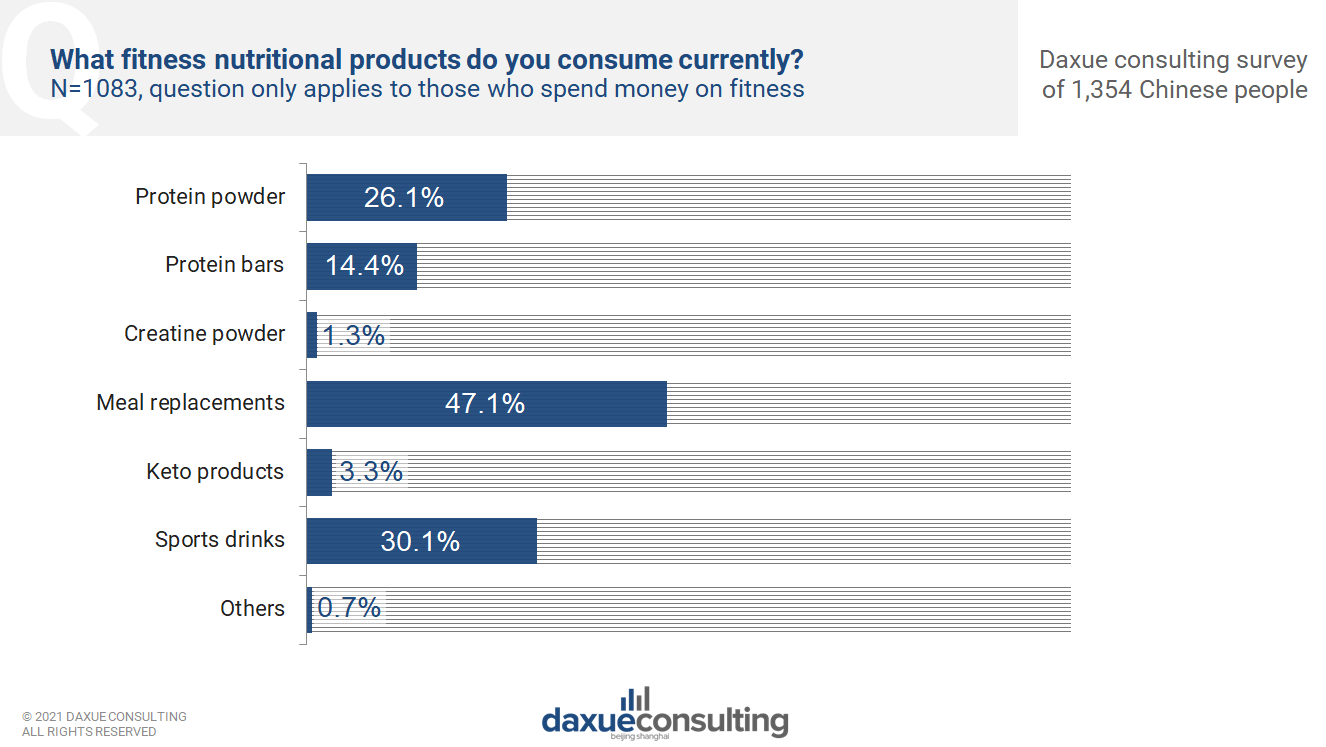

For our 1,083 respondents who exercise regularely, only 153 of them, 14.1%, consume fitness nutritional supplements. 47.1% and 30.1% of them consume meal replacement products and sports drinks respectively. Whereas 26.1% and 14.4% of respondents consume protein powder and protein bars respectively, the more advanced fitness nutritional products. Meal replacement is trending in China, especially since COVID-19 and among women who wish to lose weight.

Moreover, maybe because 88.5% of our participants are women and they have less demand to gain muscle, almost no respondents reported buyng creatine powder. When following up with survey respondents, we found that few respondents were familiar with the product, most being male.

Data source: daxue consulting survey on Chinese exercise habits, nutritional products that Chinese respondents consume

Gym members are the to the ideal target consumers for nutritional supplement merchants. Gym-goers tend to have higher expenditure on fitness, contributing to 68.8% of participants who spend more than ¥700 every month. Not only do these people buy more fitness equipment, but also more advanced fitness nutritional products like protein powder. Compared with participants who consume fitness nutritional food, 47.1% of the gym people consume protein powder, which percentage is almost as twice large as the former one.

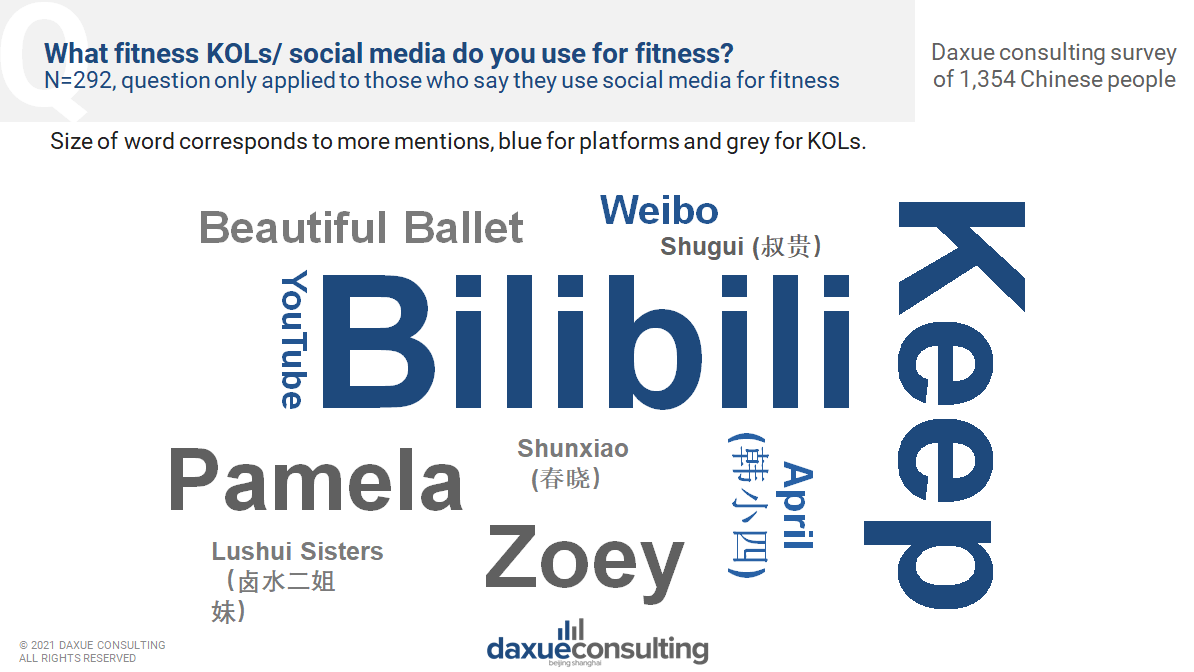

Keep and Bilibili rule the fitness app market for young Chinese

In May 2019, the number of monthly active user of China’s fitness apps reached 64.2 million, and Keep’s MAU reached 24.5 million in September 2019, taking 38.2% share of the fitness app market in China. 72.0% of the participants who follow apps or videos online to work out often use Keep. What is surprising is that, Bilibili, gen z’s favorite Chinese video platform, is even more frequently used by our respondents. 84.9% of them choose to use Bilibili when exercising. Pamela is the top KOL present on both Keep and Bilibili. Among our respondents who use social media for fitness, 47.6% follow her. Zoey (周六野) is the favorite Bilibili video bloggers, with 46.6% following her.

Data source: daxue consulting survey on exercise habits in China, fitness bloggers Chinese follow and platform they use

The young Chinese generation, especially females, still wrestle with the skinny aesthetic

Through the hashtag #Test If You Can Rock The BM Style#, along with a picture named “BM Girls’ Ideal Weight Chart,” took the Chinese Internet by storm in 2020, despite sparking controversy on Chinese aesthetic, “pale,” “young,” and “thin” are still China’s beauty standards for women. BM stands for Brandy Melville, an Italian clothing brand selling clothing in one, small size, a size which is made to comfortably fit those at an underweight BMI.

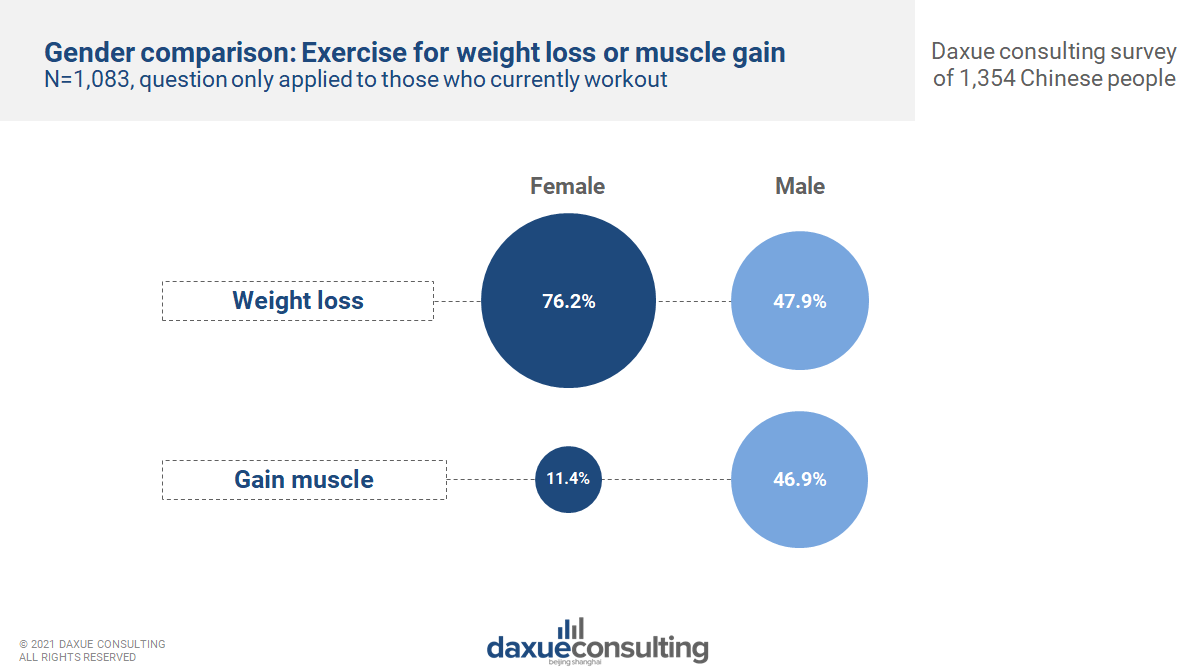

76.2% of the female participants reported weight loss as a driver for exercise and in Daxue consulting’s survey on health perceptions in China, 74.8% of the women think they need to lose weight because of aesthetic considerations. In comparison with women, only 47.9% of the male participants, list losing weight as one of the exercise reasons. What’s more, 46.9% of the male regard muscle gaining as an exercise reason, while just 11.4% of the female respondents said so.

Source: DaydayNews, Chinese posts on social media featuring BM’s clothing

Data source: daxue consulting survey on exercise habits in China, gender comparison on weight loss vs. muscle gain in exercise motivation

What motivates Chinese to exercise?

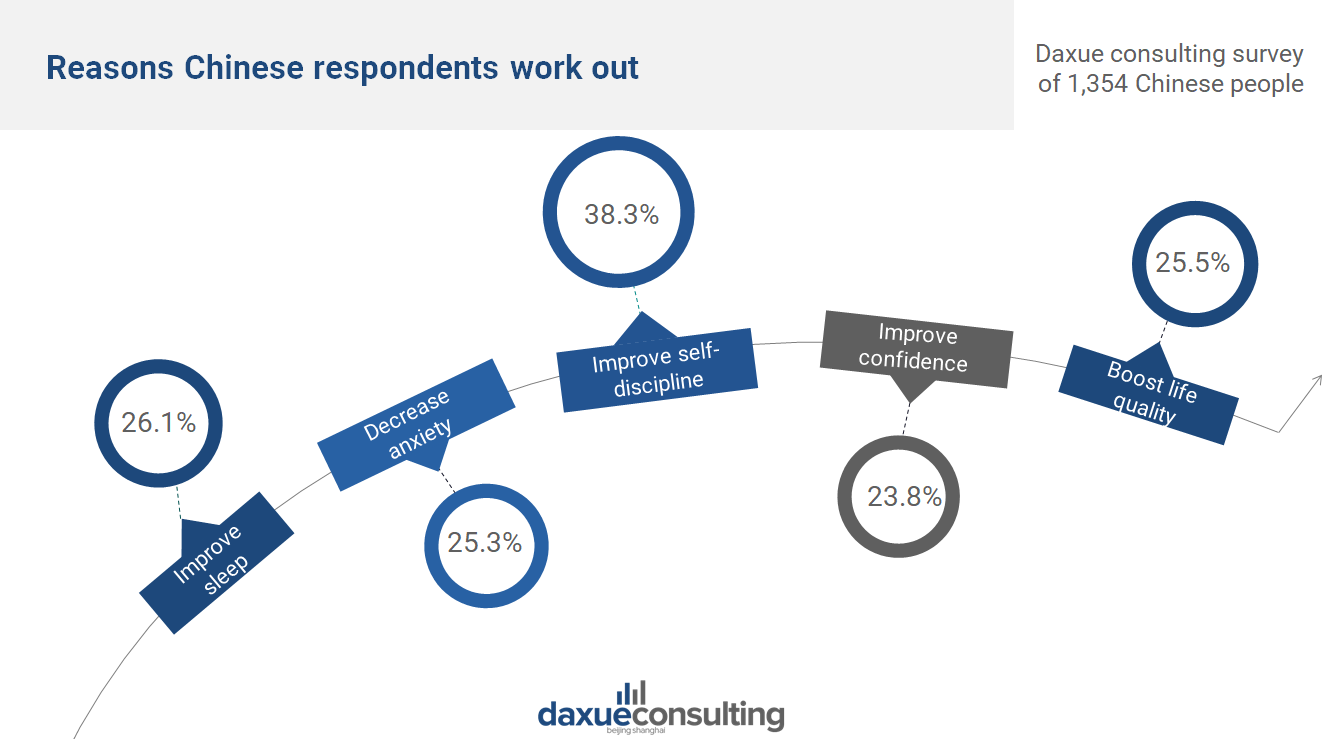

The consensus for over half of the participants who exercise is to improve physical health. 38.3% of the participants said they use exercise as a way to develop discipline. Additionally, 25.0% of the participants report improvement of sleep quality, decrease of anxiety level, enhancement of self-confidence and boost life quality as the reasons for fitness.

Data source: daxue consulting survey on Chinese exercise habits, respondents motivations to exercise

Barriers that prevent Chinese gen Z from reaching their fitness goals

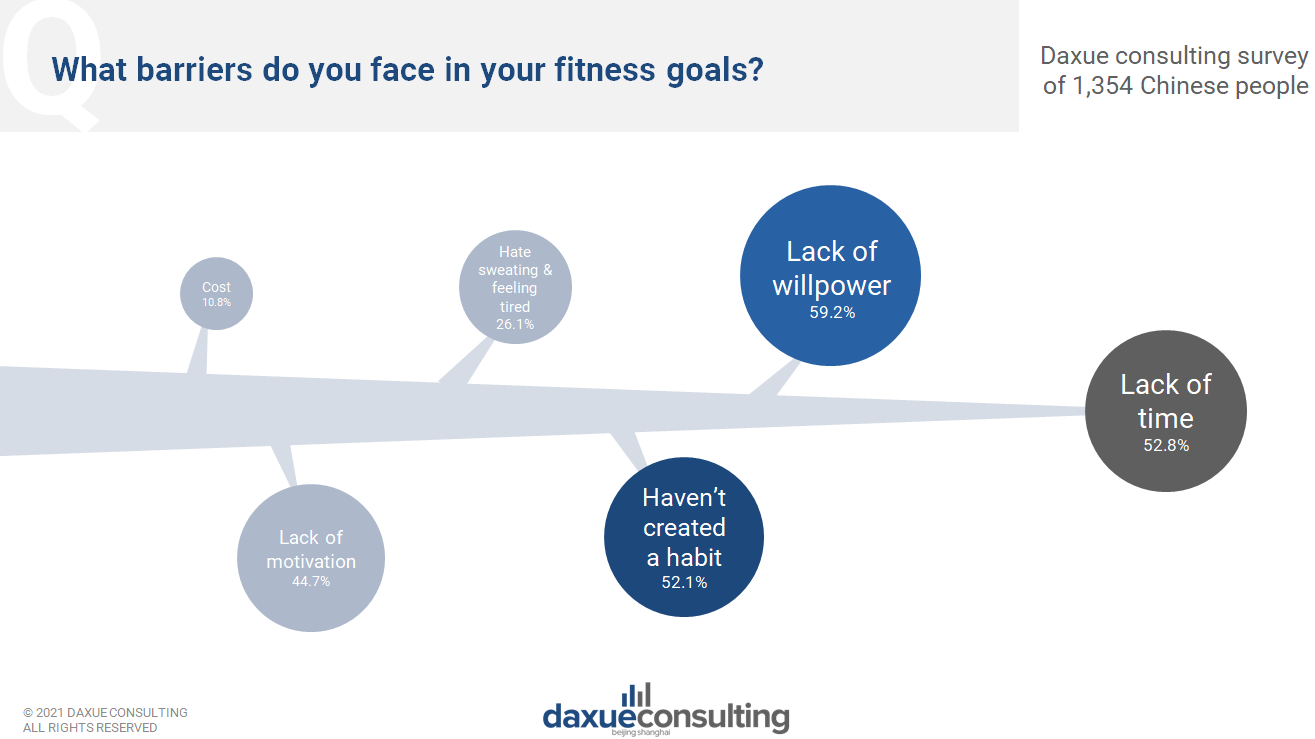

It’s not surprising that willpower is the largest reported factor in hindering exercise habits in China, as reported by 59.2% of respondents.

Lack of time is the second biggest reason. With the strong-growing economy in China, people are required to devote more time and energy in their work and tend to have fast paced life. Working out can be a huge time commitment, a one hour workout also requires added time for showering and commuting. This makes a one hour gym commitment suddenly become 2.5 hours.

Data source: daxue consulting survey on Chinese exercise habits, what prevent Chinese from sticking to fitness

The fitness market in China is still immature, but growing expeditiously

The main driving forces behind the fitness market growth come from the support from authorities, the rapid expansion of the fitness population and the increasing health awareness of Chinese. These altogether make the Chinese fitness market so vast and promising. But through this survey and other research data, we can see that the consumption per person in fitness market still has a lot of room to grow.

To reach Chinese fitness consumers, here is what brands should know

- Like in any maturing market, consumer education is key. Consumers have yet to build the habits related to fitness, which requires a basic understanding of the purpose, options and techniques of working out. Product marketing in China should emphasize how and when to use the product. Chinese consumers are also very open to learning, as our survey indicated half of the gym-members pay for extra classes, while many of those working out offline look to online videos for guidance.

- Weight loss is the number one concern, especially among women. Influenced by Chinese aesthetics, most Chinese women set a goal of weight-loss even if they are not close to being overweight; this also applies to women who don’t report working out.

- Using a KOL marketing strategy is highly effective to reach the Chinese young fitness fans. Keep and Bilibili are the two main platforms that they use frequently. Cooperating with a KOL, especially a popular blogger with trustworthy reputation in this situation, is an efficient way for brands to raise brand popularity and promote a product.

- A majority of Chinese do not spend a lot of money on fitness or supplements. So besides the material, function and appearance of a product, affordability is also important to get attention in the Chinese fitness market.

- Although gym membership in China is quite low, group classes are quite popular in the country, even more popular than exercising individually in the gym. This is key to understanding how to convince Chinese fitness fans to join a gym.