Home décor is an integral component of a house as it can affect all aspects of its inhabitants starting from one’s self-perception to their confidence and productivity. And much like culture, each country also has its own décor style and trend.

Being the most populous country in the world, it is not surprising that China also has the largest number of housing, making the country an interesting market for the home décor industry.

The global market of the home décor industry is growing with a CAGR of 3.9%

There are around 2.3 billion houses in the world in 2021 with Asia having the highest number of houses.

In 2021, the size of the world’s home décor market was estimated to be US$665.92 billion (RMB4.6 trillion). By 2030, the market is anticipated to reach US$939.64 billion (RMB6.4 trillion), expanding at a CAGR of 3.9%. Europe and the Asia Pacific are the fastest-growing and largest markets, respectively. According to a report by Technavio, Europe accounts for 42% of the growth of the global home décor market from 2020 to 2024.

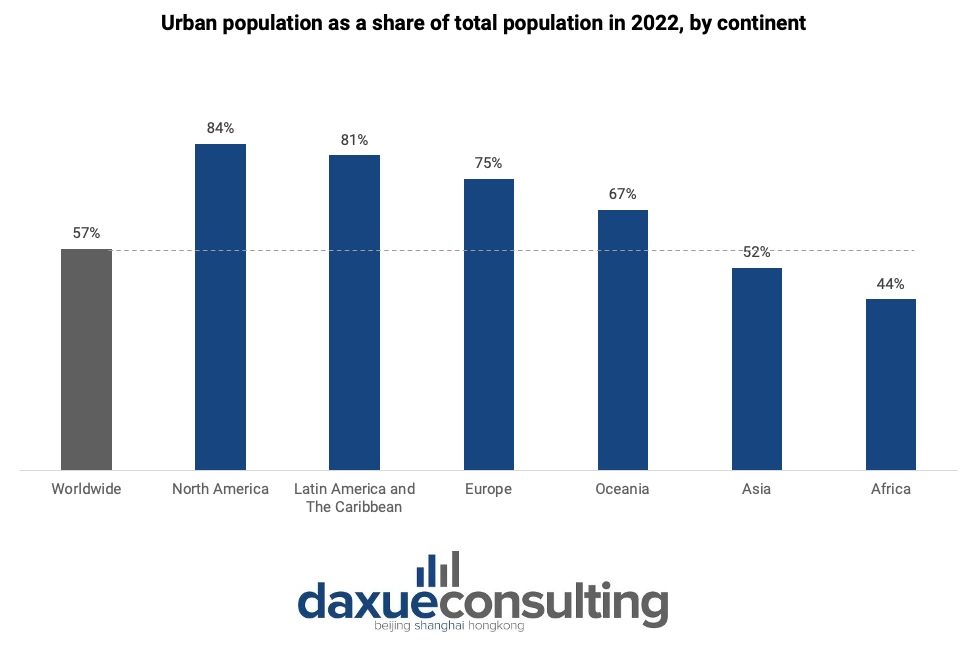

The worldwide home décor market is growing due to the expanding real estate sector and urbanization. In 2018, urban areas were home to 55% of the global population, according to the United Nations. By 2050, this percentage is expected to rise to 68%, with India, China, and Nigeria accounting for 35% of the predicted increase in the global urban population. Due to the shift in lifestyle, high-end, high-quality furnishings and appliances are also being adapted.

The rising popularity of small houses has also promoted the use of products with extra storage features and those that could enhance the visual appeal of residences. Another crucial factor in the growth of the global home décor industry is the rising customer preference for eco-friendly home design items, which is a consequence of increasing environmental concerns.

In developed nations like the U.S., Canada, and Germany, home décor products have been widely adopted, but consumer demand is expected to grow steadily in emerging nations like China, Brazil, and India.

