Nike is in a battle to reclaim its leadership in China, a market fundamental to its global identity and future growth. For years, the Nike Swoosh ruled with its international star power and deep roots in Chinese sports. But the game has changed, a massive wave of homegrown pride, the “Guochao” movement, accelerated local rivals like Anta and Li-Ning, fundamentally altering consumer loyalties and challenging Nike’s position. This isn’t just a slowdown; it represents a disruptive force that calls for radical transformation.

In response to these challenges, Nike has launched a bold strategic reset under new leadership. The “Win Now” strategy marks more than just a shift in tactics, it’s a complete revamp of how the brand operates in China. Recognizing that global playbooks no longer guarantee success, Nike is moving away from standardized international branding and toward a strategy grounded in local culture and consumer behavior. This transformation signals a deeper focus on cultural relevance, flexibility, and back to their core: performance. For Nike in China, this isn’t just about staying competitive, it’s about survival in one of its most crucial markets. For other global brands, it’s a wake-up call: success in China today demands more than presence, it demands meaningful adaptation.

Read our sustainable fashion report

Nike’s historical presence in China

Nike first entered the Chinese market in 1981, and its growth was characterized by a unique approach. Instead of directly introducing its products, Nike in China opted to support sports clubs and athletic events. A pivotal moment occurred during the 2008 Beijing Olympics when Nike proactively sponsored multiple sports teams, effectively extending its brand presence across the entire country.

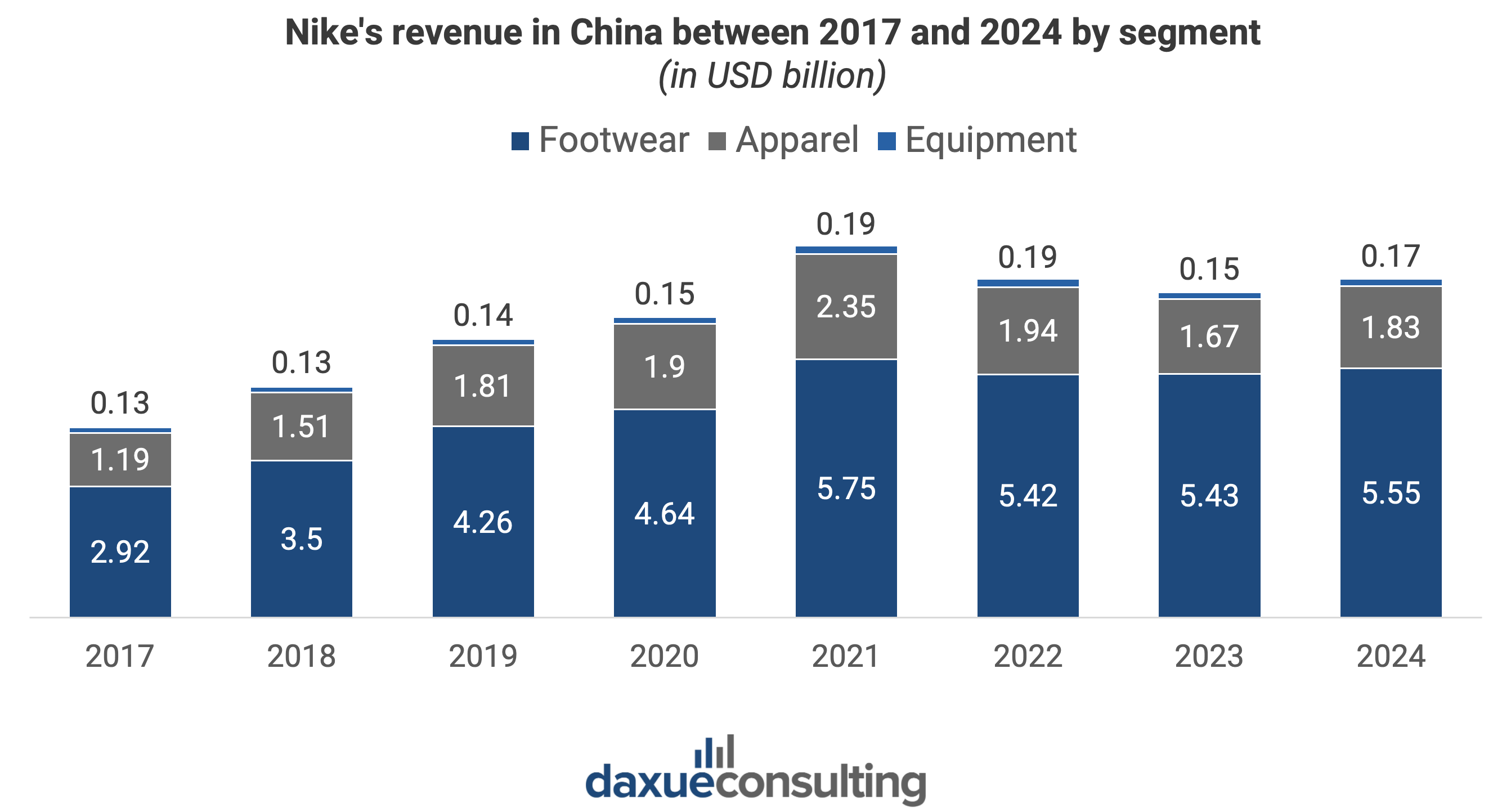

Since the brand’s establishment, over the years China has been a significant growth driver for the US sportswear brand. In 2024, the total revenue of Nike China reached USD 7.55 billion, with USD 5.6 billion coming from footwear and USD 1.8 billion from apparel. Nike’s worldwide revenue in 2024 was USD 49.28 billion, meaning China accounted for 15.3% of Nike’s total revenue.

Competitive pressure from Guochao

In recent years, there has been a noticeable shift in consumer preferences in the Chinese sports market, with domestic sports brands like Li Ning and Anta gaining popularity due to avant-garde designs and more affordable pricing. This shift can be attributed to several key factors, including the Xinjiang cotton scandal and the rise of Guochao (国潮, “National tide”). The Guochao movement has notably transformed China’s sportswear market by promoting national pride and local innovation. Young people are increasingly favoring cultural heritage, social values, and domestic products.

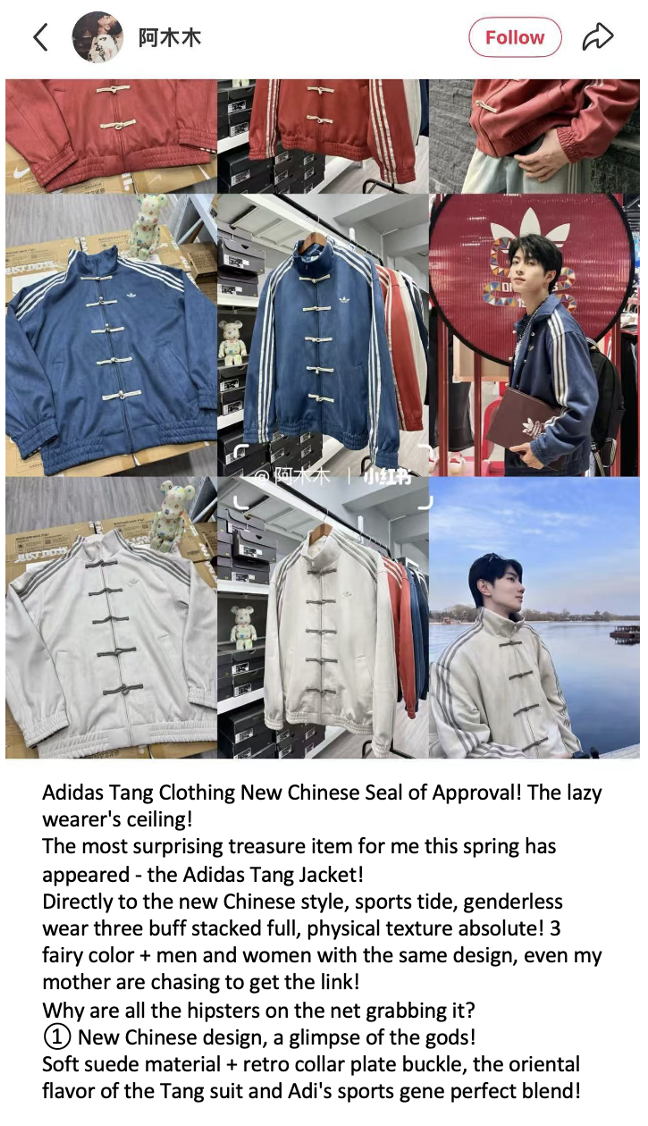

Reflecting this trend, Anta’s market share rose from 14% in 2019 to 19% in 2023, while Li-Ning increased from 6% to 9%. Conversely, international brands faced declining market share: Adidas dropped from 19% to 10%, and Nike in China slipped from 25% to 24% during the same period. Adidas, however, successfully embraced Guochao through culturally resonant collections like the “Chinese New Year Jacket,” which gained significant traction on social media. Such efforts to capitalize on Guochao played a huge role in their double digit revenue growth, 10.3%, in 2024.

The era of relying solely on international brand names and celebrity endorsements, exemplified by figures like Kobe Bryant and Messi, to capture the Chinese market is showing signs of decline. Instead, brands must focus on crafting compelling narratives that resonate with consumers and invest in understanding their preference for products with a distinctly “Chinese feel.”

Nike’s “Win Now Strategy” reset

In October 2024, Nike appointed Elliott Hill as CEO to navigate a critical juncture in its China and global strategy. By early 2025, Hill unveiled the “Win Now” plan—a US, UK, and China-centric blueprint to revive performance in a market grappling with fierce local competition and shifting consumer loyalty. The strategy signals a retreat from Nike’s earlier Direct-to-Consumer (DTC) focus, instead emphasizing hybrid retail partnerships, hyper-localized storytelling, and operational agility tailored to China’s unique dynamics.

This reset prioritizes rebuilding ties with domestic wholesale giants like Pou Sheng and Topsports, whose extensive distribution networks remain vital for penetrating lower-tier cities—where over 70% of China’s population resides. Simultaneously, Nike aims to slash USD 2 billion in global costs over three years, partly by optimizing its China supply chain and streamlining regional operations. Crucially, the plan doubles down on localized innovation, such as China-exclusive sneaker designs and campaigns tied to cultural moments like Lunar New Year or collaborations with Chinese athletes (e.g., freestyle skier Eileen Gu). This reflects a bid to counter rising domestic brands like Li-Ning and Anta, which have gained ground with patriotic “Guochao” (national trend) marketing.

Nike’s earlier DTC push, which emphasized owned stores and apps, stumbled in Greater China. Fiscal Q3 2025 revenue there plunged 17% year-over-year to USD 1.73 billion, with Nike Direct sales down 11%. Digital sales dropped 20%, highlighting a reliance on Nike’s own platforms in a market where consumers favor super-app ecosystems like Alibaba’s Tmall and Tencent’s WeChat. Meanwhile, store traffic dwindled in major cities as budget-conscious shoppers turned to discount channels or local alternatives. The downturn exposed vulnerabilities in Nike’s China DTC model: high operating costs, stiff competition from nimbler rivals, and a lack of localized digital engagement.

Despite recalibrating its DTC approach, Nike in China remains tethered to domestic e-commerce titans. Partnerships with Tmall and JD.com continue to drive visibility, particularly in lower-tier cities where these platforms dominate logistics and consumer trust. Nike has leaned into Tmall’s Luxury Pavilion for premium launches and JD’s same-day delivery network to serve inland provinces. The brand has also deepened its integration with WeChat Mini Programs, leveraging the super-app’s ecosystem that in 2024 housed 945 million monthly active users to create seamless, app-within-an-app shopping experiences. Through WeChat, Nike in China offers exclusive product access, personalized member services, and localized campaigns to consumers’ social feeds.

From DTC retreat to cultural conquest

Under the new “Win Now” blueprint, Nike is executing a multi-pronged strategy to reclaim its foothold in China’s flooded sportswear market, blending hyper-localized innovation, outdoor adrenaline, female-centric storytelling, and grassroots community engagement. Central to this effort is Icon Studio, a Shanghai-based creative hub launching in 2025 to design campaigns “of China, for China.” This studio presents an initiative that drives culturally resonant initiatives like the revitalized ACG (All Conditions Gear) line and partnerships with high-profile outdoor events such as the Chongli 168 trail running race in Hebei Province. By aligning with China’s growing outdoor movement, where urbanites seek nature-driven escapes, Nike taps into the aspirational lifestyles of the middle class, positioning itself as a bridge between performance and cultural relevance.

Simultaneously, Nike in China is aggressively targeting female consumers, a demographic that has major influence in China’s sportswear purchases. Campaigns like the “Victory Lap” debut at Shanghai Fashion Week, which fused performance wear with luxury fashion, and the “Night Run After Dark Tour,” a running series illuminating urban landmarks, blend athletic utility with empowerment narratives. These efforts position Nike in China as a lifestyle brand attuned to urban women’s evolving identities, wherein sportswear doubles as social currency.

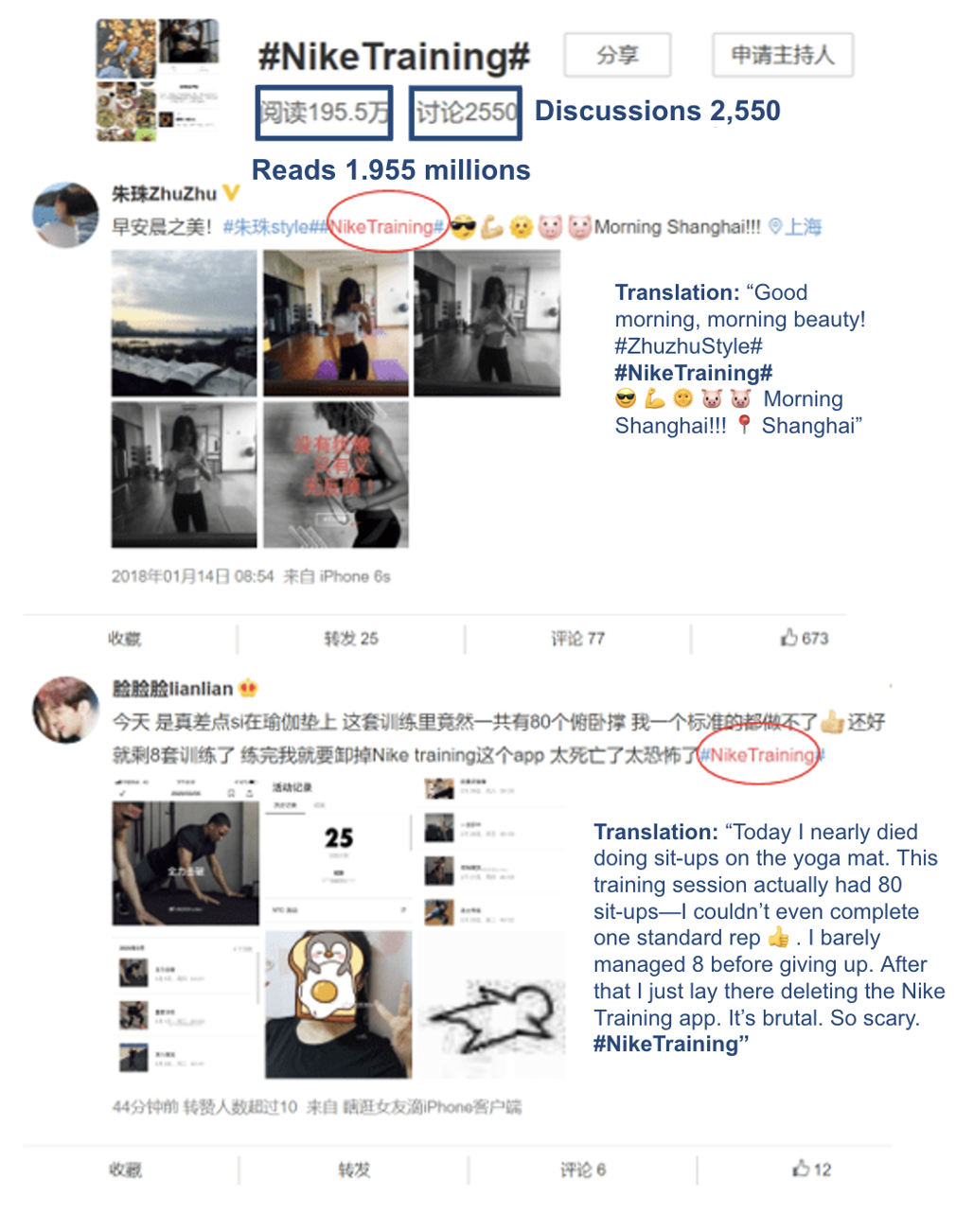

Crucially, this strategy is bolstered by Nike’s community-driven ecosystem, which bridges offline passion and digital connection. Events like the China High School Basketball League and citywide “Just Do It Sunday!” runs—infused with music, books, and charity—create shared experiences that resonate deeply with Chinese youth and families. Online, the brand leverages hashtags (#NikeTraining, #Nike+训练营), on platforms such as Weibo, creating user-generated brand stories showcase customer loyalty and the brand’s popularity, influencing prospective customers. Creating a self-sustaining cycle where offline activities spark digital conversations, and vice versa.

By intertwining localized product innovation, outdoor and female-focused narratives, and participatory community-building, Nike’s “Win Now” strategy transcends mere commerce. It embeds the brand into China’s cultural fabric as a symbol of performance, progress, and belonging, a trifecta aimed to outpace rivals like Li-Ning and Anta in the race for consumer hearts.

What brands should know about Nike’s China strategy

- Nike has successfully grown in the Chinese market through strategic measures such as supporting sports clubs and athletic events, particularly during the 2008 Beijing Olympics.

- With recent drop in performance, Nike is taking a dramatic shift in their core business model with their new CEO and new “win now” plan thatprioritizes cultural alignment to resonate with China’s Guochao movement.

- Nike is cutting back on its DTC and adopting a hybrid model, blending DTC channels with wholesale partners and leveraging partnerships such as WeChat to deliver seamless and personalized shopping experience.

- Nike actively engages with its brand community through offline and online events, particularly targeting female consumers and fueling the empowerment of women in sports.

- Placing a focus on local storytelling and fostering community loyalty through grass root events that merges offline engagement with digital buzz.