The market for feminine hygiene in China is difficult to understand. Between the open-mindedness of younger consumers and the old beliefs of older women, preferences differ. In 2017, China’s female population was 679 million. This leaves many opportunities for feminine hygiene brands. However, the obstacles are numerous. Daxue Consulting gives an overview of the obstacles and strategic levers to activate to enter this market in China or to improve your marketing strategy in this field.

The feminine product market is evolving very fast in China, especially for pads

Feminine products refer to what women use to prevent leaking during menstruation. This includes all paper made from pulp like sanitary napkins, tampons or menstrual cups and other feminine hygiene products.

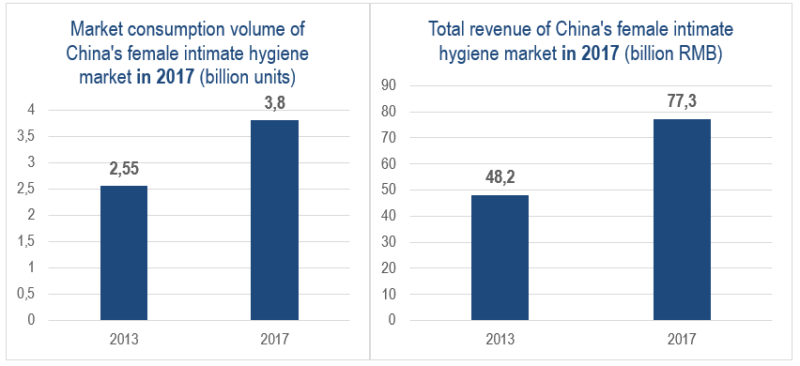

Chinese female hygiene market grows rapidly

Women are increasingly concerned about feminine hygiene issues in China

Out of a total population of 1.38 billion in China, nearly 48% are women. The country is now the largest market in Asia for hygiene products, including health protection products. But over the past decade, the Chinese population of women aged 12 to 54 has declined. However, the growing awareness of women’s hygiene practices has led to the more frequent replacement of sanitary protection products, resulting in a significant increase in volume in this category.

Indeed, the market is expected to reach 16.8 billion, growing at a CAGR close to 4.7% during 2019−2023. For now, in 2019, revenue in the Feminine Hygiene segment amounts to US$8,369m.

China’s feminine hygiene market contributed to the highest shareof the overall Asia-Pacific market value in 2017 with 77.7%. China’s spending on such products was 113.8 RMB per capita (2017).

In terms of product preferences, it is interesting to note that sanitary napkins are very widely represented in China, accounting for 88% of total sanitary protection sales in 2018.

In comparison, in the United States, about 42% of women would use tampons and 62% sanitary napkins. In Europe, the percentage of women using tampons is as high as 70%.

Feminine hygiene market in China: types of products and brands

Thus in China, we find mostly sanitary napkins on the market and some brands of tampons. Here is a list of the most important hygienic protection brands in China in 2019:

· Whisper (Procter and Gamble)

Whisper is the equivalent of Always for the Chinese market. The brand is recognized as an essential player for Chinese women and inspires confidence, mainly through the innovations they bring. Two years ago the brand launched its sanitary foam pads in China with a material that can absorb 10 times its weight in liquids and remain contoured to the human body, to eliminate leakage. Whisper saw its sales revenue reached more than 2 billion yuan ($315 million) in China in 2017.

· Hengan (Hengan Fujian Holding)

Hengan Group, as the earliest enterprise entering into the sanitary napkins market in China, was established in 1985. Its strength lies in its extensive marketing network across China because it has 300 sales offices in more than 40 different locations. The brand has 3 sanitary napkins brands: Anle, Anerle and Space 7 which is known for its pink culture.

· Kotex (Kimberly-Clark)

Kimberly-Clark came up with the brand Kotex more than 90 years ago in the United States. The products are manufactured in Japan. The brand is known for its communication on women’s empowerment and is present in 100 countries around the world. In China, the brand also sells its tampons.

· Sofy (Unicharm group)

Sofy has been present in China since 1993 and sells top-quality sanitary napkins, tampons, and pantyliners. Its communication highlights perfect hygiene, safety, good health, and worry-free chums. The name “Sofy” has the meaning of “Sophisticated” and “Soft-hearted.“ The last product they launch in China is ‘’Chao shushui anxin ku’’ that are napkins preventing night leakage in 2014.

· ABC (Kingdom Healthcare Holdings)

ABC is a high-end female personal care brand including sanitary napkins, hygiene wipes, and care solutions. Since its establishment in 1998, ABC has been adhering to the concept of “health, quality, and comfort” and has provided care and love to women in China and the rest of the world.

To buy their sanitary napkins or tampons in China, women can go to female specialty stores, supermarkets or convenience stores or purchase them online.

[button animation=”bounceInUp” animation_delay=”200″ animation_iteration=”1″ style=”1″ color=”#555555″ hover_color=”#000″ background_color=”#1e497c” icon=”icon-briefcase” icon_upload=”” icon_position=”centre” url=”https://daxueconsulting.com/contact-us-now/” target=”_blank” align=”alignnone”]Contact us for any question on the Chinese market[/button]

Very different expectations and perceptions depending on the age and region

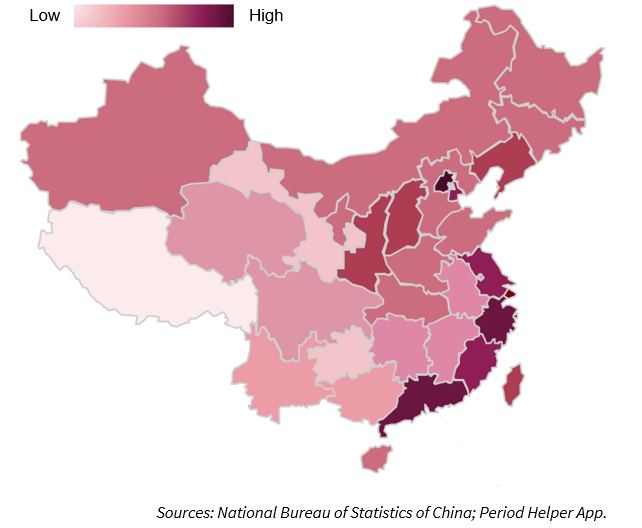

China is a vast country, and perceptions between regions can be very different.

For example, as shown in the graph below the main cities and provinces which have a high female’s attention to feminine hygiene are the ones benefiting from the highest GDP and personal income in China. These regions are Beijing (City, GDP ranked 2nd in 2017), Shanghai (City, GDP ranked 1st in 2017), Zhejiang province (Province, GDP ranked 4th in 2017), Tianjin (City, GDP ranks the 6thin 2017) and Guangdong province (Province, GDP ranked 1st in 2017).

Consumers from these regions can allocate more money to feminine products that have a direct impact on their health and help them improve their quality of life.

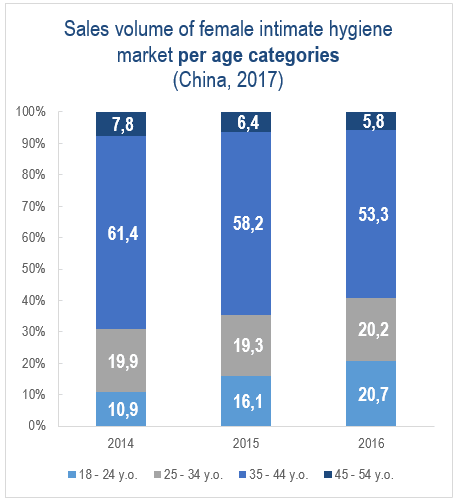

Age is also a factor to be taken into account when considering the consumption of sanitary protection in China.

Indeed, younger women have a very different vision of female hygiene. Women are active and ambitious and are now looking for new protection systems adapted to their lifestyle. Then the demand for slim, thin, and ultra-thin sanitary napkins is increasing, and the demand for tampons and menstrual cups is also expected to increase, even if the consumption remains currently very low.

Women aged 18 to 34 are therefore spending more and more money on feminine hygiene products in China, accounting for 40.9% of female buyers in 2016 compared to only 30.8% in 2014.

