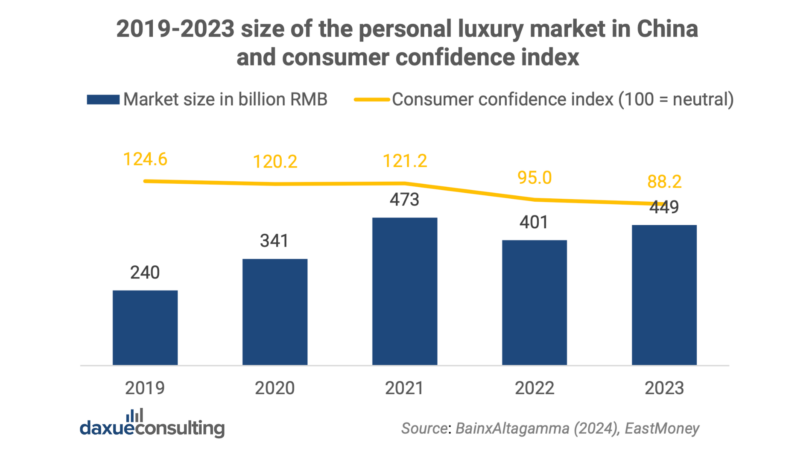

In 2019, McKinsey estimated China’s share of the global luxury market would grow to 41% by 2025. China’s luxury market has been mounting up for the past five years, doubling in size between 2019 and 2021. This growth was disrupted in 2022 due to the zero-Covid policy. In 2022, nearly every luxury category and most brands experienced their first major decline in five years.

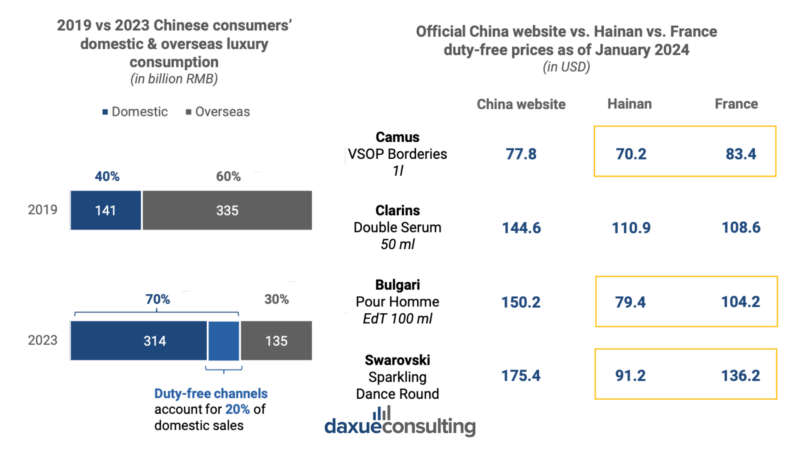

Before the pandemic, Chinese luxury shoppers emerged as the world’s biggest spenders, contributing to around one-third of global sales. Two-thirds of those sales were made on trips abroad, particularly in Europe, while the remaining third was in Mainland China.

Those economic challenges in 2022 led to over half of Chinese consumers wanting to save more in 2023. It’s safe to say, that the Covid era is over, but will the Chinese luxury market rebound?

Download our China luxury market report

The Chinese Luxury Market is Rebounding

With the government announcing the relaxation of anti-pandemic measures in late 2022, many experts anticipated the revival of China’s luxury market in 2023. Although showing small growth at the beginning, the market has begun to demonstrate signs of its comeback. LVMH reported a 14% surge in its Asia sales in the first quarter of 2023, with China accounting roughly for 80% of the company’s sales in the region.

Compared to other regions, China is promising bigger growth. According to Bain, the country’s middle- to high-income population expanded by 180 million people from 2014 to 2022, and it is forecasted to reach 250 million by 2030. Morgan Stanley expects Chinese consumers to increase luxury goods purchases throughout 2023 and account for 60% of spending growth by 2030.

Despite a slight dip in consumer confidence, luxury spending by Chinese consumers experiences a growth of 12% year-on-year, reaching RMB 449 billion in 2023. This rebound is primarily driven by core Chinese luxury shoppers, who exhibit less elastic demand and are expected to contribute significantly to the expansion of the Chinese luxury market.

But China is also facing some challenges. As youth unemployment has hit a record high in 2023, peaking at 21.3% in June, in addition to rising uncertainty triggered by both domestic and international factors inducing consumers to save money, there are fewer first-time luxury consumers.

Domestic luxury purchases are becoming a new normal

Despite a resurgence in overseas luxury spending, the appeal of the domestic market persists due to product availability and a narrowing price gap in duty-free offerings, making Hainan a continuing focal point. In 2023, Hainan’s duty-free sales reached RMB 43.8 billion, attracting 6.7 million Chinese shoppers.

