Nowadays, Online selling in China is booming and it is becoming increasingly popular for people to do some online shopping. They surf on taobao.com and jd.com instead of amazon.com or eBay.com. In fact, eBay has attempted to convert some Chinese consumers but it still has a relatively low impact. Chinese sellers and buyers both prefer the mode of online trade, which tabao.com and jd.com can provide.

What are the modes of Chinese local E-commerce?

The Daxue team made a recent research on the Chinese online Giant. In this article, only two of the most typical Chinese online marketing companies are introduced, tabao.com from Alibaba and jd.com from JD Co.Ltd.

A quick insight of Taobao and Tmall

First of all, tabao.com is tailored for the Chinese online market by its C2C method. This system allows the sales of goods and services between individuals. For example, Taobao acts as an intermediary in sales between private parties. Taobao marketplace offers a possibility for individuals to open an online shop on their website, as long as they meet with certain requirements. The way in which Taobao works, makes many sellers want to open their stores on a Taobao Marketplace. They dream of a rapid growth for their businesses, many do not realize the difficulty of this, sometimes resorting to dishonest sales to improve cash flow. However, this does not mean that buying on Taobao is risky. Taobao Marketplace has a special department responsible for tracking suspicious transactions and does not hesitate to close shops owned by unscrupulous sellers. As a result, the risks are significantly reduced. However, with the recent technology boom and the fast-changing market, taobao also developed its B2C (business to consumer)method and it gave the birth to “Tmall”. This trade model assumes that the seller must be a legal entity (an organization, official manufacturer or a registered brand) offering their goods and services to end consumer. To open a shop on Tmall, the legal entity needs to provide all appropriate documentations to confirm reliability, genuineness and the real fact of existence of the organization, company, manufacturer or brand. This approach eliminates the risk that an unscrupulous seller with products of dubious quality will trade on Tmall. Taobao guarantees that all goods on Tmall are official and authentic. On each seller’s page, you can see certificates of quality and compliance. Since Tmall does not get involved in the actual trades, it makes profit by charging fees from shops. These include a real time technical support fee, annual technical support fee of 6000 RMB and a commission fee of 2% per transaction.

Double 11 day:

This particular day has been invented by some students in Nanjing in the 1990’s, for the celebration of single people, it has now turned a big commercial celebration. This shopping festival is now celebrated by every Chinese and it is an amazing ways for the big brands to boost the domestic demand. Local and International brand are ready to launch this year big war discount between the giant of the Chinese E-commerce. Alibaba’s own aim is to beat his own record. Every year the sales volume reach an annual growth of 640%.

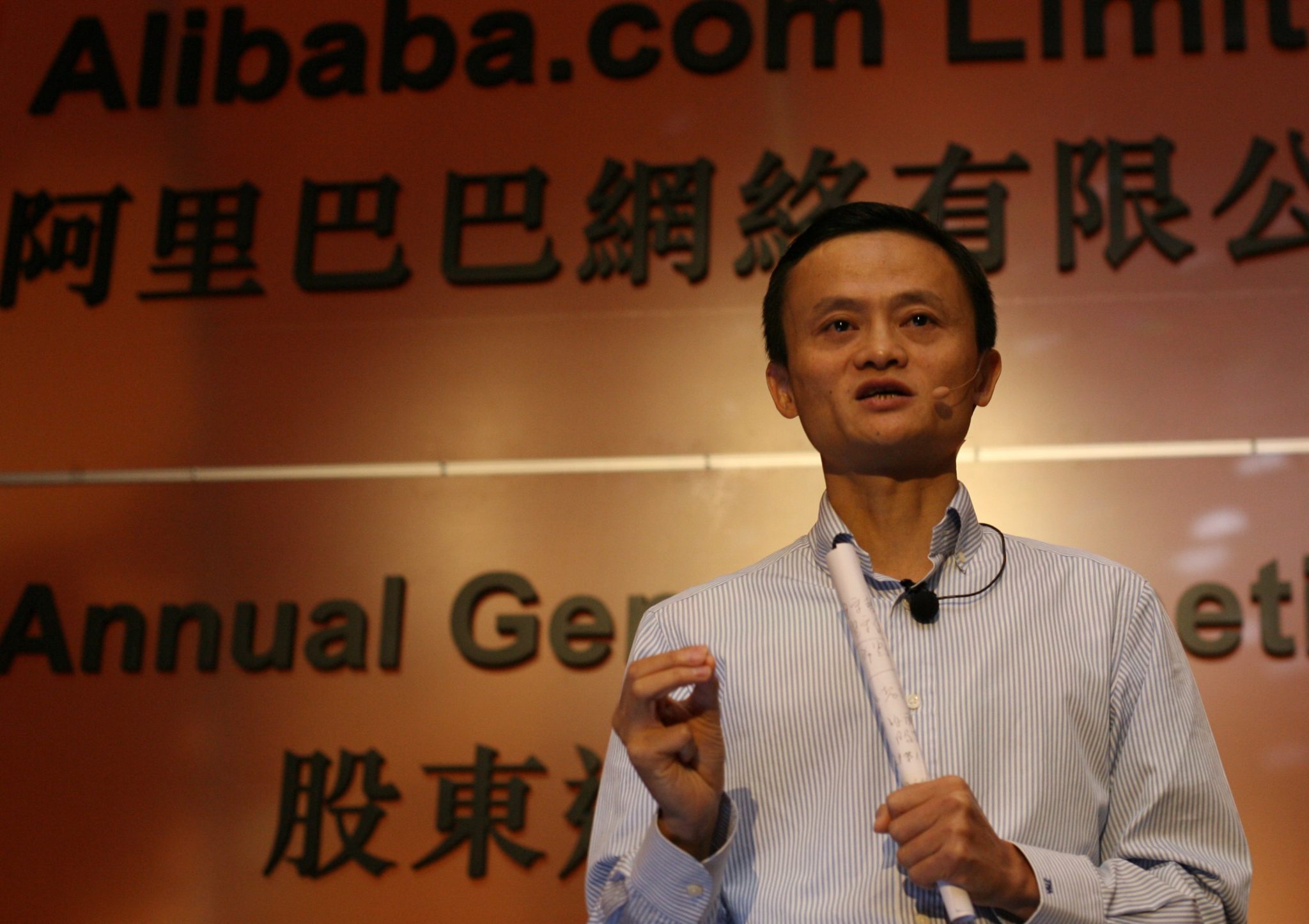

Jack Ma, the chairman of Alibaba, just recently said at a trip at Chicago that he will double the amount of his sales within the 5 next year. The reason of this profit growth is mainly because the company is investing heavily in such growth areas as the mobile internet. The firm is developing from an online shopping platform to a broad provider of online services.

A quick insight of JD (Jingdong)

JD.com or Jingdong Mall, formerly 360Buy, is a Chinese E-Commerce company headquartered in Beijing. It is one of the largest B2C online retailers in China by transaction volume. Its English website, for worldwide shipping, launched on October 18th2012. Since then, their business has grown rapidly. The number of products they offer through their online direct sales and marketplace has grown from approximately 1.5 million stock keeping units (SKU’s), as of December 31st2011, 7.2 million SKUs as of December 31st 2012 and approximately 25.7 million as of December 31, 2013. They had 12.5 million, 29.3 million and 47.4 million active customer accounts and fulfilled approximately 65.9 million, 193.8 million and 323.3 million orders in 2011, 2012 and 2013 respectively. JD has three types of upstream partners: manufacturers, distributors and dealers. Goods are purchased from one of its partners, and then sold via its online store. Jingdong’s sales are nationwide, leading to the problem of ‘cuanhuo’, or cross-regional distribution. In China, prices often differ in different markets through regional distributors. Since the same products are sold in different regions at different prices, cross-regional sales by a regional distributor are often not allowed. At the beginning, 90% of Jingdong’s suppliers viewed ‘cuanhuo’ as a problem and would not permit the practice. Liu had a different opinion: “E-commerce should not be confined by when and where the trade is made. If I buy from manufacturers in Beijing but sell the products in Shenyang, in the traditional business sense, this is ‘cuanhuo.’ However, in ecommerce, this concept does not and should not exist.” Prior to e-commerce, Jingdong had accumulated six valuable years of dealership experience and established sales channels for many products. Jingdong used this experience to break barriers and build additional channels and in March 2007, business started to pick up. HP 2 took the initiative to contact Jingdong, followed by other major IT manufacturers such as Lenovo and Intel, which extended their support to the company.

Why can those local E-business companies attract customers?

To explain this, we should use JD as an example. Different from Taobao, JD is a whole B2B platform. Certainly, They are many competitors in this field. And JD’s rise does not come without competition and some controversy, particular price undercutting criticisms from China’s two leading appliance and electronics giants, Gome and Sunning. Both of which established online malls while maintaining their offline outlets as well. However,to answer the question of why those local E-business companies can attract customers, it is certain that the price is the first answer. Some experts believe that the main point of this success is that JD chooses to sacrifice short-term profit in order to gain long-term development. We can easily get to this point from the strategy that JD has made: Product categories are selected by the sellers,related to a term plan and decided by the information system. They classify all the categories of goods from A to F by the sales of goods. When the day-order of a product has steadily come to more than 500 units, JD will contact the manufacturer directly, thus meaning that distributors are bypassed in order to obtain the lowest retail price. Taken this in to consideration, it now becomes easier to understand why JD can give such low prices to their customers. Retailers and companies are discovering that winning in this field requires a broad view of consumer engagement and consumer data.

We hope you enjoyed reading this article, and have gained more of an insight about the e-commerce industry in China. If you would like to learn more about this topic or to get more information on another market in China, we, the Daxue Consulting team, are happy to answer any inquiries. Contact us!