Under the influence of the “beauty value economy”, the lipstick market in China continues to captivate beauty enthusiasts. China’s lip makeup market witnessed substantial growth in 2023, reaching RMB 26.28 billion, up by 13% year-over-year. This trend is expected to continue, with the market anticipated to expand to RMB 37.95 billion by 2028. Lipsticks remain a significant segment of the Chinese cosmetics market. It was driven by innovative marketing strategies, evolving consumer preferences, and the rise of digital sales channels. So, what is the current state of the lipstick market in China?

Download our report on the She Economy in China

Key consumers of the lipstick market in China

People aged from 25 to 34 have become the main consumer groups in the lipstick market in China. They account for about 58.8% of the total population, of which females are the main consumers. On average, a middle-class female consumer in China buys at least 5 lipsticks every year.

However, women are no longer the only important consumer group for the lipstick market in China. The men’s beauty market in China has shown remarkable growth, contributing to an overall value of RMB 18.9 billion in 2023. The local skincare market continues its upward trajectory, with projections to reach RMB 21.3 billion by 2025. Recent data indicates a surge in lipstick consumption by men, with a remarkable growth rate of 278%. Notable influencers like Li Jiaqi, famously dubbed the “Lipstick King,” play a significant role. Li Jiaqi’s social media presence, featuring videos of him testing and recommending different lipsticks, has not only popularized male cosmetics but also normalized their use.

Many cosmetics companies have specially developed men’s facial skincare kits, cleansers, lotion creams, special masks, BB creams, CC creams, and lipsticks for male consumers.

New trends in the lipstick market in China

Lip glosses lead the lipstick market in China

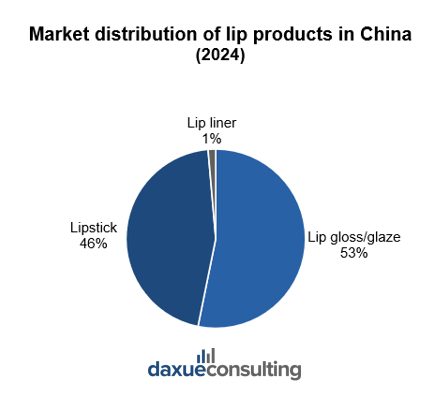

Lip makeup has several sectors: lipsticks, lip glosses, and lip glazes. From the perspective of market distribution, lip gloss, and lip glaze are the largest segment of the lipstick industry in China, accounting for about 53% of the lipstick market, followed by lipsticks, accounting for about 46%, and lip liners taking third place.

The domestic lipstick market in China is booming

Driven by the rise of the beauty economy, increasing consumer demand for innovative and affordable makeup, and the growing influence of local brands, the Chinese lipstick market is experiencing remarkable growth. According to iiMedia Research, the size of China’s lip cosmetics market reached RMB 26.28 billion in 2023, representing a year-on-year growth of 13.0%, and is projected to grow further to 379.5 billion RMB by 2028. E-commerce platforms like Xiaohongshu (Little Red Book) and Douyin (China’s TikTok) account for a significant share of sales across the entire lipstick market in China.

Livestreaming and social interaction: Drivers of lip makeup growth in China

E-commerce platforms like Xiaohongshu (Little Red Book) and Douyin (China’s TikTok) play a pivotal role in driving this growth. These platforms go beyond being mere sales channels—they shape consumer preferences through personalized recommendations and livestreaming. For example, Xiaohongshu fosters a sense of community by enabling users to post shopping hauls and makeup tutorials and share honest reviews via comments. This creates a consumer-driven content economy that builds trust and drives sales.

What’s particularly unique to China is the seamless integration of social interaction and commerce on these platforms. Livestreaming sessions on Douyin are not just about selling products but also immersive events where brands engage consumers in real-time with limited-time discounts and interactive Q&A sessions. This real-time interactivity, combined with gamified shopping experiences and cultural nuances like “gift-giving culture” during festivals, creates a highly dynamic market environment. In the first half of 2024, Chinese brands such as INTO YOU, Perfect Diary, and Judydoll ranked among the top sellers on Douyin, collectively achieving over RMB 44.84 billion in sales.

In addition, the trend towards “妆养合一”(makeup and care integration) has also contributed to the diversification and refinement of the lipstick market. Products such as hybrid lipsticks with skincare benefits, lip serums, and multifunctional lip tints are becoming increasingly popular. For example, Perfect Diary’s Biolip™ technology combines the effects of lipstick, lip balm, and lip masks, aligning with the growing consumer preference for health-focused, multi-purpose beauty products.

Foreign lipstick brands’ influence in China

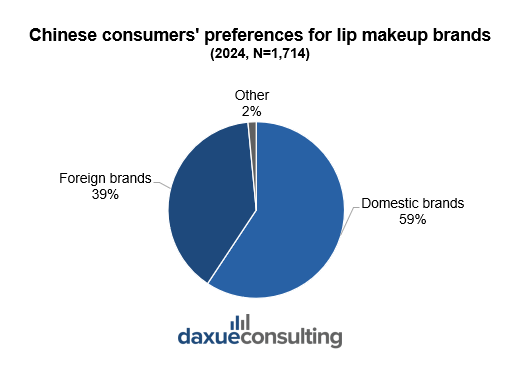

Foreign brands, while still significant players in China’s lipstick market, are facing challenges as they adapt to shifting consumer preferences and increased competition from domestic brands. Historically, luxury brands like Yves Saint Laurent, Dior, Givenchy, Chanel, Estee Lauder, and Giorgio Armani dominated the market, leveraging their prestigious reputations and strong brand images. These brands have long been associated with reputation, quality, and marketing strategies that appeal to Chinese consumers seeking premium products.

For years, owning a foreign luxury lipstick symbolized social status and international cosmopolitanism. The appeal was further amplified by their ability to market themselves as purveyors of “true luxury,” emphasizing craftsmanship and exclusivity. The perception of quality played a crucial role. Foreign brands were widely regarded as offering superior products, especially when compared to the emerging local brands of the time, which were still developing their formulas. The association of “Made in France” or “Made in Italy” with luxury and trustworthiness allows foreign brands to gain popularity.

Foreign brands also excelled in marketing, creating emotional connections through collaborations with Chinese celebrities and global stars. For instance, Guerlain partnered with famous celebrities like Fan Bingbing to appeal to Chinese consumers who are fans of these celebrities.

However, the influence of these foreign brands has started to wane. French brands, in particular, remain prominent exporters of lipsticks to China, with France accounting for a significant share of the imported beauty market. Even so, their dominance is no longer unchallenged.

Domestic brands use traditional Chinese elements to attract customers

Considering the rise of cultural confidence in China, cosmetics using traditional Chinese aesthetics to risen in popularity. Some cosmetics brands that focus on Chinese designs cater to the consumption trend of modern young consumers. For example, Run Baiyan’s Forbidden City lipstick which is part of a Forbidden City cosmetic range includes lipsticks, eye shadows, blushes, nail polishes, and other makeup products. The most prominent are the six Forbidden City lipsticks, namely Langyao Red, Bean Paste Red, Rose Purple, Maple Leaf Red, Tourmaline, and Mermaid Ji.

The color of the Forbidden City lipstick paste comes from the red national treasures in the Palace Museum. The appearance design of the lipstick tube is inspired by the costumes of the imperial concubine of the Qing Dynasty. The Forbidden City lipstick also uses 3D multilayer printing technology to print traditional patterns on the lipstick tube, highlighting the texture of the fabric and the three-dimensional sense of embroidery.

As a creative product developer, the Forbidden City has always developed many popular cosmetic products. With the support of fans, the Forbidden City lipstick marketing has received a lot of attention with its eye-catching design and colors.

Foreign lipstick brands also ride the wave of Chinese culture-themed designs

At the same time, many international brands also include Chinese cultural elements or regularly launch festival-limited products. However, some foreign brands have a relatively superficial understanding of Chinese culture. Most of the festive and New Year limited editions just add the Chinese zodiac of the year to the packaging.

Pharmaceutical companies enter the lipstick market in China

Currently, not only ordinary cosmetics companies but also pharmaceutical companies have entered the lipstick market one after another. Drug makers suffering from deteriorating earnings have chosen the lipstick market as a new growth driver.

For example, Ma Yinglong, which was focusing on hemorrhoid ointment, launched lipstick products recently. According to the Ma Yinglong Babao flagship store news, the lipsticks launched this time are Ma Yinglong’s brand Ma Yinglong Babao, which are magenta matte velvet cream, Champs Elysées matte velvet cream and first love color blemish water lip balm. The three lipsticks cost RMB 138, and the three-color set costs RMB 399.

Key takeaways about the lipstick market in China

- Lipstick is one of the most promising industries in the Chinese cosmetic market: it has a wide range of products both in luxury and low-end categories

- Men’s cosmetics are contributing significantly to the lipstick market, driven by increased demand and the influence of male beauty influencers.

- Lip glazes lead the market in popularity, followed by lipsticks and lip glosses, while hybrid lip products combining makeup and skincare are rising in demand.

- Domestic brands like INTO YOU, Perfect Diary, and Judydoll are gaining prominence due to affordability and innovation, challenging the dominance of foreign luxury brands.

- The integration of e-commerce platforms like Xiaohongshu and Douyin has revolutionized consumer engagement, blending social interaction with commerce through personalized recommendations, livestreaming, and gamified shopping experiences.

- Both domestic and foreign brands are leveraging Chinese cultural elements in their designs that appeal to many consumers.

- Pharmaceutical companies are entering the lipstick market, introducing health-focused products as a new growth strategy.