Fast Fashion in China refers to low to middle-cost clothing brands which focus on supplying their clients with fast changing collections that reproduce the current fashion trends seen on each season’s international designer shows.

Fast fashion in China has strong attractiveness for young citizens

The appeal of fast fashion in China is undeniable for the young consumers: while they’re attracted by the uniqueness and originality of the newest fashion catwalk pieces, more often than not they can’t afford it. Fast fashion is here to remediate to this issue: access to designs that are fresh and innovative (though it often comes at the stake of the pieces’ quality) is given to a class of people that couldn’t even dream of it before. On top of that, with collections that are designed and marketed within two weeks at most (against the six months that it usually takes), teenagers are presented with pieces that are almost limited edition items, which adds to their value in the sense that they’ve become a scarce resource.

Another upside to fast fashion is the fact that it draws the customer in knowing how fast the collection disappears, the consumer feels trapped into choosing between buying right now or never finding it again. It’s the knowledge that the collection will soon disappear that somehow gives no choice to the customer but to buy it.

Nowadays, many brands have adopted the fast fashion strategy in China. Among all them, Zara and H&M are two of the most successful ones. Market research in China shows the importance of their strategy toward fast-fashion.

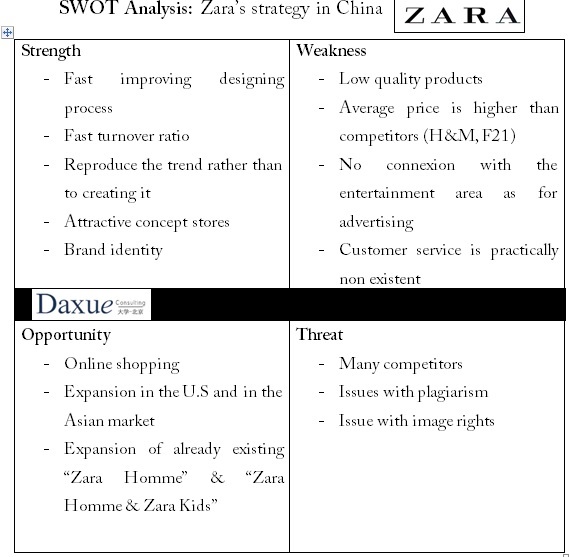

Zara

[see Zara’s portal in China]

Zara stores are operated by The Inditex Group, a large company based out of Spain. Inditex is home to numerous universally known clothing brands like Massimo Dutti, Bershka, Oysho, Pull and Bear, Zara, Zara Home, Uterque, and Stradivarius. With constant experimentation and research in developing their product process, Zara became one of the first brands ever to implement a fast fashion marketing strategy.

• Porter’s Five Forces:

- Medium to High threat of substitute : though there are competitors like H&M, F21, Topshop; none of them are quite like Zara in the sense that their styles are all different (H&M is more casual, F21 is more geared towards the youth, Topshop is more classy while Zara is straight out of runway. It’s more daring, in a sense). Therefore, innovating in its own style is for Zara a sure way to secure the market shares they’re already holding. However, for a consumer who doesn’t belong to any specific style, each shop has clothes that can interest them, and thus represents a threat of substitution for Zara.

- Low degree of rivalry: the brand already has a well-established identity. Because of that, bulk advertising isn’t the main priority to gain market shares.

- Medium threat of new entry : attractiveness of the fashion industry because of well-known brands that have done well (Zara, H&M, etc.) but at the same time the capital requirement is quite high, and the customers’ loyalty to already established brands seems like a deterrent to potential new entrants to the fast fashion market.

- Low supplier power: As the customer is at the center of the whole process, and as the number of suppliers is quite high, Zara has to comply with the wishes of its buyers.

- High buyer power: Due to the threat of substitution, and the fact that the buyer is at the center of all decisions, it’s ultimately his choice on what clothes to buy. He can or he can decide not to do it regardless of what the other competitors offer as long as what he wants to buy isn’t specific to Zara.

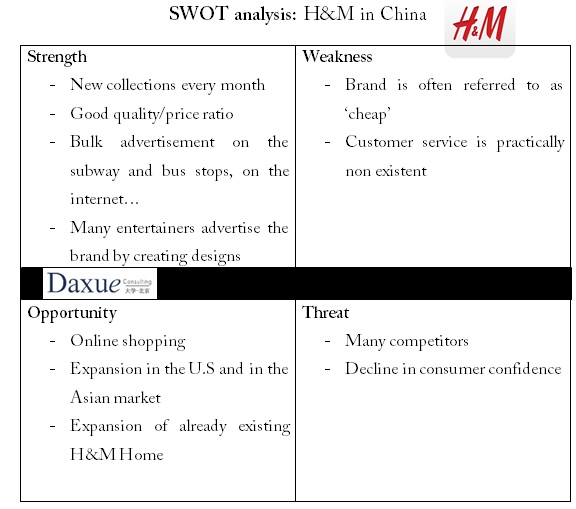

H&M

[see H&M portal in China]

• Porter’s Five Forces:

- Medium to High threat of substitute : though there are competitors like Zara, F21, Topshop; none of them are quite like H&M in the sense that their styles are all different (H&M is more casual, while F21 is more geared towards the youth, Topshop is more classy and Zara is straight out of runway). Therefore, innovating in its own style is for H&M a sure way to secure the market shares they’re already holding. However, for a consumer who doesn’t belong to any specific style, each shop has clothes that can interest them, and thus represents a threat of substitution for H&M.

- Medium degree of rivalry: due to the many competitors, H&M invests in advertising the fact that their prices are practically the lowest.

- Medium threat of new entry : attractiveness of the fashion industry because of well-known brands that have done well (Zara, H&M, etc.) but at the same time the capital requirement is quite high, and the customers’ loyalty to already established brands seems like a deterrent to potential new entrants to the fast fashion market.

- Low supplier power: As the customer is at the center of the whole process, and that the number of suppliers is quite high, H&M has to comply with the wishes of the buyers.

- High buyer power: Due to the threat of substitution, and the fact that the buyer is at the center of all decisions, it’s ultimately his choice what clothes to buy. He can or he can decide not to do it regardless of what the other competitors offer as long as what he wants to buy isn’t specific to H&M.

Zara and H&M in China: comparison with the 4P analysis

Product :

Zara in China: customer-oriented product. The product’s quality isn’t spectacular but it looks alright on the first few wears. The products are designed to satisfy temporary cravings for one specific type of clothes after having watched a fashion runway.

H&M in China: the products’ quality is reasonable and it’s often a casual design though it’s inspired by the newest trends. Less « straight out of the runway » than Zara, it’s somehow more accessible to the masses.

Price:

Zara in China: medium to low cost, but still higher than its competitors. Zara’s prices don’t stray away from the brand’s motto: « cool clothes now, not later »

H&M in China: low cost, H&M focuses on offering innovative clothes at the lowest prices.

Promotion:

Zara in China: the advertisement isn’t the main focus point for Zara as the brand’s identity is enough for them to sell well (approx 67% of Inditex’s sales revenue). Sales aren’t quite as frequent either though Zara does participate in seasonal sales

H&Min China: bulk advertising through video ads, billboard ads and all sorts of printed posters. H&M also does many exceptional sales on top of taking part in seasonal sales.

Place:

Zara in China: a strong sense of unity in the store’s visuals participates in drawing the customer’s attention. Zara stores are also placed very conveniently in crowded areas and shopping malls.

H&M stores in China: store’s visuals accurately relay the brand’s image, it’s low cost but good quality. The stores are also placed very conveniently and in most big cities of Europe.

Branding in China cannot be underestimated, as it will determine whether your entry in the country is a success or not. It is imperative to think through every aspect, and to have a good understanding of the consumers and the market. To learn more, contact us.

Follow us on Twitter to be up to date about the Fast Fashion in China, follow us on LinkedIn.

#China is running towards a large growth in the #outdoor equipment retail industry. pic.twitter.com/stgtpweU7Y

— Daxue Consulting (@DaxueConsulting) July 17, 2015