COVID-19 had a great impact on the Chinese economy. Although China is already recovering from the coronavirus, economists suggest we will see a U shaped recovery in contrast to a V shaped one. This means that the economy will not bounce right back to normal as it did after SARS. Rather, we will see some months of lowered consumer confidence and a short-term recession Recession affects every business differently, however some of them have proven to be in recession-proof markets in China.

Chinese economy is bouncing back

China’s GDP contracted by 6.8% in the first three months of 2020. It is the biggest drop in nearly three decades, as the country’s factory output ground to a halt. National Bureau of Statistics of China showed that industrial output was down 8.4% from the year before.

[Data Source: Tradingeconomics.com, ‘China’s GDP growth forecast’]

In the beginning of April, State Council claimed 99% of manufacturing firms had begun working again. Besides, 84% of small and medium businesses had reopened. The economy’s performance in the second quarter will be crucial for the government to get the economy back on track. A quick rebound can happen because of the “countercyclical policies”, or pro-growth measures taken by Beijing. Chinese experts expect economic indicators to significantly improve in the second quarter, with growth returning to potential by the end of 2020 or early 2021.

Recession-proof markets in China during the epidemic

Some markets have proven that they are recession-proof during the epidemic in China. For example, people need health services even more so than usual in these hard times. In a crisis period people also visit discount stores to buy goods in bulk and at discounted rates to save money. Since people had to use nearby supermarkets during the epidemic in China, convenience stores saw good growth dynamics.

Such goods as food, hygiene products, household and baby products were always essential and did not experienced recession. The Chinese began to be more attentive to their own health, so the sale of facemasks and sanitizers also increased. Given the current situation, most companies are making their workforce remote. They are using Chinese video conferencing solutions such as WeChat work and DingTalk. Additionally, in a recession period, people fear losing jobs, and they get insurance to be safe.

A unique characteristic about consumption following COVID-19 in China, is that digital and online tools and services came out as a recession-proof market in China. Due to being indoors, consumers spent much more time on entertainment like gaming, short videos, and streaming movies.

Higher demand for healthcare services in China

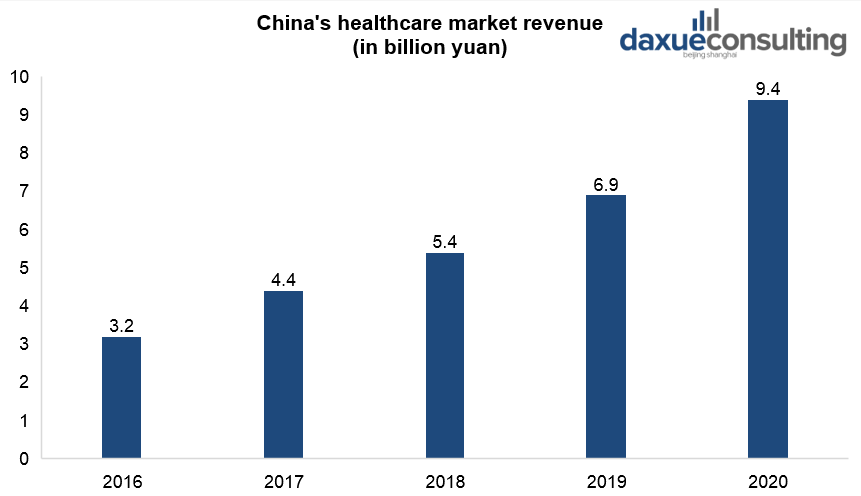

The growing healthcare sector is in many aspects a byproduct of China’s recent economic rise. Now several hundred million people have higher living standards and can afford healthcare services. This increases the demand for healthcare services. Although the medical industry is growing fast in China, the demand for further healthcare services is growing even faster.

Industry experts estimated the Chinese healthcare market will grow to 90 billion yuan by 2020. The Prospective Industry Research Institute predicts that the sales revenue of China’s pharmaceutical industry will exceed 3 trillion yuan. The industry scale will exceed 5.3 trillion yuan in 2025.