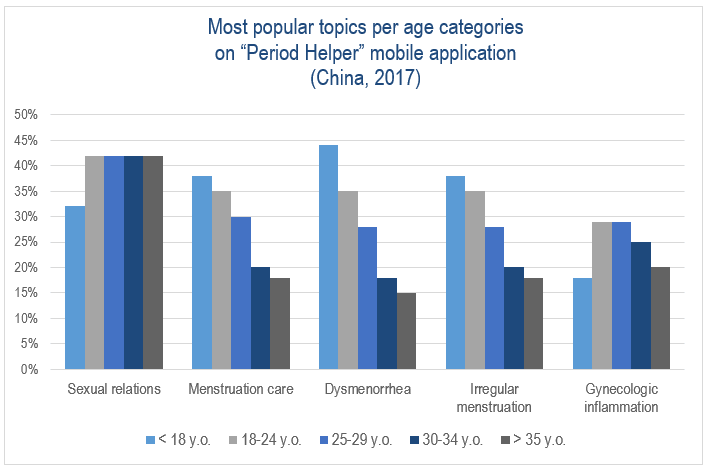

Another thing is that women of 18-24-year-old pay more attention to feminine hygiene than the other groups, as personal care during menstruation and gynecologic inflammation are 2 topics they would like to be more knowledgeable about.

They are influenced by ideas and lifestyles from the West and grow up in more open and international environments.

But a market with many obstacles for brands

Despite an increase in awareness and sales in recent years in China, sanitary protections brands face many obstacles such as scandals or cultural gaps.

A lack of sexual education but not a taboo among young people

The first thing that makes hygiene protection products challenging to promote in China is the lack of sex education and regulations imposed by the Chinese government.

For example, China’s media regulator, banned advertisements of feminine hygiene products on TV at lunchtime and during prime time shows. Which is particularly revealing is that their reasoning for this is a question of disgust, explaining that feminine hygiene was disgusting and thus would turn people away from the TV.

Thus Chinese society still portrays a disgusting and embarrassing image of menstruation and the lack of sex education reinforces this feeling.

Sexual education in China: the recent textbook scandal

Recently in China, a sex education textbook caused a wave of anger among parents. The book published by the Beijing Normal University [u1] was intended for primary and secondary school students in China. While information such as ‘how to make a baby’ or ‘how sex works’ seems normal for Western countries, in China, the book has outraged parents.

Some sentences like: “Daddy and mommy are in love with each other; daddy puts his penis into mommy’s vagina, then sperm enters mommy’s womb.” – shocked some Chinese people.

One chapter described the transformation of the body between childhood and adolescence. In another chapter, homosexuality, which is tolerated in China, is presented as a normal phenomenon by the researcher.

Some parents consider this manual to be pornography. Others say they blushed when they saw the images describing a child’s conception. But we can also read very positive reactions that show that Chinese young people have grown up differently. Young Chinese parents consider it is high time for China to get rid of taboos on sexuality.

Swimmer Fu Yuanhui remarks about her menstrual cycle

Another event that happened in 2016 in China is an excellent example of how Chinese see menstruation and the evolution of ways of thinking. In August 2016, after competing in the women’s 4x100m medley final at the Olympic Games, Chinese swimmer Fu Yuanhui (傅园慧) explained her disappointing performance (4th place) by discussing her period.

“I didn’t swim well enough this time. It’s because I’ve been having my period since yesterday, so I feel unusually tired. But that’s no reason; I didn’t swim well enough.’’

Her explanation shocked the audience, and the scandal was broadcast on all the country’s media. But on the internet, one could read very good comments, many women finding Fu Yuanhui brave and impressive because she represents a generation of modern and open-minded Chinese women.Young Chinese women are comfortable with menstruation

The interesting thing, despite all of these cases, is that the female monthly cycle is not a taboo topic in everyday Chinese conversations.

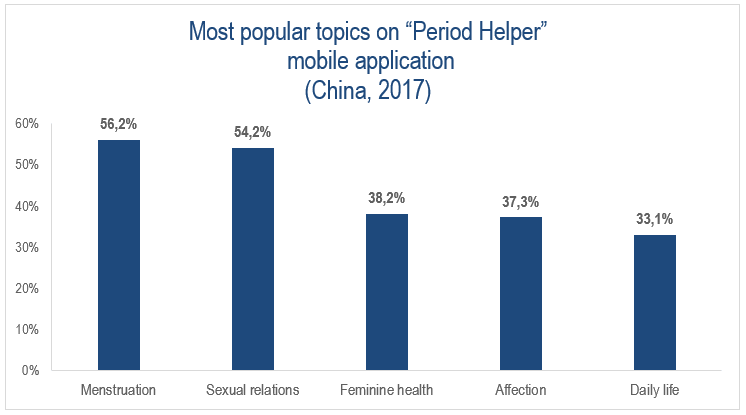

As can be seen in the graph below, women are interested in these topics and easily seek new information about sexual relations or the menstrual period.

Today in some China’s provinces it is even possible to have sick leave for menstrual pain (Ningxia, Shandong Province, Anhui, Hubei, Shanxi) or to make short after lunch naps.

Many scandals happened that increase the need for brand vigilance

Scandals that have frightened Chinese women

Two years ago, a huge scandal occurred in southern China where the police found more than 10 million fake sanitary towels produced in unsanitary facilities. It was then learned that the counterfeits had been sold for 3 years throughout the country and under famous brands such as ABC or Whisper. At that time, Chinese netizens were shocked, and tens of thousands of Sina Weibo microblog users were posting under the hashtags #Over10MillionFakeSanitaryTowels and #SanitaryNapkins.

Two years ago, reports also revealed that some napkins made in China might contain a fluorescent carcinogen agent.

These scandals and mistrust contributed positively to the situation of the international feminine hygiene brands that Chinese consumers tend to prefer thinking they are more qualitative.

Innovations brought by brands to reassure the buyers

Chinese women are therefore paying more and more attention to the quality of the products they buy.

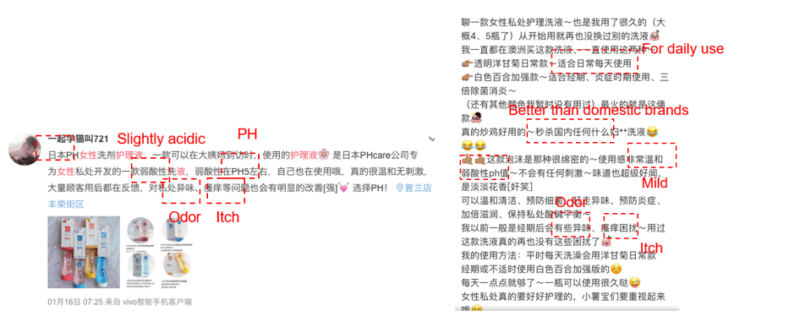

The above data shows the main comments and keywords used on Weibo Xiahongshu in February 2019 by Chinese women consumers of feminine hygiene products. By the keywords on social media, people care about the brand origin, its qualities and characteristics such as doctor’s endorsement, natural PH, odor protection, etc.

Thus, international feminine hygiene brands in China have been able to seize this opportunity and have developed more qualitative products with soft materials and organic compositions, promising safety and natural feeling.

Manufacturers now begin to introduce 100% organic cotton products to attract consumers who feel uncomfortable with synthetic fibers or who have concerns about safety. For example, in October 2017, Whisper launched pure cotton towels which contain no preservatives, softeners or fluorescent brighteners, to avoid skin irritation and safety troubles.

These organic cotton pads, whose top sheets are manufactured in Japan using organic cotton produced in the United States, are the results of considerable investments in research and development in China. According to Yang Shanshan, vice-president of female care of P&G China, “Whisper plans to increase more research and development efforts in China, to develop products at its research center in Beijing and then export abroad, using advanced big data technology in the country.”

Tampons in China, what uses and perceptions?

A growing category for feminine hygiene in China but difficult to reach because of different beliefs

As mentioned above, tampons are not common in China. Barely 2% of Chinese women would use tampons as hygienic protection: on the contrary, more than 70% of Westerners would be regular users. Although Chinese women are increasingly attracted to the Westerners’ way of life and welcome European cosmetics products with open arms, tampons are still a hard sell to a culture still bound in cultural traditions.

However, tampons in China saw the most dynamic growth in sanitary protection in 2017 in China even if it is mainly due to its small buyer base.

According to the market research firm Euromonitor International, the tampon market reached 408 million RMB in 2018 compared to just 100 million RMB in 2014. This increased by 342% from 2014 to 2018. Euromonitor International predicts that in the next five years, the size of the tampon market will grow from 598 million RMB in 2019 to 2.123 billion RMB in 2023, it means an increase of 255%.

Today, among the regular users of tampons, we mainly find young women who have lived overseas or who have strong western influence and who live in top-tier cities in China.

But then why don’t Chinese women buy tampons?

- The tampon is a foreign body

In traditional Chinese medicine, we learn that the body must be free and that the tampon can bring bacteria in addition to obstructing the free flow of blood out of the uterus and vaginal canal. In the book ”Chinese Medicine for Women: A Commonsense Approach” written by Bronwyn Whitlocke, we can read “Tampons do not allow free flow of blood. The tampon acts as a dam, absorbing some of the blood; and that is not absorbed can flow back to the uterus.’’

So some Chinese women do not see the tampon as something beneficial but as a foreign body that can hurt the body. In addition, there is a lack of knowledge around the use of tampons and women think that the object hurts or is uncomfortable.

- The cult of virginity

In China, this is called ”the Virgin complex,” and it is one reason why tampons are not successful. Indeed, for some Chinese people, being a virgin means being pure. For younger women, there has always been a fear that tampons will break the hymen.

The cult of virginity comes from ancient traditions in patriarchal family structures. Marrying a virgin woman was very important at the time and was seen as a gift. Today, in some tourist villages in Anhui province, you can still see female chastity memorial arches built by local governments between the 14th and 20th centuries to honor widows who never married again.

However, today Chinese women are less concerned about these issues of virginity. Indeed, with more than 70% of Chinese women having sex before marriage, virginity and sexual taboos seem to be disappearing. However, maternal or grandmother influences are still obstacles to the use of tampon in China.

- The cost

Finally, there is also an objective reason: tampons are about 2 to 6 times more expensive than sanitary napkins in China. On average, a tampon costs between 3 and 4 yuan while sanitary napkins cost less than 1 yuan. So the calculation is quickly done: if a woman uses 15 sanitary napkins or 15 tampons for each menstrual period, the difference in price per year is more than 500 yuan.

Major tampons brands in China

- OB Tampons (Johnson & Johnson)

O.B. tampons are the old tampon brand in China. They first appeared in 1993. Indeed, Johson and Johson was one of the first foreign pioneers to enter China in the 1980s, when it set up the joint venture Xi’an-Janssen Pharmaceutical Ltd. Their simple packaging suggests that they have a medical aspect, which appeals to Chinese customers because it inspires confidence. According to Euromonitor International, OB is the top-selling tampon brand in China with 22,5% market share.

- U by Kotex Click Tampons

Kotex launched its first tampons in China in 2015. The non-slip and small design makes them easy to use and portable. Coming in sleek and hygienic packaging, these tampons guarantee top-notch protection for regular and high levels of absorbency.

- Tampax Radiant Tampons (Procter & Gamble)

Tampax has been in China since 2010; however, it is still seen as the brand imported from the United States. These tampons come with a smooth and compact plastic applicator and rounded tip for comfortable insertion.

- Danbishuang

Danbishuang is the first brand of Chinese tampons in China. Launched 3 years ago, the brand uses Tampax’s color codes while focusing on protection and safety.

[button animation=”bounceInUp” animation_delay=”200″ animation_iteration=”1″ style=”1″ color=”#555555″ hover_color=”#000″ background_color=”#1e497c” icon=”icon-briefcase” icon_upload=”” icon_position=”centre” url=”https://daxueconsulting.com/contact-us-now/” target=”_blank” align=”alignnone”]Contact us for any question on the Chinese market[/button]

A dual communication strategy for feminine hygiene brands in China: Through information and woman empowerment

Inform to reassure: when brands become prescriptive

The best way for a brand to gain legitimacy in a market where doubt and mistrust reign is to position itself as a teacher, as an advisor. By adopting an educational approach, the brand seems expert. Many brands call on experts and doctors to carry their messages.

In China, since women are not very familiar with tampons and do not know how to use them, brands should provide useful advice and guides. More generally, in a sector as complicated and sensitive as feminine hygiene in China, it is essential for brands to reassure the public.

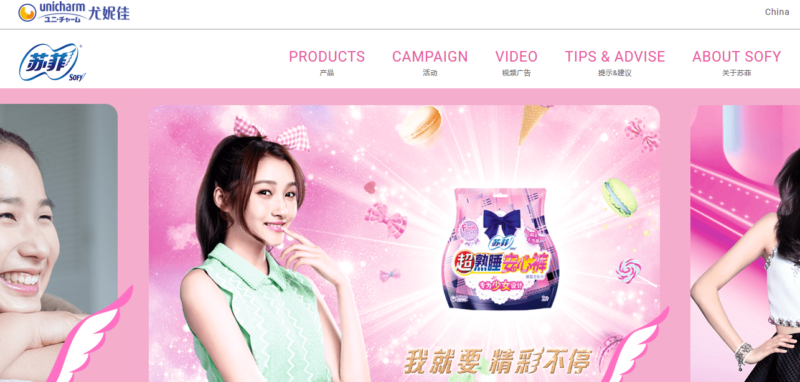

Unicharm has developed a whole digital content strategy on their Chinese site and social networks: tips, tricks, and useful tips, consumers can easily refer to this section called “Tips & Advise.”

Female empowerment in China: feminine hygienic protection brands want to become its new symbol

In recent years, Chinese women have seen their living conditions and lifestyles change: young women are now more independent, more open to the world and sometimes feminist.

It is in this niche of women’s liberation speech that feminine hygiene brands want to position themselves in a market like China.

For example, Whisper hired the famous actress Dilraba Dilmurat to carry the message of empowered women to China. The actress, beloved in China, is recognized as a model of success, having received last year the “Golden Eagle Goddess” award at China’s Golden Eagle Awards, one of the three main national award ceremonies that recognize excellence in Chinese TV.

Some brands are also positioning themselves in the women’s sports market to show that women are now able to play sports when they want and that no one can prevent them. This was Johson & Johnson’s strategic choice in 2018 by sponsoring sports halls in China, and also the choice of the brand ABC with the ad below:

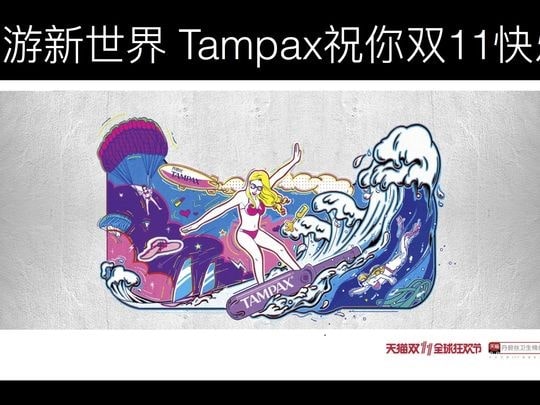

Tampax also developed a communication campaign focused on women’s empowerment during the Single’s Day in 2017, which left its mark on people’s minds. The advertisement then showed a woman in a bikini surfing on a tampon with the legend “Explore the new world. Tampax wishes you a happy 11.11”.

Thus, the market for feminine hygiene products in China is undergoing a major disruption as women emancipate themselves and change their vision of their bodies and their sexuality. It is therefore certain that the tampon will be able to make its mark on this market in the years to come. But will Chinese women be ready for other types of hygiene protection such as menstrual cups? Nothing is less certain.

Author: Steffi Noël

To learn more about the needs and preferences of the Chinese market for feminine hygiene products, subscribe to our newsletter or contact our team at dx@daxueconsulting.com.

Our team of experts offer in-depth interviews and focus groups that construct insightful profiles on consumers across the country, and provide marketing strategy recommendations to our clients based on extensive experiences in China.