The trillion-dollar fashion industry is quickly expanding, but its environmental impact is becoming a growing concern. It is estimated that the fashion segment contributes to 10% of the global carbon emissions annually, which is more than all international flights and naval transport put together. With the tendency of buying new garments and keeping up with the latest trend, greenhouse gas (GHG) emissions from the fashion business will increase by more than 50% by 2030. Thus, paying attention to luxury brands’ sustainability is becoming increasingly important as Chinese consumers’ appetite for green consumption is growing.

Understanding the meaning of sustainability

Sustainability refers to the ability to maintain a process over time, with economic, environmental, and social principles. Organizations must preserve natural resources, maintain a healthy community and workforce, and generate enough revenue to be financially viable. Governments and corporations have committed to pursuing sustainable objectives and green investments are becoming more popular.

A study in 2019 showed that sustainable companies are more appealing to investors, who are willing to pay extra for shares in companies that donate to charity. However, some corporations engage in greenwashing, claiming to be environmentally conscious for marketing purposes without truly becoming sustainable. Genuinely sustainable goods or businesses should provide evidence of their commitment to sustainability to avoid misleading investors and consumers.

The environmental footprint of the fashion industry

The fashion industry has a damaging environmental footprint, with one garbage truck’s worth of textiles burned or landfilled every second. If no efforts are being made, the sector will consume up to a quarter of the world’s carbon budget, the highest concentration of GHG that can be emitted into the atmosphere over time while controlling global warming, by 2050. The human cost is another factor to consider. Textile workers frequently receive inadequate pay and are required to put in long hours under appalling conditions.

The increasing pace of fashion is increasingly weighing down sustainability

Nowadays, more than 100 billion articles of apparel are sold annually, which is a 200% increase from the early 2000s. Online sales platforms have further fueled the buying spree, particularly because home deliveries and returns are virtually always free.

Over the past 15 years, the amount of time spent by customers wearing clothing has decreased by 40%, while garment production has doubled. As a result of this trend, ultra-fast fashion has increased, offering consumers ever-cheaper clothing with quick turnaround times.

Shein is a prime example of ultra-fast fashion. The company has surpassed other fashion apps in terms of downloads in the US for more than a year. In spring 2023, the company’s valuation surpassed that of the two market leaders, Inditex and H&M, by US$100 billion.

Taking a closer look at the ecological impact of luxury brands

In recent years, luxury fashion companies have jumped on the sustainability and CSR bandwagon. However, the guarantee of sustainable materials for the luxury sector is becoming more and more challenging due to its supply networks, which are global, intricate, and highly difficult to trace.

Kering, a French-based multinational firm that specializes in luxury goods and owns several luxury brands including Balenciaga, Bottega Veneta, Gucci, Alexander McQueen, and Yves Saint Laurent, conducted an environmental study which found the supply chain’s initial stages are responsible for 75% of its overall environmental impact.

Of the 75%, 50% came from raw material processions such as cotton growing, cattle farming, and ore/metal mining. In this stage, large-scale GHG emissions are produced. Meanwhile, the other 25% is generated from activities related to the processing of raw materials including leather, metals, and textile spinning.

The luxury industry is also known for its leather goods which utilize “exotic materials” from wild animals which has a detrimental impact on the environment and hampers the efforts to fulfill the world’s sustainable development goal number 14 (life below water) and 15 (life on land). For instance, the sale of leather goods accounted for around 42% of Hermes’s earnings in 2022.

Efforts are made by various parties to reduce the negative environmental impact of the fashion industry

In 2018, fashion stakeholders worked under the framework of UN Climate Change to determine how the larger textile, apparel, and fashion industries may advance toward a comprehensive commitment to climate change. The Fashion Industry Charter for Climate Action was then created with the goal of achieving net-zero emissions by the year 2050.

Some actions were also being made by fashion companies too. For example, GOBI, a Mongolian cashmere company that owns its own brand while also operating as a private label to almost 150 clients in more than 30 different nations. Through its Sustainable Cashmere initiative as a member of the Sustainable Fibre Alliance, GOBI works in three interconnected areas: promotion of ethical animal farming, improvement of cashmere quality, and strengthening of community management. The United Nations Development Program is supporting the Government of Mongolia, brands, local processors, and herders to reverse land degradation in the country.

The luxury brand market in China continues to grow

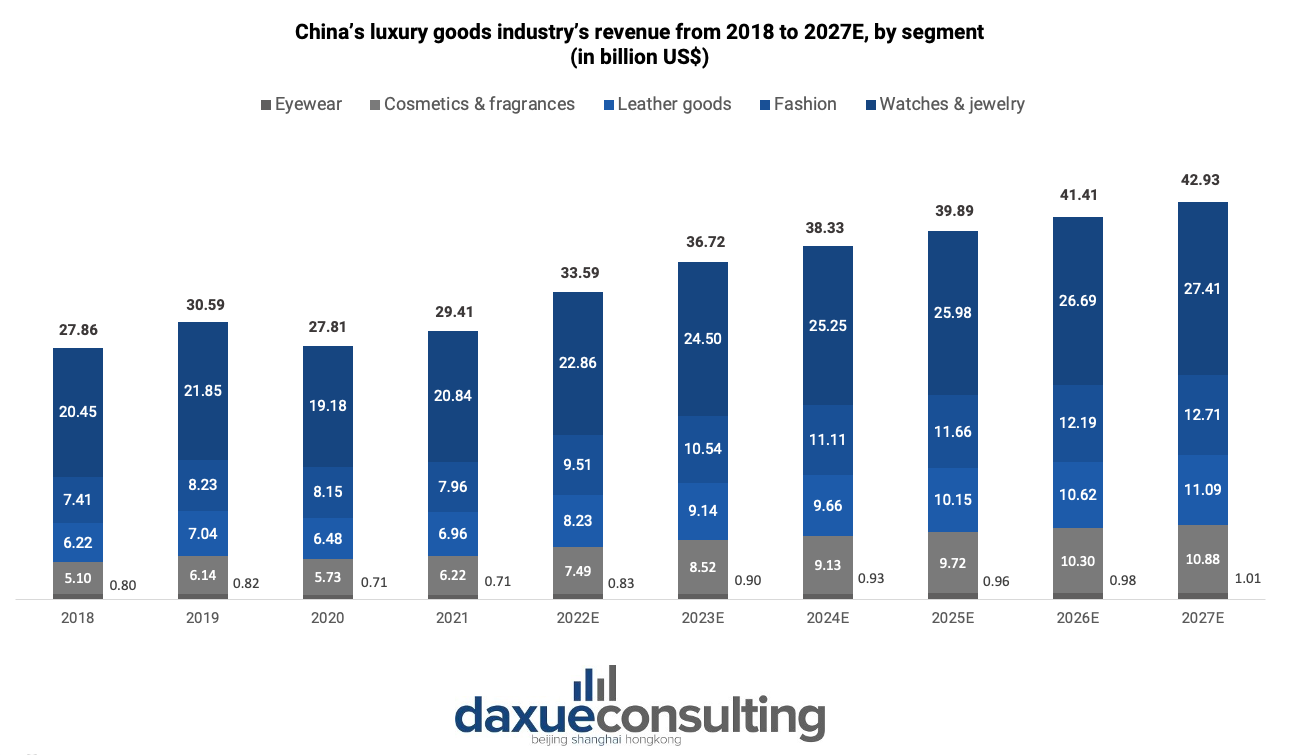

By 2030, Chinese customers are set to become a significant part of the global luxury consumer base, accounting for 40% of luxury consumers. The luxury goods market in China is expected to generate US$53.61 billion in revenue that same year, and it is predicted to grow by 4.15% annually between 2023 and 2027. Luxury Watches & Jewelry is largest segment, with a market size of US$24.50 billion in 2023., followed by luxury fashion, with an estimated market size of US$10.54 billion in 2023.

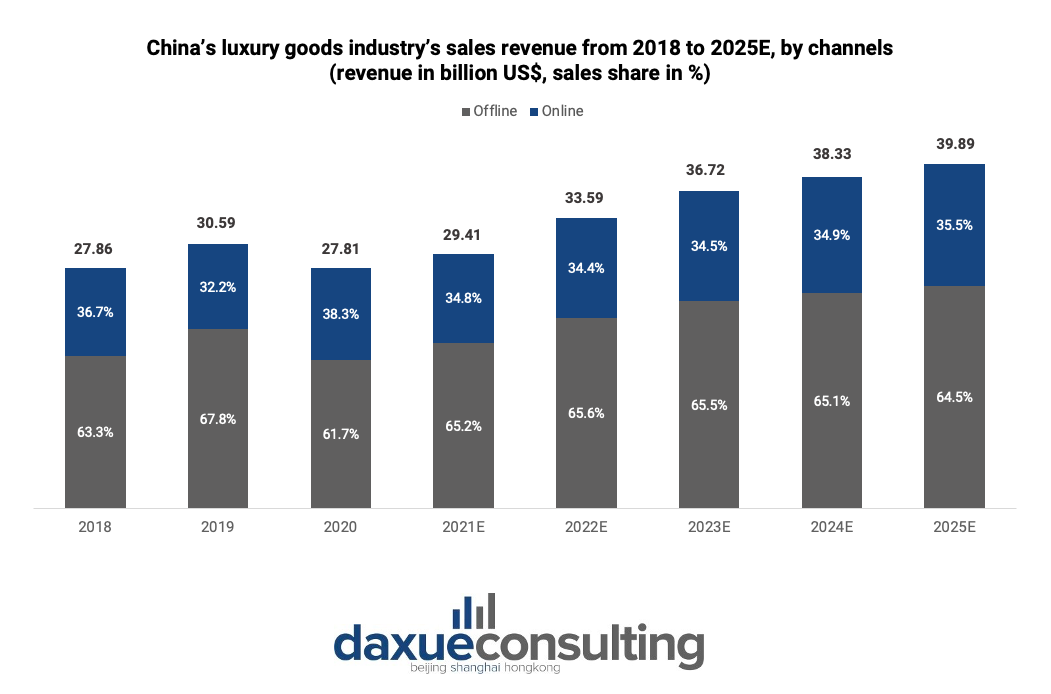

Offline channels continue to dominate the sales of luxury goods in China, with online channels accounting for only 34.5% of total revenue in 2023. Mobile devices are the primary driver of online sales, representing 92.2% of online revenue by 2025.

The rise of sustainable consumption among Chinese citizens

Nowadays, Chinese consumers are very much aware of sustainable consumption. In addition to raising awareness of sustainability issues, the COVID-19 pandemic’s aftermath and social media discussions have altered customers’ perceptions of environmental sustainability. According to data from the Vogue Business Index, sustainability has shifted from being a “nice to have” to being “important but not mandatory” for Chinese luxury shoppers of all ages in the wake of the pandemic.

Instead of displaying status symbols from well-known fashion brands, Chinese customers are increasingly looking for unique products that fit with their values and lifestyles. Therefore, with the increasing demand for sustainable luxury goods in China, this large market offers a great opportunity for both well-established and lesser-known luxury brands to tap in.

How to make sure that your brand is producing sustainably in China:

The interaction between companies and their supply chain can be grouped into three different levels:

Basic

Businesses send surveys to their suppliers to ask for their emission reports.

Transactional

Firms estimate their carbon footprint, find opportunities for advancements, and set up targets and motivations for their whole supply chain.

Collaborative

At this stage, companies are collaborating with their supply chain players to create shared sustainability goals and principles.

Completing all three levels is an ideal goal for any firm. However, it is imperative that the parties involved share the same commitment to sustainability. Thus, having the right partners is important. With a shared purpose and vision, a business can then create a strategic framework that includes a thorough and effective method for achieving sustainability goals.

Sustainability case studies: Chanel and Burberry

In 2020, Chanel launched its sustainability strategy, Chanel Mission 1.5°. The company aimed to reduce their carbon emissions by 50% and shift to 100% renewable electricity in their operations by 2025. In 2021, Chanel issued a performance update report, indicating a 33% decrease in carbon footprint but a 4% increase in emissions from their value chain. The French brand also released its first eco-responsible skincare, make-up, and fragrance line, Nº1 De Chanel. On Chinese social media, Chanel is widely popular among luxury brand followers, but sustainability efforts are not widely discussed.

Burberry has taken significant steps towards sustainability by setting the goal of becoming Climate Positive by 2040. This includes buying 100% renewable electricity, achieving zero waste to landfill, and supporting carbon removal projects. The brand has launched a ReBurberry line made of sustainable materials and refinanced a sustainability-linked loan with key ESG targets. Despite facing criticism from some Chinese consumers over their suspension of approval for cotton sourced from Xinjiang, Burberry’s ReBurberry campaign has received positive feedback on social media. The brand’s sustainability focus has positioned it as one of the top sustainable luxury brands globally, following Chanel, Hermès, and Dior.

What to know about luxury brands’ sustainability in China:

- The fashion industry’s environmental impact is becoming a growing concern, with it contributing to 10% of global carbon emissions annually, more than all international flights and naval transport put together.

- Luxury fashion companies have jumped on the sustainability bandwagon, but their supply networks are global, intricate, and difficult to trace.

- Efforts are being made to reduce the negative environmental impact of the fashion industry, such as the Fashion Industry Charter for Climate Action, which aims to achieve net-zero emissions by 2050.

- Chinese consumers’ appetite for green consumption is growing, making it increasingly important for luxury brands to pay attention to sustainability.

- Brands like Chanel and Burberry have implemented sustainability strategies and are taking steps towards reducing their carbon footprint and becoming more environmentally friendly.

Author: Regina Sukwanto