Chinese home décor market is estimated to reach US$20.23 billion (RMB138.34 billion) in 2023

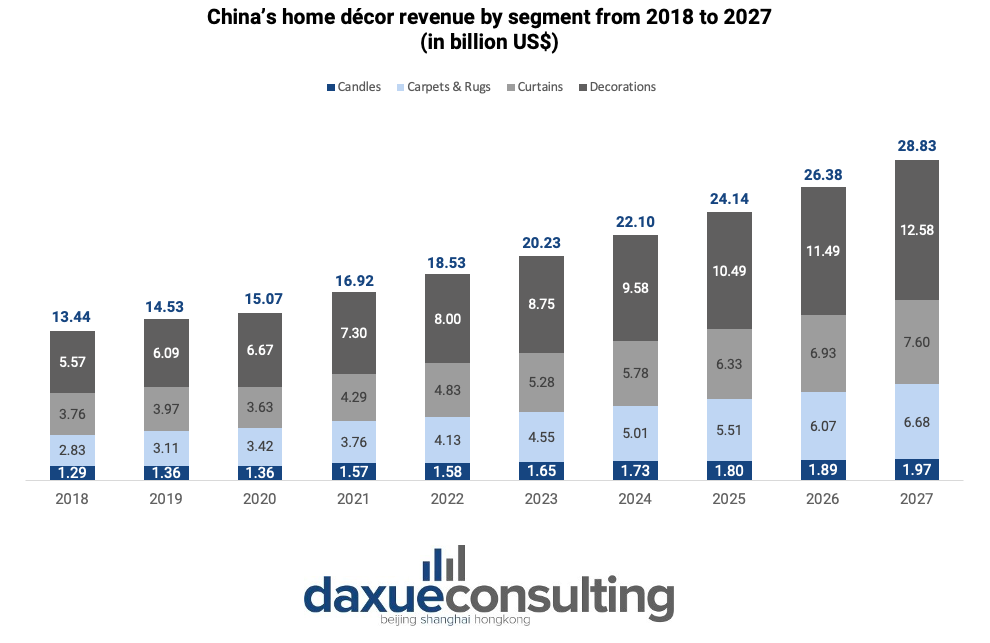

Since 2014, the revenue size of China’s home décor industry has maintained steady growth. As of November 2022, China’s home décor market’s revenue in 2022 is estimated to amount to US$18.53 billion (RMB126.72 billion) and would grow to around US$28.83 billion (RMB197.15 billion) by 2027. The market is predicted to grow with a CAGR of 9.26% from 2023 to 2027.

The decorative accessories segment is taking the lion’s share of the Chinese home décor industry’s revenue followed by curtains. Each consumer in China is spending an average of US$5.28 (RMB35.81) on decorative accessories in 2022, 26.1% of their total spending on home decorations in that year.

Customized furniture and premium home decorations are trending

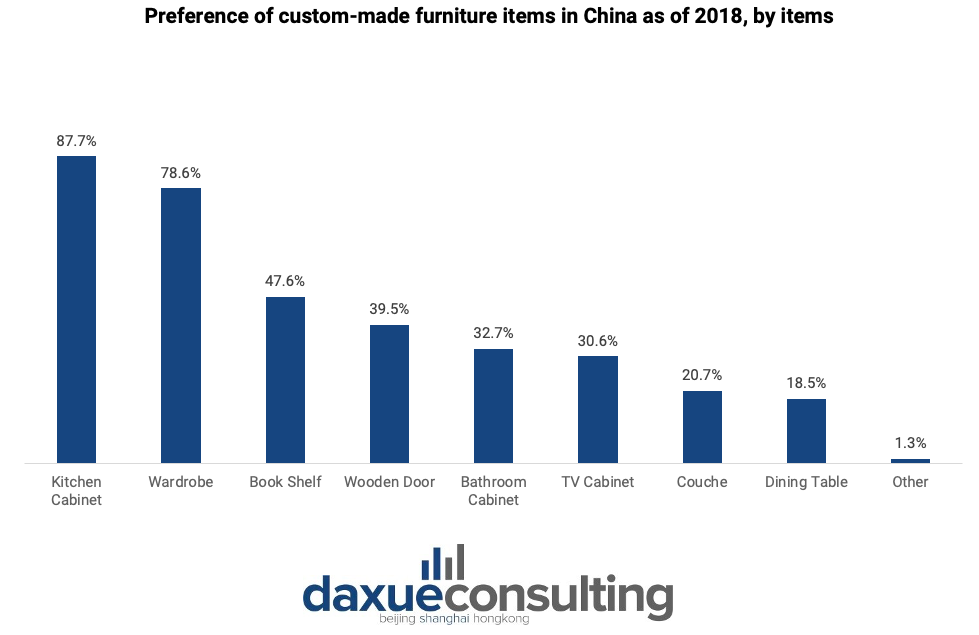

The customized furniture and high-end home décor segment in China have experienced significant expansion and offer great opportunities. Personalized, diversified consumption is the mainstream of modern consumption. In 2018, the search volume for keywords like “customization”, “premium”, and “smart home” increased.

In 2018, kitchen cabinets and wardrobes were the two most popular furniture categories in China’s customized and premium home décor market trailed by bookshelves and wooden doors.

Whole-house customization is also preferred by both customers and companies

For customers, whole-house customization ensures style uniformity throughout every part of the house. It also allows them to have a one-stop procurement and cost control to manage their budget.

On the other hand, for home décor companies, customizing a whole house means lower cost and higher profit. Therefore, it is extremely beneficial for them, especially to expand their business.

Finally, for the home décor industry altogether, complete house customization results in overall cost reduction while also helping build distribution channels for small and medium size companies

A change in the housing supply structure in China’s home décor market

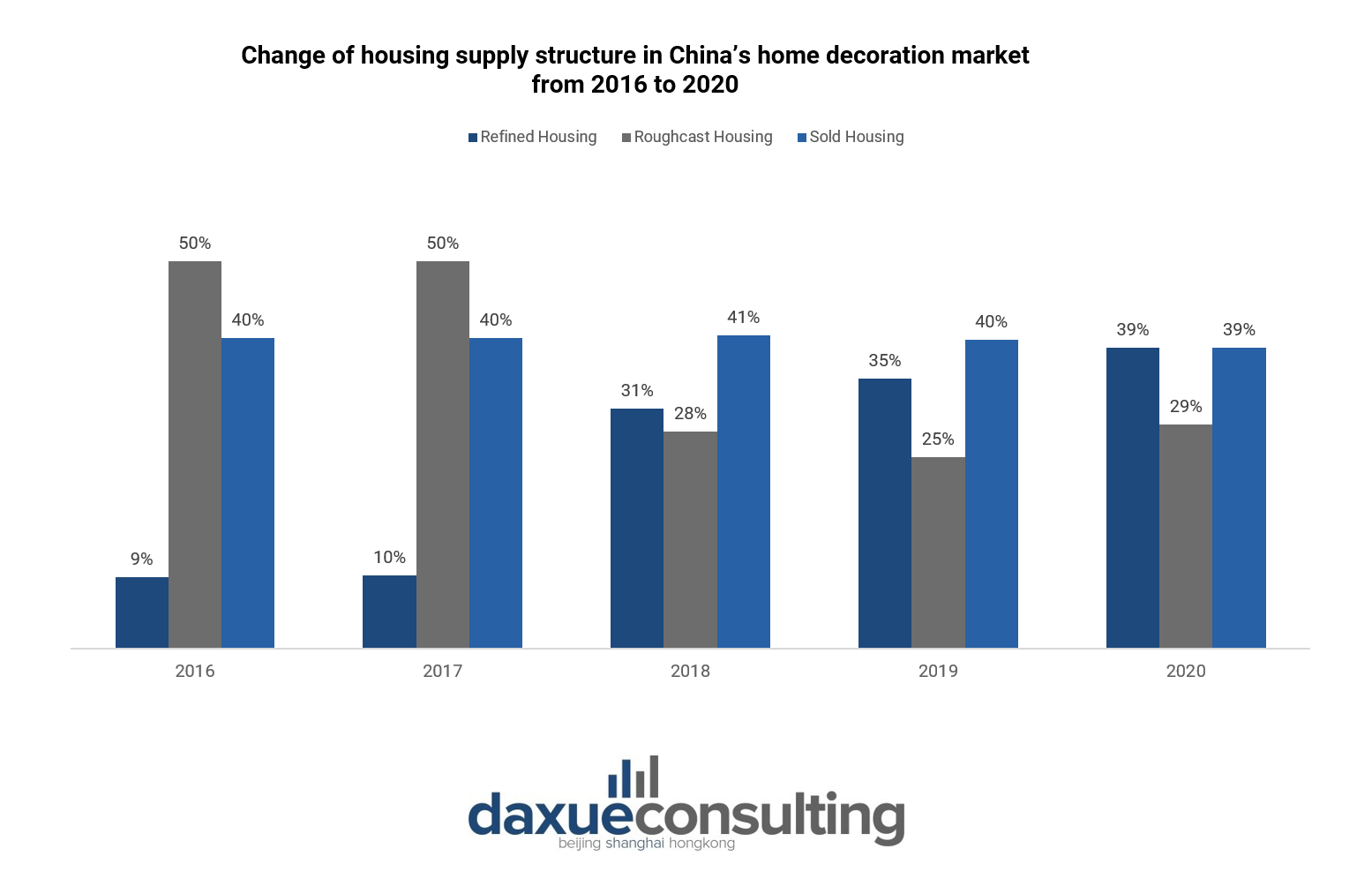

Between 2016 and 2020, the housing supply structure in China’s home décor market changed. Sold housing’s popularity remained stable throughout the years. “Refined Housing”, houses that already have cabinets installed, wall painted, bulbs set, and floor adorned, is gradually becoming more popular. Meanwhile, the “Roughcast Housing” type, houses which insides are left blank, became increasingly less popular.

Understanding the factors that drive the Chinese home décor industry

Currently, there is an increasing trend of home renovation and premium home décor consumption in China. China’s home décor industry still boasts plenty of room for future development. There are several reasons to explain the great opportunities of China’s home décor industry:

- First, the steady progress of urbanization stimulates the demand for commercial housing. Thus, promoting the growth of home decoration market demand.

- Second, the real estate golden decade accumulated a large housing inventory for the home decoration industry and laid a solid production value foundation.

- Third, the rapid recovery of the home decoration market in the post-epidemic era stimulates demand.

- Fourth, the second-hand housing market in fast-developed cities is active, giving rise to a large demand for housing reconstruction.

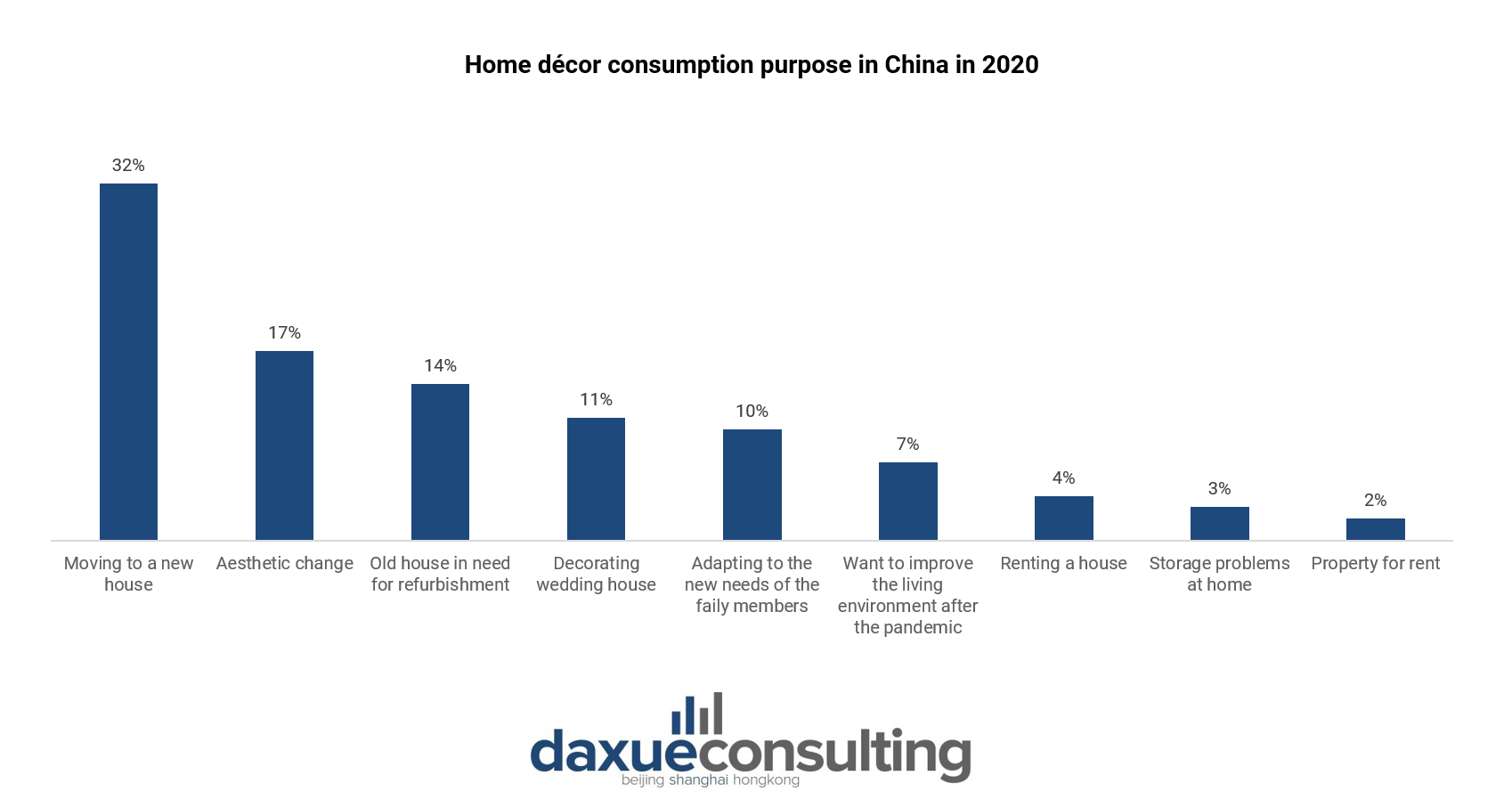

Decorating a new house is the top motivation for home décor consumption in China. It is then followed by wanting to change the home’s aesthetic and to replace old décor. There also seems to be a correlation between the city tier and the consumption rate of home décor in China. The lower the tier of the city, the higher the consumption. Based on Tencent’s 2020 report, 3rd and lower-tiered cities in China accounted for 48% while the 1st tier cities accounted for only 10%.