In 2019, 60% of Chinese luxury buyers made their purchases abroad. Despite a rebound in travel, this figure has not returned to pre-pandemic levels in 2023. During that time, 90-95% of luxury goods were locally purchased in China. Despite a drop in 2023, domestic purchases will play a bigger role in Mainland China in the next few years.

Hard luxury products are in higher demand

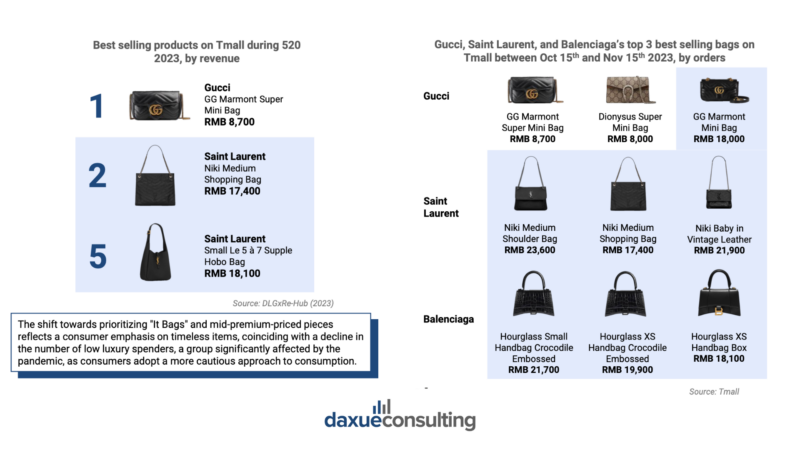

In 2023, luxury watches, jewelry, and iconic bags saw significant growth as consumers sought higher-value investments, with 31% emphasizing the importance of goods retaining value. This trend is particularly pronounced among medium luxury spenders. Consumers with an annual luxury spending of RMB 50k-300k plan to cut overall expenditure by 5%, yet increase watch purchases by 3% to account for 18% of their spending.

Consumers are also increasingly interested in luxury-related short videos on Douyin and other platforms. This growth also aligns with the increasing importance of gifting and collecting purposes as drivers for luxury purchases. Chinese consumers purchase luxury goods not for themselves only, and the demand for products such as watches, diamonds, gold, leather goods and fashion items corresponds to that need.

Luxury bags are one of the leading categories of products purchased by luxury shoppers in China, recording 21% year-on-year growth in 2023. During 520 (Chinese Cyber Valentine’s Day) in 2023, two of the top three best-selling luxury bags on Tmall were premium (RMB >10k). Between October 15th and November 15th, premium luxury bags continued to dominate the top 3 highest-selling bags for Saint Laurent and Balenciaga, with Gucci featuring one premium bag, signalling sustained demand for high-end items.

Transformation in the luxury travel market

Post-Covid recovery has also seen changes in the luxury travel market, with more customers now focusing on their physical and mental health. Although the lockdowns stopped travelling, it is now seeing a revival: domestic destinations are attracting more travellers. Tourists’ vacation choices vary from long-distance trips to day trips, glamping or even luxury train tours.

What Chinese Luxury Consumers Are Looking for In 2024?

Post-Covid recovery: Focus on quality, health and leisure

The Covid-19 pandemic significantly influenced consumers’ values and priorities, leading to a shift in their perceptions of health. In 2021, health and family safety became the top concerns for half of Chinese consumers. As a result, consumers are now paying greater attention to the quality and safety of products. This shift in mindset has led to food sometimes taking precedence over material acquisitions, with buyers favouring gourmet meals over luxury handbags.

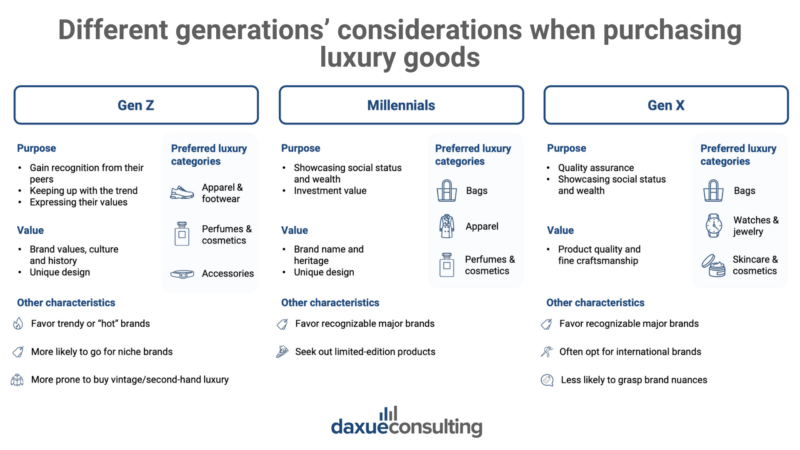

Gen Z go beyond the physical attributes of luxury items

In comparison to Millennials and Gen X who prioritize the tangible features of luxury goods, emphasizing brand name, heritage and product quality, Gen Z focus mostly on brand values with its culture and history. They favour trendy leading brands, but they are more likely to go for niche brands, as long as they offer unique designs and great values. Those consumers are also gaining interest in second-hand luxury which has become a new trend in the Chinese market.

Consumers in higher-tier cities look for uniqueness, sophistication and values

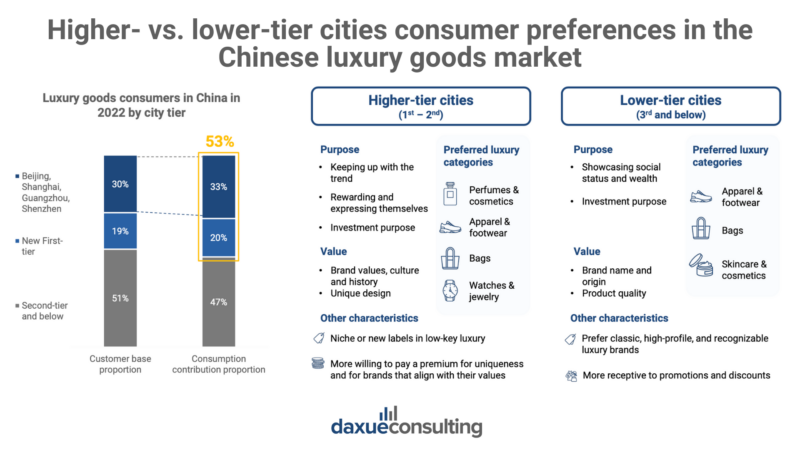

Purchasing luxury items for investment purposes is a significant motivator in both higher and lower-tier cities. However, consumers in higher-tier cities, accounting for 53% of total spending, exhibit greater openness to niche or emerging labels and are less price-sensitive compared to their counterparts in lower-tier cities. Those prefer classic, high-profile, and recognizable luxury brands (as a means to showcase their social status and wealth) and are more receptive to promotions and discounts.

Very Important Consumers (VICs) become the key focus of luxury companies in China

As the Chinese economy faces a slowdown, the pivotal role of HNWIs in driving luxury consumption is poised to increase. Brands shifting focus from entry-level consumers to Very Important Customers (VICs) are positioned for better performance in this evolving economic landscape.

China ranks 3rd in the world (2022) in the number of high-net-worth individuals, boasting approximately 780,000 people with investable assets bigger than USD 1 million. Those individuals account for 42% of luxury sales in China and 56% of them plan to up their spending on personal luxury goods in the next three years.

To best serve and attract this type of Chinese customers, luxury brands deploy many initiatives to instil a profound sense of exclusivity, privilege and an elevated customer experience, ensuring VICs feel uniquely connected to the brand. Those initiatives include:

- Exclusive or early access to new launches, limited editions, and exclusive products

- Providing gifts for birthdays, festivals and special occasions

- Invitations to exclusive events, fashion shows or behind-the-scenes

- VIP lounges

The rise of quiet luxury

At the same time, the quiet luxury trend is seeing a rise, driven by the common prosperity campaign and the changed economic environment. Affluent customers, who are more resilient to economic downturns, now prefer timeless and chic items. Instead of flaunting their wealth, they prioritize quality and tailored customer service offered by “quiet” luxury brands. These brands, such as Brunello Cucinelli, Stefano Ricci, Loro Piana, and China’s Icicle, are gaining popularity due to their subtle approach to branding. Instead of prominently displaying logos on their products, they cater to customers seeking a more understated and refined expression of luxury.

Domestic and Foreign Luxury Brands in the Guochao Era

The Guochao trend has gained significant momentum among Chinese consumers, particularly during the pandemic. They are increasingly drawn to luxury brands that align with their cultural identity and express admiration for Chinese culture. However, while domestic luxury brands are on the rise, they still face challenges in establishing strong brand equity to compete with well-established foreign brands, with Guochao being more prominent in the mass market.

In fact, during the first half of May 2023, Douyin’s brand index for luxury brands in China prominently featured Western names as the most successful brands, as determined by factors such as content, reach, and search volume. Nevertheless, in response to the growing Guochao trend, foreign brands are increasingly recognizing the importance of prioritizing localization strategies to maintain their positions in the luxury goods market.

Sales Channel Preferences are Changing, Redefining Consumer Experiences

The pandemic has pushed through further digitalization of the luxury sector. A 2022 McKinsey report showed that more than half of Chinese retailers declared to be focusing on expanding their omnichannel operations, and a third were concentrating on increasing their use of artificial intelligence, while almost 40% of Gen Z consumers claimed to prefer to browse apparel in-store but shop online.

Luxury brands are capitalizing on this trend by adopting innovative approaches to their online and offline sales channels. Offline stores have evolved to offer a more immersive and experiential environment, focusing on creating unique customer experiences. Leading luxury names such as Louis Vuitton, Dior, Hermes, and Sisley have responded to this shift by opening lifestyle stores and spaces. Now, their venues not only allow them to showcase their products, but also to provide customers with food, beverages, and even art exhibitions, enhancing the overall luxury shopping experience.

Brands go omnichannel to multiply consumer touch-points

Luxury brands are adapting to digitally-savvy Gen Z preferences by employing digital innovations that enable instant communication with consumers across online and offline platforms, recognizing the demand for immersive in-person experiences alongside digital interactions.

Brands create centralized customer profiles that consolidate data from all channels and employ AI and analytics to identify patterns so that they can offer the best user experience to their customers. Then, with the use of collected information, they can offer a personalized shopping journey, providing tailored services by accessing customers’ previous interactions at all touch points.

The boundaries between digital and physical are starting to blur – with omnichannel strategies altering the old practices of retail management while reimagining online sites to mimic frictionless, immersive, and highly personalised live retail experiences. Other, previously used methods of product discovery that relied on editorials, videos and attractive visuals, can now be enhanced by new technologies, like below:

Lifestyle stores redefine consumer experiences

Pandemic changes have also boosted interest towards lifestyle stores, with consumers showing growing attention to decor, leisure, and dining experiences. Both foreign and Chinese brands are jumping on the bandwagon, recognizing the opportunity it presents. Partially pushed by this, in 2022, Tiffany, Louis Vuitton and Burberry all opened stylish cafes or restaurants. The same was done by the Chinese brand Shang Xia which launched its first tea house, combining futuristic interior design and tea-based drinks with the traditional elements of Chengdu.

Retailtainment becomes a new norm in luxury shopping

Experiential marketing has become a trend, with luxury shoppers beginning to embrace sophisticated “retailtainment” featuring interactive displays, voice-activated and AR-enabled mirrors, and smart dressing rooms for unique experiences.

China’s Luxury Market: Pre-Pandemic Boom, Disruption, and Post-Covid Recovery

- China’s luxury market experienced a downturn in 2022, marking the first decline in several years. However, 2023 has seen a great rebound, and it’s expected that Chinese consumers will increase luxury goods spending, reaching 60% of spending growth by 2030.

- The zero-Covid policies prevented customers from shopping abroad, thus boosting domestic consumption and increasing flexibility in setting prices.

- Chinese consumers invest in hard luxury products, with luxury bags, jewelry and ready-to-wear apparel becoming the most sought-after products.

- The COVID-19 pandemic has reshaped consumer values, leading to a greater emphasis on health and safety, the rise of experiential lifestyle stores, and a shift towards understated luxury with a focus on quality and tailored customer service.

- Luxury brands in China shift their focus to VICs, offering exclusive deals, gifts, invitations and VIP lounges.

- The Guochao trend in China has sparked interest in luxury brands that embody Chinese culture, leading to the need for foreign brands to adopt localization strategies alongside the rise of domestic luxury brands.

- The luxury sector is undergoing digital transformation, with brands expanding omnichannel operations, creating immersive offline stores, and relying on e-commerce for sales.

Mastering China’s Luxury Market Dynamics

As China’s luxury market witnesses a robust rebound, positioning your brand effectively in this evolving landscape is paramount. We specialize in strategic consulting for luxury brands aiming to penetrate or expand within the Chinese market, leveraging our deep understanding of local consumer preferences, cultural nuances, and digital trends.

Our Services Include:

- Market Insight: We provide comprehensive analyses of the latest trends and consumer behaviours in China’s luxury sector, ensuring your brand stays ahead of the curve.

- Brand Localization: Tailoring your brand’s narrative to resonate with Chinese cultural values and consumer expectations, enhancing relevance and appeal.

- Consulting Services: We offer strategy and management consulting every step of the way.

- Regulatory Navigation: Assisting with the legal and regulatory aspects of entering and operating in the Chinese market, ensuring smooth and compliant business practices.

Connect with our team of experts to refine your strategy and secure your brand’s position in China’s thriving luxury market.