Frozen food is preserved from the time it is made until the time it is eaten. Its packaging must maintain its integrity through cooking, machine filling, sealing, freezing, storage and logistics. Chinese consumers, especially office workers often prefer it, for its convenience and quality. As the pace of life in China gets faster, for the frozen food market in China continues to grow.

Increasingly more frozen food consumers in China

Most Chinese families use refrigerators which enables them to follow the pace of modern life. As a consequence, frozen food naturally bursts into Chinese grocery lists. However, in 2011 we found that quite a lot of foods are unqualified to sell in China due to pathogens. Chinese people are more health conscious and not only sensitive to just taste and price. China is a country famous for delicacies, with a variety of local cuisine made into frozen food, such as zongzi, dumplings, meat balls, sea food.

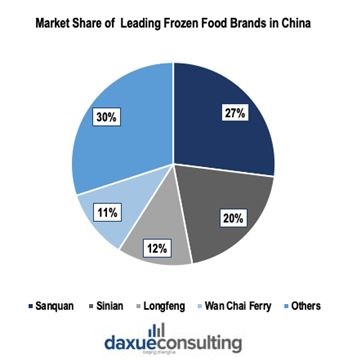

Frozen food companies in China: Oligopoly between Sinian, Sanquan and Longfeng

In 2012, the top four frozen food companies took 60% of the frozen food market share in China. Three of them were Chinese local enterprises, Sinian (思念), Sanquan (三全) in Henan (河南) province and Longfeng (龙凤) from Taiwan (台湾). Sinian was found in the year 1997 as the name of Henan Sinian frozen food Limited(河南思念速冻食品有限公司). And Sanquan is now the largest frozen food enterprise in China and has expand their business all over the world as their products are exported to North America, Europe, Asia and Oceania. In 2012, Sanquan launched an innovated product, Dumplings of Private Kitchen. It was the milestone for Sanquan’s business as the company was able to reposition itself at a higher stage in this industry. Longfeng was founded in 1977 in Taiwan and now is well-received in Mainland of China. In 2013, Sanquan took over a large share of the frozen food market in China.

International Frozen food company in China—Wan Chai Ferry

Wan Chai Ferry was founded in Hong Kong by a Chinese woman and is part of the American company General Mills. Being one of the top four frozen food companies in China, in 2012, Wan Chai Ferry took 10% market share of fresh and 30% of frozen dumplings in Hong Kong. Though the price of this brand is a bit high, there are still many young people would like to pay for its quality. However, since 2013, the market share of Wan Chai Ferry has been dropping in frozen food market in China.

Reaching a fast-growing period with space for future development

The Chinese frozen industry only occupies around 5% of the total food market in China, which is much less compared to other developed countries such as the US. The frozen food sector occupies around 60%-70% of total food market in developed countries.

Sales performances and predictions of the frozen food in China

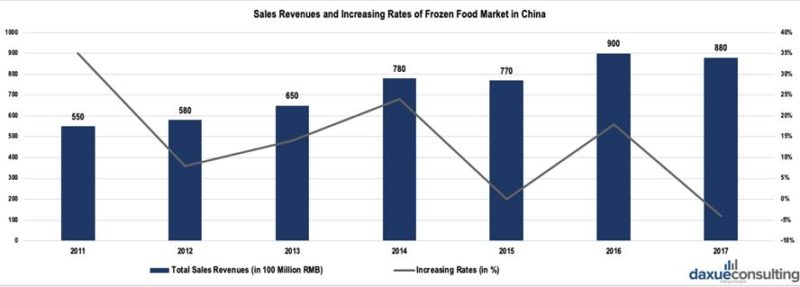

The total sales revenue of China’s frozen food industry reached ¥ 86.979 billion RMB in 2017, which represents a decrease of 3.71% (¥ 90.347 RMB) from 2016. However, compared, the sales revenue had grown by 59%, representing a YOY growth of 8.04%.

