Growing demand for premium seafood in China

China is a traditional fishing country that accounts for two-thirds of worldwide aquaculture. With the growing middle class and the rise of disposable income, the Chinese purchase a progressively more diverse basket of seafood products and the premium seafood market in China is expanding.

Demand for luxury seafood products has increased significantly in China over the past few years. For example, in 2015, China accounted for approximately 20% of the luxury seafood consumption globally. With polluted and overfished waters at home, China is importing a lot of premium seafood. Wealthier Chinese consumers who can afford to avoid scandal-plagued chicken and pork have in some cases switched to seafood.

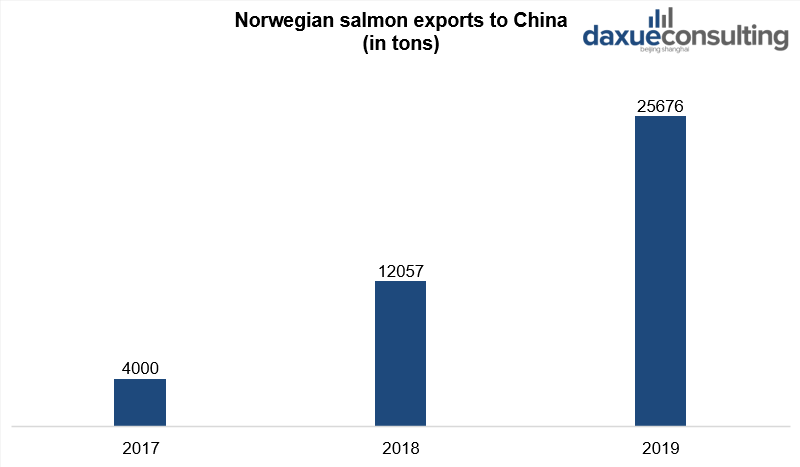

Chinese consumers are looking more and more to foreign countries for premium seafood products. For instance, according to the Norwegian Seafood Council, the value of Norwegian salmon exports to China reached $54.8 million in the first half of 2018. This was a rise of 544% year-on-year.

[Data Source: Global Times, ‘Norwegian salmon exports to China’]

Luxury seafood products on the Chinese tables are becoming more easily accessible

The list of premium seafood on the table is becoming longer with the increase of luxury seafood imports to China. According to Eva Kam, Project Manager at Daxue, all the high-end seafood was from Hong Kong before but China has now its own providers in foreign countries. Luxury seafood appreciated by Chinese consumers include lobster, crab, salmon, oysters, sea cucumbers and many others. The luxury seafood consumers are not only rich people but also the emerging middle class in China. The rising incomes and the growing middle class contribute to an attractive outlook to the premium seafood market in China.

Imported premium seafood is more welcomed in China

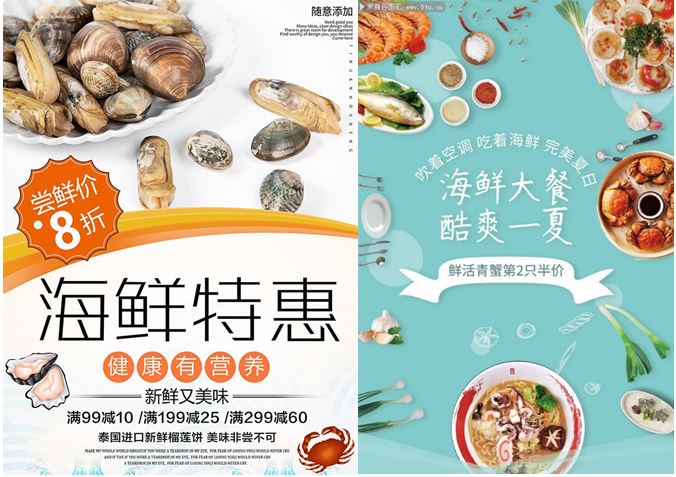

Most seafood advertisements use the words fresh and live (鲜活), France(法国), imported with original packaging (原装进口, Ready to eat (即食). They highlight foreign origin of seafood, as Chinese people tend to trust it more.

Source: 5tu.cn, Advertisement of seafood, both using word “fresh”

The pollution of China’s own waters create demand for imported seafood, especially for the higher-value species like crabs, lobster and salmon. Chinese consumers have also become more food safety-conscious. This underlines the importance of clear and precise information about seafood products. For example, Canada and Denmark are famous for its caridean shrimp (pandalus borealis), Russia and Chile for king crabs, France for oysters and Norway and Australia for salmon.

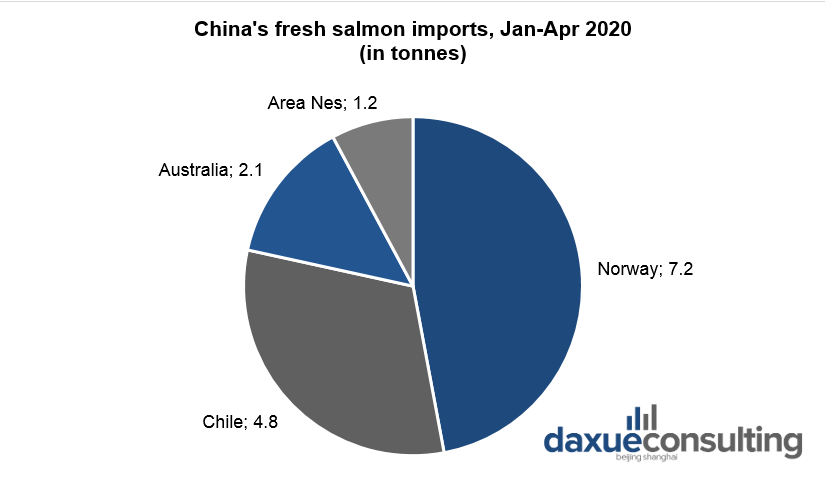

Data Source: Under Current News, China’s fresh salmon imports by country

The perception of Norwegian salmon is positive in China

Norway is one of the primary countries of origin for seafood by Chinese consumers. Over the past few years, awareness about Norway as a seafood producer has grown from 7% in 2012 to 22% in 2018. In the same period, awareness of Japan as a seafood nation fell from 52% to 28%. Salmon is probably the most famous Norwegian product in China. About 44% of Chinese consumers prefer Norway as a country of origin for salmon, an increase of 25% compared with a few years ago.

Australian seafood is gaining momentum

Australian seafood enjoys an extremely strong reputation in China. In particular, Australian rock lobster and abalone are held with a high regard. Such perceptions express local media and WeChat discussions that promote the quality of Australian seafood. In Ningbo and Qingdao in 2017, for example, local media reported with excitement about the first direct sales of Australian rock lobster. Specific promotional events help to highlight Australian seafood, for example: an Australian lobster tasting event in Chongqing; Lobster fest in Shanghai; and the Australian Lobster Festival in Yongcheng, Henan.

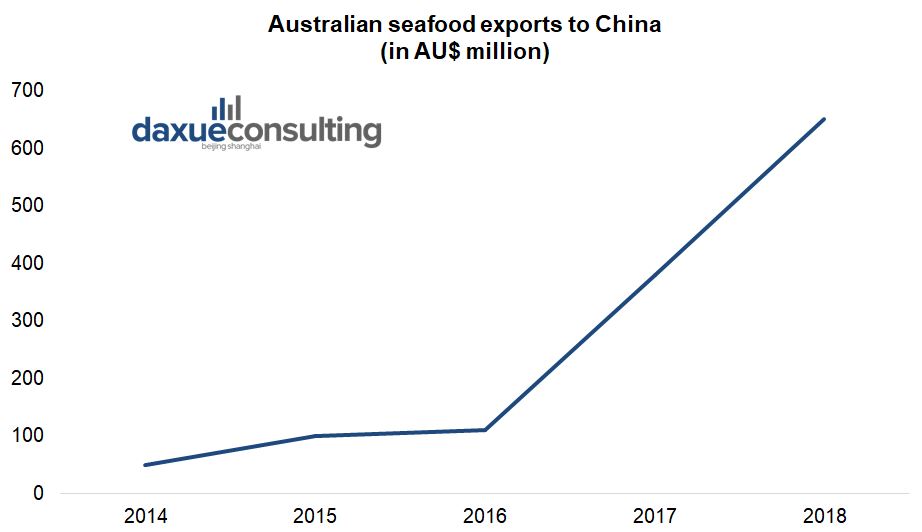

Exports to China from Australia reached $658 million in 2017–18, making China the most valuable export destination that year for Australian fisheries products. The increase in export value was driven by an increase in the value of Rock Lobsters, Salmonids and Abalone species.

Data Source: Australian Bureau of Statistics, Australian seafood exports to China

Australia’s coronavirus-battered exports of premium seafood are recovering as China gradually moved out of lockdown. China’s demand for premium seafood is gradually on the rise again, though it remains sporadic and prices are much lower compared to pre COVID-19 levels.

Barry Dun, CEO of Australian Reef Fish Trading Co (ARF), told the company’s exports to China had recovered to 15 to 25 percent of the pre-outbreak volume.

Foreign oyster brands are popular in China

The perceptions of French oyster brands are very positive in China. For example, oysters of Gillardeau (吉拉多) brand have the reputation of “Rolls-Royce in oysters”, having strong salty tang of the sea. Another French brand Belon promotes their oysters as “rare”, “expensive” and “king of oysters”. Other popular French oyster brands include Fine de Claire (芬迪克莱尔), Ostra Regal (皇御) and Fleurdeseaux (水中花). All of them highlight the exclusiveness of their products.

Most restaurants selling premium seafood are western-oriented

Analyzing restaurants that sell oysters in Shanghai and Beijing, we can see that mostly they sell imported oysters, and most often as a side dish. Only some places exclusively sell oysters as a key element of the restaurant. The price varies from 30 to 150 yuan per dish. The key feature of the restaurants selling oysters is that most of them are western-oriented. For example, popular Beijing restaurant Maison FLO awarded as Michelin Plate, sells oysters as a side dish for 118 yuan. Most restaurants sell cooked oysters rather than raw.

Source: Dianping, Western-oriented restaurants with oysters in Shanghai

Some examples of restaurants in China serving oysters:

- The Plump oyster

- Gillardeau: 89 RMB

- French L’emeraude Oyster: 69RMB

- Providing cost-effective combo of oysters

- OTTIMO

- Gillardeau: 78RMB

- Special oyster cooked by three ways: 78RMB

- Famous for oysters and wine

- Oysteria

- Fresh oyster:10RMB for each

- Cost-effective combo of oysters

Premium seafood restaurants use VIP membership to attract customers

Seafood restaurants in China actively promote on social media with discounts and offers. For example, some restaurants offer VIP membership for those who order for more than 500 yuan. Also, customers who order for more than 300 yuan get free beer and soft drinks.

Some restaurant in Dalian came up with the advertising campaign on Valentines’ Day in 2018 offering discounts to people coming with their significant other. They could have a discount up to 65%. Through this well-planned marketing campaign, the restaurant created double the sales volume and attracted 5,000 customers.

Social media contribute to the growing premium seafood consumption

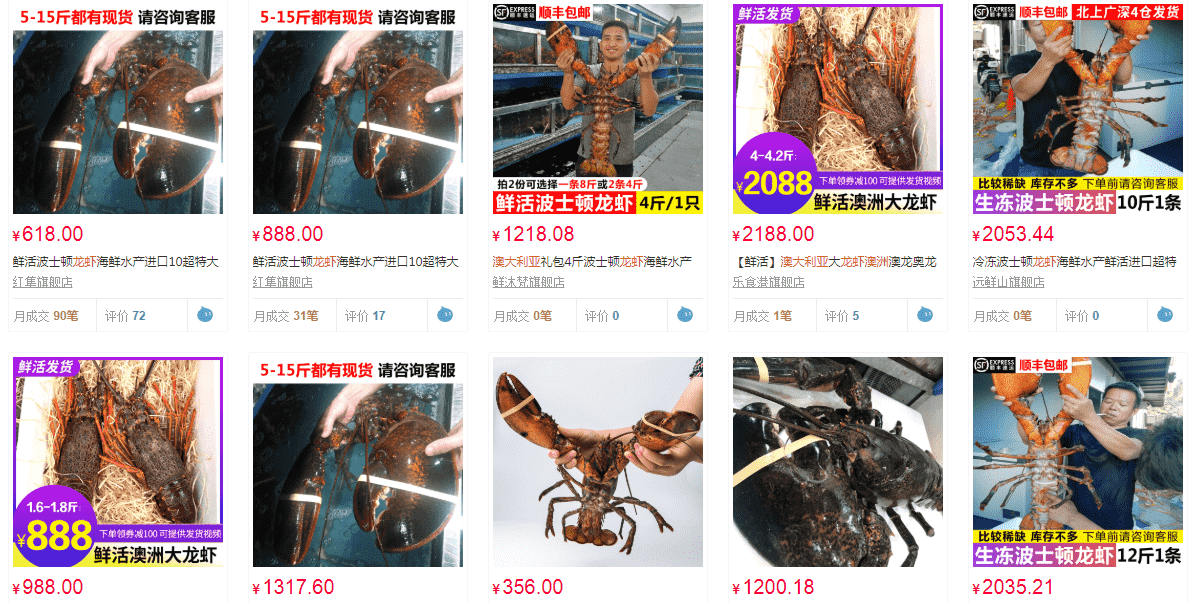

Seafood promotion in China increasingly relies on social media platforms such as Dianping (大众点评) or WeChat (微信). Thanks to the boom of e-commerce in China, consumers can buy their favorite premium seafood on electronic commerce platforms such as Tmall and JD, which are both reputable and reliable operating systems. For example, Canadian lobsters are available on Tmall.com as well as fresh Australian lobsters and oysters too. Chinese consumers can also buy raw oysters on WeChat.

[Australian fresh lobster on Chinese E-Commerce Platform Tmall]

Taobao and Tmall as e-commerce channels for the premium seafood products in China

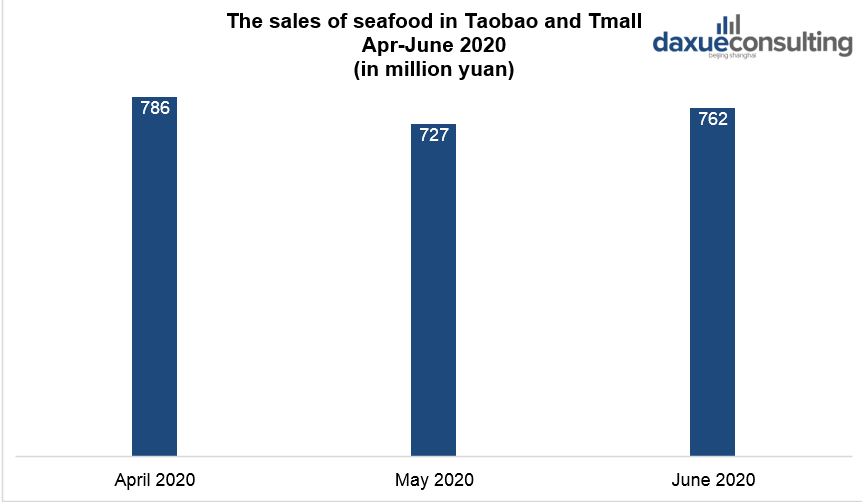

During the severe epidemic period, the sales volume of seafood online declined by 55.8%. Once the epidemic was alleviated in March, the sales volume bounce back with a great growth of 136%. However, the sales volume of seafood dramatically dropped by 62% since the Xifadi incident. Two breakouts of coronavirus in seafood markets exerted negative impact on seafood industry, since people associate seafood as a channel of transmission, even though there was no evidence to prove it.

Data Source: Taosj.com, The sales of seafood in Taobao and Tmall Apr-June 2020

The price range of seafood is from 10-150RMB, most of price centers at 50-150 RMB, meaning online sellers mainly target middle and working-class consumers. Those online consumers prefer domestic brands to foreign brands.

Crawfish is the most popular seafood on Taobao & Tmall. In terms of oysters, mainland ones are the best sellers in Taobao. The sales volume of mainland oysters are 95 times that of French oysters. The sales of oysters on Taobao and Tmall in April 2020 was 27 million (27,588,327) RMB, the volume of sales was 465,441 items. In May there was a slight decline, the sales of oysters in Taobao and Tmall in May were 16 million (16,253,835) RMB.

Hema supports seafood farmers

Since the beginning of the year, the entire seafood and aquatic industry has been affected, and the recovery is still slow. Recently, a new round of outbreaks has caused consumers to worry about imported seafood, and it has affected the entire aquatic product category, and sales have declined significantly.

Hema app launched activities related to agricultural assistance. Oysters and crabs farmers have suffered heavy losses. During the New Year, they suffered a 70%-80% decline in sales from previous years. In June, only 40% of the previous year’s sales recovered. “Save Domestic Seafood” on the Hema app has about a dozen types of seafood sold at a reduced price. For example, the price for gentian grouper has been reduced from the original 59.9/piece to the current 39.9/piece. The price for abalone dropped from 11.9 yuan/piece to 6.9 yuan/piece.

Food bloggers and KOLs promote premium seafood consumption in China

Many Chinese food bloggers pay attention to premium seafood in their blogs. For example, popular Chinese blogger Mi Zijun (密子君), who has 6.15 million followers on Weibo. She went to the famous Xu Ji Seafood restaurant in Changsha and ordered 60 pounds of seafood including shrimps, hairy crabs, oysters and ate it in one hour. She shared her experience with followers and advised to visit this restaurant.

Source: Eat More, Chinese blogger Mi Zijun tries seafood

There are several food KOLs in China each with their own approach. What they all have in common is they like to take photos of food or restaurants. For example, 羽萱的妈妈 had some posts about some seafood, such as shrimps and crabs.

Source: Weibo, Dragon Social, Example of post of blogger 羽萱的妈妈 on weibo

Douyin (TikTok)

Many people use Douyin to share their seafood experience. So-called “mukbangs”, which is a Korean term to describe those who eat a large amount of food during live-streams, are especially popular.

Answering the question on Zhihu “Why are videos about seafood are so popular on TikTok?”, one user claimed that there are a lot of ways to eat seafood (raw, cooked), so bloggers can gain the attention of audience. Besides, many people eager to try it, but not many have a chance, so they watch videos about it instead.

For example, girl from a small town in Jiangsu province named Zhang Xiuling (张秀玲) became a celebrity with 440,000 followers on Douyin. Jiansu is not only a place for seafood, but also a large seafood distribution center. Over the years, wholesalers have transported the seafood to all parts of the country through trucks. In recent years, young people in the town have started selling seafood online using Douyin for promotion.

Source: Sohu, Douyin, Blogger Zhang Xiuling promotes seafood on TikTok

Weibo and WeChat offer new ways of promotion for the premium seafood market in China

Very premium seafood such as sea cucumbers sell very well on Taobao. However, Taobao’s algorithms make it so high-selling shops can get more orders, additionally, the promotion cost of Taobao is very high. Therefore, many premium seafood producers are developing some new sales ideas, such as promotion through WeChat. In addition, WeChat can also allow old customers to attract their circle of friends.

Source: Zhuanlan.zhihu, Sea cucumber advertisement on Weibo

Besides, at present, there are many manufacturers of sea cucumbers, crabs and other seafoods promoting through Weibo. The advertisement adopts the sales method through WeChat and offers delivery. The purpose of the advertisement is to attract more users in WeChat. During the process of the advertisement, it has received a total of 718 reposts, 1,327 comments and more than 5,000 likes.

Premium seafood is a seasonal product in China

Chinese primarily consume seafood at banquets, events and other social functions. The close associations between luxury seafood and banqueting is partly because of the increased importance of Cantonese cuisine. The strong influence of Cantonese cuisine affects the types of seafood served and the ways they are prepared. Some of the important dishes at these banquets typically include: lobster, geoduck, crabs, abalone, shark fin, sea cucumbers, and reef fish.

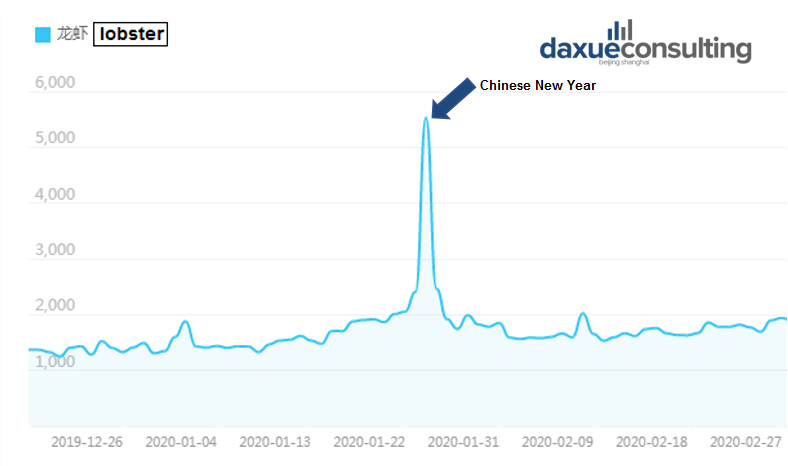

Imported premium seafood is increasingly taking a place at the Chinese New Year dinner table. Not only are Chinese families spending more on seafood at Chinese New Year, but the variety of imported and premium categories such as lobster and king crab is also increasing. In the past two years, large-scale imports of shrimp, as well as high-end lobster, king crab and salmon have witnessed “explosive growth” during the Chinese New Year. For example, prices for king crab rise by as much as 30 percent before the Chinese New Year.

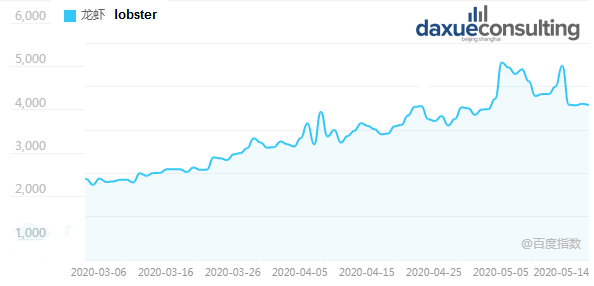

Baidu index: search frequency for “lobster” peaks during Chinese New Year

Lobster market in China

China’s lobster industry is booming

A new generation of Chinese consumers attaches great importance to health, and they have higher requirements for lobsters. Therefore, the lobster market in China tries to ensure the quality of lobster and sends them to the consumers faster. New refrigeration logistics help to transport lobster to reduce damage and maintain high quality lobster during long-distance transportation. In addition, established tracking systems have created an open and transparent market environment. It helps customers follow the production process from farm to table.

From a national perspective, the main lobster producing areas are the Yangtze River Delta region as well as Hubei, Anhui, Hunan, and Jiangxi provinces.

[Data Source: Baijiahao, ‘Share of lobster production in China’]

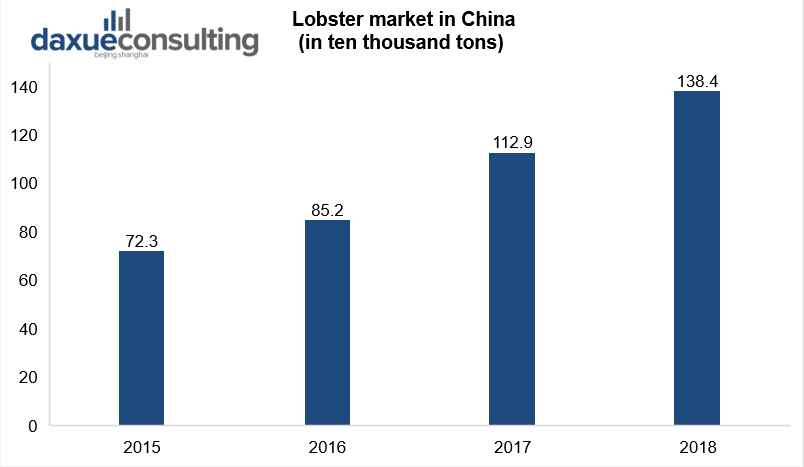

According to statistics, yearly lobster consumption in China in 2018 reached 1.3 million tons, an increase of 22.56% from the previous year. 80% of retailers sell lobster through dine-in channels (including supper stalls). 20% of retailers sell lobster through Internet channels.

[Data Source: Aquatic Products Association, Guanyan World Data Center, ‘Lobster market in China’]

Big cities have larger lobster consumption

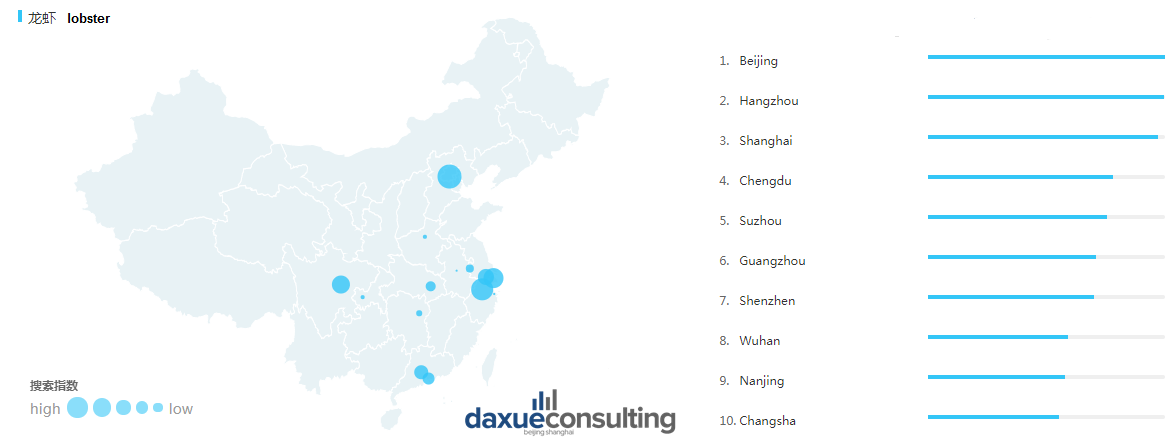

At present, the consumption of lobster in China has appeared all over the country. In recent years, the consumption of lobster has developed from large cities to the south and northwest China. This progression is due to the development of e-commerce in conjuncton with lobster cooked food products. Currently the lobster market in China in the northwest, south, and northeast regions continues to grow. However, cities such as Beijing, Hangzhou, Shanghai and Changsha still have the highest levels of consumption.

Baidu index: searching frequency for “lobster” in Chiense cities

China is the fastest growing market for Boston lobster

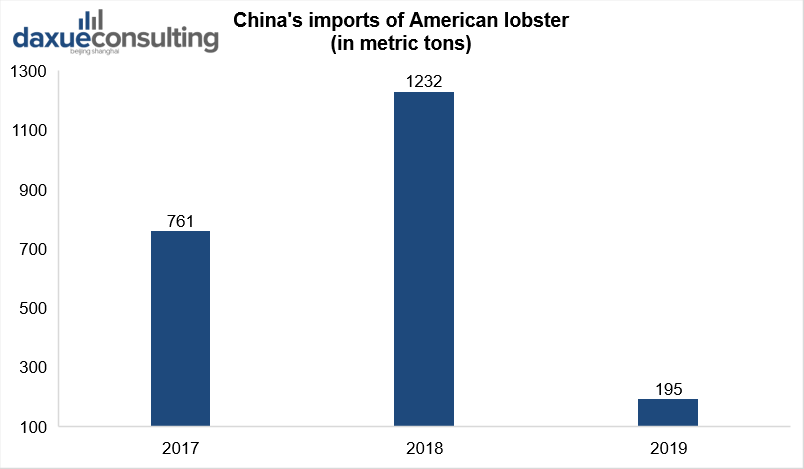

The premium seafood market in China is one of the most important for the American lobster industry. In 2016, total US lobster exports to China had reached around 8 million kilograms, valued at $136 million, accounting for 14% of total US lobster exports. In 2018 import of lobster from the US to China reached 1,232 metric tons. However, in 2019 this value was down 91% year-on-year over the period, due to Chinese tariffs.

[Data Source: UCN, ITC, Chinese customs, ‘China’s imports of American lobster’]

The Chinese New Year is the busiest season for the American lobster industry, as demand is growing. China’s monthly lobster imports peak before Chinese New Year. In January 2019, China imported 2.3 metric tons of live or fresh lobster. In February 2018, during the end of the festival, the figure was 2.4 metric tons. This is a rise from January 2017, with 1.9 metric tons.

Increasing consumption of premium seafood in China

Crab market in China

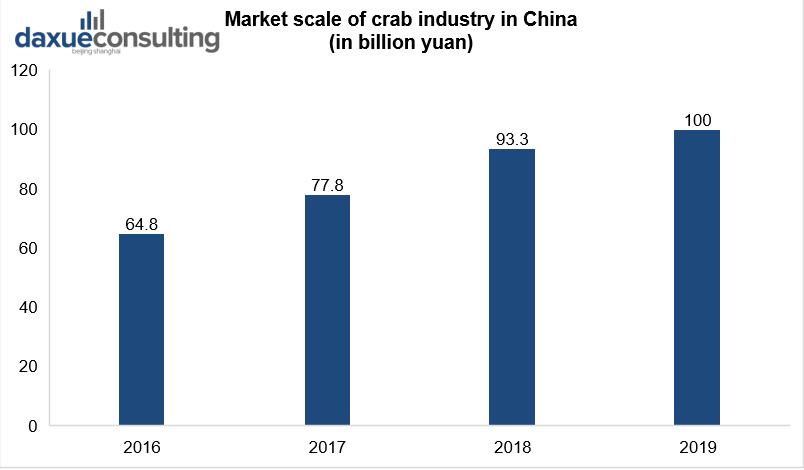

According to statistics, the output of crab reached about 800,000 tons in 2018 in the premium seafood market in China. The industrial scale was 64.8 billion yuan in 2016. It was about 77.8 billion yuan in 2017, with an annual growth rate of about 20%. In 2019 China’s crab market reached 100 billion yuan.

[Data Source: Baijiahao, ‘Market scale of crab industry in China’]

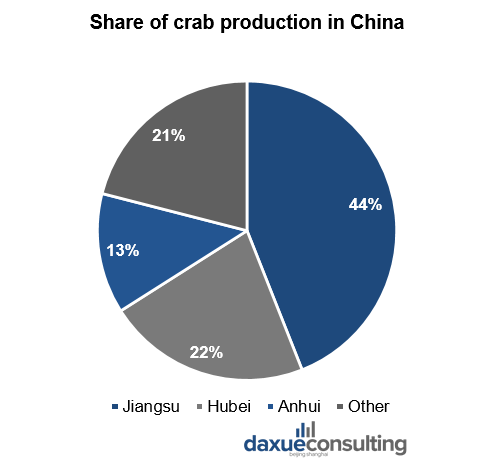

The top ten crab production areas in China are Jiangsu, Anhui, Hubei, Shanghai, Jiangxi, Henan and Taiwan. The total output of Jiangsu accounts for about 44% of the country. Hubei accounts for 22%, Anhui accounts for 13%, and other regions account for 21%.

[Data Source: China Business Research Institute, ‘Share of crab production in China’]

Due to the entry of e-commerce giants, the industry scale of crabs is increasing year by year. For example, JD.com adopts the “airline + refrigerated truck” transportation matrix. It adds air routes, airport express lanes and truck transportation routes to ensure that the delivery time of crabs is not more than 48 hours. SF Express sends them directly from multiple lake areas. It opened more than 22,000 shipping directions, ensuring the supply of crabs and safe delivery.

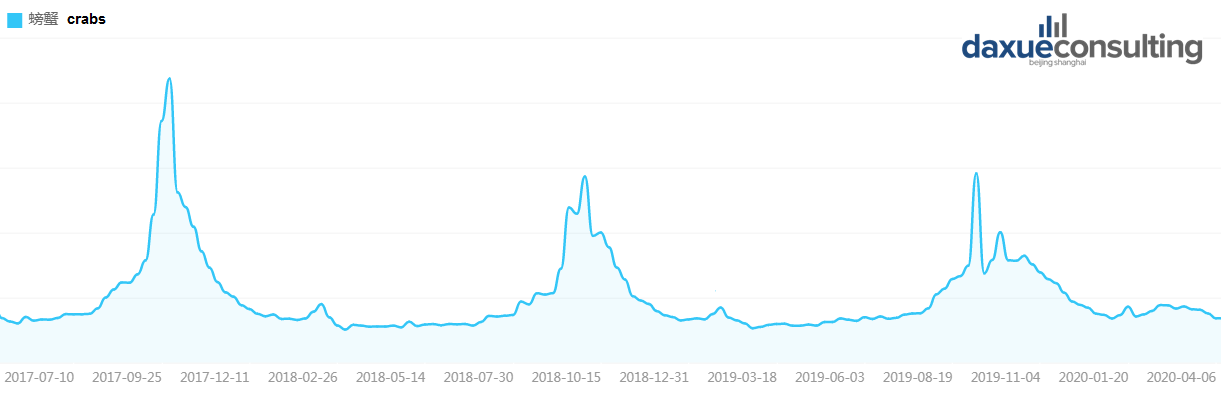

Data Source: Baidu Index, Search frequency for “crabs” 2017-2020, search frequency for crabs peaks during hairy crab season in the fall

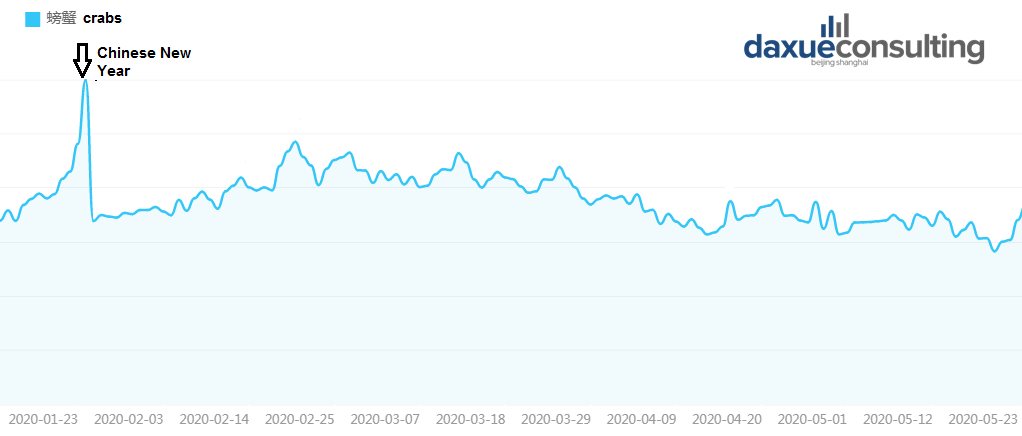

Data Source: Baidu Index, Search frequency for “crabs” in 2020, Chinese new year is also a primary occasion for crab consumption.

According to Baidu index, the demand for crabs in 2020 was quite low, comparing to 2017-2019. The reason could be the coronavirus outbreak in China. In 2020 the demand was higher during Chinese New Year, as people tend to eat premium seafood during that time.

Sea cucumber in the premium seafood market in China

Sea cucumber is a premium product with large popularity in China. Asia is the largest consumer market of sea cucumber in the world, with a market share of more than 70%, followed by North America.

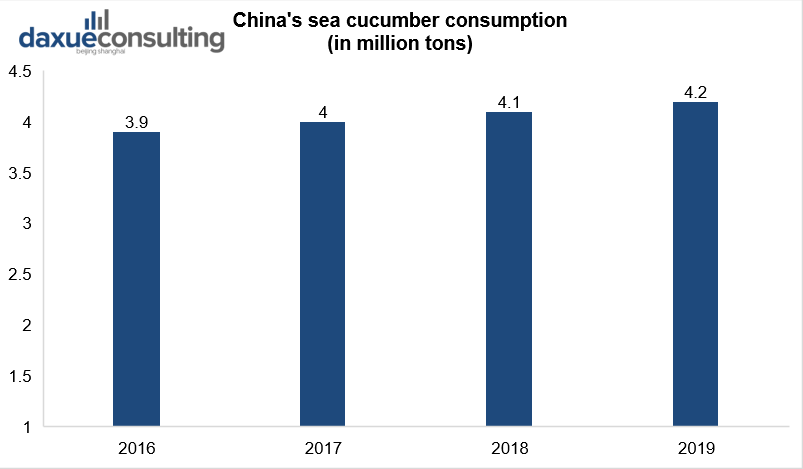

The Chinese sea cucumber industry shows an overall stable trend. Farm-gate prices have continued on an upward trend in the past two years. Production volumes and stocked amounts have also increased significantly. The growth in consumption of sea cucumbers increased from 3.8 million tons in 2014 to 4.1 million tons in 2018. By 2025 the consumption of sea cucumbers in China will be around 5.9 million tons.

[Data Source: Chyxx, ‘China’s sea cucumber consumption’]

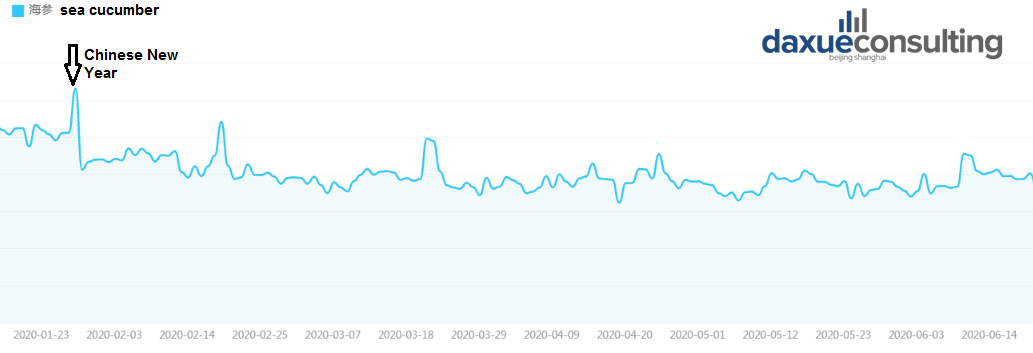

Data Source: Baidu Index, Search frequency for “sea cucumber” 2017-2020

Data Source: Baidu Index, Search frequency for “sea cucumber” in 2020

Due to coronavirus outbreak in China, the demand for sea cucumber in 2020 was lower comparing to 2017-2019. During 2020 the demand was quite stable, except increasing during Chinese New Year period.

Caviar industry in China

With the development of China’s economy and improvement of living standards, the caviar industry has also developed rapidly. By the end of 2014, there were 63 sturgeon farming units in China, including 40 raw sturgeon farming units. From 2006 to 2012, China’s production of artificially cultured caviar increased from 0.7 tons to 28.8 tons, with a compound annual growth rate of more than 85%.

In 2018, world caviar output reached 271 tons, while China’s caviar output was around 100 tons. China plans to rely on artificially cultured sturgeon to become the main exporter of caviar in the world.

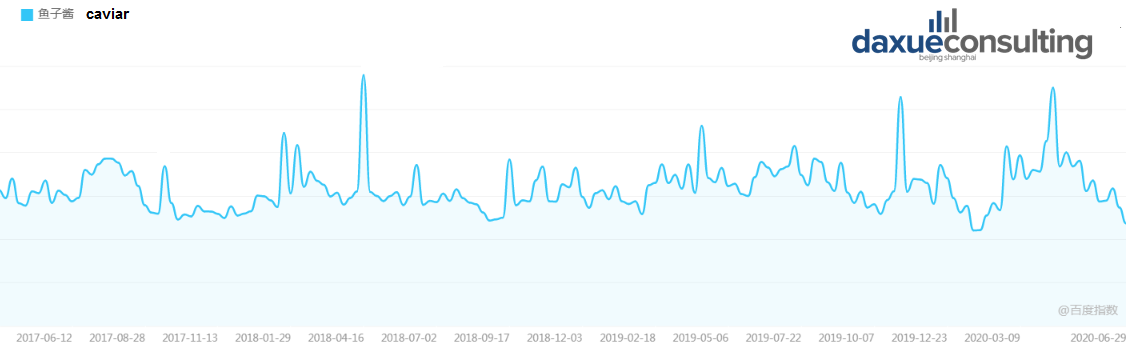

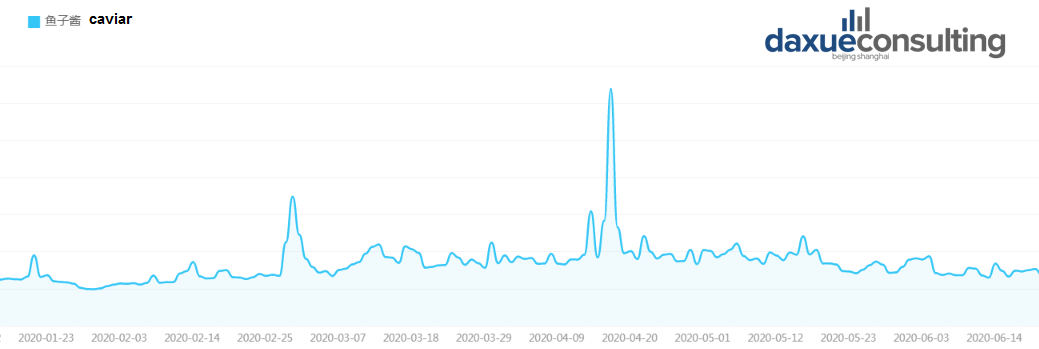

Data Source: Baidu Index, Search frequency for “caviar” 2017-2020

Data Source: Baidu Index, Search frequency for “caviar” in 2020

The demand for caviar was stable during 2017-2019, however due to COVID-19 outbreak, in 2020 it saw a decline.

Oysters industry in China

Chinese consumers are more and more demanding about the quality of oysters they buy. Therefore, they are willing to pay a high price for high-quality oysters. Chinese consumers tend to choose imported premium seafood products. Imported oysters come from Japan, the US and Australia.

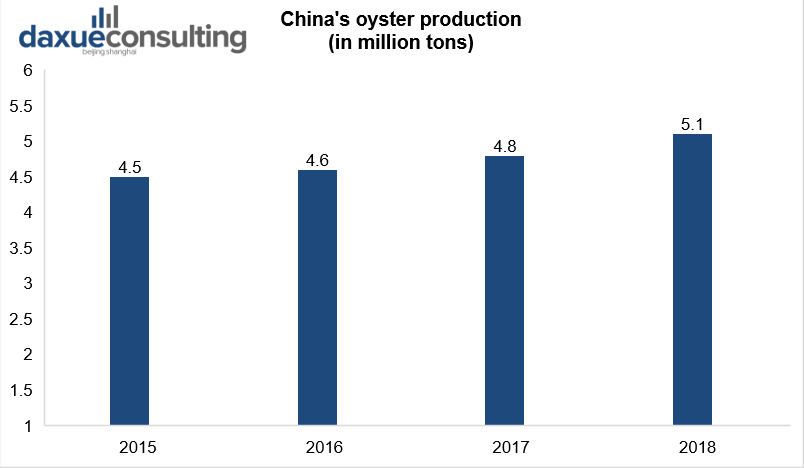

Eating raw oysters is a relatively new concept in China. Data from the China Fishery Statistical Yearbook 2019 shows that China’s oyster aquaculture production reached 5.1 million tons in 2018, a year-on-year increase of 5.3%. In 2017 it was 4.8 million tons.

[Data Source: China Fisheries Yearbook 2019, ‘China’s oyster production’]

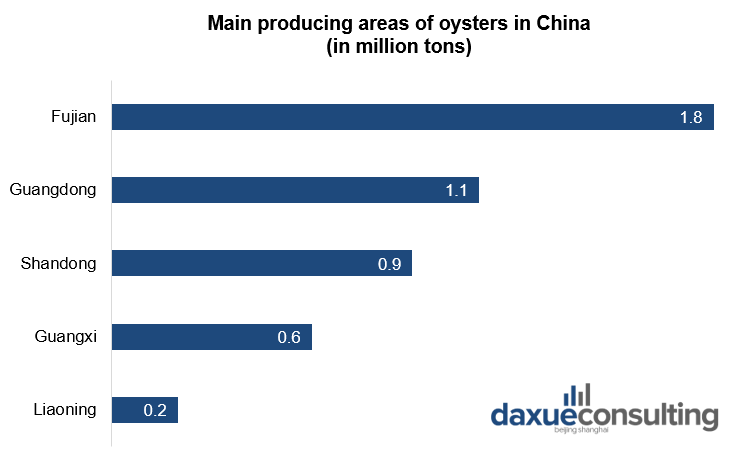

The main producing areas of Chinese oysters are in Fujian and Guangdong provinces. Fujian has a long history of oyster farming and has so far become China’s largest oyster farming area. In 2018, Fujian oyster aquaculture production reached 1.8 million tons, ranking first in the country. Guangdong oyster production was 1.1 million tons, taking second place.

[Data Source: China Fisheries Yearbook 2019, ‘Main producing areas of oysters in China’]

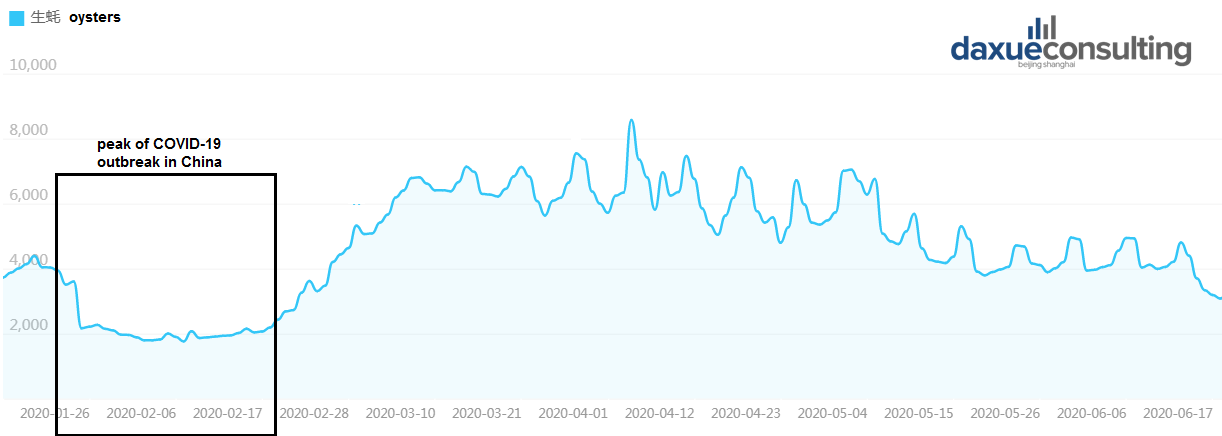

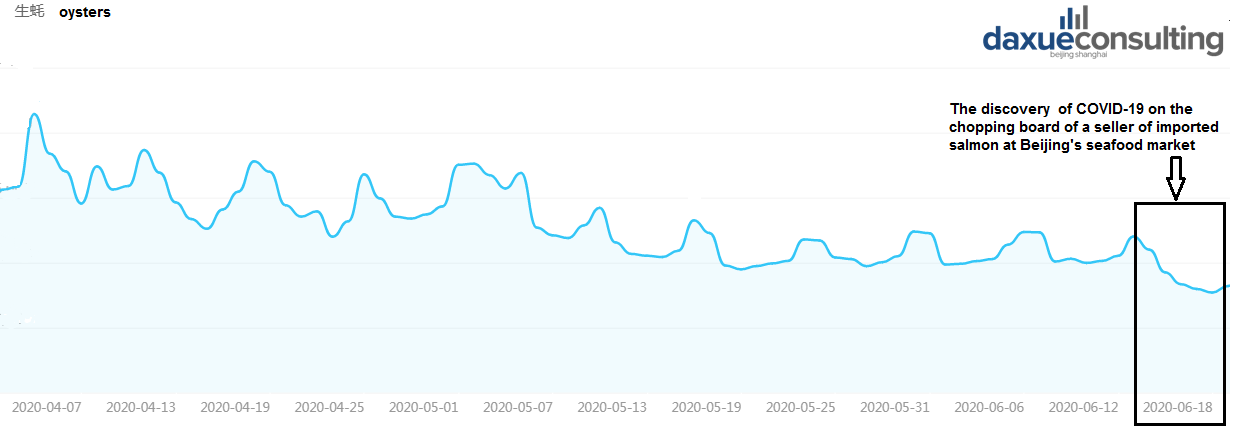

Despite the outbreak of coronavirus in 2020, demand is gradually returning to the 2019 level. During the peak of COVID-19 outbreak in China (February-March 2020), the demand for oysters decreased significantly. But since mid-March, it showed stable dynamic. Analyzing Baidu index from April-June 2020, we can see that the demand for oysters was stable during April-May. However, there was a slight decrease in June due to discovery of COVID-19 on the chopping board of a seller of imported salmon at Beijing’s main wholesale seafood market.

Data Source: Baidu Index, Search frequency for “oysters” 2017-2020

Data Source: Baidu Index, Search frequency for “oysters” in 2020

Data Source: Baidu Index, Search frequency for “oysters” April-June 2020

COVID-19 impact on the premium seafood market in China

Fall in prices for lobsters

Lobster prices have plummeted to the lowest levels in four years after the spread of coronavirus halted charter flights to Asia. It happened at a time when sales usually boom for Chinese New Year celebrations. That is why the lobster industry was particularly affected. Prices for a whole lobster weighing 1.5 pounds have tumbled 17% since January 20, falling to $8.10. This is the lowest price since 2016. Demand for live Canadian lobster has dwindled to 5% of normal volumes in mainland China.

After the coronavirus outbreak in China restaurants started canceling reservations and people stayed home. When it comes to premium seafood exports, the most affected countries were the US, Canada and Australia, as they are the main exporters of lobsters to China. For example, the US company Lobster Co saw an inventory loss of 40% of its value as shore prices dipped from $7.45 to $4.38. They had to sell 50,000 pounds at a loss. In Australia fishers and wholesalers began trying to offload the premium product in local retail markets.

Salmon industry saw the decrease in sales from COVID-19

The discovery of COVID-19 on the chopping board of a seller of imported salmon at Beijing’s main wholesale seafood market is set to disrupt demand for product in the Chinese market. Carrefour in China and Wumart were among the supermarkets to stop selling the product.

It may be possible for salmon to be contaminated by virus-contaminated water during processing, transportation or packaging. Despite this, the outbreak in the seafood market will inevitably impact demand, with consumers fearful of any possibility of transmission.

Chile, Norway and the Faroes are the main suppliers, with rapid growth in the market in recent years playing a key role in producers’ strategies. Norway held 45 percent market share of fresh salmon to China from January to April 2020. The Norwegian Seafood Council claimed last week of June exports fell to 240 tones – a decline of 34 percent.

“As the probe into the cause of the latest outbreak is underway, salmon business around the world will be affected,” Cui He, president of the China Aquatic Products Processing and Marketing Alliance (CAPPMA), told the Global Times Sunday.

The premium seafood market in China after COVID-19

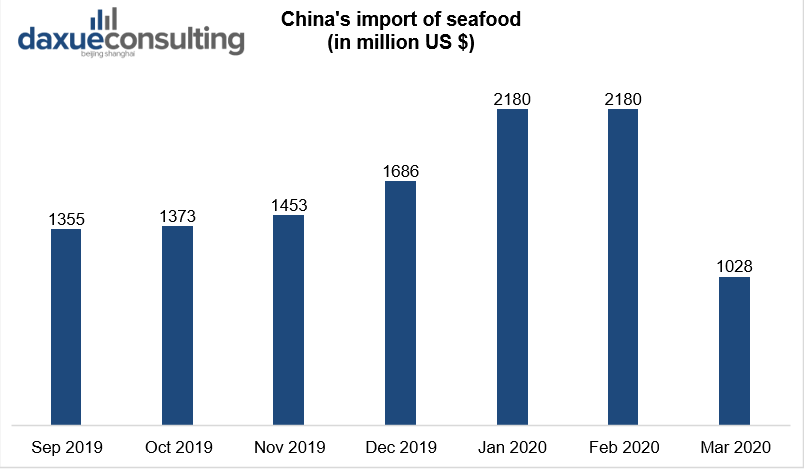

According to the statistics, import of seafood in China in the first quarter of 2020 fell by 27% from the fourth quarter of 2019.

[Data source: Statista, ‘China’s import of seafood’]

By the first quarter of 2020, consumption was almost stagnant. Besides, the import and transportation of Chinese seafood was blocked. Although China’s premium seafood imports slowed in 2020, consumption has a potential to grow. The coronavirus epidemic in China will have a serious economic impact on the Chinese and global premium seafood market and supply chain. It will also have an impact on both supply and demand of seafood in Asian countries. However, the Chinese market has recovered earlier than other countries around the world. There is hope that once the supply chain of seafood regains balance, the industry will function normally.

After the epidemic is over, experts expect that the public will experience retaliatory consumption. Gradually the demand for seafood is returning to normal. For example, the frequency of searching “lobster” on Baidu increased after the epidemic situation got better.

Baidu index: search frequency for “lobster” increased after COVID-19 outbreak

Key takeaways for China’s luxury seafood market

- The premium seafood market in China has great potential due to rising living standards in the country.

- Although premium seafood is particularly popular during the Chinese New Year, it may soon become a regular meal in middle-class Chinese families.

- The coronavirus outbreak had a huge impact on the premium seafood market in China. It interrupted the supply chain and reduced consumption. However, the trend shows that China is returning to normal life and demand for premium seafood will soon be restored.

See our report on China’s seafood market:

Listen to 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast