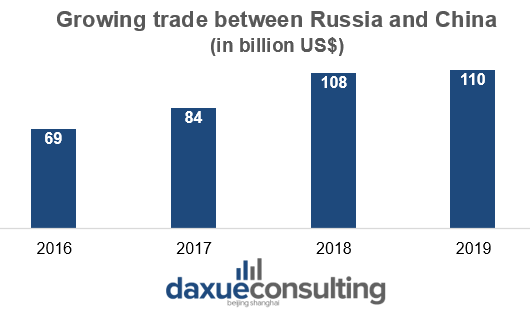

Russia and China have a long history of trade relations. After Western sanctions against Russia in 2014, Russia introduced a new approach to the foreign policy – “Pivot to Asia”. As a result, China has become Russia’s largest export country for agricultural products. In 2019 the Chinese market for Russian products hit a record of over $107 billion US. The same year Russian President Vladimir Putin set a task to increase trade with China to $200 billion US in 2020. Ranging from minerals to food products, the market for Russian products in China is now bursting with potential.

Data Source: Ru-Stat, The Chinese market for Russian products report by daxue consulting, growing trade between Russia and China

China is one of the key trade partners of Russia

Exports of Russian goods to China in 2019 & 2020

China’s rapid economic development and geopolitical issues with the United States have necessitated new trade partners such as Russia. Currently China is №1 importer of Russian goods. Besides, bilateral trade between Russia and China increased by around 4.5% in 2019, reaching 110 billion US$. In the first half of 2020 export value from Russia to China reached 23.7 billion US$, a 12% decrease from the same period in 2019.

In 2019 oil traditionally was the largest Russian export to China. The seafood market in China is also a target of Russian export: 1 billion US$ was the value of exported seafood, fish and shellfish from Russia to China. However, very often, Chinese companies repackage these products and send back to Russia to sell. Meat was also a promising area of Russian export to China in 2019 totaling to 144 million US$. Chicken meat was the biggest category. Fats and oils account for 61 million US$, ranking second in the food category.

In 2020 the share of oil is decreasing, but due to the growth in exports of non-primary products to China, in general, exports are growing. Confectionery and general consumption Russian products in China faced with some problems, because export of them came to China unofficially through the border trade zones. During the pandemic, these areas were closed. Therefore, there was a decline in the export of confectionery and general consumer goods. Now there is a trend that Chinese companies either begin to import goods officially without border trade zones, or they refuse cooperation, because they do not know how to make official imports.

Exports of food and agricultural products from Russia to China have a huge potential

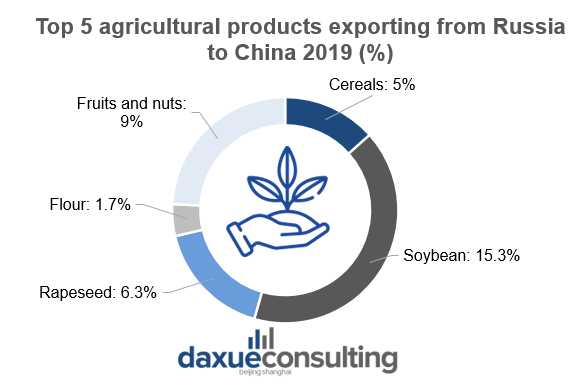

Data Source: AgroInvestor, The Chinese market for Russian products report by daxue consulting, Top 5 agricultural products exporting from Russia to China 2019

How the trade war gave a chance to Russian soybean exports

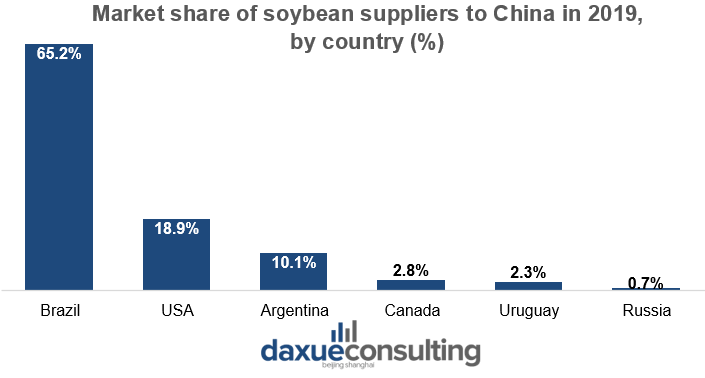

Soybean, fruits and nuts, cereals and rapeseed are the leaders in the export of Russian agricultural products to China. The most dynamic growth in exports of agricultural products to China in 2016-2019 saw Russian soybeans and rapeseed. Soybeans in China are a strategically important commodity, ensuring the country’s food security. When the China – US trade war started heating up in 2016, China needed to find an alternative supply and a way to cover a 10-20 million tons soy deficit. In the future, China will not import the same amount from the US, opening opportunities for Russian soybean producers.

Data Source: Statista, The Chinese market for Russian products report by daxue consulting, Market share of soybean suppliers to China in 2019

F&B goods: changing patterns in consumption

Due to the growing population, China ranks first in the world in terms of the retail food market. According to Euromonitor, food consumption in China will continue to grow and will amount to about $1.8 trillion by 2024. Since the reform and opening-up, China’s urban lifestyle has become more fast-paced. Therefore, do not have time to treat themselves with decent meals. It contributes to the growing demand for snacks and canned food.

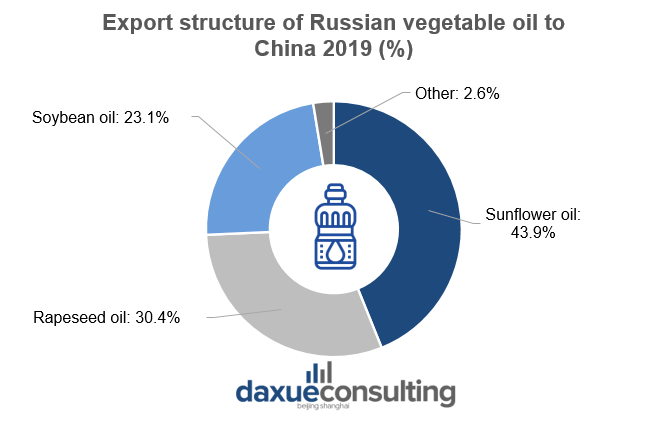

Vegetable oil exports have doubled since 2018

Export of vegetable oil takes one of the biggest shares among Russian products in China. China’s policy of reducing oilseed acreage in favor of grain crops is shrinking the domestic vegetable oil production. This gives a promising opportunity to Russia to further increase oil exports to China. Forecasts show that by 2024, the share of vegetable oils exported from Russia to China will amount to 20% of the total export of Russian oils.

Data Source: Statista, The Chinese market for Russian products report by daxue consulting, Export structure of Russian vegetable oil to China 2019

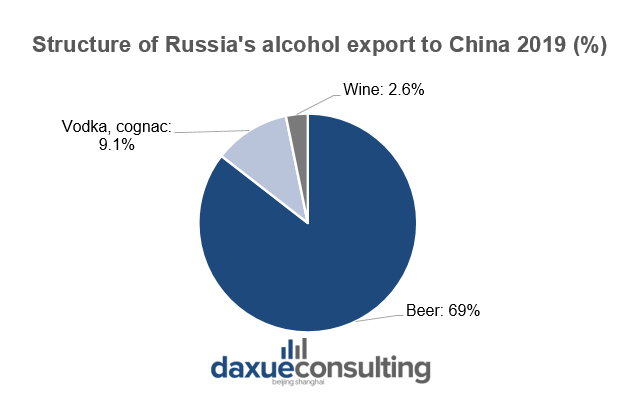

Russia is famous for vodka, but is that really the case in China?

Foreign alcohol has a big popularity in China. There are several reasons for that. First of all, Chinese people do not trust local manufacturers due to the poor quality of products. Besides, In China, it is customary to give a bottle of good wine or cognac in a beautiful package as a gift. The first-tier cities occupy the largest share of the imported alcohol market in China due to higher population and consumer income.

Beer is the leader of Russia’s alcohol export to China. Today over 50 Russian beer brands have entered the Chinese market. For example, the Russian company Baltika has been supplying beer to China for about 10 years. Its exports to China grew by 9% in 2019.

Moreover, Russia is actively exporting Beluga vodka to China, signing an exclusive distribution agreement with cognac house “Camus” in China. Since September 2013 “Camus” became an exclusive distributor of “Beluga” brand in China. Wine is also a part of Russian products in China. Chinese consumers are especially interested in the wines of the Kuban region. For example, Kuban-Wine brand exports its wine to Beijing, Heilongjiang, Jilin, Liaoning, Guangdong, Fujian, Zhejiang provinces.

Data Source: Ru-Stat, The Chinese market for Russian products report by daxue consulting, Structure of Russia’s alcohol export to China 2019

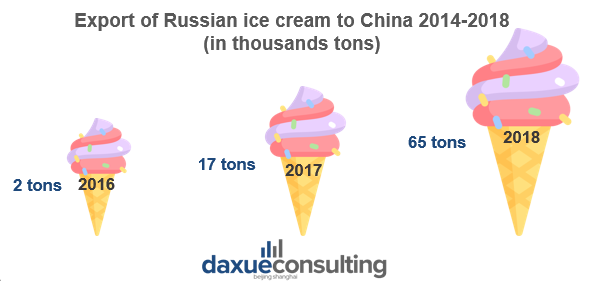

Chinese people have a taste for Russian sweets

Sweets are the most popular category among Russian products in China on Taobao and Tmall platforms, they get good reviews and comments from consumers. One of the most promising spheres is Russian ice cream. In September 2016, Vladimir Putin met with potential investors in the Far East. One of the Chinese businessmen complained that they were not allowed to import ice cream from Russia. The Russian President admitted that he was surprised. In 2016, during a bilateral meeting before the G20 summit Russian President Vladimir Putin presented a box of ice cream to General Secretary of the Communist Party of China Xi Jinping. From this year Russian ice cream appeared in the Chinese supermarkets and e-commerce platforms. In 2018 export of Russian ice cream to China almost tripled from 2017 and reached 65,000 tons.

Data Source: Vedomosti, The Chinese market for Russian products report by daxue consulting, Export of Russian ice cream to China 2014-2018

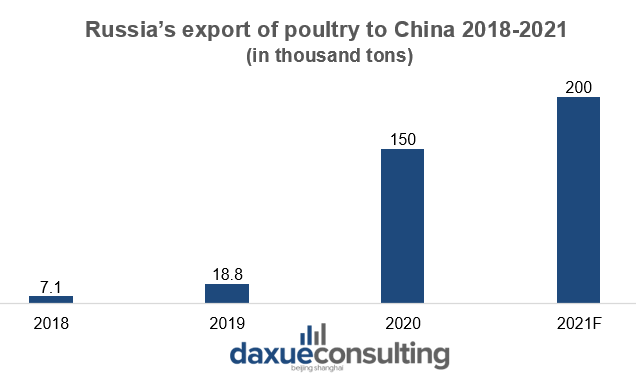

China meets Russian meat: how beef entered the Chinese market

China is the world’s largest meat consuming nation. This is a big opportunity for Russia’s meat export industry. In 2020, Russia started exporting beef to China, as two Russian companies got license by the Chinese authorities. The rapid growth in Chinese beef imports has dramatically altered global beef flows with several countries now exporting a significant share of total exports to China. However, for now, Russia occupies less than 2% of the China’s beef market. Russia can become one of the main exporters, if more companies get the license for export.

In terms of poultry, Russian farmers can supply to China since the end of 2018, as Russian companies got a license for export. At the moment, 44 Russian enterprises have a certificate for the export of poultry meat to China. Russian poultry exports to China will grow over the next four years, with a total value to reach $814m per annum by 2024. There are two reasons for that. Firstly, pork consumption dropped in 2019 as prices reached record highs and many Chinese consumers switched to chicken meat as a cheaper alternative. Secondly, Chinese consumers have placed a higher priority on health issues in recent years. Compared with most cuts of red meat, chicken has much less saturated fat and is healthier.

Data Source: Ru-Stat, The Chinese market for Russian products report by daxue consulting, Russia’s export of poultry to China 2018-2021

Frozen seafood is one of the key categories of Russian exports to China

Seafood is the leading categories among Russian products in China. About 70% of the total Russian seafood export volume goes to China. In 2019, Russia exported 1.7 million tons of fish worth US $4.5 billion, of which US $1.2 billion went to China. The most popular seafood products from Russia are king crabs, pollock, salmon and shrimp. Russia is also famous for caviar (which exclusively comes from sturgeon).

Russia’s “milky” way to the Chinese dairy market

By 2022, sales of dairy products in China will account for 20.4% of global sales. Chinese analysts call the Russian market one of the main import markets for dairy products. In November 2018, the Russian and Chinese governments agreed to export Russian dairy products to China. According to the Russian Export Center, in 2019 the most popular dairy products in China were baby milk, yoghurt and pasteurized milk for long storage.

Currently, 31 Russian companies have the right to export dairy products to China. In August 2019, a large Russian company Soyuzsnab announced the creation of its own dairy production in China. Another Russia’s large milk producer EkoNiva is building a special plant to supply milk and cheese to China in 2024. In July 2020 China expanded the list of permitted Russian entities for export of dairy products.

Cooperation is a key to success: how Russia & China promote technological innovation

According to the CEO of Epinduo platform, Anastasia Tarasevich, in China, IT projects related to entertainment are doing well today and have great prospects. For example, the Russian military-themed game War Thunder. Tencent got the rights to distribute the game in China. They adapted it for the Chinese market and distribute this game in China. Gaming technology could have a big future in China.

Skolkovo foundation and Xixian Fengdong, a Chinese techno park

Since 2016, Skolkovo foundation and Xixian Fengdong focus on scientific research, design work, and software development, as well as the production of technologically complex robot components in Russia. Through partnership with the Xixian Fengdong techno park, Russia will create a platform in China to facilitate manufacture on an industrial scale with the use of leading Russian technologies.

‘Two Countries, Four Cities’ program

This program intends to unite the potentials of 4 cities: Moscow, Yekaterinburg, Harbin and Shenzhen. As of 2019, this program included the plan for opening Russian innovation center in Shenzhen enabling resident companies to enter the China market with their own software and technologies, such as big data and automation systems for mining.

Harbin’s tech park

In October 2018, in Harbin emerged the initiative to create a Russian-Chinese tech park co-founded by GEMMA. It is an international economic cooperation organization registered in Russia, and the Harbin Ministry of Science and Technology. At present, 19 companies are residents in the center, which will expand and receive robust support from the local government.

What Chinese netizens say about Russia and Russian products

Heilongjiang, Liaoning, Beijing, Jilin, Hebei and Inner Mongolia have a big interest in Russian products, as they are northern China regions which are close to the Russian border. Regarding Russian goods, Chinese people actively discuss on social media such categories as “cosmetics”, “food”, “snacks”. For example, Zhihu users are noting the high quality of Russian food products, such as snacks and sweets.

As import from Russia to China is growing, more and more Russian food brands are entering the Chinese market. Therefore, the awareness is increasing. According to the Chinese e-commerce platforms Taobao and Tmall, such Russian products in China as seafood, sweets, and supplements are gaining more popularity. Brands that produce alcohol and food products such as flour, honey and vegetable oil are the first association with Russian brands for the Chinese consumers.

Data Source: Baidu Index, Regional distribution of ‘Russian goods’ searches on Baidu

Russian seafood gets mostly positive reviews among Chinese consumers. Users note good taste and the relatively cheap price. The negative comments refer to a special way of producing caviar in Russia, which affects the taste.

In terms of alcohol, Russian beer, as well as Russian vodka are known for good taste and quality among Zhihu users. Besides, Chinese consumers notice the non-sugary pure taste of Russian wine.

Data Source: Zhihu, The Chinese market for Russian products report by daxue consulting, Discussion on Zhihu about Russian goods

Listen to over 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast