Second part of our focus on Online market in China. The first part here

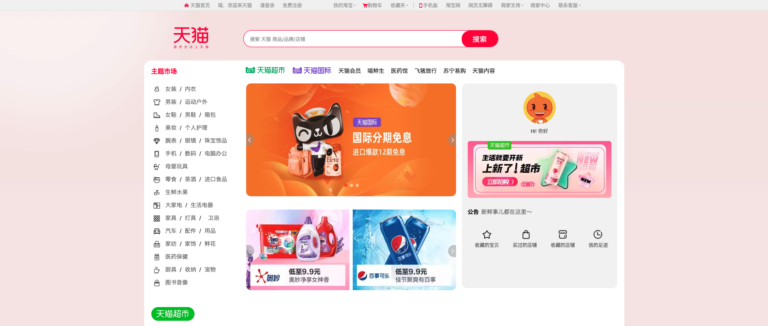

Type of Online Retailer : C2C (Taobao) & C2b (Tmall)

The most popular type of online retailers falls under the consumer to consumer (C2C) category. The C2C market model is a platform or marketplace, which connects individuals and smaller online business to other individual consumers looking to purchase products. Though the second model B2C or business to consumer is catching on, Alibaba’s Taobao, which is a C2C platform where 38% of consumers make their first online purchases.

In the smaller B2C market, 10 players claim 80% of the traffic. According to Iresearch, the B2C total market share was 36% of the total e-commerce market. The B2C market is where official registered businesses set up their own sites, or work with third party sites such as Tmall or 360buy.com and sell directly to consumers. These include both online only stores, as well as the online stores of traditional brick and mortar retailers. This segment is also growing rapidly. Tmall, Taobao’s sister company, and China’s largest B2C company quadrupled sales over the last year. B2C platforms provide an alternative for customers worried about the authenticity and quality of a C2C product. Tmall controls 51% of this market. JD.com, its next competitor controlled 17% of the B2C market, and maintained over a 45% share amongst its fellow independent B2C companies. The B2C is an intensively competitive market, beyond these two companies, there is a group of about 8 second tier companies including Amazon China, which together account for 21% of the market.

Though pure-play online retailers have taken the majority of the market share this far, there is strong potential for retailers with both a physical and online presence. According to Bain, when given the choice, Chinese shoppers preferred the option of purchasing from physical retailers online sites versus exclusive online sites like Jindong. This is largely due to the fear that the goods they are purchasing may be of poor quality or counterfeit.

The Singles Day, a symbol of growth of the online market in China

Singles Day has become akin to Cyber Monday in the U.S.A. Online retailers typically offer steep discounts and other promotions to lure customers to their sites. According to the Financial Times, sales on Alibaba’s websites totaled $5.7 Billion; it almost doubled its sales from the previous year’s Singles Day. Moreover, visits to Taobao via mobile devices totaled over 120 million views according to IResearch Consulting. JD.com received 6.8 million orders, of which 15% came from mobile.

Online Payments are the next stake of online market

Online and mobile payments are proliferating in number and in their integration with online shopping. Tencent has updated its popular WeChat mobile app to include a mobile payment feature. It is also integrated to its online B2C store 51buy.com. This allows the company to use its over 270 million strong base to support its payment network. According to Bloomberg, Alibaba meanwhile owns the popular Alipay website which has over 800 million registered users. By comparison, the Agricultural Bank of China, China’s largest bank by number of customers has just over 400 million registered customers.

Increasing competition between companies for new services, as well as price wars has significantly impacted both revenue and profit margins. This has made it very difficult for independent companies, without the support of a larger conglomerate to support itself. While many Chinese Ecommerce sites have large sales volumes, many have very low margins. Alibaba for example makes the majority of its profit by selling advertisements on its shopping portals Taobao, rather than realizing profits from the actual sale of the items themselves. Tencent on the other hand makes about half of its revenue from online gaming. Both Alibaba and Tencent are increasingly squaring off against each other, with Tencent’s Wechat including an online payment feature directly challenging Alibaba’s Alipay, and Alibaba blocking Taobao sellers from using WeChat and introducing its own chatting service.

It is expected that, as the market is growing, these giants will develop more efficient supply chain management, and other efficiency gains which will increase profit margins. In the short to medium term given the current number of competitors and the highly competitive environment for increased services, quality, convenience, and price competition, margins will continue to be very slim.

China’s E-commerce market is very strong, and it is still developing. We can expect total sales to continue to expand at a very high rate. Key growth drivers include continued economic expansion and consumption, as well as internet and mobile penetration (which bring new users). As the market continues to develop, individuals will continue to increase the amount they spend online and the diversity of items and services they purchase. Consumer expectation will also change. Consumers will slowly move from only cost consideration, to user experience, quality, convenience, and other factors which influence buying. The B2C marketplace is one of the fastest growing segments. There will be always more companies which will attempt to take advantage of this space. Profits for independent retailers will be difficult in the near term; however there is significant growth potential.

To learn more about online market in China : online market research in China

https://www.academypublisher.com/proc/wisa09/papers/wisa09p202.pdf