As of November 2025, 55-65% of China’s population of 1.4 billion live in third-tier cities and below. Contributing to 40-50% of the country’s GDP and with rates of per capita disposable income growth outpacing that of high-tier city consumers, and increasing leisure time, lower-tier city consumers in China pose a significant opportunity for expansion for international brands in the coming years.

Download our China emerging-tier cities report

Lower-tier, or emerging-tier, cities refer to tier-3 and below in the informal Chinese city-tier system. This categorization is determined by factors like GDP, income level, administrative status, and population. Despite not being an official designation by the central government, the tier system is extensively used to describe markets across various sectors.

An embrace of traditional culture and local tastes

It is crucial to note that despite some trickle-down of purchasing imitation, lower-tier city consumers in China still largely differ from their higher-tier city counterparts in terms of influencing trends and purchasing priorities. They are significantly more pragmatic and price-driven, as demonstrated by lower brand loyalty, a willingness to use online platforms for discounts, and even a tendency to switch platforms for a RMB 1 (USD 0.14) price difference.

Additionally, Chinese consumers have a strong attachment to their hometowns, associating them with stability, belonging, emotional warmth, and insecurity. While terms like “土”, a term synonymous with tacky, often describe rural tastes, soon, rural tastes could be seen more positively.

The role of e-commerce and livestreaming beyond consumption

Government policies play a significant role in fueling the consumption of emerging-tier cities. As the government invests in infrastructure, digital access, and local industries, lower-tier residents spend more, travel more, and participate in China’s consumption upgrade.

As delivery networks mature, e-commerce platforms in China is supporting equal access to the same products and services for everyone. This is particularly important as there is limited offline brand presence in smaller cities, with consumers needing to rely on these platforms to discover and purchase products.

As lower-tier city consumers spend more time online, e-commerce and livestreaming have become prominent consumption channels. Platforms such as Pinduoduo and Douyin are primary channels of consumption.

In a 2025 report on the distribution of new Pinduoduo users by city, lower-tier cities account for more than 50% of user-base expansion. The chart below depicts the distributions of new users by city tier, demonstrating the presence of a growing digital lower-tier city consumer market.

Douyin’s short-form content is effective at driving impulse purchases and delivering humorous content in bite-sized, digestible reels.

Livestreaming in China is a form of consumption that is rapidly gaining popularity, especially for its combination of authenticity and hyper-competitive pricing. Anchors effectively build rapport with viewers through speaking local dialects and sharing relatable aspects of everyday life, connecting with consumers who value community and locality. Group-purchasing and interaction beyond sales make watching livestreaming a general pastime in addition to a means of consumption.

How fashion and luxury tastes deviate from Western trends

The strong sense of patriotism unique to lower-tier city consumers in China also translates to a much stronger preference for domestic brands in areas of fashion and beauty. Top brands among emerging-tier consumers include Ledin for clothing, Judydoll for makeup, and Proya for skincare.

Consequently, beauty standards and trends are more traditionally Chinese compared to high-tier cities, with an emphasis on dramatic glam, fair skin, and big eyes, as well as slimness.

Additionally, lower-tier city consumers are also aspirational purchasers of luxury goods, contributing to the growth of the Chinese luxury market. Their primary motivators behind luxury purchases are to showcase social status and wealth, as well as to view items as investments. This translates to a greater emphasis on high-profile, recognizable luxury brands as opposed to the quiet, lower-profile luxury trends emerging in higher-tier cities.

Coffee and tea as part of lifestyles of leisure

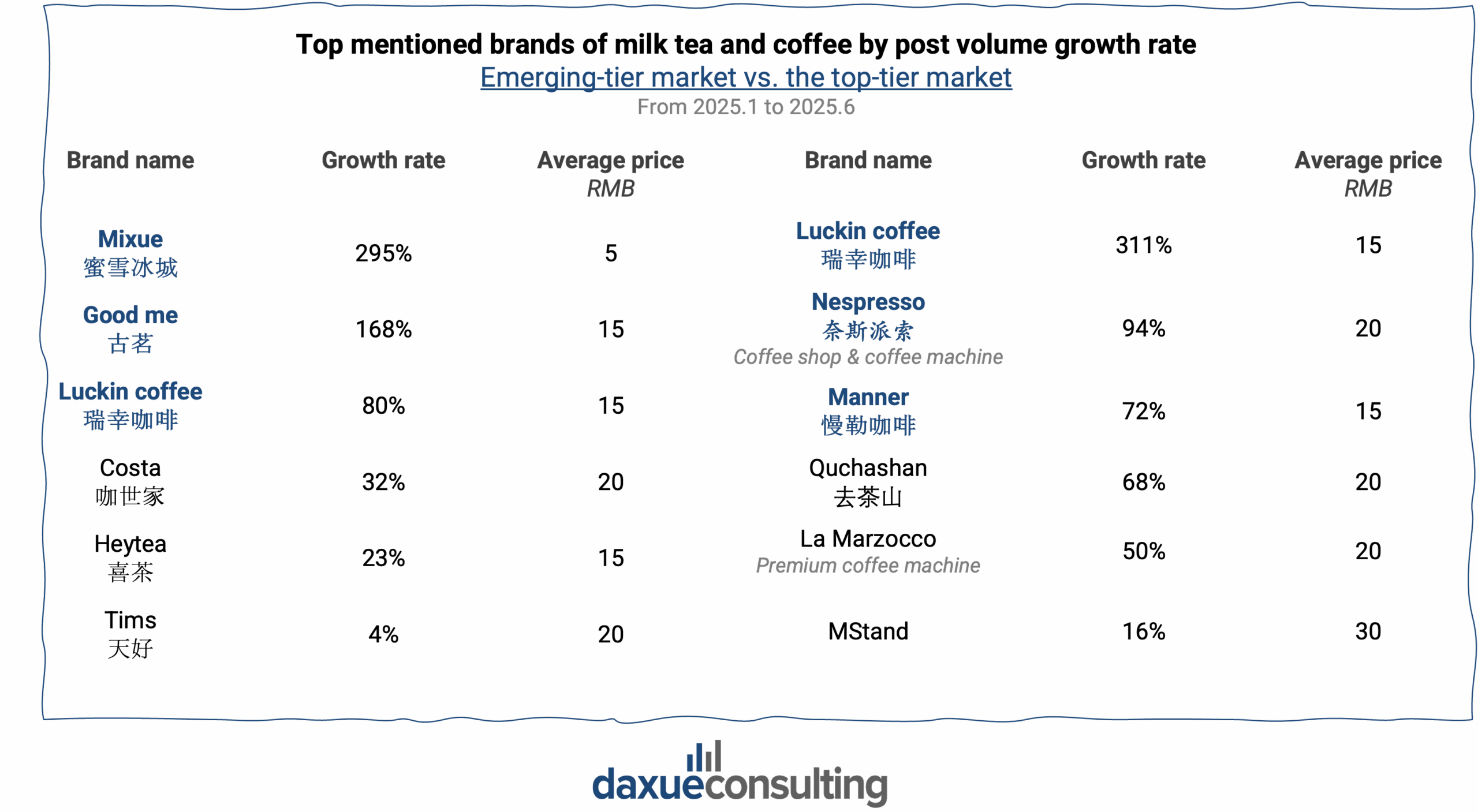

The combination of a slower lifestyle with a focus on indulgence has driven a rapidly growing Chinese coffee market, where a freshly made drink at a café is synonymous with relaxation and indulgence.

Despite the presence of the Chinese tea market, given the cultural significance of tea, specialty drinks, including milk tea, are still less established in lower-tier city markets, with significant room for expansion. However, the novelty of the drink market means there is a lack of brand loyalty and incredible sensitivity to price fluctuations.

In terms of taste preferences, less health-consciousness compared to high-tier city consumers means a preference for sweeter drinks from chains such as Mixue and Luckin Coffee. Brands have also exhibited fierce price wars to capture more of the market share, relying on high sales volumes and low margin models.

Bold flavors and innovation in the growing snack market

The vast Chinese snack market and local fast-food chains offer regional products catered towards region-specific tastes. The emerging-tier market prefers sweeter and spicier flavors, purchasing snacks for novelty and to participate in trends in addition to taste.

The newer phenomenon of specialty snack stores is especially reflected in lower-tier markets, given that the stores can sell a large variety of unique snacks at competitive bulk prices.

New technology as an indicator of status

A combination of higher marriage rates and rising disposable incomes in lower-tier cities has translated to an increased investment in appliances and technology to enhance homes for greater comfort. From voice-controlled rice makers to Ultra-thin TVs, quality appliances have become a status symbol for lower-tier city consumers in China, demonstrating a combination of aspirational living and pragmatism.

In terms of transportation, EVs produced by brands such as BYD and Wuling in China’s growing electric vehicle market fit the consumers’ needs as family cars or as short-range commuter cars.

Lower-tier city consumers as the next drivers of growth

- China’s growth is happening outside top-tier cities. Even though global brands often focus on top-tier cities like Shanghai, over half of China’s population and about two-fifths of the GDP come from these emerging tier city consumers.

- Low-tier city consumers in China value pragmatism and are significantly more price sensitive than higher-tier city consumers. This is reflected in their lower brand loyalty and utility-driven purchases, with quality home appliances being viewed as status symbols.

- Consumers also value the localization of products and tailoring of flavors to regional cuisines and cultures. Those in lower-tier cities also have a stronger sense of patriotism.

- Style trends and fashion are more uniquely Chinese, as beauty standards continue to emphasize the traditional look of big eyes and fair skin. A higher sense of patriotism is reflected in preferences for domestic fashion, makeup, and skincare.

- Specialty snack and beverage consumption is increasingly integrated into everyday life as companies continue to focus on low prices and local tastes. Consumers continue to make purchasing decisions based on choice, remaining loyal to large chains and specialty snack stores.

Unlock lower-tier city markets in China with Daxue Consulting

Daxue Consulting provides key insights into China’s lower-tier city markets, offering tailored research and strategic guidance to unlock their potential. With our focused approach on consumer behavior and market dynamics, we equip businesses to engage with and capitalize on these emerging markets effectively. Reach out for expert strategies to navigate and succeed in the vibrant landscape of China’s lower-tier cities.