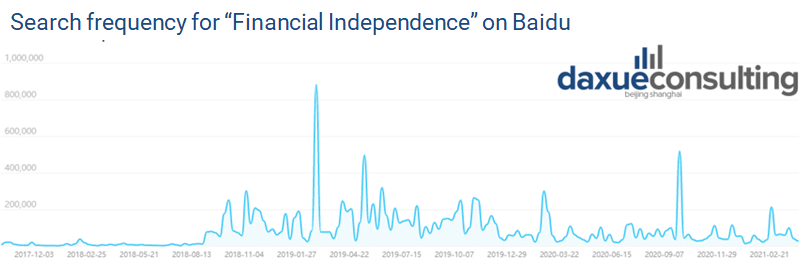

As the Chinese middle class keeps growing, foreign and domestic brands have been rushing to satiate the growing appetite of Chinese consumers. Having grown up during a period of economic prosperity, Chinese millennials (those born between 1996 and 1981) are now a strong engine of the booming Chinese economy. As the Chinese society gets wealthier, the concept of financial independence has become increasingly popular among Chinese millennials in recent years. Financial independence, or financial freedom, is the idea of living a comfortable life from one’s capital and passive income without having to work for a wage. However, people do not necessarily have the same definition of what a comfortable life is, and the income needed to achieve financial independence. In this article, we will see what Chinese millennials perceive financial independence to cost, how realistic this goal is and how to achieve in China.

How much does financial independence cost according to Chinese millennials?

Everyone has their own definition of what a comfortable life is and how they can achieve it. This cost greatly differs depending where people live, especially in a tier 1 Chinese city like Shanghai where the SCMP estimated a hefty 3.5 million USD price tag in capital to live there financially free. A study from DT Finance has shed some light on how much Chinese millennials think financial independence really costs. According to the study, 21% of Chinese millennials consider that financial independence in China could be reached with a passive income of between 10,000 and 20,000 RMB a month while 66% of survey respondents say that it would take between 20,000 and over 50,000 RMB a month.

This threshold is on average higher for married couples as they are considering expenses like education and healthcare. For 42% of respondents, earning between 5,000 to 10,000 RMB a month means they are poor; the main source of poverty is their housing situation.

Financial independence is a long shot for most Chinese millennials

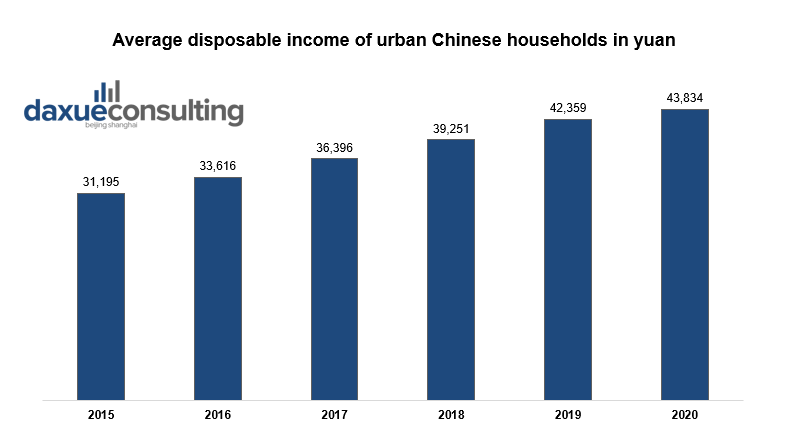

Considering the per capita income of Chinese urban households in 2020 was on average 43,834 RMB per year, financial freedom has only a tiny percentage of the population. Worse yet, according to the Chinese National Bureau of Statistics, while households’ incomes have significantly increased along the years, so have their expenditures. Between 2013 and 2019, Chinese urban households’ expenditures have increased on average by 51%. This means that households would need increasingly more money from passive income to attain financial independence. In China, passive income yields primarily from real estate and other safe financial assets. Although home ownership in China is exceptionally high and the Chinese financial market is soaring, the sheer amount of passive income needed to be financially free according to Chinese millennials limits the idealization of this goal to a small elite. This is doubly true in tier 1 Chinese cities where life is notoriously more expensive.

What are the main sources of passive income in China?

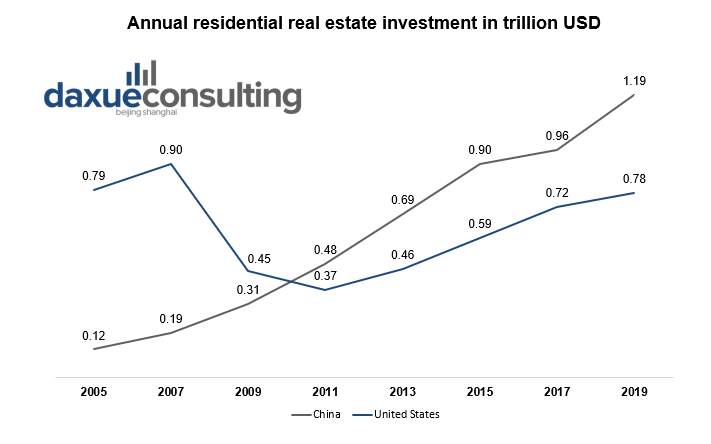

Real estate – The most common way to invest in China

Real estate in China represents the primary means of investment for Chinese households and about 74% of the Chinese middle class’ wealth. This is thanks to a home ownership ratio of 89.68%, with 20% of Chinese households also owning a second home. Due to this long tradition of home ownership, many Chinese millennials are in a situation where their parent’s house is paid for and, depending on specific family situations, they may have relatively easier access to ownership themselves. However, if home ownership in China is easier to achieve than in the West, rents are also significantly lower. Although real estate prices in China have been steadily rising in China, the price for homes in the large majority of Chinese cities is under 30 RMB/m² a month. Despite concerns about a speculative bubble, real estate remains by far the go-to way to invest in China.

The Chinese financial sector – a soaring yet heavily regulated industry

Carried by China’s booming economy, the Chinese financial system keeps accumulating more benefits. Initially heavily regulated, the Chinese finance sector has greatly benefited from China’s slow liberalization process that started in the late 70’s. Although the Chinese government keeps a tight leash on some financial items, Chinese people now have increasingly more access to a large variety of placements. With high deposit interest rates and a booming wealth management industry, Chinese households are given great opportunities to make relatively high-yielding and safe savings. As the Chinese government continues to liberalize the sector while protecting it from aggressive foreign investment, banking will continue to be a premium source of savings in China.

How are millennials reaching financial independence in China?

- Chinese millennials have relatively high standards for what a comfortable financial-burden free life is, making it possible to achieve only by a privileged elite on passive income alone.

- This is solidified by the growing cost of life in China that has accompanied the rise of the Chinese middle class, especially in tier 1 cities where real estate prices have soared.

- Residential real estate is the most popular passive income source for Chinese people thanks to the relative safety of the investment and China’s high home ownership rate.

- The growing Chinese finance industry offers good investment opportunities as a source of passive income for Chinese people thanks to China’s high interest rates and booming economy.

Author: Camille Gaujacq