In the zoo and aquarium industry in China, many parks have been for failing to innovate, mainly relying on animals without offering new experiences to encourage repeat visits. However, those that have transformed into immersive and comprehensive spaces — incorporating hotels, restaurants and attractions — are successfully bringing more people.

Download the winter sports market report:

With the surge of Chinese domestic tourism, interest in educational entertainment, and demand for visually pleasing, high-tech, and immersive activities, consumers are increasingly visiting zoos and aquariums. In 2022, the zoo sector welcomed 94 million visitors across 195 parks and had a market size of RMB 6.97 billion, a year-over-year increase of 15.9% and 12.1%, respectively. Meanwhile, the ocean theme parks, including aquariums, attracted 50.6 million visitors to 82 parks and had an industry size of RMB 4.64 billion. As zoos and aquariums innovates their experiences, they are expected to bring in new customers and retain existing ones.

How Chinese zoos and aquariums are adapting to new standards

Zoos and aquariums in China saw a rapid expansion during the 2000s with mass domestic tourism. The parks focused on entertainment, offering animal shows and crowd-pleasing exhibits. However, little emphasis was put on animal welfare, often leading to many scandals.

In the following decade, parks went through an ethical shift mainly driven by government regulations. The Wildlife Protection Law, revised in 2016 and 2022, strengthened the necessary standards to obtain captive breeding permits. Additionally, the Chinese government partially banned wild animal performances and enforced rules against illegal wildlife trade and mandates that zoos participate in species conservation programs. Zoos’ role in conservation therefore became more prominent. In response, leading parks have invested in conservation-focused programs, such as the development of Chengdu base’s research on giant panda breeding. Nature-based safari parks like Chimelong Safari Park and Hangzhou Safari Park also gained popularity, while outdated and low-cost parks risked long-term decline.

The COVID-19 pandemic was a difficult time for many Chinese zoos and aquariums. Their high maintenance costs were not compensated by visits revenue. Some zoos and aquariums like Wuhan Donghu Safari Park, Nanchang Polar Ocean World, and Shenyang Forest Wildlife Zoo even had to close permanently. These smaller and more traditional parks were often unable to comply with new welfare regulations. They also struggled to adapt to consumer demand in quality conservation, immersive experience and innovative attractions. Competing with mega-parks like Chimelong became highly difficult for them.

The fall of traditional zoos and the rise of mega parks

The Chinese zoo and aquarium industry recently transformed from modest, state-run facilities into expansive, modern mega parks that reflect global trends in animal conservation and technologies. This led to a strong polarization in the market, with traditional caged zoos and aquariums falling behind.

The Suzhou Zoo and Beijing Zoo, for instance, saw a strong attendance decline since 2020 due to the lack of exhibit updates and animal welfare scandals. Many tourists complained about empty exhibits, the size of animals’ cage, and the absence of natural habitat reconstruction.

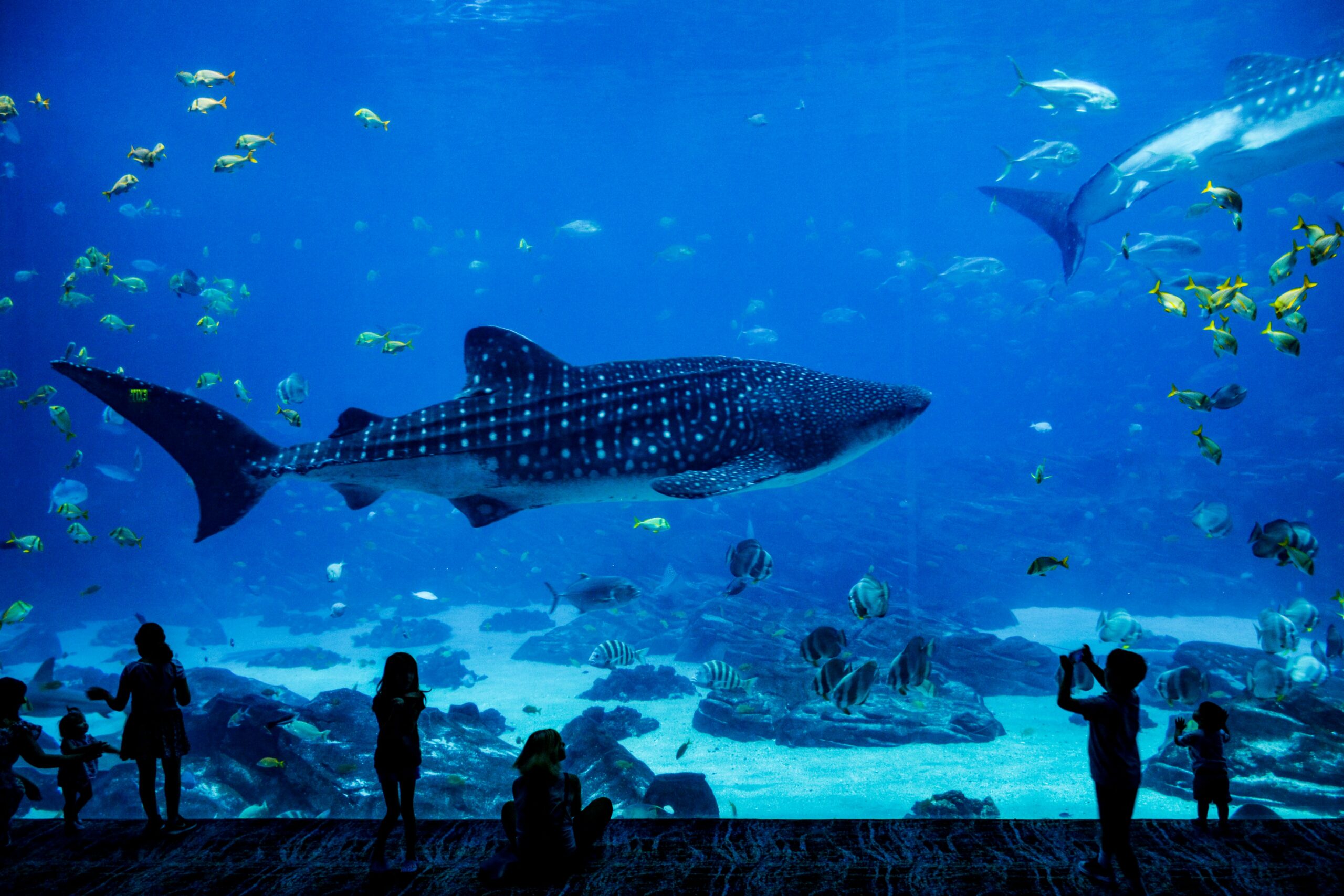

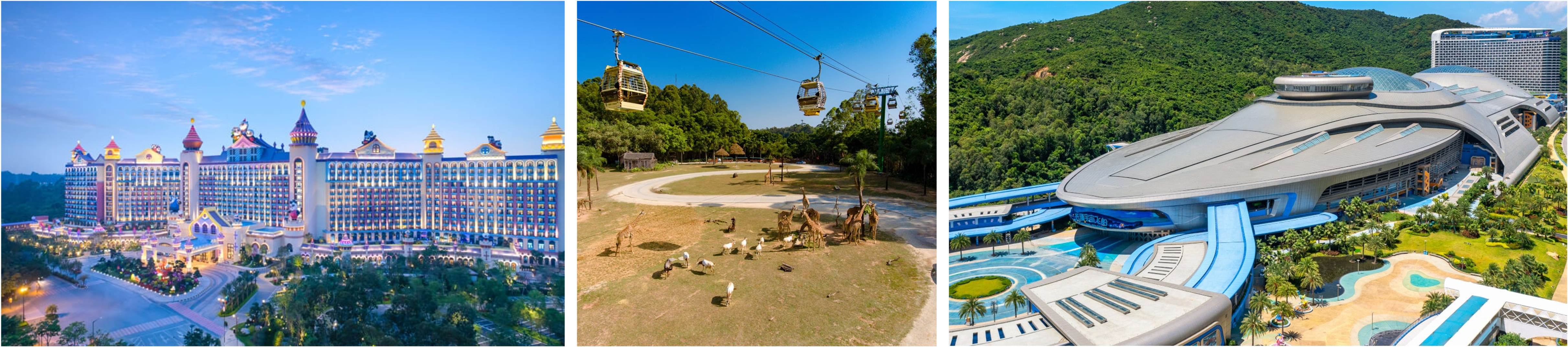

On the other hand, the parks enjoying strong post pandemic rebound often include premium offerings and conservation-focused parks. Zoos and aquariums started being integrated into resort-like theme parks, with hotels, restaurants and attractions. The most famous one is the Chimelong Group which possesses multiple theme parks like Chimelong Safari Park, the biggest safari park in Asia, and Chimelong Ocean Kingdom, the world’s largest aquarium. The Group’s attendance recovered from pre-COVID levels, welcoming over 40 million visitors in 2024. The ticket prices are up to RMB 510 per person, showcasing Chinese people interest in premium parks. As a comparison, Beijing Zoo’s ticket is less than RMB 20 per person.

Other thriving players include Shanghai Wild Animal Park and Chengdu Panda Base. They are well-known for being China’s main panda conservation exhibit, drawing many domestic and international tourists. The park is praised for its high-quality conservation conditions.

Changes in visitor demand: Education, visuals and immersion

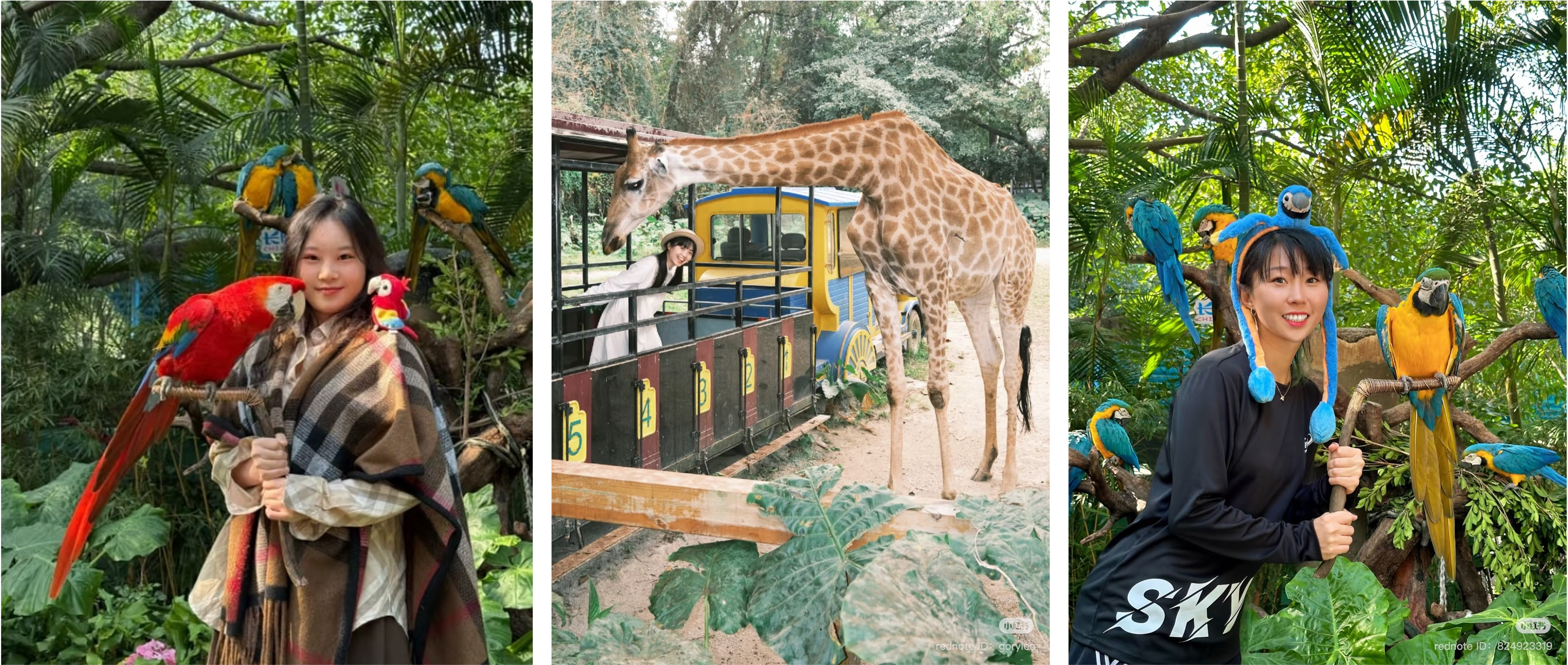

Zoos and aquariums’ visitors’ interests have changed. Parents with children are seeking interactive and educational experiences. The success of the panda keeper workshops in Chengdu is an example of such a trend. People can spend one day helping the conservation facility by preparing food, cleaning the enclosures and feeding the pandas.

Additionally, young Chinese consumers are drawn to visually engaging and immersive experiences. In China, taking pictures of oneself is a huge part of the travelling culture. Many tourism spots and attractions are set up in visually appealing ways for the main purpose of taking pictures. Visitors interact with animals and take photos to later post on WeChat Moments, the Chinese equivalent of an Instagram page.

As China’s traveler market expands, zoos are adapting their offerings to attract long-term stays. Going to the zoo is not just a one-afternoon-activity anymore. Many tourists often book hotels near the zoos using travels apps like Ctrip or WeChat Mini programs. After visiting the zoo, they eat at restaurants, watch performances, and stay in hotels rooms often incorporating themed shows and unique infrastructures. For instance, at the Ocean Kingdom, rooms are designed as sea or wildlife environments. Guests can even look at animals while dining, and much of the infrastructure includes oceanic elements.

Innovations as a tool to solve monotony

The Chinese zoo industry faces a major challenge – monotony – especially after the parks experience their peak profit period. Without any new animals or attractions, most tourists have no reason to revisit. Indeed, zoos and aquariums cannot bring new animals every year. Therefore, to address this challenge, many parks are turning to technology integration and premium experiences. Innovations include inverted zoos, virtual reality components, and themed infrastructures centered on specific animals.

Inverted zoos like Lehe Ledu Wildlife Zoo in China flip the traditional zoo concept. Visitors stay in caged vehicles while animals roam free. Meat is tied outside the cages to draw predators close for a thrilling experience.

In 2018, the Guangzhou zoo closed its circus performance to launch a “VR Zoo” with more than 20 devices for visitors to watch the feeding, playing, and breeding of various wild animals. The exhibit is a massive hit, and on its first day of opening, more than 20,000 people visited the VR section of the zoo.

The transformation of China’s zoo and aquarium industry

- In 2022, the zoo sector welcomed 94 million visitors across 195 parks, generating RMB 6.7 billion. Aquariums weren’t far behind, attracting 50.6 million visitors to 82 parks, with a market value of RMB 4.64 billion.

- The rapid growth of China’s zoo and aquarium industry is driven by domestic tourism, middle-class demand, and interest in tech-based educational entertainment.

- Visitor demand is shifting from sole entertainment to ethical, photogenic and immersive experiences, driven by Gen Z and families.

- Traditional parks declined post-COVID. Several closed permanently due to costs, outdated infrastructure, and inability to meet new welfare standards.

- Premium players like Chimelong and Chengdu Panda Base thrived with conservation programs, immersive experiences, and themed exhibits.