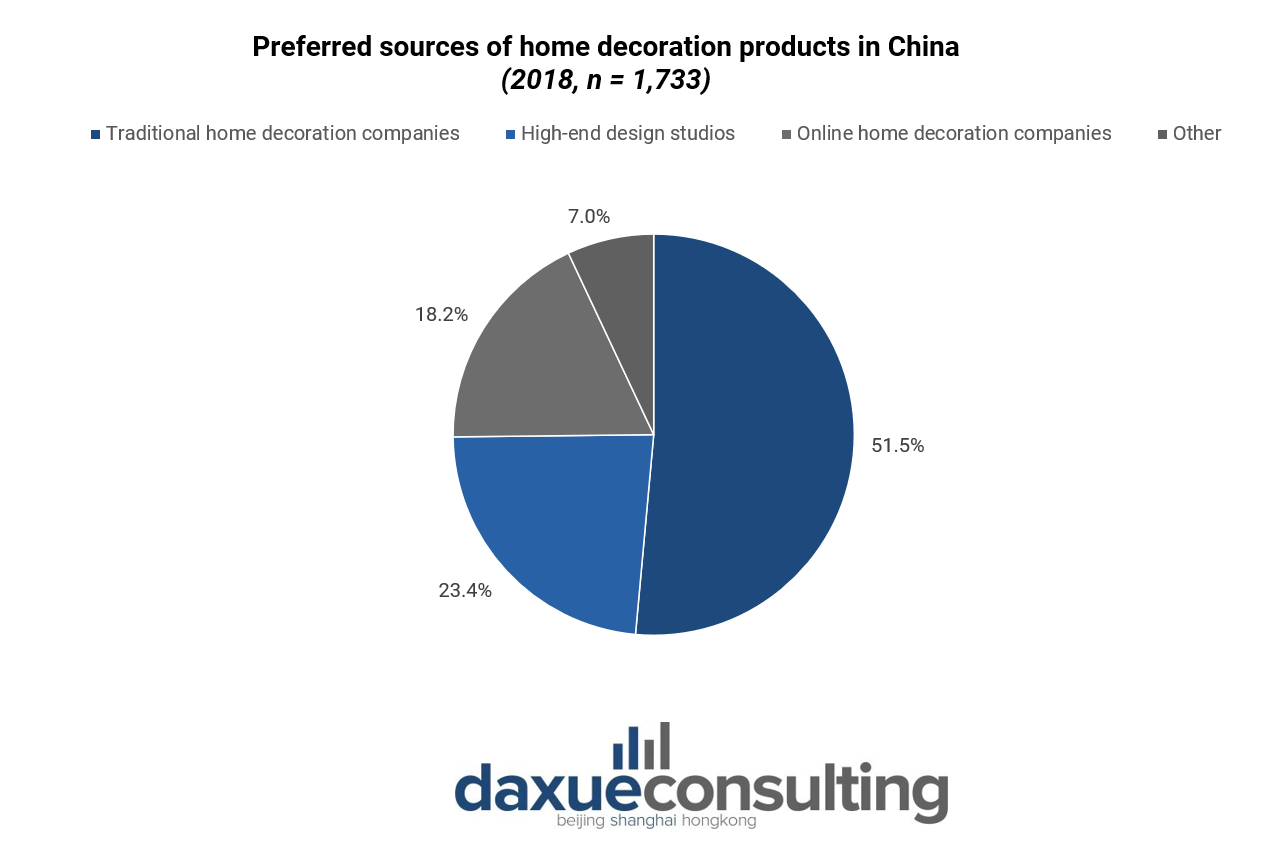

Traditional home décor companies are the main players in China’s home décor industry

Traditional home decoration companies are much preferred by the Chinese. In 2018, more than half, 51.5%, of people prefer to source their home decorations from traditional home decoration companies followed by high-end design studios with 23.4%.

Window treatment: a closer look at China’s home décor market

To put it simply, window treatment refers to anything that you would place over or around your windows. Window treatment can be divided into two groups: soft treatments, such as curtains, and hard treatments, such as blinds and shutters.

The window treatment market size in China is growing with six types of treatment being the most popular among Chinese homes

The curtain industry in China has the second-largest revenue source in the home décor category. The revenue of China’s curtain market is estimated to reach US$5.28 billion (RMB35.71 billion) in 2023. There are six popular window treatment types in China:

- Cloth curtain

The cloth curtain is the most common type of curtain in daily use. They are frequently used in living rooms, bedrooms, hotels, and offices and are typically made of linen, flannelette, or chenille.

- Gauze curtain

Gauze curtains are mainly used for decoration, have the ability to block sunlight and dust, and are normally paired with cloth curtains. These curtains are made of polyester, chiffon, linen, lace, and so on.

- Roller shutter

Roller shutters are very convenient to assemble and provide good shading. They are commonly used in offices, schools, banks, and other places.

- Roman curtain

Most styles and types of fabrics can be used to make a Roman curtain. This curtain type is widely utilized in high-end homes, villas, banquet halls, clubs, etc.

- Soft gauze curtain

Soft gauze curtain is commonly made of double-layer polyester, nylon, or linen. The fabric accessories are relatively exquisite and are mostly used in public parts such as homes and villa clubs.

- Shutter curtain

Shutter curtains are made of many thin sheets, including aluminum sheets, bamboo, wood, plasticized sheets, and flax sheets.

Smart curtains are increasing in popularity among Chinese consumers

The global market for smart curtains is predicted to reach US$6.68 billion (RMB45.68 billion) by 2026 from US$3.97 billion (RMB27.15 billion) in 2020, rising at a CAGR of 9.2% from 2021 to 2026. This growing trend can also be observed in China. According to CSHIA data, the sales volume of smart curtains in China grew from around 200,000 sets in 2016 to 1.3 million in 2018. The number is predicted to reach 13 million in 2022.

Smart curtains have always been at the top of the list for supply equipment in the chain of the smart home sector. Data from 2020 show that smart curtains ranked fifth in the industry chain for smart homes and accounted for 12.5% of the supplied equipment.

Smart curtains are mostly used in offices and hotels now in China. Although automated curtains are currently only found in premium residential houses, the demand is constantly growing as people are pursuing a better and smarter lifestyle.

Jinchan is ranked first among key players in the premium window treatment market

What to know about Chinese home décor market:

- Chinese home décor market is estimated to reach US$20.23 billion (RMB138.34 billion) in 2023 with a CAGR (2023-2027) of 9.26%.

- Customized furniture and premium home decorations experienced significant growth with kitchen cabinet and wardrobe categories leading the demand for custom-made furniture. Chinese consumers are also increasingly interested in smart home devices.

- Urbanization, the real estate sector, the rapid recovery after COVID-19, and the growth of second-hand housing were the main drivers of the home décor market in China.

- Housewarming is the number one motivation for the Chinese to decorate their house. Moreover, people living in lower-tier cities seem to spend more compared to those in higher-tier cities.

- Consumers in China prefer to buy home decorations from traditional home décor companies rather than high-end design studios and online furniture markets.

- Window treatment is one of the most popular categories in the Chinese home décor market. Within this segment, the smart curtain is rising in popularity.

Author: Regina Sukwanto