[Data source: chyxx , ‘Sales revenues and increasing rate of frozen food market in China’]

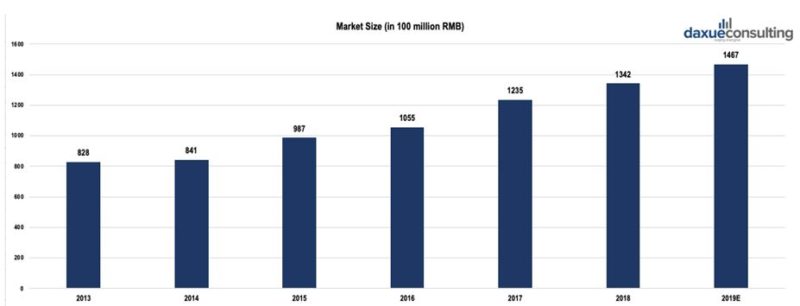

The market scale of the Chinese frozen food industry is expected to increase from ¥ 123.5 billion RMB in 2017 up to 146.7 billion RMB in 2019 (around 18.7%). Moreover, Chinese frozen food consumption is shifting from seasonal to daily.

[Data source: chyxx, ‘ Market size of frozen food market in China’]

Frozen food consumers in China

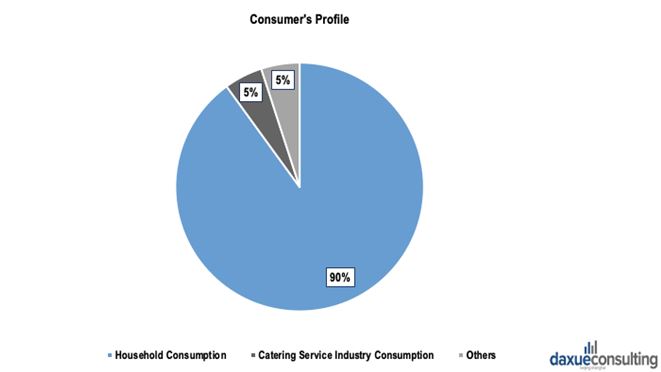

Almost 90% of frozen food consumption in China are households, while catering service industry contributes less than 5%.

[Data source: chinabaogao, ‘Frozen food consumers in China’]

Frozen food products in China

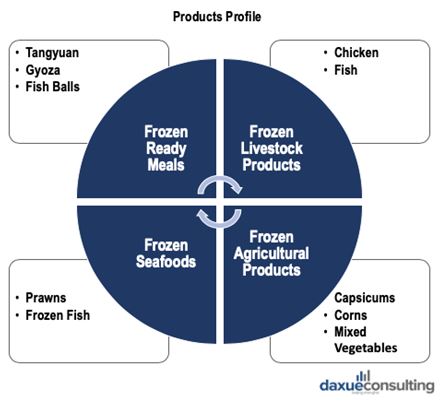

There are 4 main categories within the frozen food market.

[Data source: Forward The Economist, ‘Frozen food products in China’]

The top five products in China’s frozen food industry sold are dumpling, fozen tangyuan, frozen pastry, frozen zongzi and frozen wonton. Frozen dumpling sales occupied more than 50% of the total frozen food market, while Frozen tangyuan around 20%. Frozen pastry, frozen zongzi, frozen wonton, frozen spring roll as well as some other frozen snacks together occupies around 30% of total market share. Frozen ready meals is projected to reach ¥28.5 billion RMB in China by 2023.

In the future, product innovation and logistic infrastructure development will boost the sector. Market scale of frozen dumplings, glutinous rice balls, traditional Chinese rice-puddings, hotpot ingredients, meat and vegetarian-based meals will grow steadily in the following years.

Key players of China’s frozen food market

Market share of leading frozen food brands in China

The top four brands make up 70% of China’s frozen food market. These top four companies are all Chinese companies, since most Chinese frozen food consumption is traditional Chinese food and not foreign food.

[Data source: Forward The Economist, ‘Market share of leading frozen food in China’]

China brand power index of leading frozen food brands in China

China Brand Power Index (C-BPI) is form of consumer research based on the independent and unbiased consumer feedback of products they used. It is used to evaluate the brand power which affects consumers’ buying. Except for the top three brands which are Sinian, Wan Chai Ferry and Sanquan, other brands show lack of strong brand personality. Many of those brands in the chart ranking after the top 3 mainly focus on certain city or region markets in China. For example, Goubuli and Yingke focuses on Tianjin’s market, Ruida and Duolingduo focuses on Beijing’s market, Guiguan, Riqing focuses on Shanghai’s market.

[Data source: chyxx, ‘C-BPI of leading frozen food brands in China’]

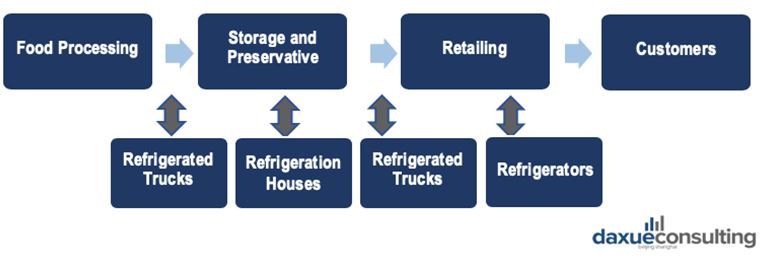

Supply chain analysis of China’s frozen food industry

The supply chain of frozen food in China

The supply side of frozen food in China is simply designed but efficient. After the frozen food is produced in the workshops, it will be kept in special warehouses first and then be sent to the supermarket directly. The greatest supply chain challenge in China’s frozen food industry is keeping the food at a cold temperature throughout the whole process.

[Data source: askci, ‘Supply chain of the frozen food industry in China’]

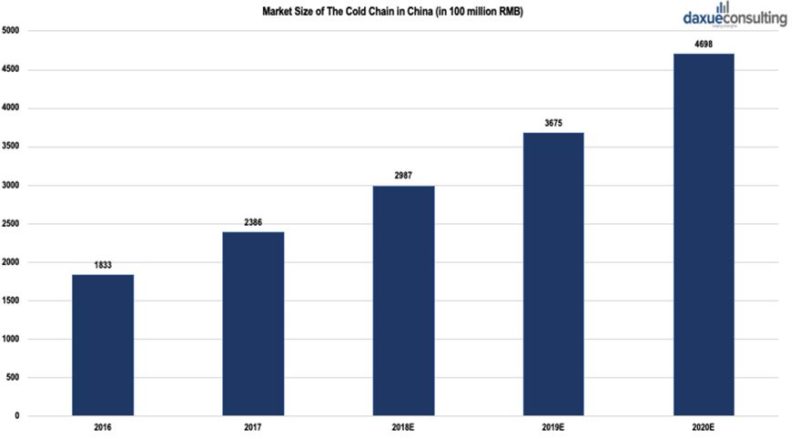

The growth of Chinese cold chain

A cold chain is a term to describe the frozen food supply chain. The Chinese cold chain has expanded in the past years and will continue to expand as a wider demographic of consumers purchase frozen food. The rapid development of cold chain help expand frozen food brand radiation range. The development of cold chain will also promote frozen food companies to improve the quality and flavor of their products in frozen food market.

[Data source: askci, ‘Market size of the cold chain in China’]

