According to a report by the firm Reports and Data, the global pesticide market is predicted to reach 96.96 billion US dollars by 2027, driven by the rapid growth in population and food shortage. A 2019 study by Chinese Academy of Social Sciences forecasts that the population will peak at 1.44 billion in 2029. Mordor Intelligence predicted a 3.8% CAGR of the pesticide market in China between 2020 and 2025. Market trends reflect the increasing demand driven by the population growth in conjunction with the government’s environmental regulations and the ongoing restructuring of crop protection industry in China.

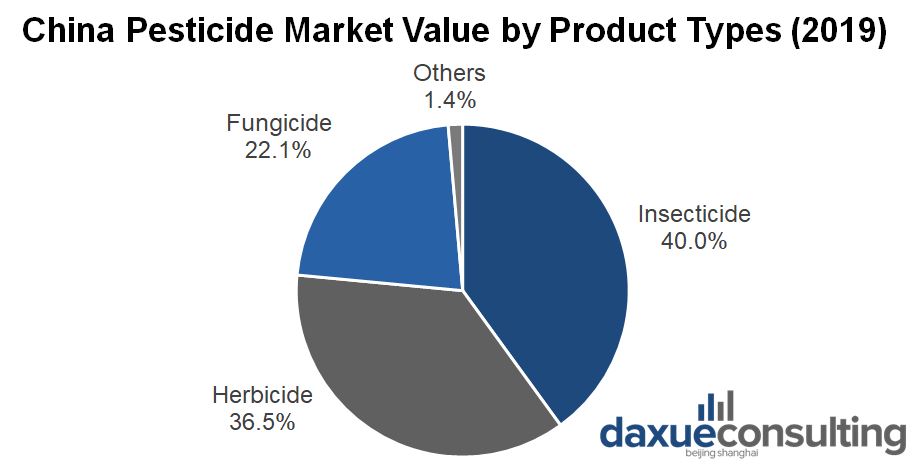

According to figures from Kleffmann Group and Phillips McDougall, the pesticide market in China had a value of 5.72 billion US dollars in 2019. Based on the product type segments, insecticide accounts for 40% of the market value, while herbicide and fungicide accounted for 36.5% and 22.1% in 2018 respectively. Based on crop type segments, rice farming as the largest segment contributes to 32.62% of the market value, while the values of fruits and vegetables, wheat, and corn segments are all above 10%.

Source: Kleffmann Group and Phillips McDougall, designed by Daxue Consulting, China Pesticide Market Value by Product Types (2019)

In the broader Asia-Pacific region, which has become the largest pesticide market since 2009, China is the largest market in Asia, with more than twice the market value of Japan, which has a 2.71 billion USD market.

Drivers of the pesticide market in China

The main drives for pesticide’s demand are the subsequent effects of high population growth, such as increasing food demand, soil degradation, and finite arable land, accompanied by consumers’ diversification in diets and change in mindset regarding pesticide.

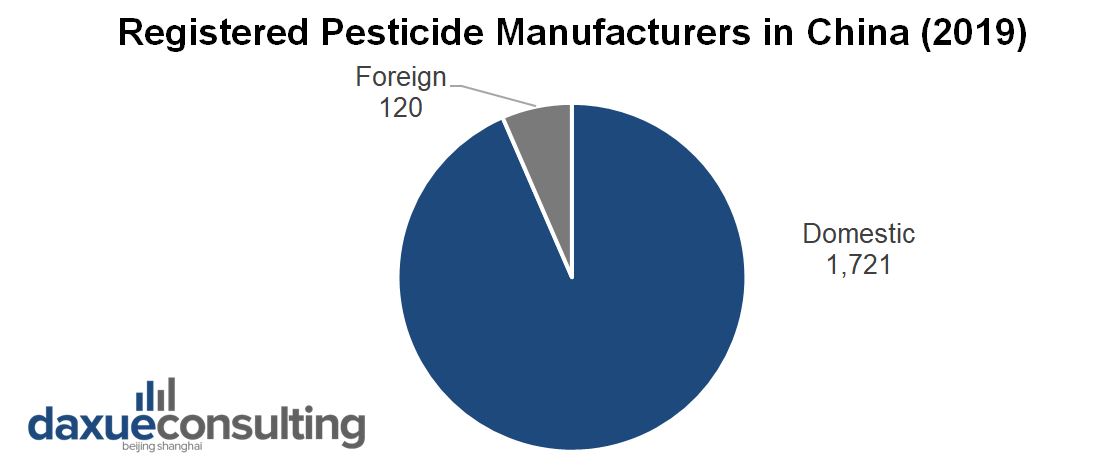

Since the 1980s, alongside the increasing demand for food due to the rapid population growth, pesticide has been applied on a large scale, and the market has rapidly expanded in China. As of 2019, there are 1,941 pesticide manufacturers in China and 120 of them are foreign companies.

Source: Ministry of Agriculture and Rural Affairs, designed by Daxue Consulting, Registered Pesticide Manufacturers in China (2019)

New trends of the pesticide market in China shaped by environmental regulations:

Since the 1980s, the pesticide market in China has experienced four stages of development:

- The 1980s to mid-1990s: rapid growth (expansion of the agriculture industry in China)

- The mid-1990s to 2000: stable development (transformation of the agriculture industry in China)

- 2001 to 2014: accelerated development (growth of new segments of the agriculture industry in China)

- 2015 to 2020: gradual decline (environmental regulations in China + restructuring of crop protection industry in China)

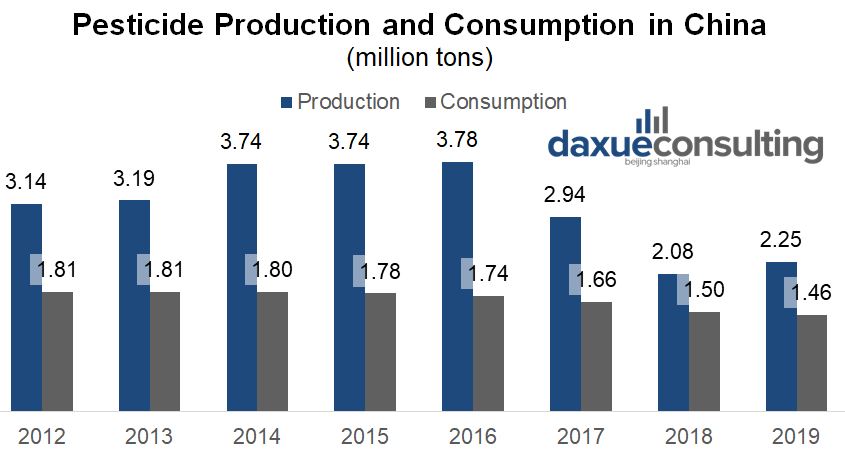

Since 2015, the pesticide supply and demand have been steadily declining amid the industrial restructuring and re-orientation motivated by the government’s policies and regulations.

The overall production of pesticide in China experienced a rapid fall in 2017, maintained relatively stable since then. The overall usage has gradually declined since 2015, expected to continue in 2020.

Source: National Bureau of Statistics of China, designed by Daxue Consulting, Pesticide Production and Consumption in China

The stricter environmental regulations in China and restructuring of crop protection industry in China have driven both declines. Simultaneously, the trade war and the reduction in demand of the international market due to the climate condition in recent years also contribute to the decline.

Import and export of pesticides in China

Due to the declining demand and the development of products domestically, the import of pesticide in China has gradually declined since 2015, from 926 thousand tons in 2014 to 792 thousand tons in 2018.

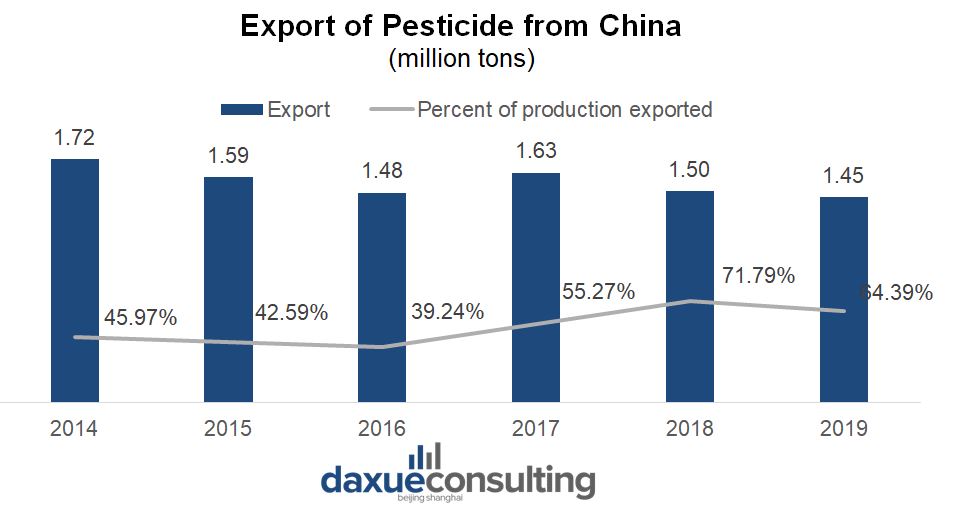

Impacted by the declining production, the export has also been subjected to a decline since 2015. However, the percentage of production being exported has rapidly increased since 2015, reaching more than 70% in 2018.

Source: General Administration of Customs of China, designed by Daxue Consulting, Export of pesticides from China

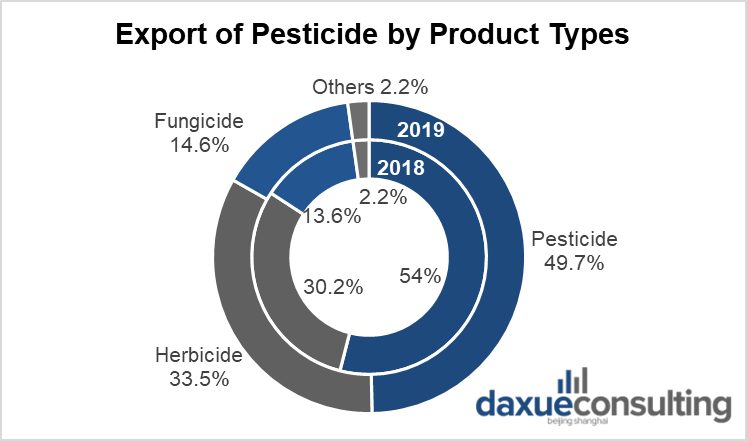

Pesticides are largest export segment, accounting for 49.7% of the total export value in 2019. The exports of insecticide and fungicide, accounting for 33.5 and 14.6 of total export value, experienced growth of 14.4% and 11.1%, respectively, in 2019.

Source: Ministry of Agriculture and Rural Affairs of China, designed by Daxue Consulting, Export of pesticides by product types

Policies impacting the pesticides markets in China

The industry is susceptible to authorities’ regulations. The government has imposed a series of regulations and guidelines to restructure the crop protection industry in China and create a more environment-conscious and technology-driven argriculture industry and pesticide market in China since 2015.

China’s “zero growth” action plan

In February 2015, the Ministry of Agriculture adopted a “zero growth” action plan regulating pesticide usage by 2020. The authority aims to reduce the overall use by promoting “safer, more efficient, and more environmentally friendly” use. Under the plan, the administration enlarged the scope of subsidies to encourage the scientific applications of “more efficient, less persistent, and less toxic crop pesticides.” The industry was impacted most significantly by the new pesticide regulations and further tightened environmental regulations in China in 2017.

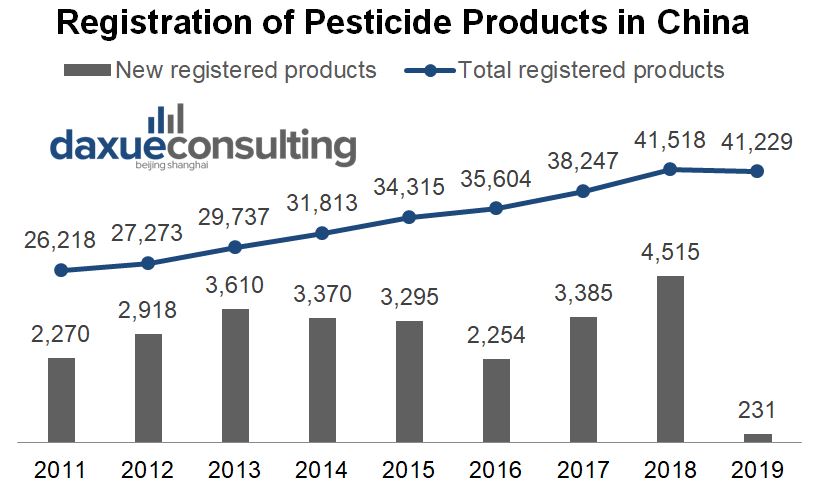

The strict environmental regulations in China have accelerated the phasing-out of less efficient SMEs, forced some foreign manufacturers to move their production out of China, and increased the entry barrier. At the same time, companies started to phase out high-risk pesticide products. In 2019, the total registration of pesticide declined for the first time in China.

Source: Ministry of Agriculture and Rural Affairs of China, designed by Daxue Consulting, Registration of Pesticide Products in China

The biopesticide segment benefits from preferential policies

Meantime, some segments of the industry have benefited from the authority’s effort to reduce environmental risks. Most notably, the biopesticide segment enjoys a series of preferential policies in China. Between 2015 and 2019, the number of registrated biopesticide products in China grew in the average rate of 9.46% annually.

From September 2020, the Ministry of the Agriculture fast-tracked registration of biopesticide products and simplified and streamlined the procedures. The policies will further accelerate the development of the segment.

Creation of “National Champions” by restructuring:

Alongside the strict environmental regulations, the authorities started to restructure the industry in 2015. China Crop Protection Industry Association (CCPIA) published a guideline for the industry intending to reduce the overall number of more than 2000 companies in 2016 by 30%, create large and ultra-large companies, and increase overall R&D input from less than 1% to 3% by 2020. The emergence of big domestic enterprises and the diminishing of smaller ones have been observed since then.

Since 2015, many SOEs have been merged to become the “National Champions” to increase efficiency, sometimes through acquisitions of foreign companies. The framework has created several industry giants in the hope of gaining efficiency. For example, state-owned ChemChina acquired Swiss crop protection giant Syngenta in 2016 and Israeli Adama in 2020, and its merger with another state-owned giant Sinochem is recently confirmed.

Source: Global Times, ChemChina deals part of ‘national strategy’

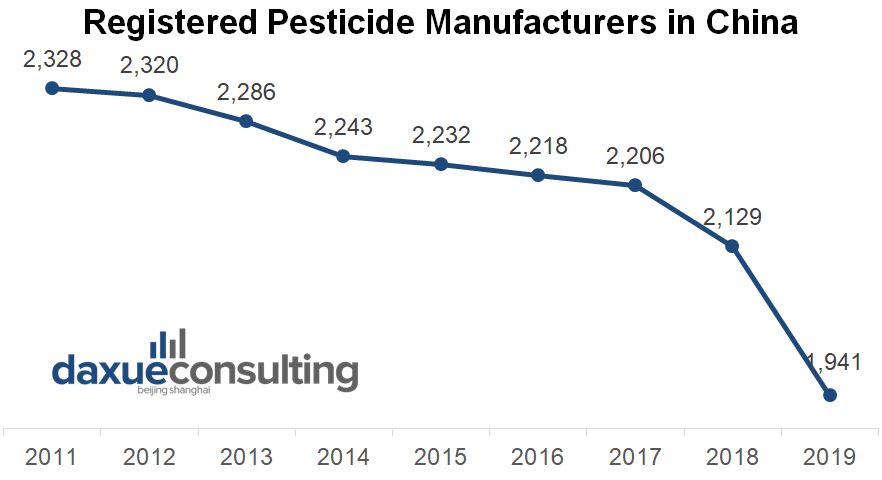

Despite the decline in overall production, both the revenues and profits of large companies have increased. The restructuring has impacted the SMEs most significantly and the number of registered pesticide manufacturers in China decreased drastically in 2019.

Source: Ministry of Agriculture and Rural Affairs of China, designed by Daxue Consulting, Registered Pesticide Manufacturers in China

Crop-production chemicals market in China amid COVID-19:

The COVID-19 pandemic has impacted the economy and the market globally. The authorities’ sanitary regulations have hit the industry’s supply chain, while the social distancing policies have affected the market demands.

The rising cost of production:

David Li from Beijing-based Biosciences Inc. suggests that the following factors contributed to the shrinking of China’s manufacturers’ profits during the domestic outbreak:

- Higher logistic costs due to block of the upstream raw materials and intermediates;

- Multiple currencies’ sharp depreciation;

- Cost of routine investments into new capacity.

Nevertheless, the pandemic’s impact on China’s supply chain is less significant than in other economies. China experienced a short period of domestic logistics block, and most of the pesticide manufacturers in China halted the production at the beginning of 2020 due to the strict lock-down. Starting from February, the authorities introduced a series of policies to facilitates the industry. Many pesticide manufacturers in China resumed production in late February, and the supply has remained stable prior to manufacturers in other economies.

Fluctuation in demand:

Regarding consumer demands, the pandemic has impacted the agriculture industry in China. The social distancing policies influenced the consumer demand for food that backwardly affects the agriculture industry and pesticide market in China and worldwide.

The vegetable and fruit segments has been hit harder by the pandemic than field crops. While the pesticide purchasing had become stable due to the domestic outbreak’s shorter time span, the demand is likely to remain weak overseas.

However, according to surveys by Kantar and BCG, both domestically and globally, there are substantial demands for fresh food during the pandemic and in the post-COVID era. The farmers might purchase more pesticide to make up for the loss during the pandemic, implying the potential for growth opportunities.

The crop protection industry in China in the post-COVID era

The impact of the pandemic will accelerate the ongoing restructuring of the crop protection industry in China since 2015. According to David Li, the industry expects to see large quantities of active ingredients from Chinese suppliers in the next few years. Considering the increasing power of suppliers due to the upstream resource integration of raw materials and intermediates, the pesticide manufacturing sector will become more selective and competitive in the post-COVID era. The demands for higher supply chain standards worldwide will accelerate the ongoing horizontal integration of each segment of the supply chain.

The emphasis of the industry in the post-COVID era in China will be:

- Production cost-savings;

- Off-patent active ingredient R&D;

- New formulation R&D;

- Digitalization;

- Logistic integration/cooperation.

MNCs will still maintain the dominant position due to their substantial R&D resources and global supply chain. R&D investments of “National Champions” will show positive results in the coming years, but most of them still lack a robust global supply chain and international cooperation experience. The pandemic and subsequent changes to the industry will phase out more SMEs unless adopting new strategies such as cooperation with MNCs.

Learn something new? Stay updated on the Chinese market by following our WeChat, scan the QR code below, or subscribe to our newsletter

Listen to over 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast