Established in Guangdong in 2012, HEYTEA (喜茶) is a new-style tea drink brand that blends traditional Chinese tea culture with modern aesthetics, acclaimed for inventive teas and chic outlets. As of May 2023, it boasts 241 stores across China, concentrating on first and second-tier cities in the East and South. Moreover, the brand’s international growth is noteworthy, spanning 83 cities globally by 2022, including countries such as Singapore, Canada, the United States, the United Kingdom, and Australia.

Download our report on the She Economy in China

1. Surfing the Guochao (国潮) trend

Strategically capitalizing on the Guochao (国潮) trend, HEYTEA is enhancing its popularity through a thoughtful integration of traditional Chinese elements in product names and packaging design. Beyond being a beverage provider, the brand positions itself as a cultural experience. By embracing the essence of Guochao, HEYTEA resonates with consumers seeking a harmonious blend of modernity and tradition in their lifestyle choices.

2. HEYTEA’s visual charisma and enduring freshness in tea culture

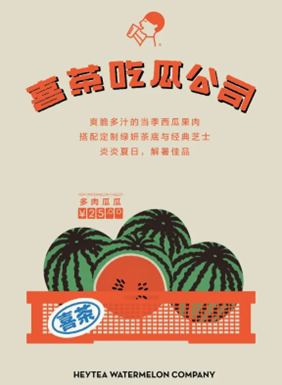

HEYTEA, often playfully dubbed a “design company wasting time with milk tea,” captivates its audience through visually appealing elements. The brand successfully appeals to a broad spectrum of young consumers by incorporating Chinese aesthetics, minimalism, and retro elements in its marketing content design. For example, the launch posts for its watermelon-based drink in 2019 evoked nostalgic Hong Kong retro vibes, striking an emotional chord with Chinese consumers. Furthermore, through each IP collaboration, HEYTEA introduces unique cup designs, ensuring a perpetual sense of novelty.

3. Utilizing co-branding to maintain a buzz-worthy status

HEYTEA strategically incorporates co-branding into its marketing, evident in its collaboration with Barbie on October 30, 2023. This initiative, specifically targeting female consumers, achieved remarkable success, selling nearly 3 million cups within the first week. Leveraging the global appeal of Barbie enhances HEYTEA’s standing among this demographic. This partnership, specifically targeting female consumers, achieved remarkable success, selling nearly 3 million cups within the first week. By leveraging the popularity of the globally recognized Barbie brand, this tea brand aimed to enhance its appeal among this demographic.

Furthermore, in mid-May 2023, the Guangdong-based tea company teamed up with luxury brand FENDIin the launch of a new tea product, which sold more than 1.5 million cups in just 3 days, and the whole network generated more than 100 million user-generated content on social media platforms, including Xiaohongshu and Douyin. The collaboration with FENDI catered to the growing demand for luxury goods, allowing customers to enjoy a cup featuring the FENDI logo at a more accessible price, blending tea with the elegance of high-end fashion.

As for December, 2023, this tea brand has engaged in over 110 co-branding partnerships since its establishment in 2012, maintaining a consistent pace of approximately 20 collaborations per year. This showcases the brand’s ability to adapt as a brand to meet the ever-changing desires of consumers, demonstrating a strong understanding of current market trends and preferences.

The controversy surrounding HEYTEA’s co-branding initiatives

While HEYTEA’s co-branding initiatives have been largely successful, there have been instances where controversies emerged.

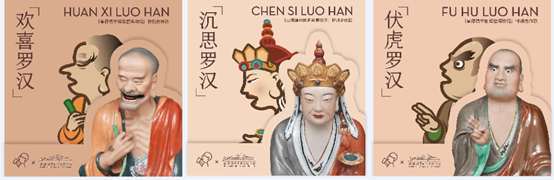

On November 28, 2023, the brand collaborated with the Jingdezhen China Ceramic Museum to release a tea featuring a Bodhisattva expression, garnering significant attention both online and offline. However, this collaboration faced criticism due to its religious-themed packaging, violating regulations outlined in the “Regulations on Religious Affairs” that prohibit commercial promotion in the name of religion.

However, this is not the first time the Guangdong-based company sparked criticism among Chinese consumers. Back on April 19, 2019, the brand partnered with Durex, a major condom brand, on Weibo. The caption, the text in the post, and the company comment under the post were considered inappropriate by netizens due to their sexually suggestive nature, prompting the brand to address the issue by deleting the related content and issuing an apology.

Elevating the tea experience with premium milk protein

The tea drinks market in China is becoming increasingly competitive as more players enter to secure their share of the market. Relying solely on IP collaborations is seen as unsustainable in the face of growing competition, highlighting the need for higher quality and innovation. Moreover, Chinese consumers are placing greater emphasis on the quality of tea ingredients and expressing a desire for nutritionally rich products.

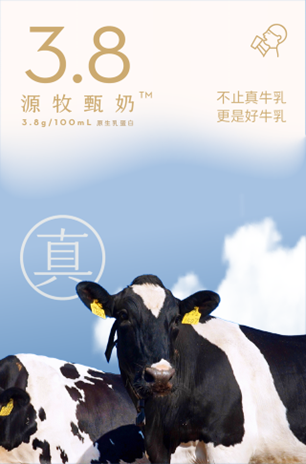

As a result, in September 2023, HEYTEA introduced a new milk for their teas, boasting 3.8g/100mL of premium milk protein with no additives. Aligned with current consumer preferences for natural products, the brand carefully manages the entire production process, sourcing from prime dairy farms with Holstein cows known for high milk yield and superior nutritional content.

Guochao, aesthetics, and co-branding at the core of HEYTEA’s marketing strategy

- HEYTEA, is a new style tea drink brand that blends traditional Chinese tea culture with modern aesthetics. Initially, it garnered attention for its innovative tea beverages and stylish outlets.

- This brand is strategically riding the Guochao (国潮) wave to elevate its popularity, by integrating traditional Chinese elements into its product names and packaging design.

- The brand’s marketing strategy revolves around the allure of high aesthetics, making it a focal point for young individuals engaged in social sharing.

- HEYTEA strategically adopts co-branding for long-term success, boasting over 110 partnerships by December 2023 at a consistent pace of around 20 collaborations annually. Notably, partnerships with brands like Barbie and FENDI have effectively captivated customers and generated buzz among Chinese consumers.

- The brand is achieving quality upgrading through innovation. For example, it introduced a new kind of milk for its tea beverages, which boasts 3.8g/100mL of premium milk protein without any additives, aligning with current consumer preferences for natural products.