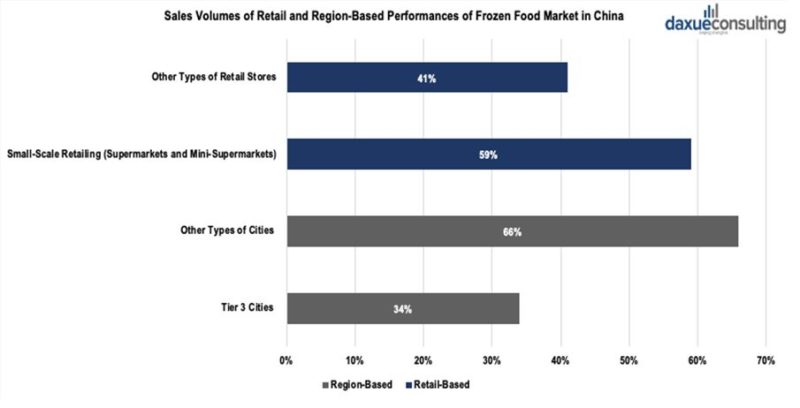

Remarkable Performance of Tier 3 Cities and Small-Scale Retail Stores Reveal Keys to Success

Prior to March 2019, in terms of region-based performances, the sales volume of tier 3 cities accounted for 34%. Because they compromise 1/3 of the total sales volume in the frozen food market in China, these consumers are an important part of a China market plan.

On the other hand, in regard with the retail-based performance, the sales volume of small-scale retail formats (supermarkets and convenience stores) among all frozen food channels has been increasing for three consecutive years. Until March 2019, it has accounted for 59% of the total sales volume in this sector. The optimal distribution plan would include supermarkets and convenience stores.

In the foreseeable future, selling frozen food in tier 3 cities and small-scale retail stores is likely to lead to success.

[Data source: Nielson, ‘Sales volumes of retail and region-based performances of frozen food market in China’]

Frozen food scandals of in China: safety, pricing strategy and law

Although frozen food market is developing and projected to generate more revenue, it is not free from scandals that affect Chinese consumers perception of the industry. The failure to monitor the quality of ingredients, aggressive pricing strategies and imperfect regulation of food safety are problems to avoid in this industry.

Company factor: lack of quality control and appropriate strategy

On one hand, some firms do not do enough to control the quality of their products in order to meet the required standard and consumers’ expectation. The food safety issue has been prevalent in the industry of Chinese frozen food market.

[Source: NetEase and Sohu, ‘Frozen food scandal: MRSA and ASF infected pork’]

Frozen food scandal in China number one: MRSA infected major brands (2011)

In 2011, major market players such as Sanquan, Sinian and Wan Chai Ferry were reported that their products contained a dangerous amount of MRSA, antibiotic-resistant staph bacteria. Since then, consumers have been concerned about frozen food in China.

Frozen food scandal in China number two: ASF infected pork (2019)

In February 2019, African swine fever broke out in China. Firms such as Sanquan, Anjing and Jinluo were found to use contaminated pork as the ingredients of dumplings. Furthermore, since Sanquan is a market leader, this incident has affected performances and reputation of the company significantly. Any safety issue of the company causes huge fluctuations in its operation and industry. The share price of Sanquan which was listed on China’s stock market plunged by 3.58% while the annual total revenues of Sanquan dropped by 4.2 million RMB. Moreover, the food safety issue undermined consumers’ faith in the brand. According to iiMedia Research, 46% of the total interviewees claimed that they were disappointed with Sanquan because of this incident.

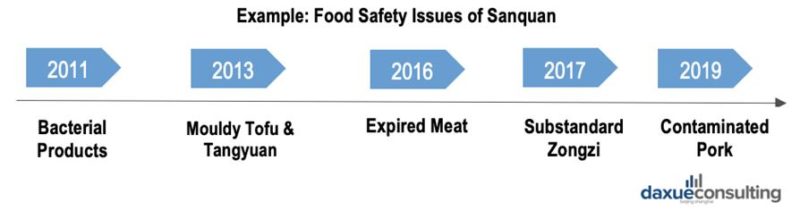

[Source: Baijiahao, ‘Timeline Sanquan frozen food scandals in China’]

Frozen food scandal in China number three: prioritizing profits over safety

What is more, owing to the high concentration ratio and non-differentiated products in this industry, small firms that want to occupy the market share are likely to apply an overly aggressive pricing strategy. In other words, they are likely to sell their products as cheap as possible. As a result, this has created negative effect to the industry. Firms might neglect the quality assurance measures and development of new products in order to sell at lower prices.

[Source: Sohu, ‘Frozen Food Products of Small Firms Sold at Retail Stores’]

Lack of regulatory institutions

On the other hand, from the perspective of the Food Safety Authority in China, the required safety standard in China is loose and it lacks strict regulation to monitor the quality of food. For example, in 2011, the incident of a bacterial break out in Chinese frozen food. Firms that were related to this incident claimed to obey the new food safety standard. That is, the amount of MRSA of their products remain under the threshold value set by the Food Safety Authority in China. However, prior to the new standard, firms were not allowed to produce items which contain any MRSA. Therefore, it is only after the MRSA bacteria breakout that frozen food in China is allowed contain MRSA.

Chinese perceptions towards frozen food: it is necessary in urban lives.

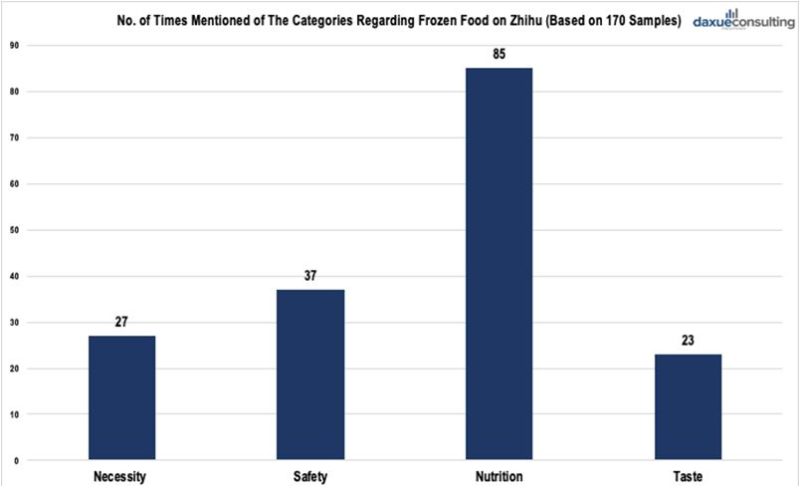

According to a small consumer analysis on the platform Zhihu, one of the largest online discussion forums in China, Chinese consumers hold diverse opinions towards frozen food. Nevertheless, many of them perceive that the frozen food is becoming the daily necessity in urban lives due to people’s fast pace of living. In other words, Chinese people may consume more frozen food inevitably.

[Data Source: Zhihu, ‘Chinese People’s Perceptions towards Frozen Food in China’]

Nutrition: Health comes first

Whether frozen food is nutritious or not has been widely discussed by Chinese consumers. Some people express their concerns to frozen food as they think that it includes many preservatives and causes the loss of nutritional value.

Safety: One of the main barriers

The safety issue about frozen food is always a top concern of Chinese consumers. Considering that food safety is a common issue in China’s frozen food industry, people have been concerned with the quality of frozen food and some of them have expressed their distrust of Chinese frozen food. This has weakened their incentives to consumer frozen food.

Demand driven by urbanization and pace of living

Even if some Chinese people perceive frozen food negatively, there is a market demand of frozen food in China. With the growing pressure on Chinese work schedules, the demand for frozen food is still primarily driven by need for convenience rather than flavor or health preference. A source of competition of the frozen food market in China is delivery or eating out. Currently, the advantage frozen food has on restaurants is price.

Taste: Freshness and different preferences

Some people presume that the frozen food does not have a good taste. Influenced by Chinese food culture, people lay more emphasis on the freshness of foods. When it comes to tastes, the frozen food is pale in comparison with fresh food.

On the other hand, for those frozen food consumers who have emphasized tastes, different segments (i.e. regions) of customers have different preferences towards frozen foods. In terms of regions, consumers from North China prefer dumplings while those from South China prefer Tangyuan. Frozen seafood is accepted all over China.

Let China Paradigm have a positive impact on your business!

Listen to China Paradigm on iTunes