On November 1st, 2025, a quiet regulatory update from China’s Ministry of Finance rewrote the logic of the gold jewelry market in China. The Ministry of Finance Announcement No. 11 adjusted how gold jewelry is taxed. At the same time, international gold prices surpassed USD 4,000 per ounce in 2025 for the first time in history. Together, these two forces pushed Chinese consumers into a different relationship with gold.

Gold jewelry is increasingly being treated as emotional comfort and a financial object — something closer to stored value than seasonal fashion. In addition to gold bars and coins, they are seeking lighter, more flexible, and personalized pieces. This shift echoes a broader change across the Chinese luxury market, where buyers are becoming less interested in symbolic spending and more concerned with long-term preservation. For brands, the problem is no longer how to sell beauty. It is how to prove that beauty can also hold its worth.

Why is the market growing in value but shrinking in volume?

According to the National Bureau of Statistics, China’s “Gold, Silver, and Jewelry” retail category generated RMB 341.4 billion in sales between January and November 2025, up 13.5% year-on-year. But this growth is misleading.

Behind the revenue increase is a sharp contraction in actual consumption. Data from the China Gold Association shows that gold jewelry volume fell 32.5% in the first three quarters of 2025. Fewer pieces are being sold. Each piece is simply much more expensive.

What changed is not appetite, but tolerance. As gold prices surged, the traditional premium attached to jewelry — branding, craftsmanship, retail markup — became harder to justify. Instead of buying heavier pieces, consumers redirected spending into gold bars and coins, which rose 24.5% over the same period. The gold jewelry market in China did not collapse. It hollowed out.

How did the 2025 VAT reform change industry costs?

The latest Announcement No. 11 introduced a clear line between investment gold and consumption gold. Bullion remains tax-advantaged. Jewelry does not.

The policy reduced the VAT deduction available to jewelry manufacturers from 13% to 6%, structurally raising costs. Citi estimates the reform adds roughly 7% to total operating costs for gold jewelry retailers – costs that eventually passed on to consumers.

For consumers, this widened a psychological gap. The difference between raw material value and retail pricing is becoming increasingly visible and uncomfortable.

Why are consumers switching to “remaking” gold?

Among young Chinese consumers, this redesign has taken the form of “Gold Beans” — one-gram investment pellets sold at near-spot prices because they qualify as investment products. Often marked up less than RMB 20 per gram, these beans are purchased not as finished goods, but as raw inputs.

Consumers then bring them to independent workshops, paying a fixed labor fee to melt and reshape them into pendants. On Xiaohongshu, content related to DIY goldsmithing has accumulated over 400 million views (May 2021-Jan 2026). The popularity of this practice reveals something precise: younger buyers value metal integrity more than brand authorship.

Why are consumers looking to Hong Kong for better gold prices?

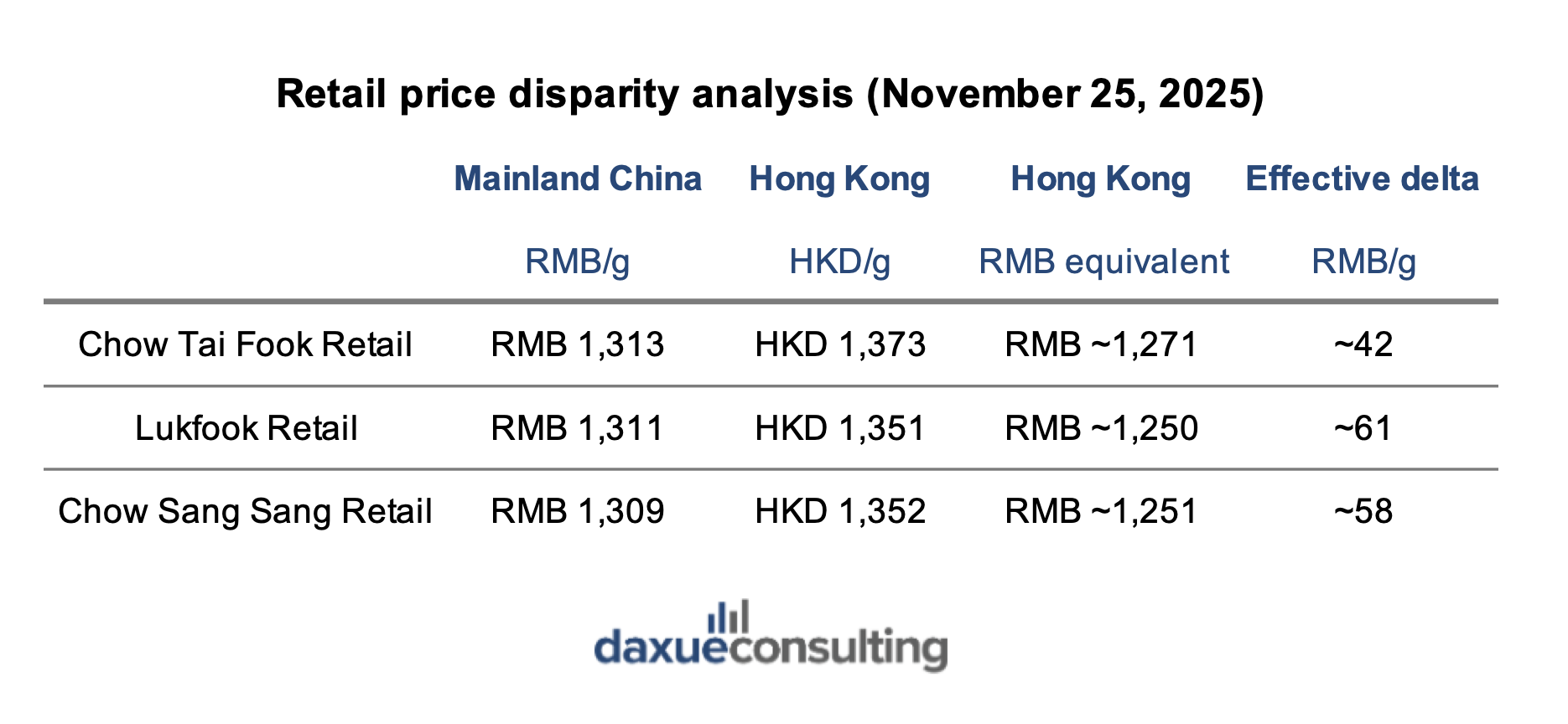

The reform has also revived a familiar Chinese behavior: cross-border arbitrage. As mainland retail prices climbed, Hong Kong’s tax-free market regained its role as a reference point.

Chow Tai Fook, Lukfook, and Chow Sang Sang all showed gaps between RMB 42–61 per gram between mainland China and Hong Kong. For heavy purchases, this difference is not cosmetic but structural. The border once again functions as a pricing tool inside the gold jewelry market in China.

How are international luxury brands responding?

Global jewelry houses are responding by retreating upward. Rather than competing on gold weight, brands like Tiffany and Cartier are concentrating on segments where material cost is no longer central. Tiffany has reduced the scale of its Shanghai flagship, reallocating space toward appointment-based private salons. Cartier, backed by Richemont, continues to push high-jewelry lines where craftsmanship, stones, and design dominate pricing. At RMB 500,000 per piece, a 7% gold tax shift barely registers. What these brands are protecting is price stability rather than margins.

Moreover, luxury brands are taking advantage of the seasonal gifting occasions, particularly the Lunar New Year, the largest holiday in China. As consumers hesitate to buy gold jewelry, brands are accelerating innovation through IP collaborations, traditional craftsmanship styles, and products that emphasize emotional and cultural value over gold weight.

What do search trends reveal about intent?

Searches for “gold recycling price” climbed sharply in early 2025 as global prices surged. This created a paradox: retail jewelry prices rose because of tax, but buy-back prices remained tied to spot gold. The gap widened. For consumers, this means jewelry feels expensive to buy and disappointing to resell.

Navigating the new gold landscape

- In 2025, China’s Ministry of Finance revised the VAT rules for gold jewelry, cutting deductible VAT and increasing costs. This pushed retail prices higher, widened the gap between jewelry prices and raw gold value, and contributed to consumer demand for investment gold, remaking, or cross-border arbitrage.

- Chinese consumers are seeing gold jewelry as an attractive investment. Young people in particular are viewing it as emotional comfort and long-term value rather than just decoration, and are separating the value of gold itself from brand and retail premiums rather than treating all gold jewelry as an investment.

- Besides gold bars and coins, consumers seek lighter, more flexible, and design-focused pieces.

- Young Chinese consumers are also turning to gold “remaking”. They buy near-spot “gold beans” as raw materials and pay a fixed fee to reshape them into jewelry. This trend’s popularity shows that younger buyers prioritize gold purity and value over brand names.