In 2011, then Chinese vice president and lifelong football fan, Xi Jinping announced his 3 world cups dream. That being for China to host, qualify for, and eventually win a World Cup. Fast forward a few years, Xi is now the president of the country and Chinese authorities have set their sights on becoming a global football powerhouse, as indicated by the government’s 2016 “The Medium and Long-Term Development Plan of Chinese Football (2016-2050)” which as well as going towards realizing Xi’s dream, will develop the football market in China.

The first 5 years of the government plan is to build a solid foundation and strengthen grassroots football in a move to promote football among young people. Mostly, Europe has been turned to for this know-how. This represents an opportunity for Western companies involved in coaching and academies. According to research carried out in 2020, the estimated value of the football coaching and training market in China will be worth 20 billion USD by 2025.

The medium-term goals (2021-2030) of the plan are to qualify for international tournaments (Asian Cup and the World Cup). To have one of the best domestic leagues in Asia while being sustainable. And for the men’s national team to become one of the best in Asia with the women’s maintaining its place among the top teams in the world. The long-term goals (2031–2050) are for Chinese people to make a contribution to world football and become one of world football’s leading powers, to qualify, host, and eventually win a world cup.

Politics drives the growth of the football market in China

Despite being largely absent from the global football scene since the start of association football, China wants to host and win World Cups. Tied in with these goals are more market driven goals such as increasing the popularity of the domestic league, developing a robust sports industry bolstered by sports-related consumption, production of sporting goods, and turning sports leisure and tourism into a strong pillar of economic growth by 2050. By 2025 the goal, which was revealed at the State Council in a December 2018 guideline by Liu Fumin, director of the CCP’s Sports Economy Department, is to triple the value of its professional sports industry. China’s sports industry is currently expected to be worth 813 billion USD by 2025, with football expected to make a large contribution to this.

According to research carried out by Nielson Sports, football still lags behind basketball in terms of sports in which respondents expressed an interest in. 31% of Chinese people aged 16–59 expressed an interest in football representing a market size of about 275 million people. However, football is the fastest growing team sport in which Chinese people express interest, with levels of interest in basketball not increasing.

Being a sustainable market in the entertainment industry will spur on consumption led growth, but being recognized as one of the world’s best in the world’s most played sport, football, ties in with national goals; China being seen as competitive on a global stage. The resulting pride its citizens will have in the country will help with unity at home. Six years into Xi Jinping’s football masterplan and with the Chinese Super League recently resuming, let’s take stock of the football market in China.

What retail opportunities are available in China’s football market?

As the Chinese economy transitions from being heavily reliant on export led growth to more consumption led growth, it is necessary for private consumption to rise. Football is regarded as a method of promoting domestic consumption in China. This is an opportunity for the retail sector but innovations must be made to spur on this growth.

As a result of government policies, football has become more attractive to Chinese people in terms of participation and watching games. These implications are felt in the retail sector with consumers buying all manner of football related products. All 16 of the top division’s teams have their club apparel made and sold by Nike. Three out of the second division’s 18 clubs have their apparel made by western companies (Nike and Puma) with 11 clubs in the division having their apparel made by Kelme, a Spanish-Chinese company. The remaining 4 clubs use domestic brands to make and sell their apparel, including Anta, Li-ning, and Ucan. This is not merely the selling of kits and replica jerseys but also includes all casual-wear, club affiliated clothing.

The estimated 2025 value of the industry in football boots, shorts, and jerseys alone is 20.75 billion USD.

The merging of online and offline in China’s football market

Clubs or sports brands can also open official stores on Tmall.com, a massive online shopping platform in China with access to 700 million consumers. Recently, Manchester United opened its first ever Manchester United Experience Center in Beijing to capitalize on its 107 million Chinese fans, with more of the interactive centers to follow in China’s other megacities.

Even players can get in on the act with a Lionel Messi theme park being developed in Nanjing for 200 million USD.

Source: manutd.com, Manchester United fans queue outside the world’s first Man United Experience Center, Beijing.

Breakdown of the football equipment and apparel market in China

Naturally following the rise of the country’s football fandom is the growth of the football equipment and apparel market in China. Both Chinese and foreign brands compete in this market, but have different advantages.

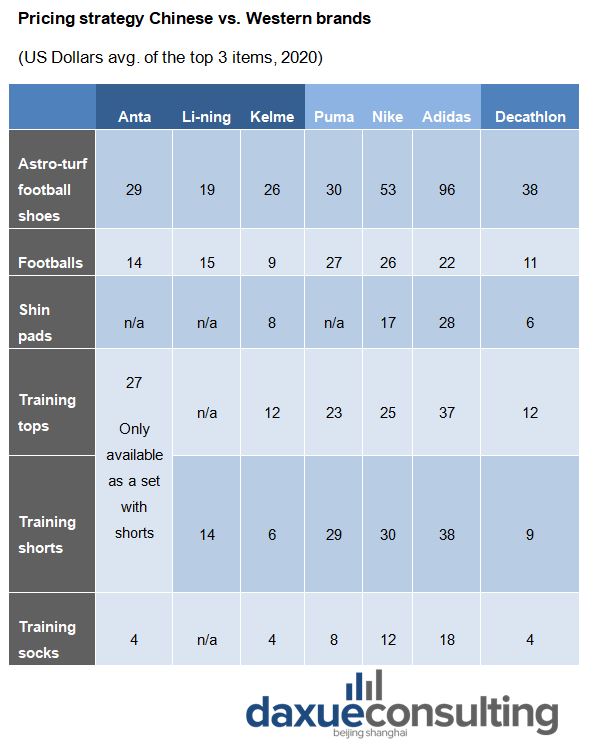

Anta, Li-ning and Kelme are the most well-known Chinese football apparel and equipment brands. Puma, Nike, and Adidas are Western brands. Decathlon also competes as it is the biggest sporting goods store in China. We compared the average prices of the 3 latest release men’s sized products from each brand. All prices are rounded to the nearest USD and come from the official stores of each brand on Tmall.com except for Puma, which does not have an official store but sells its products on the platform.

Domestic Chinese sports brands are more likely to cater to basketball than football. Kelme is the only brand almost solely focused on football.

Decathlon has a very wide choice of store brand football boots and some are cheaper in price than the Chinese brands while others are more expensive.

Adidas is clearly marketed as a premium brand while Puma and, to a lesser extent, Nike in China are marketed as affordable foreign luxury brands.

How does brand licensing in China’s football market work?

Driven by sports fandoms, China’s licensed sports equipment market has an annual growth rate of over 10%. Brand licensing in football involves an individual or a company paying a football club or a football celebrity for the exclusive rights to that company’s or person’s image rights in that country. Juventus and Stoke City FC are two such clubs who have started down this path in Shanghai.

Chinese firms, often schools, capitalize on the club’s image and receive coaches from these clubs, this allows them to charge the parents of attending kids more than other academies. They can also sell that club’s merchandise and apparel in China. This represents a big market for many European football clubs, and not necessarily only the top-level clubs. Stoke City FC currently play in the second tier of English football. Toulouse FC, Bayern Munich, and Inter Milan, Marseille, and RCD Espanyol are among some of the more well-known clubs who run academies with or entirely through affiliates in China.

The Brazilian Ronaldo is one player who sold his Chinese branding rights to a company. The Ronaldo Academy has been in operation since 2015.

The rise of Chinese football training academies

Part of the government plan is to have a popular and sustainable domestic league. This is only possible with a constant supply of fresh talent. To nurture and develop this talent is an important job that is recognized in the plan. Where possible foreign, qualified coaches are sought as these coaches are perceived to bring with them best practices and international experience. Non club affiliated, Western football academies can access this market. Parents pay on average 7-12,000 RMB (1,000–1,700 USD) per year for their kids to be part of these programs.

While week-long camps organized and ran by European football academies charge between 500–1,200 RMB (71–172 USD) per child and usually organize 3 or 4 of these camps per year, coinciding with school holidays. In 2016 only 5,000 schools across the country specialized in soccer. Now, according to the Ministry of Education there are now 27,000 primary and middle schools featuring football as part of their education and employing Western P.E teachers with backgrounds in sports education.

A view of Guangzhou Evergrande’s youth academy, the world’s largest, which contains 50 pitches and over 2,500 students. 24 Spanish, Real Madrid coaches are employed at the school. Source: Mirror/ Getty Images

Current state of football infrastructure in China

Part of the plan acknowledges the need for physical playing space to go along with the investment in coaching expertise. In a rapidly urbanizing country, green space or even synthetic green space is a less profitable use of space than apartment blocks. To combat this, fields are often built on the rooftops of buildings, limiting their size to 7 or 5 a side pitches. The first part of the government backed campaign called for the construction or renovation of 70,000 football fields.

In a December 2019 press conference, Wang Dengfeng, director of the Department of Physical Health and Arts said that 40,000 had been built or renovated already with another 20,000 to be completed by the end of 2020. Govt subsidies incentivize the building of pitches by private companies or individuals.

In an official document released by the National Development and Reform Commission on July 30th 2019, the Chinese government will subsidize newly built 11-a-side football pitches by 2 million yuan (290,000 USD) each with newly built 5-a-side and 7-a-side pitches being subsidized by up to 1 million yuan.

Source: Flickr, urban roof top football field in Shanghai, China

With China’s plan to create a sustainable and popular domestic league, many new stadiums will have to be built or old ones refurbished. And with China aspiring to someday host an Asian Cup and a World Cup, the demand for stadiums will have to be met. This represents an opportunity for Western design or construction companies with expertise in the field.

Most valuable football broadcasting rights in China

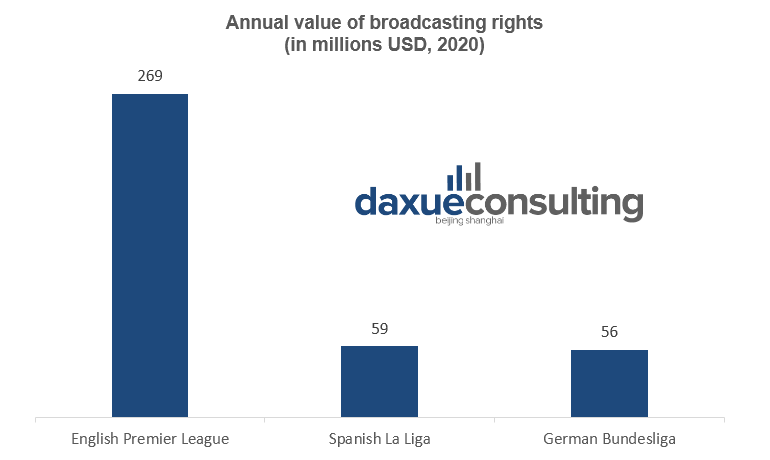

In terms of earning money from selling broadcasting rights to the Chinese, the Premier League is the clear winner. Chinese media companies paid the English league 269 million USD per season for the rights to show their games and highlights from 2019 to 2022. In second place, La Liga received 59 million USD per season from China in order to show Spanish games from 2015 to 2020. The Bundesliga was the next most in demand league, commanding 56 million USD per season for the rights to show German games between 2018 and 2023 in China.

Data source: Statista, the value of European football leagues’ broadcasting rights in China.

How Chinese people interact with football is also important to Western companies selling in China

Mobile has now overtaken PC in terms of how most people get access to information about sports in China. The convenience of mobile payments in China through all-encompassing apps like WeChat allow users to spend 30 RMB (4.3 USD) per month to watch a wide variety of sports including Premier League, La Liga, and Bundesliga games. The cost per game is 5 RMB (0.72 USD) and payment is completed instantaneously through fingerprint scanning or facial recognition. Clubs, players, and indeed advertisers can reach Chinese football fans through other social media avenues such as Weibo.

For example, the Portuguese Ronaldo earns almost 1,000,000 USD per Instagram post where he advertises a product or service to his mostly non-Chinese, 180 million followers. Ronaldo is the second most followed footballer on Chinese social media with almost 10 million Chinese fans but for western companies looking to sell in China, using somebody like Ronaldo or Messi, who has 16 million Chinese social media followers, as a celebrity endorsement would be a powerful marketing tactic.

The football market in China still has room to grow

As was hoped for when star foreign players and coaches were brought into the country, the domestic league grew in popularity and areas for improvement were identified by these star foreign coaches whose careers had been used to the highest of standards when it came to player care. Backroom staff and physiotherapists with experience of working with the game’s greatest names are needed to create a culture of excellence within China’s domestic league. Besides the marquee signings that have been brought in for big money, many relatively unknown football journeymen have come to China to play in its leagues.

As the last of the foreign players filter back into China and the Chinese Super League resumes after the Coronavirus break, and with important 2022 World Cup qualifiers against the Philippines and Syria in the next 3 months it is certain that China has made great strides in developing football and the football market. However, to create a large and steady football economy, a culture of football will need to be further developed. Qualifying for 2022’s tournament will certainly help with that and put the country on track to completing another of its objectives.

See our report on the licensed sports merchandise market in China

Listen to 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast