Despite broader economic challenges and a slowdown in the overall luxury sector, luxury watches continue to hold strong appeal among affluent Chinese consumers, increasingly viewed as a smart alternative investment during times of economic uncertainty. In 2024, the luxury watch market in China was valued at approximately USD 18.12 billion, reflecting steady growth, with an expected annual growth rate of 5.77% from 2025 to 2033. In the same year, leading luxury watch brands in China—including Vacheron Constantin, Cartier, Bulgari, IWC, Piaget, Omega, and Rolex— ranked highest based on store expansion and marketing activities.

Download our China luxury market report

Chinese men between the ages of 25 to 34 are among the main consumers in the luxury jewelry and watch sector. Luxury watch consumers in China buy watches in hopes to depict status and consider RMB 5,000 as an entry price for luxury watches. While consumers are digital-savvy and buy luxury products online, when it comes to watches, they tend to search information online and purchase their watches in physical stores. “Swiss Made” watches are the first choice for luxury watch consumers in China, accounting for nearly 30% of global Swiss watch sales in 2023.

Next-gen stars endorse luxury watches in China

Brand visibility and recognizability strongly influence Chinese consumers’ motivation to purchase luxury goods. Well-known brands are not only associated with higher quality but also serve as powerful markers of social status and success. Therefore, brand awareness becomes a key factor in Chinese consumers’ purchasing decisions. In China, celebrity brand endorsers remain one of the most effective and widely practiced strategies across industries, particularly in the luxury watch sector. While the early 2010s featured a small group of universally recognized national celebrities leading brand campaigns, the landscape has since evolved. Today, younger stars and rising talents dominate the endorsement space, offering brands fresh appeal and direct access to China’s digitally engaged and trend-driven consumer base.

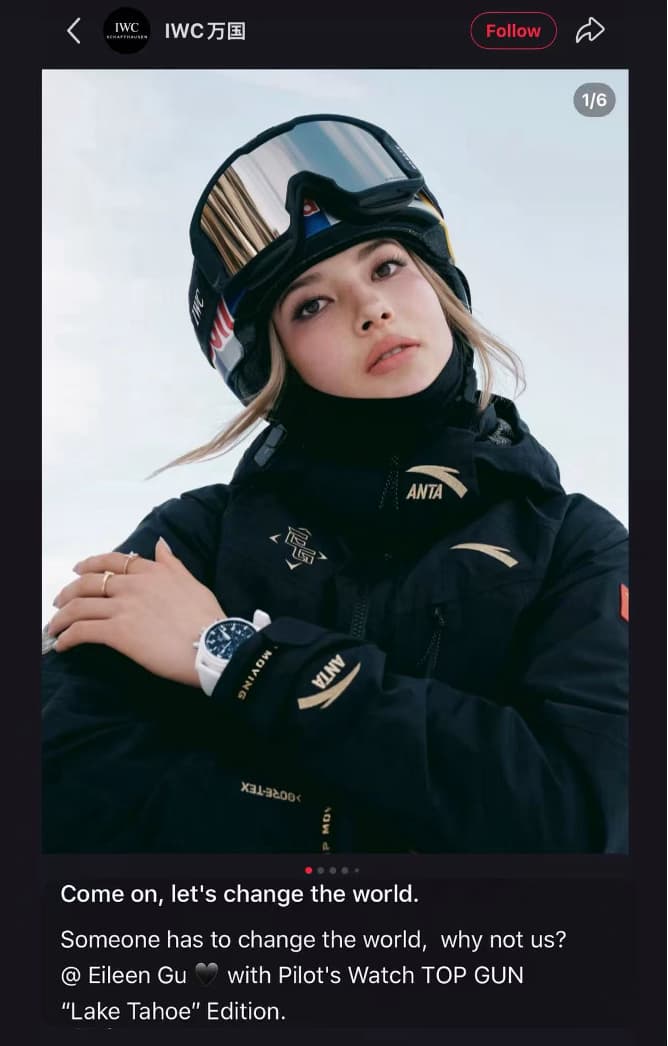

IWC collaborates with Olympic gold medalist Eileen Gu

A prime example of this is the partnership between IWC and Eileen Gu. In 2022, Swiss luxury watchmaker IWC Schaffhausen appointed Olympic gold medalist Eileen Gu as its brand ambassador to connect with China’s younger demographic and capitalize on the nation’s enthusiasm for winter sports—a divergence from the brand’s traditional partnerships that leaned towards classic and masculine figures, such as Nico Rossi and Cate Blanchett. Gu’s remarkable performance at the Beijing Winter Olympics, where she secured two gold medals and one silver, catapulted her to national stardom. Her victory in the Big Air event was so impactful that it temporarily overwhelmed China’s social media platform Weibo, with related hashtags amassing over 300 million views within an hour, causing the site to crash.

IWC leveraged Gu’s soaring popularity by featuring her in high-profile campaigns, including a notable collaboration with Harper’s Bazaar, which showcased her dual identity as both an athlete and a fashion icon. This partnership aligned with IWC’s strategic focus on China’s dynamic luxury market, particularly targeting younger female consumers, who represent a significant portion of its clientele, allowing IWC to modernize its image without compromising its heritage. While Gu’s association with IWC initially generated substantial buzz, sustaining long-term engagement requires consistent visibility and strategic marketing initiatives. IWC’s approach underscores the importance of aligning brand ambassadors with ongoing campaigns and public appearances to maintain and enhance brand exposure in China’s competitive luxury watch market.

Luxury watches focus on real impact, not buzz

Some famous brands prefer to use soft marketing in the luxury watch market in China. Rather than relying on formal celebrity endorsements, many brands lean into subtle strategies inviting high-profile guests to exclusive events, sponsoring film festivals, and integrating their products into films and TV shows. The Year of the Snake brought out a wave of creative soft marketing campaigns in China’s luxury watch market. Jaeger-LeCoultre launched a limited-edition Reverso inspired by the zodiac, while Dior introduced the Grand Soir Year of the Snake, which resonated with Chinese cultural aesthetics. These low-key yet impactful efforts demonstrate how soft marketing has become a sustainable and widely adopted strategy among luxury watch brands aiming to deepen their connection with Chinese consumers.

Status and Rolex in China

Rolex watches symbolize the upper class, individuals who are well heeled and driven by a pursuit of prestige. On Zhihu, one Chinese netizen asked, “what was the experience after purchasing your first Rolex in your life’?” The response with the most upvotes said he had looked for a Rolex Yacht-Master watch for three years in many different countries and finally got it in a small Rolex exclusive store in London. He felt purchasing a Rolex watch was a turning point in his life. Whenever he had the urge and pressure to make a decision, the Rolex reminded him to calm down because people who wear Rolex watches have to be sophisticated. When he noticed other people were staring at his Rolex, he felt proud and extraordinarily satisfied.

Rolex was the first luxury watch brand that entered the luxury watch market in China after the Chinese economic reform. Rolex in China has a special place in the hearts of luxury watch consumers in China. They do not only treat Rolex as a symbol of luxury and prestige as other luxury watches in China, but also as a timeless masterpiece. However, some of the luxury watch consumers in China do not buy Rolex watches in mainland China because of the limited supplies and relatively higher price.

Brand awareness without social media

Rolex in China does not focus on short-term brand exposure or social media marketing since its brand awareness is high in China and it targets high-net-worth individuals who value heritage, craftsmanship, and long-term prestige over trend-driven visibility. Rolex’s marketing strategy focuses more on sponsoring artistic and athletic activities. Rolex has continued sponsoring tennis tournaments for many years and aligns with excellence in tennis. In 2011, Rolex signed an endorsement contract with Li Na, a trailblazer for tennis in Asia. Being the first Asian to win a Grand Slam her career represents discipline and breaking boundaries; all traits Rolex embodies. By backing Li Na Rolex wasn’t just sponsoring a player, they were endorsing the rise of Chinese tennis while aligning the brand with national pride and inspirations.

Beyond the athletic realm Rolex announced in June 2024, its latest brand ambassador, Chinese film auteur Jia Zhang Ke, a month following his new release “Caught By the Tides”. Regarded as one of Chinas brightest directors, this partnership emphasizes Rolex’s attempt to connect with consumers more on a cultural level. Showcasing how Rolex chooses ambassadors not for their fame alone, but for how deeply they reflect the values of mastery, legacy, and distinction, in ways that resonate specifically with the Chinese consumer mindset.

House of Wonders: Audemars Piguet in China

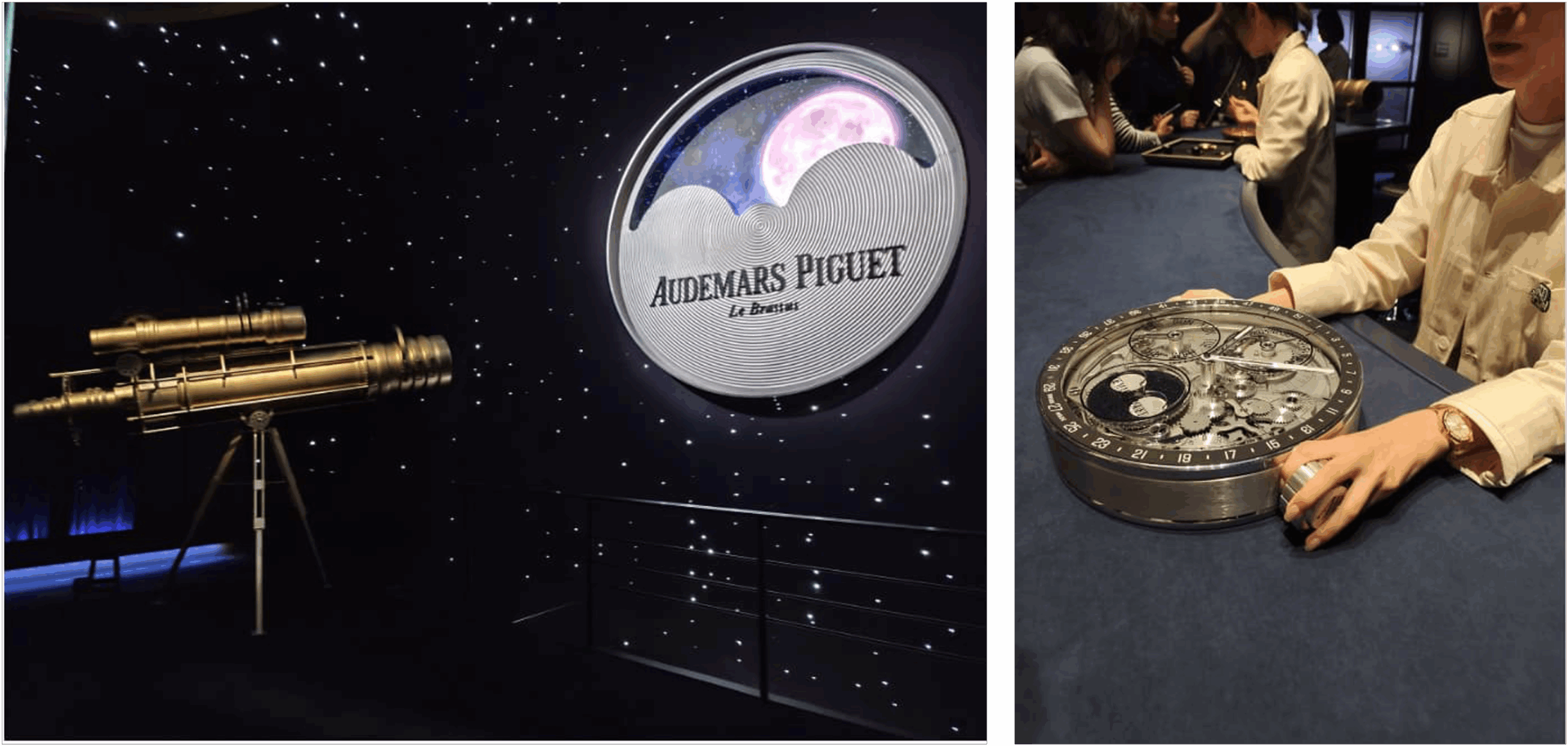

To celebrate its 150th anniversary, Audemars Piguet launched “The House of Wonders” in Shanghai an immersive pop-up experience that brought both seasoned collectors and newcomers into the heart of the brand’s universe. More than a celebration, the event was a strategic move to deepen Audemars Piguet’s presence in the Chinese market by blending Swiss horological tradition with contemporary cultural relevance. By offering exclusive previews and intimate experiences, the event catered directly to VICs (Very Important Customers) China’s elite luxury consumers whose brand loyalty and influence are critical for long-term success.

Designed to engage the modern Chinese luxury consumer, the experience balanced heritage with innovation. One of the standout features was the brand’s effort to stay culturally relevant with younger generations through limited-edition designs and collaborations with pop culture icons such as Spider-Man and contemporary artist KAWS. This contemporary edge was paired with a deep reverence for traditional craftsmanship, showcased in a dedicated room that highlighted the brand’s latest breakthroughs in timekeeping precision, including advancements in time, date, and moonphase complications.

Additionally, its spotlight on R&D, including the patented forged carbon material used in rugged sports watches, demonstrated Audemars Piguet’s relevance in high-performance lifestyles. The House of Wonders not only commemorated a milestone but also served as a calculated brand-building effort—bridging legacy and innovation to engage Chinese consumers and strengthen Audemars Piguet’s long-term positioning in this critical market.

Luxury watch market in China faces counterfeiting

An estimated 15 to 20% of all products in the Chinese market are counterfeits, posing a serious challenge for brands striving to protect their revenue streams and preserve brand value. Nearly 47% of brands report lost sales, with some experiencing revenue declines of over 10% as consumers turn to cheaper imitations. Even more concerning, studies show that 52% of consumers lose trust in a brand after unknowingly purchasing a counterfeit product. In response luxury makers and Guangzhou Customs made an alliance against counterfeit watches. In June of 2024 they seized 7,600 items, including watches, in Guangzhou as part of their crackdown on counterfeit goods. Experts said those counterfeit watches bore a remarkable resemblance to the authentic watches, highlight the threat of “dupes”.

China’s luxury watch market: How luxury watchmakers are winning in China

- China is one of the most lucrative and competitive markets for luxury watchmakers, where brand prestige, cultural relevance, and exclusivity are essential to capturing consumer loyalty.

- From Eileen Gu’s Olympic glow to Jia Zhangke’s cinematic prestige, celebrity partnerships bring emotional depth and cultural credibility. Meanwhile, soft marketing like zodiac-themed drops and art collabs keeps luxury brands in sync with China’s cultural identity.

- AP’s Shanghai pop-up serves as an example of how brands can blend innovation, pop culture, and horological heritage to woo China’s VICs and signal long-term commitment to the market.

- Counterfeiting remains a persistent threat, undermining trust, eroding brand value, and forcing companies to collaborate with authorities and invest in consumer education to protect their reputations.

Mastering China’s Luxury Market Dynamics

As China’s luxury market witnesses a robust rebound, positioning your brand effectively in this evolving landscape is paramount. We specialize in strategic consulting for luxury brands aiming to penetrate or expand within the Chinese market, leveraging our deep understanding of local consumer preferences, cultural nuances, and digital trends.

Our Services Include:

- Market Insight: We provide comprehensive analyses of the latest trends and consumer behaviours in China’s luxury sector, ensuring your brand stays ahead of the curve.

- Brand Localization: Tailoring your brand’s narrative to resonate with Chinese cultural values and consumer expectations, enhancing relevance and appeal.

- Consulting Services: We offer strategy and management consulting every step of the way.

- Regulatory Navigation: Assisting with the legal and regulatory aspects of entering and operating in the Chinese market, ensuring smooth and compliant business practices.

Connect with our team of experts to refine your strategy and secure your brand’s position in China’s thriving luxury market.