Louis Vuitton Malletier, also known as LV or Louis Vuitton, is a French luxury fashion brand founded by Louis Vuitton in 1854. The brand’s extensive range of products includes luxury suitcases, leather goods, shoes, watches, jewelry, accessories, sunglasses, and books. Louis Vuitton entered the Chinese market in 1992 and has since become one of the most popular luxury fashion brands in China, with a strong demand for its products.

A glance at China’s luxury market

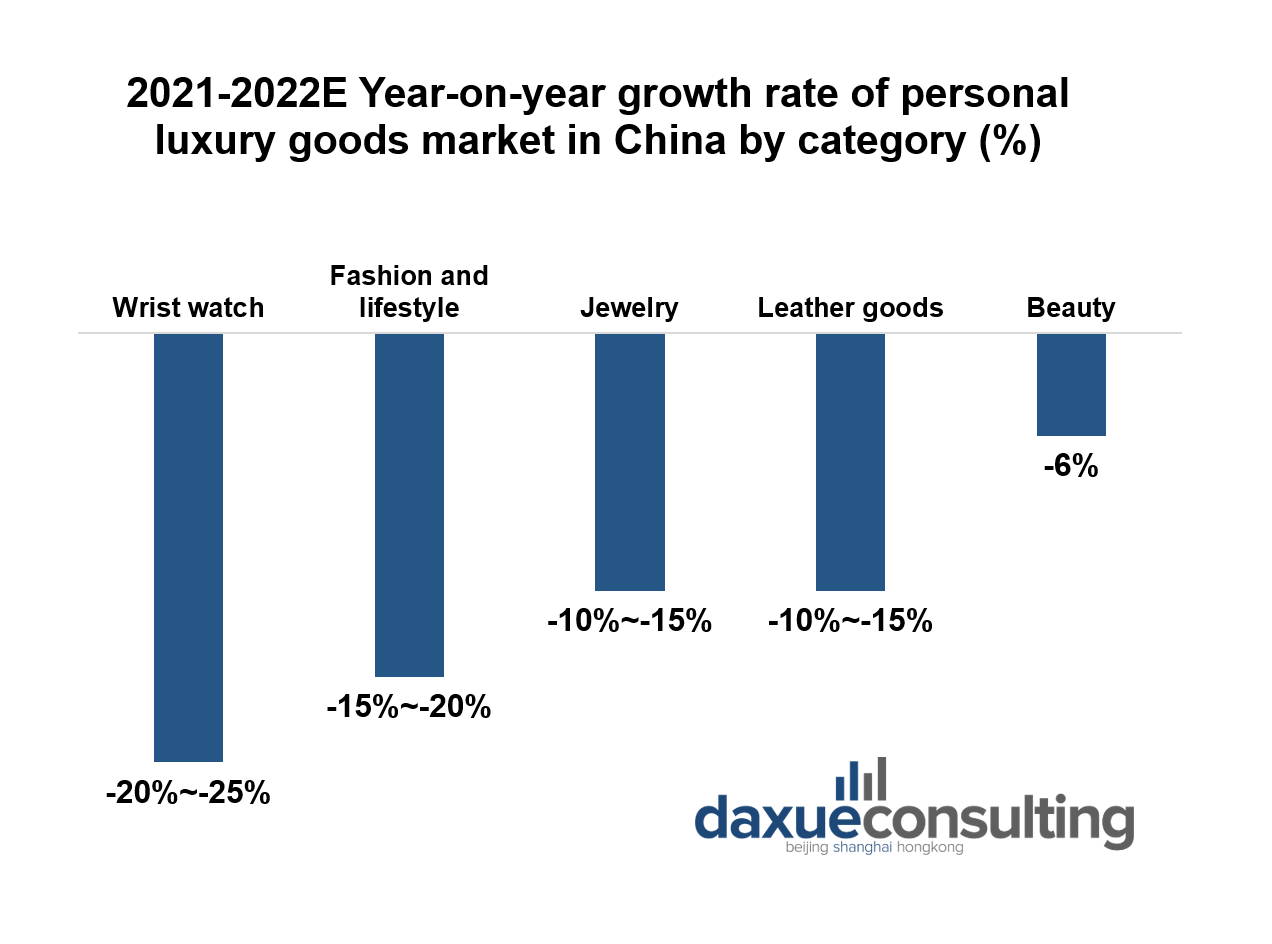

According to Bain’s China Luxury Market Report 2022, China’s luxury market saw a decline of 10% year-on-year in 2022, ending a five-year consecutive period of rapid growth. The pandemic led to frequent lockdowns, reducing consumers’ frequency of shopping in offline stores, and resulting in most Chinese consumers making luxury purchases domestically. However, despite this setback, China remains the most promising market for luxury goods, and it is expected that the Chinese luxury market will return to positive growth by the end of Q1 2023.

Online sales are key in China

In 2020, the online sales of luxury brands in China market gained 88% growth, reaching US$14.1 billion, accounting for 21% of the whole market share. In 2021, online sales of Chinese luxury goods experienced even faster growth, with a 75% growth and reaching US$24.7 billion (more than 150 billion RMB), which accounted for 26% of luxury China market sales.

While almost all luxury categories suffered from the pandemic’s impact, categories with higher online channel penetration performed relatively better. For instance, the luxury beauty category, with a 50% online penetration, only saw a decline of about 6%.

Louis Vuitton’s strategy in China

On July 24th, 2012, LV opened its largest exclusive store in mainland China—Louis Vuitton Maison Shanghai, which was a significant move in the brand’s China strategy. As of 2023, LV operates 62 offline stores in mainland China, as well as various online sales channels, including its official brand website (louisvuitton.cn), brand app, WeChat mini-program, JD mini-program, and livestream on Xiaohongshu.

LV taps into live shopping

In 2020, LV made its first live broadcast on Xiaohongshu, a popular social commerce platform in China. The broadcast was filmed at LV’s Plaza 66 House Maison in Shanghai, which is not only the largest LV store in China but also the 16th Louis Vuitton House Maison in the world. The hashtag of the brand’s live session had over 8 million views on Xiaohongshu, but the actual number of viewers during the 1-hour period livestream was only 15,000.

Additionally, On June 24, 2021, LV cooperated with NYLON to livestream its 2022 Spring/Summer Men’s Wear Show on the short video platform “Kuaishou”, turning into the first luxury maison to do so. The event drew a cumulative total of 3.9 billion viewers. This partnership exemplifies Louis Vuitton’s commitment to the Chinese market, particularly in engaging with younger audiences and expanding its reach.

The French maison’s first cooperation with a Chinese e-commerce platform

Louis Vuitton’s e-commerce strategy in China has evolved over time, but historically the brand has been cautious in its approach to digital sales in the country. In the early days of e-commerce in China, Louis Vuitton was hesitant to sell its products online due to concerns about counterfeiting and the risk of damaging its brand image.

However, in recent years, Louis Vuitton has begun to embrace e-commerce in China as a way to reach more consumers and capitalize on the growing online shopping trend. The brand launched its own official online store in China in 2017, which offers a wide range of products including handbags, shoes, and accessories. This move was a significant step for the brand, as it allowed Louis Vuitton to control the customer experience and ensure the authenticity of its products.

Louis Vuitton has also been selective about its partnerships with third-party e-commerce platforms in China. The brand did not join luxury marketplaces such as Tmall and JD.com until recently, as it was concerned about diluting its brand image and competing with its own retail stores. However, Louis Vuitton eventually realized the potential benefits of partnering with these platforms, such as increased visibility and access to a wider audience, and began selling on Tmall in 2020.

In 2021, JD.com and Louis Vuitton announced a strategic partnership to expand the French luxury brand’s digital presence in China. The partnership included several initiatives, such as opening a Louis Vuitton flagship store on JD.com, launching a “white-glove” delivery service for JD’s “Top Tier” customers, and collaborating on social commerce initiatives, including live-streaming events on JD’s platform.

LV’s Marketing Matrix

LV employs a multi-channel approach to reach its Chinese customers, both online and offline. The luxury brand is active on popular social media platforms, including Xiaohongshu, Douyin, Weibo and Wechat, where it promotes its latest products and releases TV commercials. Recognizing the significance of brick-and-mortar retail in shaping brand image, LV expanded its presence in China in 2022 by opening new stores in Taiyang Taikoo Li, Chengdu, and The Mixc in Fuzhou.

Xiaohongshu

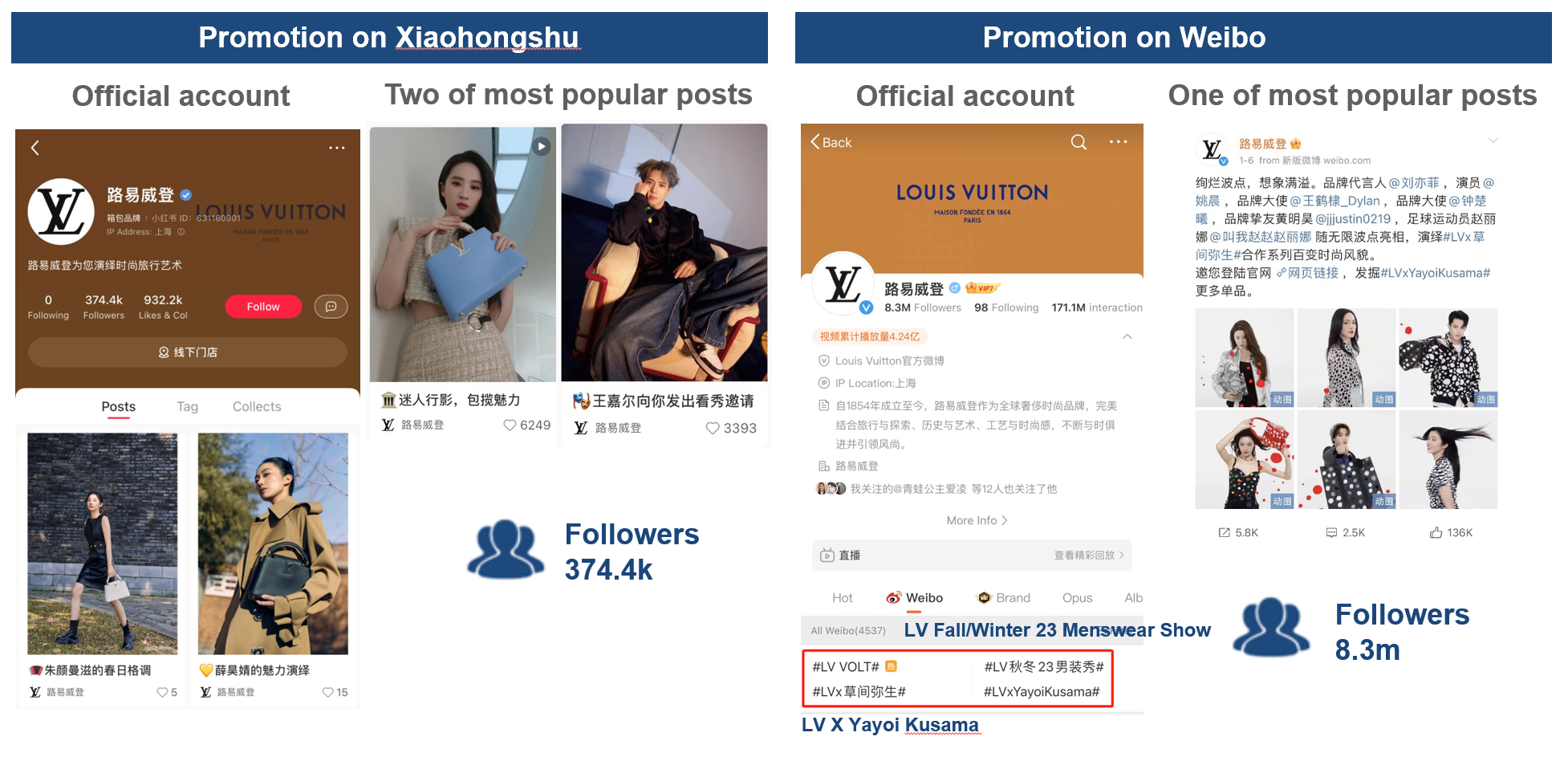

On Xiaohongshu, LV targets young netizens by pushing hot products and collaborations. Hashtags like # LV X Yayoi Kusama with 13million views, and #Capucines handbag with 650 thousand views have been created to promote LV’s cross-collaboration range. Among the posts, those featuring with celebrities such as Liu Yifei 刘亦菲 and Wang Jiaer 王嘉尔 tend to have the highest engagement.

Weibo is another one of the channels that LV uses to attract potential consumers. As of March 2023, LV’s Weibo account has reached more than 8 million followers. One example of its popular posts is about the collaboration with the Japanese artist Yayoi Kusama, with gif pictures featuring celebrities getting up to 136,000 likes.

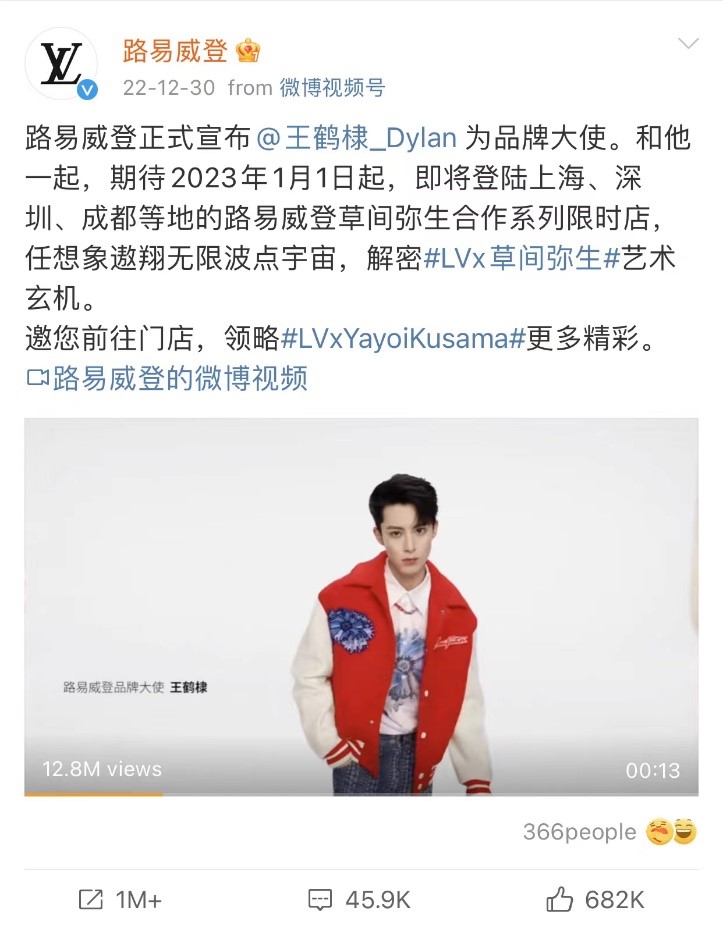

Another post that got high engagement was the announcement of the new spokesperson of the French brand, the 24-year-old Wang Hedi, on December 30, 2022. The young actor gained popularity for his performance in the drama Love Between Fairy and Devil, and the announcement of him becoming Louis Vuitton’s new brand ambassador created a lot of buzz on social media platforms. The post on Weibo got 682,000 likes and over 1 million reposts.

Douyin

From 2019 to 2023, the size of short video users in China grew from 648 million to 1 billion. As a result, it is not surprising that international luxury brands have set up their official Douyin accounts, one of China’s most popular short-video platforms. LV is no exception, and its Douyin account features include spokesperson advertisements and product concept sharing. All promotional and product videos on Douyin are optimized for vertical screens to provide a better viewing experience for netizens.

WeChat account

LV’s WeChat account is also used to communicate the brand’s culture and values to its Chinese consumers. In addition to new product releases, LV also shares articles on topics such as sustainability, craftsmanship, and the brand’s history. With an average of three articles per month, LV is able to maintain a consistent and engaging presence on the platform, while also keeping its followers informed and entertained with a variety of content.

Offline marketing

In addition to its strong online presence, Louis Vuitton is also expanding its offline presence in China with new store openings and unique dining experiences to provide a memorable luxury experience for its customers. Louis Vuitton expanded its presence in China in 2022 with the opening of new locations in Taiyang Taikoo Li, Chengdu, and The Mixc in Fuzhou. The Taiyang Taikoo Li location marks the third Louis Vuitton House Maison in mainland China and the first in Southwest China, while The Mixc store is the newest addition to the brand’s retail portfolio. In November, Louis Vuitton also launched its fifth restaurant worldwide, “The Hall”, which is the brand’s first restaurant in China and the fourth in Asia.

Pop-up stores have become an increasingly important element in Louis Vuitton’s offline marketing strategy in China. They offer a unique and temporary shopping experience, creating a sense of exclusivity and urgency for consumers, while also allowing the brand to test new markets and experiment with different store concepts. The success of Louis Vuitton’s pop-up stores, such as the Yayoi Kusama campaign, has demonstrated the value of this approach in attracting and engaging Chinese consumers.

How LV fights against brand dilution

Brand dilution refers to the blurring of a luxury brand’s image and value among consumers. Luxury brands often use entry products such as handbags to expand their influence while high-net-worth individuals pursue uniqueness and value preservation. To resist brand dilution, LV uses a price increase strategy to prevent its products from becoming too common and give the impression that they are valuable and worth preserving.

On February 18th, LV announced its first global price adjustment in 2023, taking into account changes in production costs, raw materials, transportation, and inflation. In fact, the above reasons are not all. According to data from UBS, the average price increase of luxury goods such as LV in the past 20 years has been 2.5 times the inflation rate.

Luxury goods have a small elasticity of demand among wealthy individuals, who see price increases as a way to preserve value and worth investing in. Increasing prices also help maintain a brand’s scarcity and uniqueness while demonstrating confidence in the market.

Louis Vuitton’s strategies in China

- Despite a decline in China’s luxury market in 2022 due to the pandemic, it remains the most promising market for luxury goods, and online sales are key in China’s luxury market.

- LV has 62 offline stores in mainland China and various online sales channels, including its official brand website, brand app, WeChat mini-program, JD mini-program, and livestream on Xiaohongshu.

- LV is engaging with younger audiences and expanding its reach by tapping into live shopping and partnering with popular social media platforms, such as Xiaohongshu, Douyin, Weibo, and WeChat.

- Louis Vuitton has been cautious in its approach to digital sales in China but has started to embrace e-commerce in China as a way to reach more consumers and capitalize on the growing online shopping trend.

- Louis Vuitton has been selective about its partnerships with third-party e-commerce platforms in China and recently partnered with JD.com to expand its digital presence in China.