Few brands produce and market their products to customers directly. The majority of retailers, both offline and online, purchase their goods from suppliers. This is when private label products come in. A private label, also known as a private brand or private label brand, is a product that is produced and marketed under the name of a particular retailer and competes with brand-name products.

The private label industry is growing rapidly in China, offering plenty of opportunities. According to a report in 2022 that investigated the private label brands of 28 major retailers in China, each retailer owns as many as 5 private label brands on average. In addition, COVID-19 increased the promotion of private label sales.

Understanding the process of private labeling

In the private label industry, two different types of businesses are involved: private label producers, who create the product, and private label sellers, who brand and market the products to retail customers.

Product quality will be guaranteed by a trustworthy private label manufacturer, who will also keep production expenses in check. A private label seller will create a solid brand equity, market effectively, and implement a successful price strategy.

Private label is different from white label. In private labels, all aspects of the product or items are under the retailer’s control. This covers the product’s specifications, packaging, and all further information. While white labeling also involves a third-party manufacturer making a product on behalf of a retailer, the products are not custom designed for one particular seller. Therefore, a white label manufacturer typically produces a generic product in bulk and then sells it to different merchants, each of whom then markets it under their own brand name to consumers. This implies that various businesses may market the same white label goods just under various names.

Both merchants and producers benefit from the private label business model

Unique value propositions

Private labelers have the opportunity to create and market goods that are unique from store brands, well-known names, or other private label companies. They are free to pursue innovative product concepts regardless of what the rest of the competition is doing. In many instances, private label manufacturers offer exclusive rights to sell goods to a seller. Since the seller is the only source of the commodity, effective marketing will increase demand for the good, resulting in a competitive edge.

Customized quality and pricing control

Private label business owners can have a direct channel of communication with their manufacturer and can request premium quality by doing so. Retailers and manufacturers who use private labels can also have more control over their product lines’ price points and manufacturing expenses. To increase profit margins, they can test out various price formulas.

Nimble changes

An established brand may need months or even years to change its product mix, pricing, or marketing approach. Sellers under private labels are far more flexible. They can immediately respond to unfavorable comments or slow sales and make adjustments to create the best product at the lowest possible cost.

Private labeling still has certain drawbacks despite the advantages highlighted. For example, the majority of manufacturers impose minimum orders which are typically larger than is usually needed. Additionally, some retailers make the error of ordering a line of privately labeled goods without first determining whether or not their customers will be interested in the product, which results in dead inventory. Exploring consumer preferences and careful planning beforehand should help private label sellers mitigate some of the disadvantages.

The Chinese private label industry keeps on increasing despite COVID-19

Private labels’ rate of development differs widely across the globe, with European and American private labels now holding the largest market shares. China’s Private Label now accounts for less than 2% of the global share, but the enormous growth potential is clear. Just in the last two years alone, private label sales in China have increased by approximately 30%, nearly 2.5 times as much as the most popular FMCG products.

The COVID-19 outbreak had a profoundly damaging effect on both people and businesses. The domestic GDP dropped by 6.8% in the first quarter of 2020 and consumers in China shifted their behavior dramatically overnight. Although expenditure decreased, it is interesting that customer enthusiasm for private labels did not.

Chinese consumers’ awareness of private labels has significantly increased throughout the years. In 2019, only 74% of customers surveyed understand the concept of private labels compared to 92% in 2021.

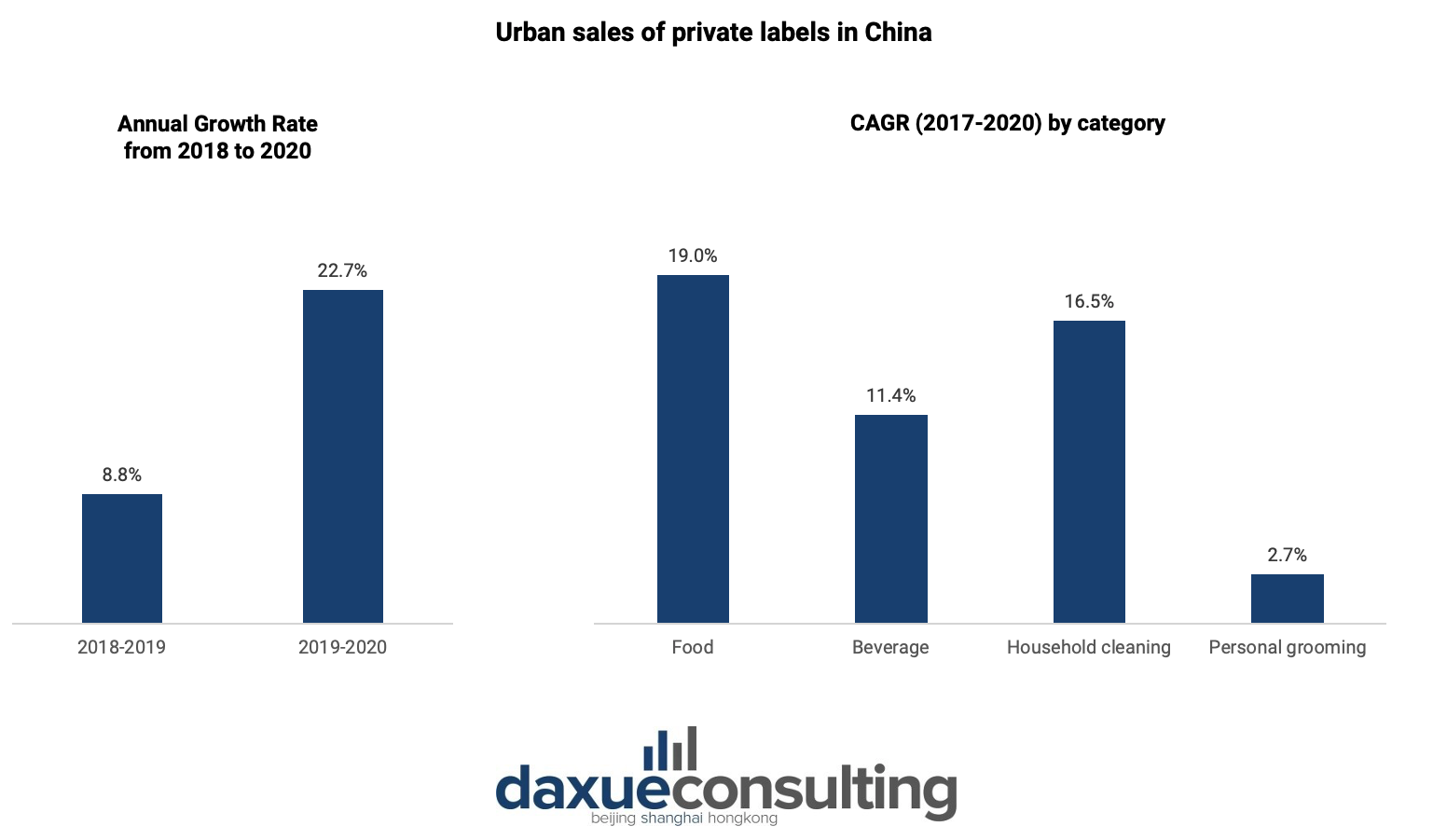

The private label market in China grew by 22.7% annually in 2020, 12 times larger than the FMCG industry. The rise in consumer households and the amount of single-package consumption are the key drivers of private brands’ significant growth in 2020. It indicates that an increasing number of consumers have started purchasing private label goods that are getting bigger and more expensive, demonstrating an increased level of customer openness to buying private labels and the value of private label products.

Within the Chinese private label industry, the food, household cleaning, and beverage categories are among the categories with the highest growth rate (CAGR 2017-2020). In 2020, the year-on-year growth of private label packaged food sales increased by 29.7% as consumers are more inclined to stockpile their supply.

Trends observed in the Chinese private label industry

High-value customer groups become the core driving force of the private label market in China

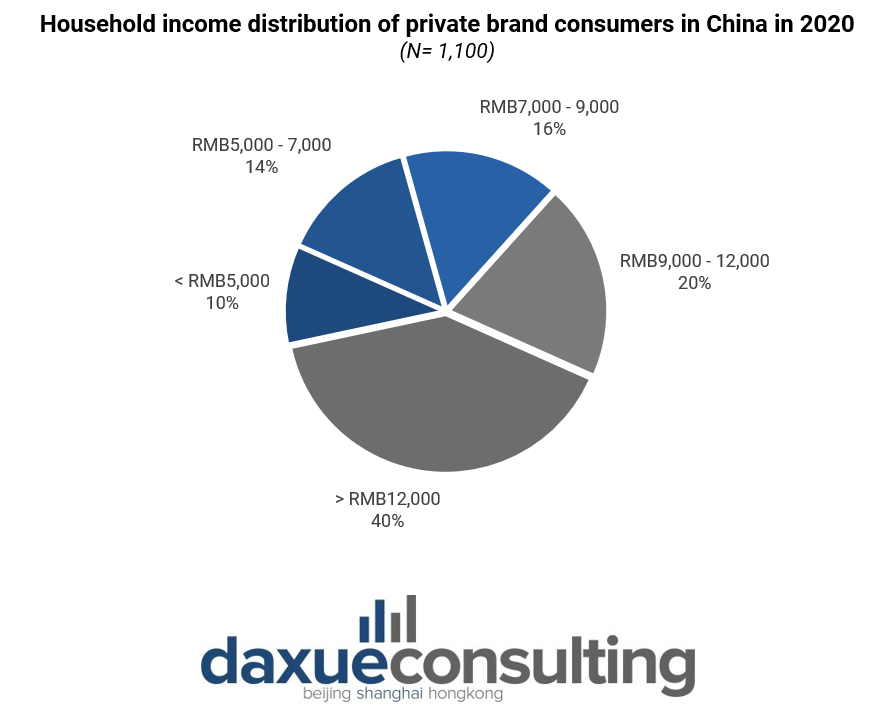

Contrary to overseas markets, middle-to-upper-class customers make up the bulk of private label product buyers in China. In 2020, 60% of households that purchase private label products have an annual income of more than RMB9,000.

The Chinese household’s spending on private label products has climbed by over 40% from RMB48 to RMB67 in 2017 and 2020, respectively. On the other hand, the consumer price index only increased by 5% during the same period.

Many retailers are launching their own brands through the private label track and focusing on attracting mid-to-high-end consumer groups

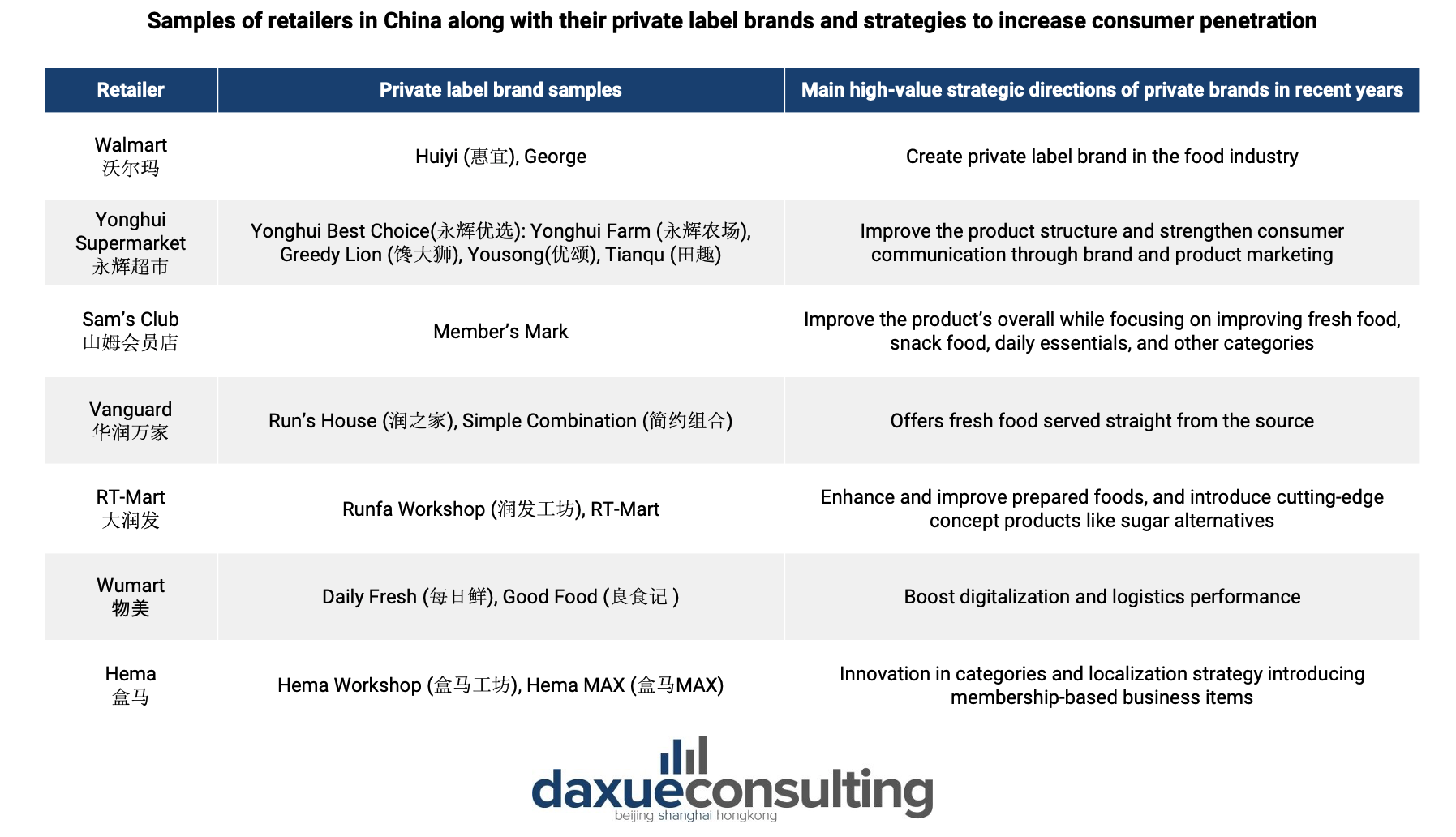

Due to the rapid growth of private brands in China and the fierce competition in the retail sector, a growing number of retailers are starting to boost their investment in private brands as part of their long-term business plans. Many retailers that entered the private label track have performed very well and increased their share by launching their own brands.

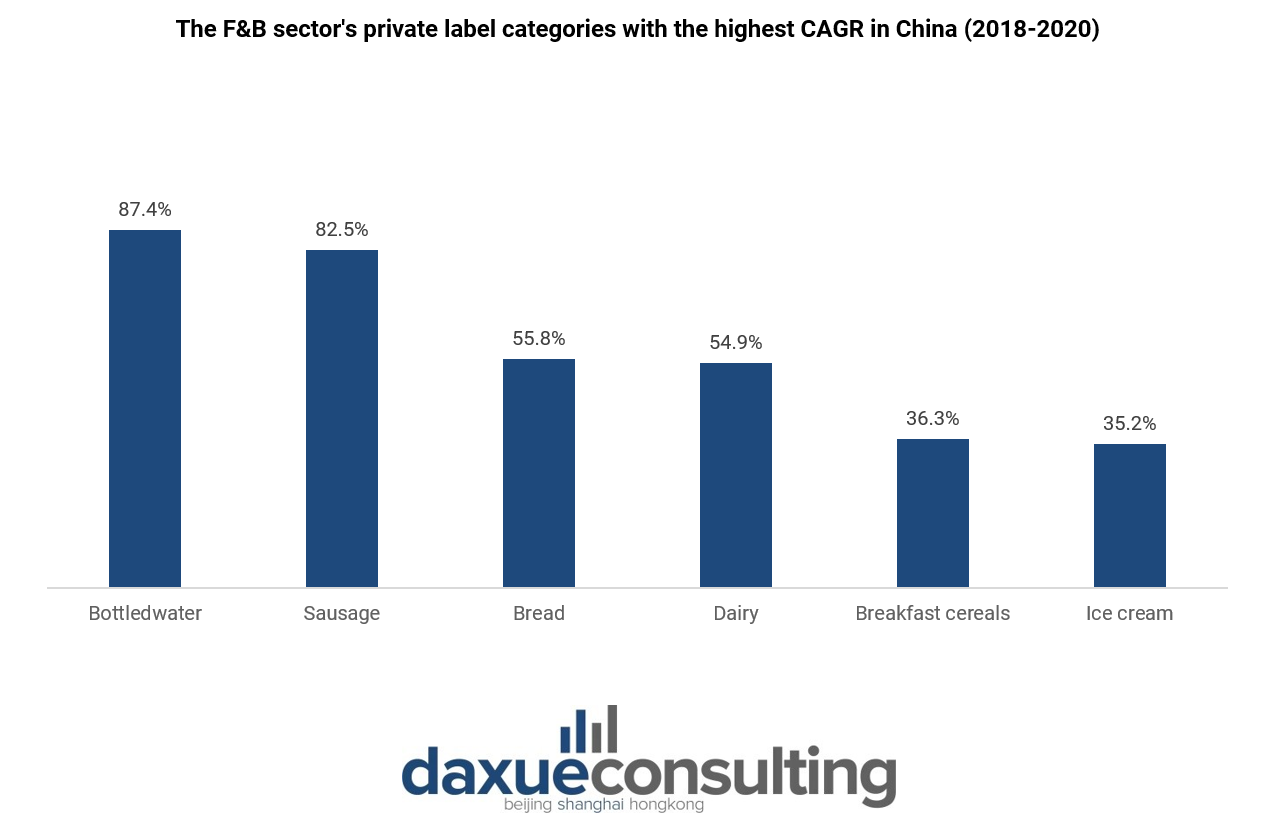

In 2021, a survey of 82 major department store operators in China revealed that about 36% of them have their own private labels. The majority of them—about two-thirds—started their own private label brands for F&B products. The F&B sector is particularly popular as private label high-growth categories mainly come from such fields. Private labels in the dairy segment have the largest market share, accounting for almost 8% of the nation’s market share in 2020. However, private labels in the bottled water sector vaunted the highest CAGR (2018-2020) with 87.4% despite only having less than 1% of the market share in 2020.

Well-known domestic retailers have begun to formulate strategies for categories, products, and marketing around their own brands targeting high-value groups. For instance, among many well-known retailers, Alibaba’s Hema launched a high-value-added private brand named “Hema Workshop” (盒马工坊) which features a series of food products called 3R (ready-to-eat, ready-to-heat, ready-to-cook). With so many retailers creating their own private label brands, differentiation is a must in order to stand out amongst the crowd.

Taking advantage of the rapidly increasing O2O commerce

One of the biggest impacts of the pandemic on the major channels of the Chinese consumer market is the acceleration of online shopping trends. Under strict lockdown regulations, Chinese citizens have adopted online shopping. This behavior carried over even after the opening of offline stores especially when it comes to grocery shopping.

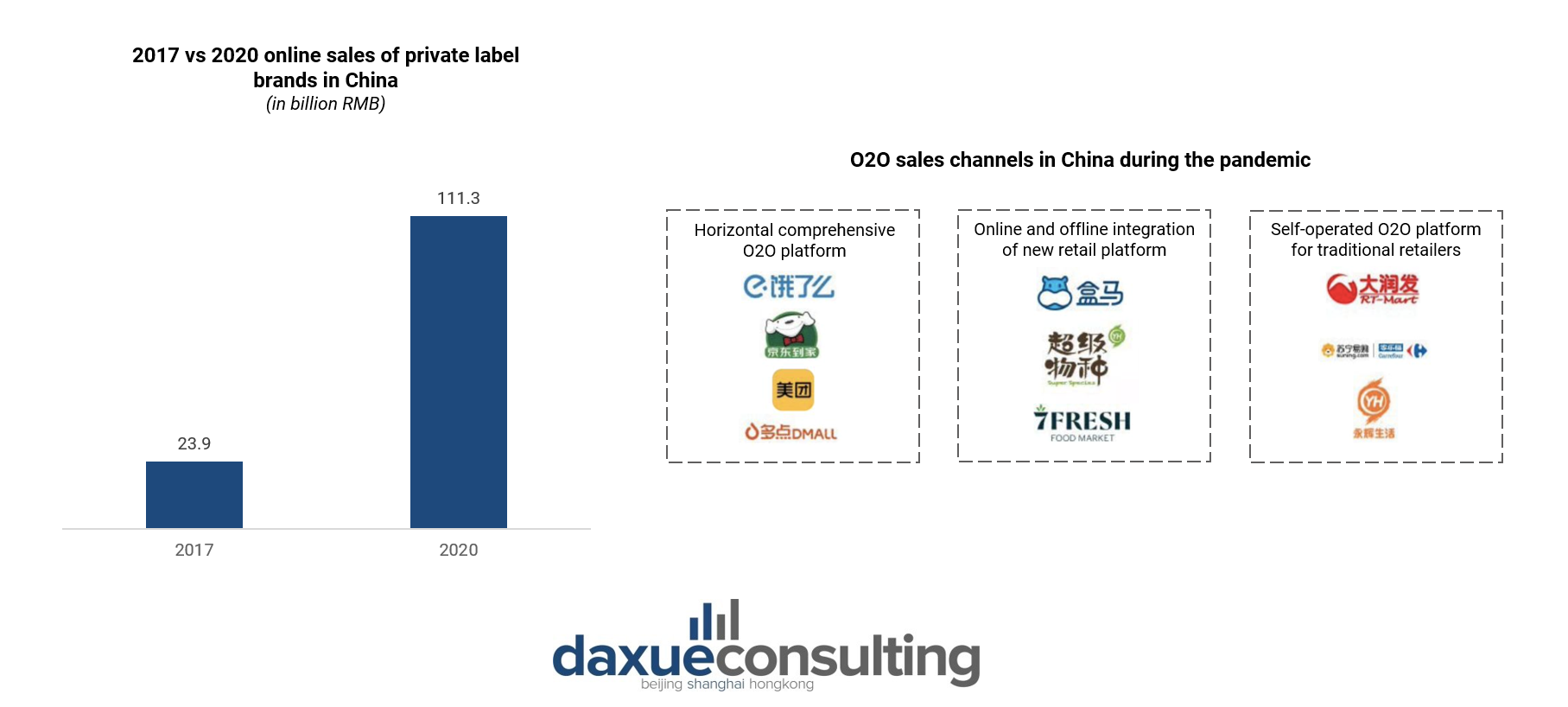

Compared to 2017, online sales of private label products in China in 2020 increased by 366.15% from RMB23.9 billion to RMB111.3 billion. Walmart, Hema, and JD.com are three companies in the market with private brands that all leverage an O2O strategy to grow their own brands. Online and offline sales are combined organically to create a complete ecosystem in new retail, thus blurring the distinction between the virtual and the physical world.

How to find a private label manufacturer in China

Choosing the best private label manufacturer is essential to building a successful private labeling firm. Finding the ideal private label manufacturer in China can be done through local trade shows or by browsing the internet.

Trade fairs provide a great opportunity to connect with various manufacturers with different specialties in person and develop a rapport with them. Visiting a region that specializes in producing your goods would also be beneficial. For instance, if a business is planning on creating a brand or products related to semiconductors and integrated circuits, going to the Guangdong region would be a great step.

There is also a ton of information available online to assist in finding a private-label manufacturer in China. However, to avoid scams, finding a partner through a reputable platform such as Alibaba is a good idea. Alibaba has the largest supplier directory and is an all-encompassing B2B platform. As nearly 8.5 million active vendors are listed there, one can nearly always locate what they need on the platform. AliExpress could also be an excellent choice for businesses that are interested in the gadgets category.

However, it also needs to aware of possible dangers. An important consideration when outsourcing to a private label manufacturer is an intellectual property right infringement. Despite allowing another business to make the product, private label brand retailers must safeguard their rights in the event of any IPR issues.

Understanding the product certification needed for the goods is also vital. There are other organizations with regulatory standards that must be followed, like the FDA and the IEC.

What to know about private labels in China:

- Adopting the private label business model allows unique value propositions, customization of product quality and price, and nimble changes for private brand retailers.

- Although GDP and spending have decreased due to the pandemic, Chinese consumers’ enthusiasm for private labels has not.

- Private labels in China are growing faster than FMCG with middle-upper households as their main consumers.

- Retailers in China are now launching their own private label brands, especially in the F&B sector. They are also taking advantage of the rapidly increasing O2O commerce by re-construction consumers’ journeys through multiple touchpoints.

Author: Regina Sukwanto