[Data Source: Sohu, ‘China’s healthcare industry market revenue’]

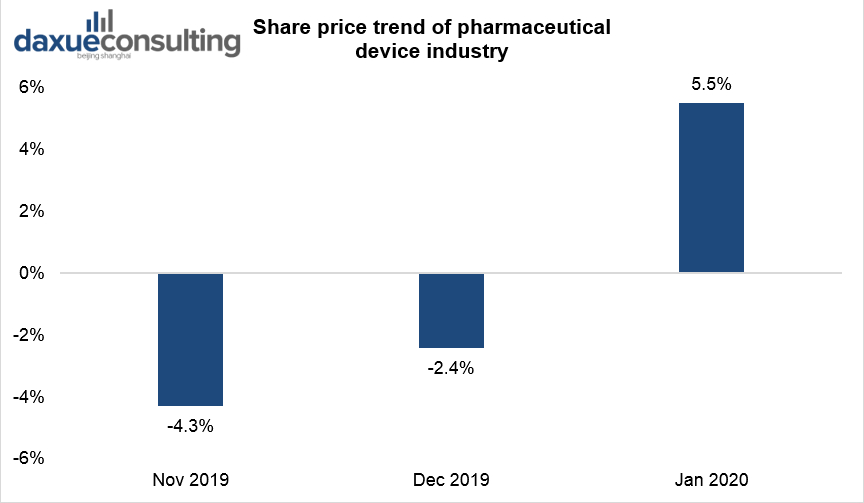

Healthcare is a recession-proof market in China. After the coronavirus outbreak in China has led to an increase in the demand for medical equipment. From January to March 2020, there were 87,265 new businesses with medical devices. Besides, the performance of some medical device companies increased in January, and the medical device industry sector is trending well.

[Data Source: iimedia research, ‘Share price trend of pharmaceutical device industry’]

Most experts agree that the coronavirus outbreak will lead to profound changes in China’s healthcare sector. These changes could include massive investment in disease prevention infrastructure and a re-visiting of pharmaceutical companies’ pipeline strategies. Other improvements could focus on greater emphasis on the role of community healthcare centers.

The outbreak will also most likely lead to digital technology playing a greater role in China’s healthcare. Healthcare industry will turn to digital technologies and solutions to engage markets using AI-based diagnostics and tools.

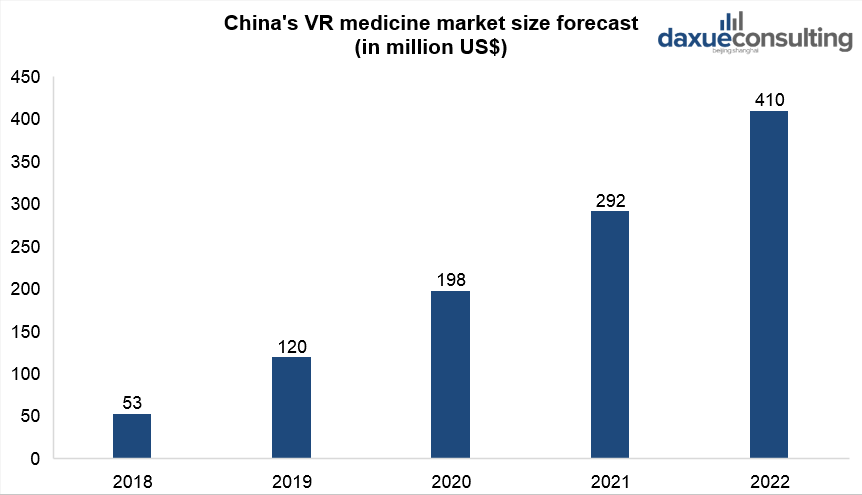

[Data Source: qianzhan, ‘China’s VR medicine market size forecast’]

Retail industry: convenience and discount stores

Convenience stores win during the epidemic

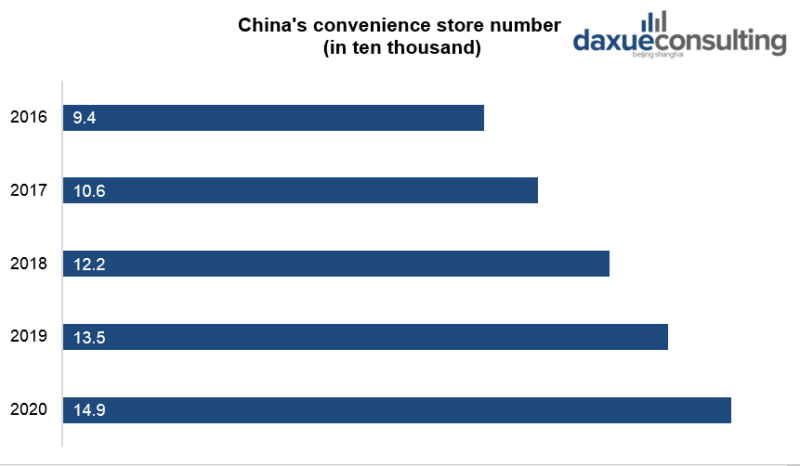

In 2019, the number of convenience stores in China is about 135,000, an increase of 10.3% from the previous year. The number of stores will be close to 150,000 in 2020. With the improvement of digitalization and supply chain, convenience stores will give consumers a more convenient and safe shopping experience.

[Data Source: chyxx, ‘Number of convenience stores in China’]

Convenience stores proved to be a recession-proof market in China. They had more advantages during the epidemic. People have reduced their outings and the scope of activities. Community convenience stores are a typical less-personal retail format. They have gradually become a centralized point of sale and their commercial value also started to stand out. Many convenience stores even started stocking fresh fruits and vegetables to better cater to Chinese demand during COVID-19.

Walmart and Costco – discount stores in China stay on track

Executives of Walmart in China claimed that sales at the company’s 430 stores had not faltered, even during the quarantine. Customers turned to the retailer to buy food and necessities. Walmart also invested in a grocery delivery venture in China that has continued to make home deliveries during the outbreak.

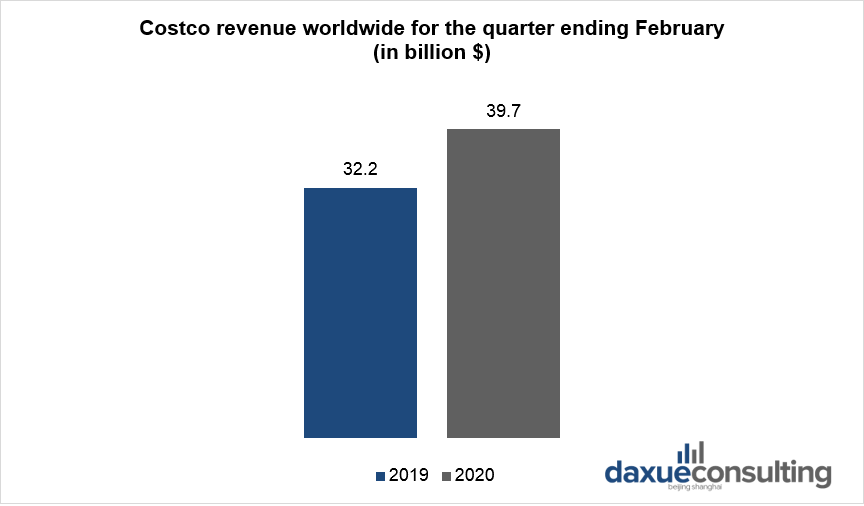

Report published by Costco showed that Costco’s sales accelerating in February 2020, increasing 11.7% year over year. Customers started shopping at the discount stores when the outbreak hit. Demand was so strong that Costco placed a limit on how much customers could purchase of certain items. This helped to increase second-quarter sales and it will influence third-quarter results. For the three months ended February, Costco reported worldwide revenue growth to $39.7 billion.

[Data Source: Costco Wholesale Corporation, ‘Costco revenue worldwide for the quarter ending February’]

Food products: healthy food and convenience food face huge demand in China

In the basic life needs food undoubtedly occupies the first place. That is why it is a recession-proof market in China. During the isolation period in China, people could not eat out, so they bought the ingredients for cooking at home. Downloads of the recipe apps more than doubled in February to 2.2 million at China’s app store. In February 2020, cooking and food-related content attracted more than 580 million views on Chinese video-streaming platform Bilibili.

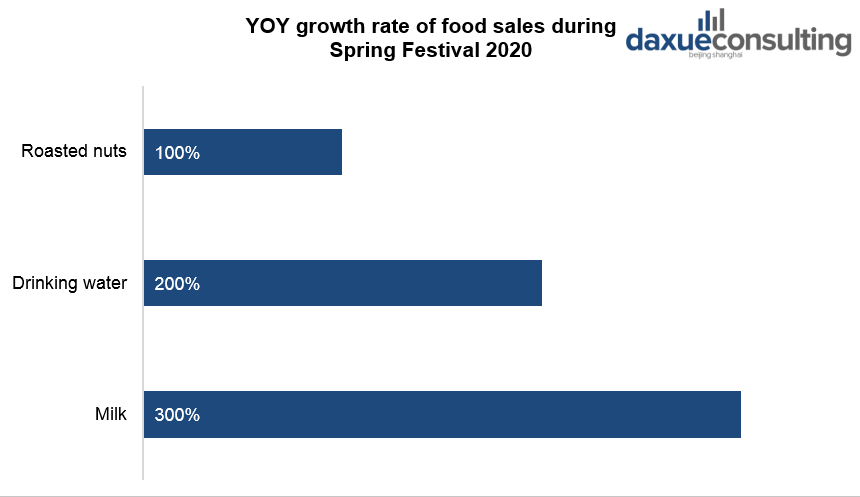

In order to avoid contact with people, consumers choose to use food delivery in China and have the habit of hoarding food products. Healthy food and vegetables saw the growth in sales.

[Data Source: JD Data, ‘YOY growth rate of food sales during Spring Festival 2020’]

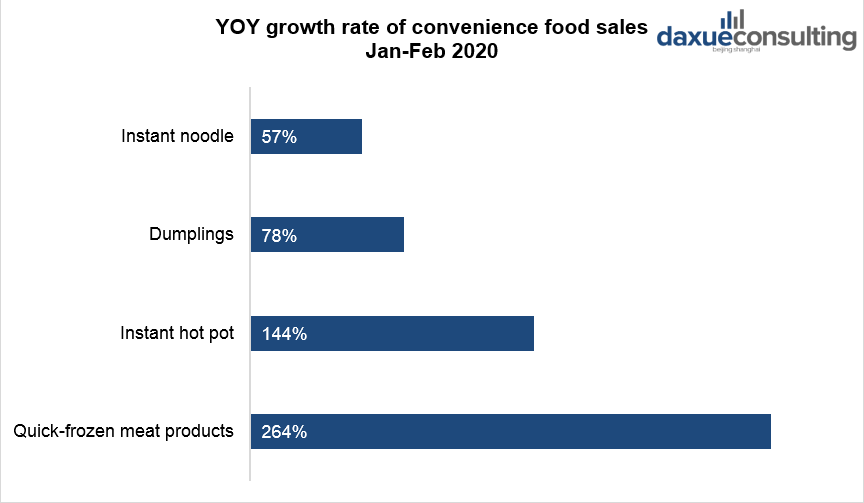

Convenience foods and quick-frozen foods have become the first choice for customers. According to ECdataway, sales of quick-frozen foods have skyrocketed from January to February. Instant noodle sales increased by 57% year-on-year, dumplings sales increased by 78%, instant hot pot increased by 144%, and meat products increased by 264%.

[Data Source: ECdataway, ‘YOY growth rate of convenience food sales January-February 2020’]

Survey by the “Food Safety” magazine showed 5% of food companies faced the risk of immediate bankruptcy. 8% of companies can persist for 1 month. 3% of companies can persist for 9-12 months. Roughly 41% of companies can persist for one year.

Baby products as essential market

As babies are a part of a natural life circle, baby products are a necessity for people. The business of baby products rarely crumbles and proved to be a recession-proof market in China. As a just-needed product, diapers had greater demand than other supplies during the epidemic. The data shows that the most stocked items for pregnant women and mothers in January-February 2020 were diapers. The proportion of pregnant women who chose to hoard diapers was 29%. The proportion of mothers who chose to hoard diapers was 64%.During the epidemic, the most used channels to buy baby products in China were large supermarkets.

Sales of cleaning household products are growing

Chinese government’s recommendation to clean touched surfaces and objects frequently increased the demand for household cleaning products. According to statistics, sales of household cleaning products on Tmall surged 210% compared with the same period last year.

Alibaba released a report which stated that the sales of household cleaning products on Alibaba website increased by 316%. Moreover, consumer demand urged the promotion and application of multifunctional washing products. As household products had big demand during the pandemic, it is a recession-proof market in China.

Hygiene industry – hand sanitizer and facemasks

High demand for hand sanitizers in China

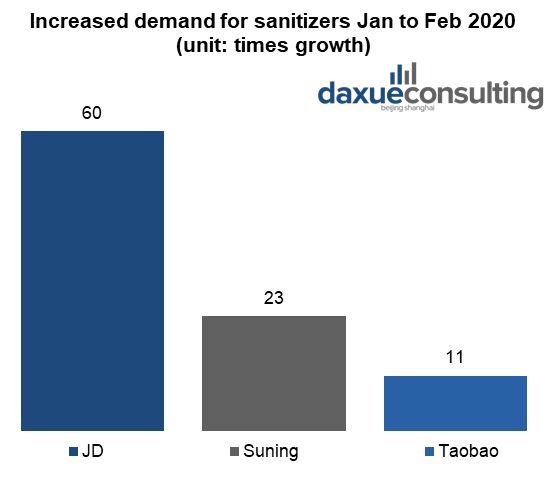

Affected by the coronavirus epidemic, the demand for hand sanitizers surged. After the outbreak, the sales of hand sanitizers increased sharply by 231%. Hand sanitizer sales on Taobao has soared to 31 million, about 11 times more from the previous year. From January 20 to February 13, 2020, JD Supermarket provided around 6 million bottles of hand sanitizer for consumers nationwide.

[Data Source: qianzhan, ‘Demand for sanitizers January-February 2020’]

Affected by the coronavirus outbreak, the growth rate of sanitizer output value will increase. The initial estimated growth rate can reach 13.7%. The annual disinfectant output value will exceed 11.5 billion yuan.

With the need for epidemic prevention and control, the demand for 75% medical alcohol has greatly increased. In 2020 it will exceed 80,000 tons. China Chamber of Commerce estimates that the annual output of hand disinfectant will exceed 50,000 tons in 2020.

Facemasks industry is growing

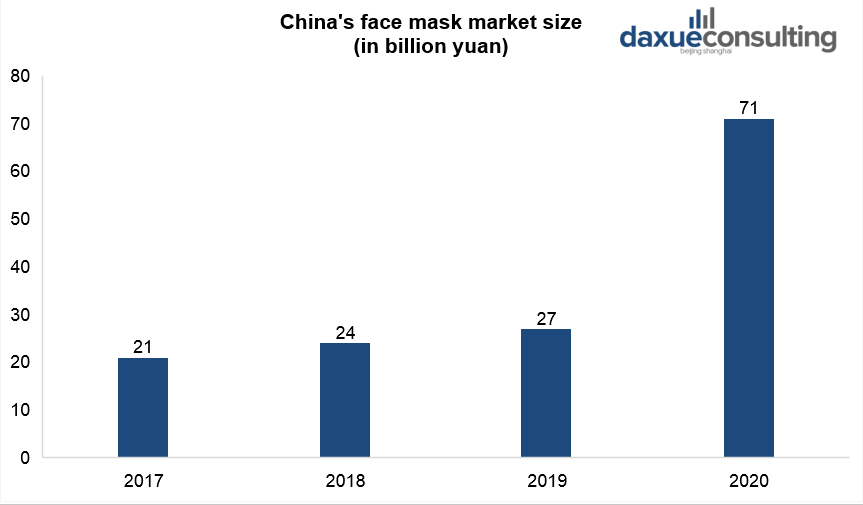

Masks have become the most important goods during the coronavirus outbreak in China in 2020. In recent years, the output value of China’s face mask industry has maintained a stable trend, and the growth rate of output value has remained above 10%. Affected by the coronavirus outbreak in 2020, the growth rate of medical masks will increase significantly, reaching 28%. The market scale of the Chinese mask industry in 2020 will have a substantial increase and reach 71 billion yuan

[Data Source: iimedia research, ‘China’s face mask market size’]

Industry insiders pointed out that in the future, professional masks will continue to occupy the market, and the market share of low-end full-gauze masks will continue to decrease.

Distance learning and remote work tools as recession-proof markets in China

Distance learning attracts more users in China

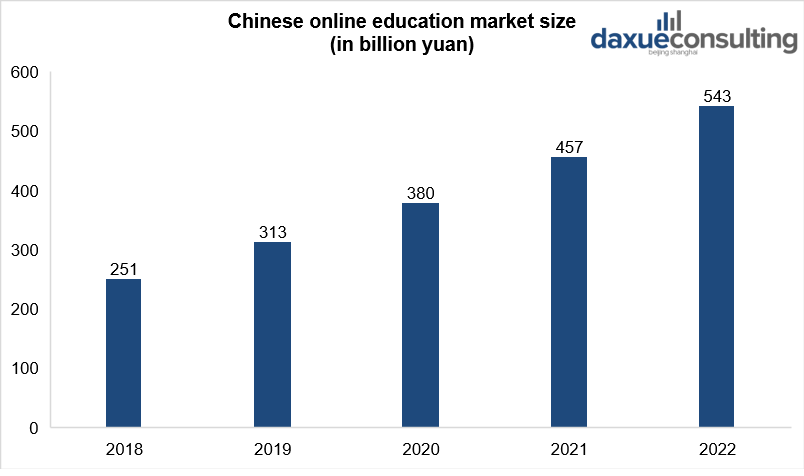

After the government announcing to postpone the starting day of school, online learning APPs achieved dramatic growth. Statistics show that the scale of China’s online education market exceeded 300 billion yuan in 2019. It will reach nearly 500 billion yuan in 2022. The epidemic brought to online education an outstanding traffic performance. During the epidemic, the daily active users of Xueersi (学而思) online education platform exceeded 10 million.

According to the data of the “Statistical Report on the Development of China’s Internet” China’s E-education users reached 232 million in 2019. It increased on 31 million from the end of 2018, accounting for 27% of the total Internet users. As many schools still have an online teaching, China’s online education users can reach 305 million in 2020.

[Data Source: chyxx, ‘Chinese online education market size’]

Remote work tools are getting more popular during the epidemic

During the coronavirus outbreak, the demand for online office software has risen sharply. According to the government reports, nearly 70% of the employees believe that the company needs to provide tools for employees to work online.

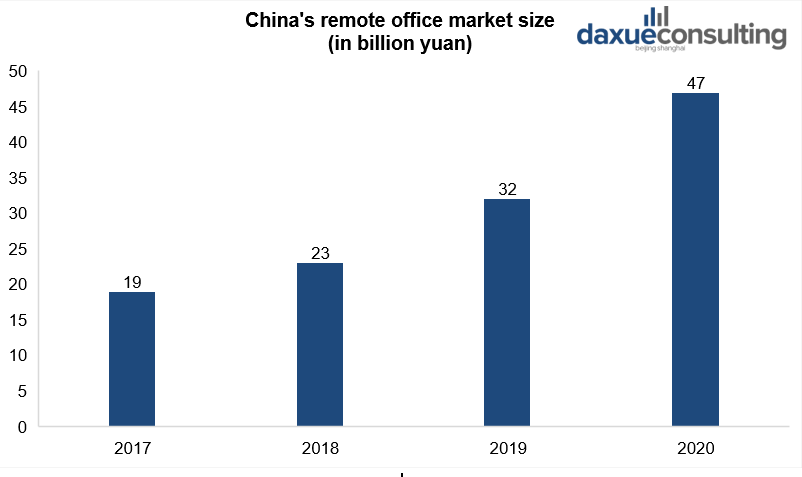

In 2017, the scale of China’s remote office market was about 19 billion yuan, and it reached about 23 billion yuan in 2018. In 2020 it will grow to 47 billion because of the big demand.

[Data Source: Sohu, ‘China’s remote office market size’]

The popular remote office in this epidemic were DingTalk and WeChat Work. Later Zoom, Xiaoyu Yilian and ByteDance’s Feishu subsequently joined the competition. According to statistics, there are currently about 4,500 cloud office companies in China. At present, DingTalk and Enterprise WeChat already have a certain lead in terms of user size.

After the outbreak, the probability of using these remote office tools will only increase. This epidemic has caused more people to start to understand and understand remote office software.

Insurance market in China can resist recession risks

The outbreak will increase China’s insurance awareness and may help the long-term development of China’s insurance industry. As the world’s second largest life insurance market, China’s growth potential remains strong. During the epidemic, the willingness of enterprises to avoid man-made and natural disasters increased.

The impact of the epidemic on the insurance company’s claims is under control. Bank of China and Insurance Regulatory Commission have strict supervision on the solvency adequacy of insurance companies. Currently, the insurance industry has enough solvency to better resist risks and is one of the recession-proof markets in China.

Listen to 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast