South Korea is one of the most digitalized countries in the world. In addition to being home to chaebol tech companies like Samsung Electronics (삼성 전자) and LG Electronics (LG 전자), its population boasts a strong affinity for technology and the services it provides. As of 2018, South Korea ranked first worldwide in terms of smartphone ownership and internet usage. According to the Pew Research Center, over 90% of adults in South Korea reported having used the Internet or owning a phone, which is higher than in other countries such as Israel, Australia, and Sweden. The rapid growth of South Korea’s digital ecosystem is partly due to such growing reliance and use of technology, particularly among the MZ Generation.

Naver is currently the top search platform in South Korea

Naver (네이버) is the most popular search engine in South Korea, often compared to Google. It is so widely used that it has become the default search engine for many. However, its top position in the market cannot be guaranteed forever, as it faces competition from its US counterpart. According to Internet Trend, Naver owned about 58% of the market share of the search engine market in South Korea from March 1st to March 20th, followed by Google with a share of about 33%.

The top three delivery apps – Baemin, Yogiyo, and Coupang Eats – are facing hardships

In the early phase of the Covid-19 pandemic, there was a high demand for delivery food. The growing number of single-person households and the non-face-to-face communication contributed to the popularity of Baemin (배달의 민족), Yogiyo (요기요), and Coupang Eats (쿠팡 이츠). However, as of October 2022, demand for delivery food has been slowing down. One of the main reasons is the soaring and inconsistent delivery fees. According to the Big Data company TDI, the three leading apps were suffering an overall decline in monthly active users (MAU) from January to September 2022. Yogiyo’s MAU decreased from 53.9% to 39.6%, while Coupang Eats’ decreased from 64.7% to 33.2%.

Fierce competition between Melon and Google’s YouTube music

For over ten years, Melon (멜론) has been the dominated the music service market in South Korea. It was launched in 2004 by LOEN Entertainment and later acquired by Kakao in 2016. As of December 2021, its MAU share was 37.28%, followed by Genie Music (지니뮤직, 19.24%) and YouTube Music (유튜브뮤직, 19.22%).

However, by 2022, Google’s YouTube Music overtook Melon. It had already experienced rapid growth, with its MAU increasing by 97% in 2021 alone. But by October 2022, it had the largest number of users with 4.59 million people, slightly ahead of Melon with 4.54 million users. One of the largest success factors is that users access YouTube Music for free if they subscribe to YouTube Premium. Considering that the music platform industry is influenced by the “lock-in effect”, where people are unlikely to move to other platforms, YouTube’s growth has put pressure on Melon. Therefore, the ongoing question is whether YouTube Music will maintain its position after its quick takeover as both platforms compete fiercely.

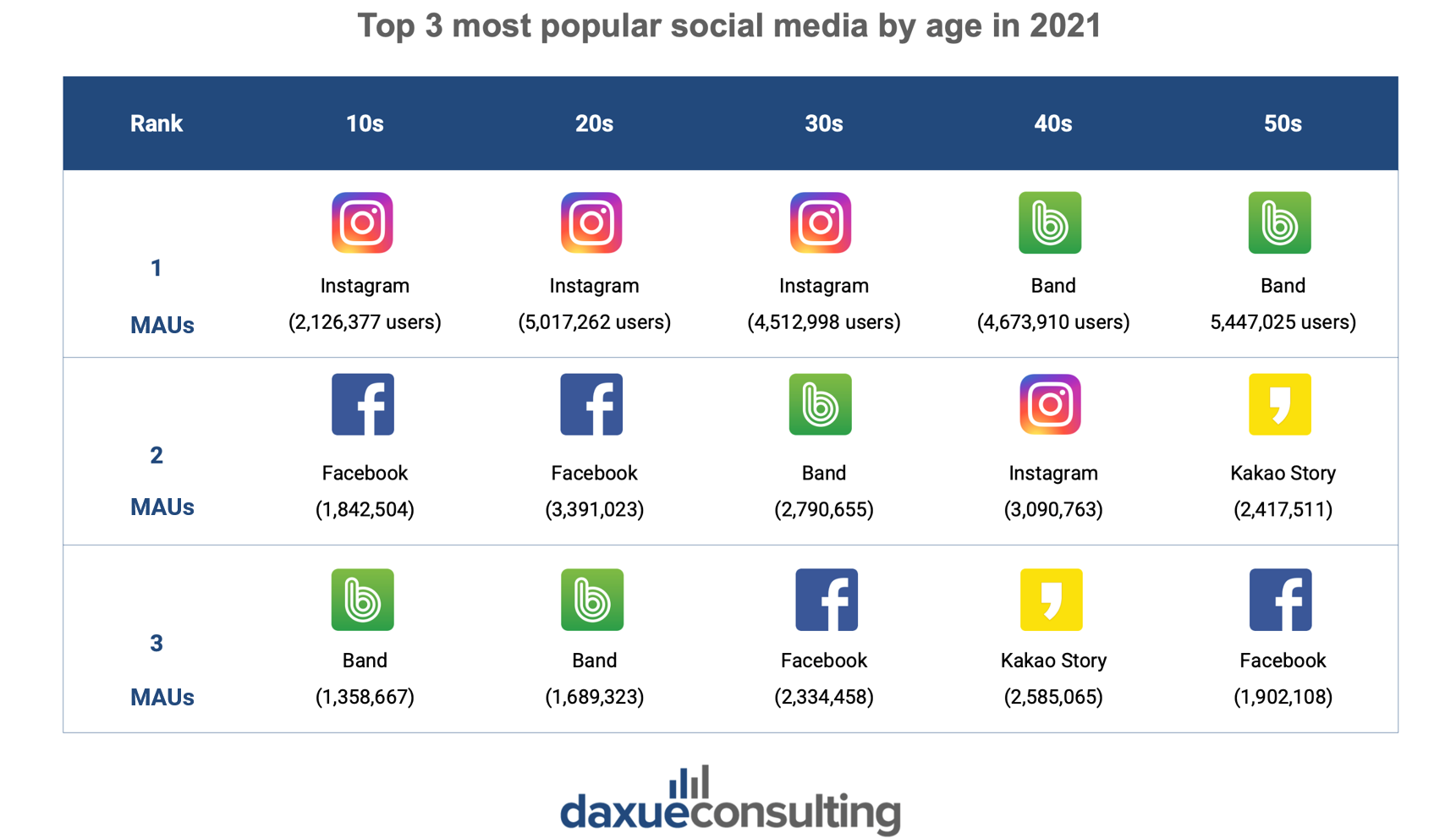

Age plays a significant role in the popularity of social media platforms

In South Korea, the most popular social media (widely known as “SNS”, or social networking service) platforms are Instagram (인사그램) and Facebook (페이스북), KakaoStory (카카오 스토리), and Naver Band (네이버 밴드). Among teens and those in their 20s and 30s, Instagram was the most used SNS in 2021, while among those in their 40s and 50s, Band was most widely used.

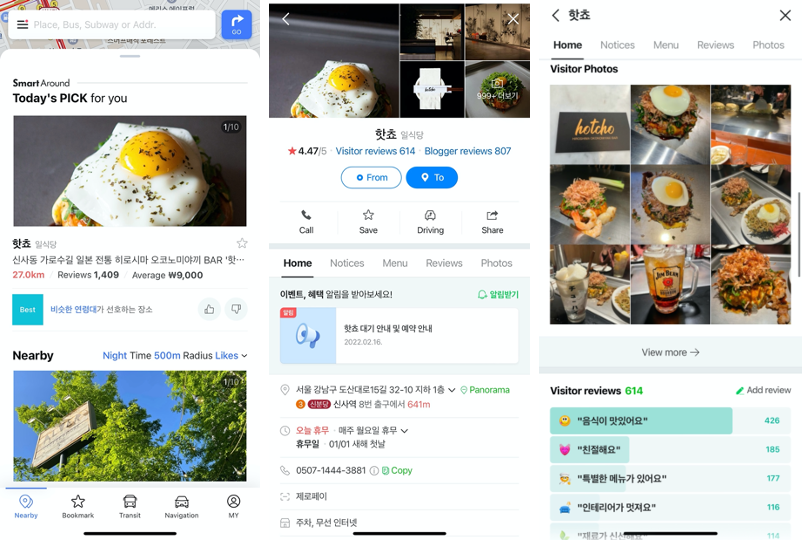

Transportation is a lot more convenient with Naver Map

In South Korea, the most popular form of transportation is walking, followed by cars, buses, and subways. Most people use Naver Map (네이버 지도), Tmap (티맵), and Google Maps (구글 지도). Naver Map in particular has a large number of users because of its simple, versatile, and convenient features. Information is updated real-time, which allows users to know when stores are closed or when accidents occur, for instance. Users can search about different places without needing to go back to Naver as the map is integrated with the search engine.

Yanolja and Good Choice are the leading domestic travel apps

One trend in South Korea’s travel industry is the increasing popularity of domestic travel, which has resulted in a surge in the use of travel platforms. Yanolja (야놀자) and Good Choice (여기어때) have emerged as the top two apps with the highest number of installations as of 2021. They provide users with booking services for accommodations, leisure activities, and entertainment activities. AirBnb (에어비앤비) ranks third but falls significantly behind them.

Coupang, the Korean Amazon, is popular across all genders and age groups

Like people in other countries, online shopping has become increasingly popular in South Korea, regardless of gender and age. Coupang (쿠팡), 11st (11번가), and Gmarket (G마켓) are the most common apps. However, in multiple categories, especially in the F&B market, Coupang is by far the most used app. Used by 26.6 million users as of March 2022, it provides fast, convenient, and reliable services through its product comparison features, quickly delivery time, and fresh food delivery.

Local vs foreign companies: Competition in South Korea’s landscape

- The South Korean population’s growing reliance on and use of digital products and services across various categories has been a major factor in the development and evolution of the country’s digital ecosystem.

- Naver, often referred to as the “Korean Google”, has long held its position as the most widely used search engine in South Korea. However, its dominance may be at risk as an increasing number of users are turning to Google for their search needs.

- South Korea’s digital landscape is predominantly made up of local players, although certain areas are encountering competition from foreign companies.

- Due to the increasing number of single-person households and the shift towards non-physical interactions, many people have turned to ordering food delivery. However, rising delivery fees have discouraged consumers from using the delivery apps.

- Melon, the once leading South Korea’s music streaming platform often referred to as the “South Korean Spotify”, is facing stiff competition from the rapidly growing foreign player, YouTube Music, who now ranks number one. This may be alarming considering that the music platform industry is largely influenced by the “lock-in effect”, where consumers don’t change easily from platform to another.

- Social networking service is one area where foreign companies dominate, and Instagram is the most widely used social media platform, particularly among the MZ generation.

- Local platforms dominate South Korea’s travel and e-commerce sectors.