Licensed sports merchandise market in China in 2019.

With a growing interest in sports, health, and fitness, and a keen eye for fashion, Chinese society has demonstrated a high demand for sports merchandise in the recent Chinese market. Licensed sports apparel, footwear, and other sporting goods have been on the rise since the Reform and Opening Up, a number of games began to be broadcast live on television. International brands are hugely popular amongst Chinese consumers, who are primarily of the younger demographic. Both online and offline distribution channels are important for the sports merchandise market, and social media platforms contribute largely to the vibrant digital landscape of sports apparel. Currently, there is a large market for both domestic and international companies, for the increasingly sophisticated Chinese consumer who is interested and informed in the all aspects of sporting products from design, to licensing, to brand activities.

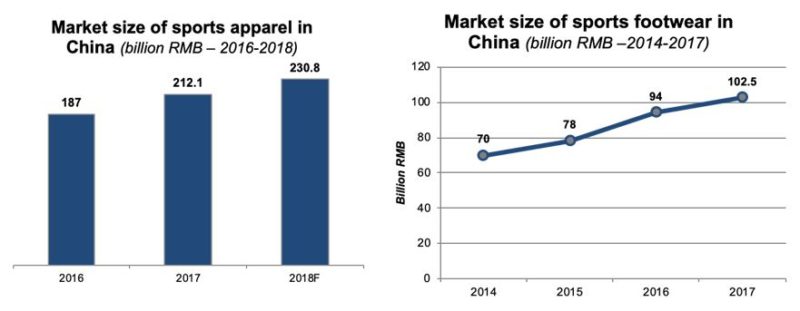

The market size of licensed sporting goods in the Chinese market: Annual growth rate of 10-15%

China entered the Olympic Games after the Reform and Opening Up in the late 1970s; thus as its athletes began participation in the games, both the Olympics and sports brands gained popularity. In 1987, the NBA games began to be broadcast which ignited the enthusiasm for basketball related products among the Chinese people. More international brands entered the Chinese market in the 1990s paired with a steady growth of domestic brands, leading to the rapid the rise of domestic companies now receiving policy support – bolstering their strength to compete with famous international brands. In 2017, the combined market size of sports apparel and footwear reached over 304.6 billion RMB (about 45 billion USD) and continues to grow steadily, with an annual growth rate of 10-15%.

Chinese licensed sports merchandise market: who is the largest target audience?

Around 80% of Chinese consumers of sporting goods are under the age of 25. Younger people mainly prefer to purchase licensed sports merchandise through official brand websites. Flagship stores and overseas purchasing are other channels popular for consumers under the age of 20, as well as those between the ages of 25-35. Yet especially for footwear and apparel, purchases are primarily made through physical stores for reasons of being able to try on and experience the product.

Why are Chinese Consumers Purchasing more sports merchandise?

Based on information from WeChat and Weibo, the two largest social media platforms in China, there are four main consumer motives for the purchase of licensed sports merchandise. The first is for functional purposes to support proper sports activity. Keeping up with trends in fashion and pop culture is the second purchasing motive, followed by daily sportswear, and fan demonstration for their favored sports stars/teams. With the influence of social media and popular KOL’s, consumers pay great attention to the merchandise that sports idols and popular figures wear or promote; thus social media has increased consumer engagement with brands, merchandise, and popular sports figures.

High standards and careful consideration for Design, Technology, Price, etc.

Consumer feedback on social media reveal sophisticated concerns regarding design, technology, discounts, and licensing. On WeChat and Weibo, design discussion focuses on aspects such as style and color. Other main topics pertain to product quality, and effects of new technologies. On Zhihu, the main questions are regarding the proper license of sports merchandise. Consumers are concerned with where they can purchase sports merchandise, in addition, to show they can authenticate the goods they purchase. These platforms demonstrate the increasingly aware and careful Chinese consumer, who take their purchases seriously, look for high quality and design, and are careful to purchase the product tailored to their specific needs.

Foreign sports brands lead the Chinese Market

In China, international sports brands occupy more than 30% market share. Nike and Adidas are the leading brands, with a market share of 17% and 15%, respectively. While they are more popular than domestic brands, the sales of Chinese sports brands have increased greatly in 2017. Foreign brands Nike and Adidas, and domestic brands ANTA, Li-Ning, and XTEP are the leading 5 companies on the market, each with continuously growing market share. While other popular foreign brands include New Balance, Discovery Expedition, and Jack Wolfskin also have a presence in China, Nike and Adidas still lead popularity in Chinese consumers by far. The primary reasons for their popularity are due to early Chinese market entry, style/design attraction, leading edge in technology, and influencer collaboration. For basketball and football merchandise, international brands were still most popular, but amongst swim merchandise, domestic brands generate greater sales due to their affordable pricing.

CONTACT US NOW TO ANSWER YOUR QUESTIONS ABOUT BUSINESS IN CHINA

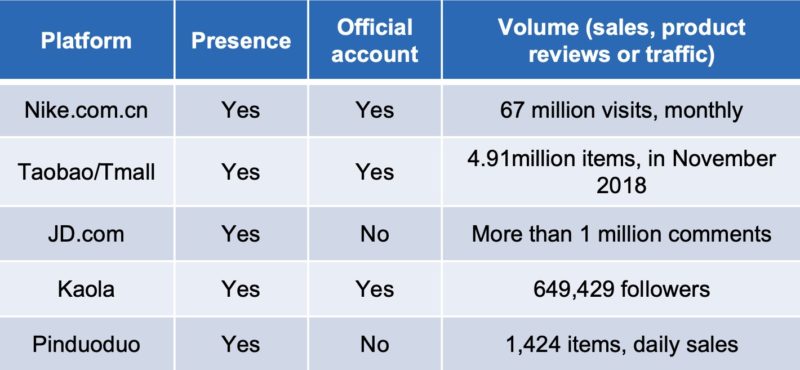

Case study: Nike vs. Adidas in China

For their official websites, Nike receives much higher monthly traffic at 67 million monthly visits, versus Adidas at 4.7 million visits. Sales on Taobao/Tmall were more comparable, with Nike at 4.9 million items, and Adidas at 3.56 million items, as of November 2018. On the group purchasing e-commerce platform Pinduoduo, Nike also tops Adidas with 60% more daily sales. Regarding online interest, Daxue’s WeChat search index also revealed Nike with the highest number of searches in the past 90 days, followed by Adidas. Overall, the two brands are fierce competitors in China for the top licensed sports merchandise player in the Chinese Market.

NIKE

ADIDAS

What distribution channel in China works more effectively for licensed sports merchandise?

While Most Purchases are Made in Physical stores, E-commerce sales continue to boom.

Currently, offline channels such as physical brand stores and brand counters within shopping malls are still the most popular form of distribution for licensed sports merchandise. Physical stores are still the most reliable purchasing channel for most consumers as it guarantees authenticity, and allows the consumer to view, try on, and experience the product first-hand before committing to a purchase.

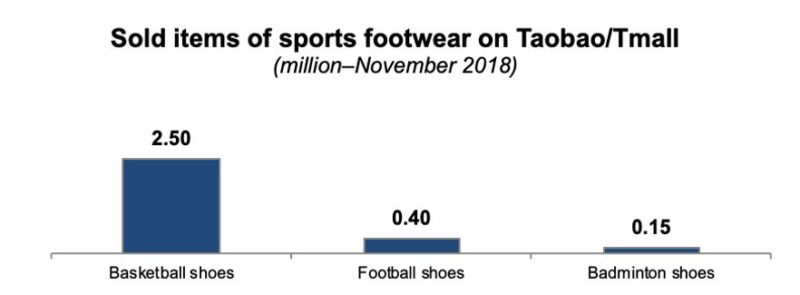

Basketball shoes are by far the most popular sports merchandise, especially online. Basketball jerseys and other apparel are also popular, making basketball-related merchandise the most popular in the Chinese market. As of November 2018, the number of basketball footwear sold on Taobao reached 2.5 million, with basketball shirts reaching 893.7 thousand.

Companies looking to enter the Chinese market should be aware of these trends

The Chinese licensed sports merchandise market becoming fiercely competitive, with domestic brands rapidly on the rise. Many domestic companies have started to work with more international sports figures and teams, fighting for more market share against foreign brands. Due to the rising demand, it is important to note the increasing market segmentation, most commonly by age group. For the sophisticated Chinese consumer, fashion is among one of the most critical criteria. Design components such as color and style are of crucial importance. The Chinese consumer favors international brands for their fashionable image, thus more domestic brands are expanding on their creativity of design to compete with top international brands.

Related Article:

Author: Julia Qi

Do you want to adjust your strategy and be ahead of the competition in the Chinese licensed sports merchandise market? Daxue Consulting can help with that

Home / Competitive Benchmarking in China. Daxue Consulting has conducted a series of surveys on Competitive Benchmarking in China and developed a specific framework to analyze the key insights related to your competition in China:

- A business model in China;

- Sales performance;

- Market share;

- Promotion strategies;

- Distribution models;

- Pricing methods;

- Product adaption for the Chinese market (for international brands).

These elements will include key information to collect before your market entry or expansion to adjust your strategy and be ahead of the competition. It will also give you an understanding of your competitors “working hypothesis” when it comes to the Chinese consumers, i.e. how their strategy is adapted to their understanding of the Chinese consumers. These working hypotheses will then be integrated into your market intelligence analysis and be validated through consumer-focused methodologies: online survey, focus groups, social listening or in-depth interviews.

Do not hesitate to reach out to our project managers at dx@daxueconsulting.com to get all answers to your questions.