Temu is a Chinese online shopping platform owned by PDD Holdings, the multinational conglomerate that owns discount shopping app Pinduoduo. Known for its bargain prices, this international version of Pinduoduo was launched in the United States in September 2022. It soon became available in some European countries, including the United Kingdom, Italy, and Germany, in 2023. Since then, Temu has expanded rapidly worldwide. In 2023 alone, it boasted more than 337 million downloads, a figure 80% greater than what was achieved by Amazon. In 2024, Temu repeated this benchmark downloads figure with little more than half of the time.

Download our US consumer segmentation report

Low-priced products contributed to the exponential growth of Temu

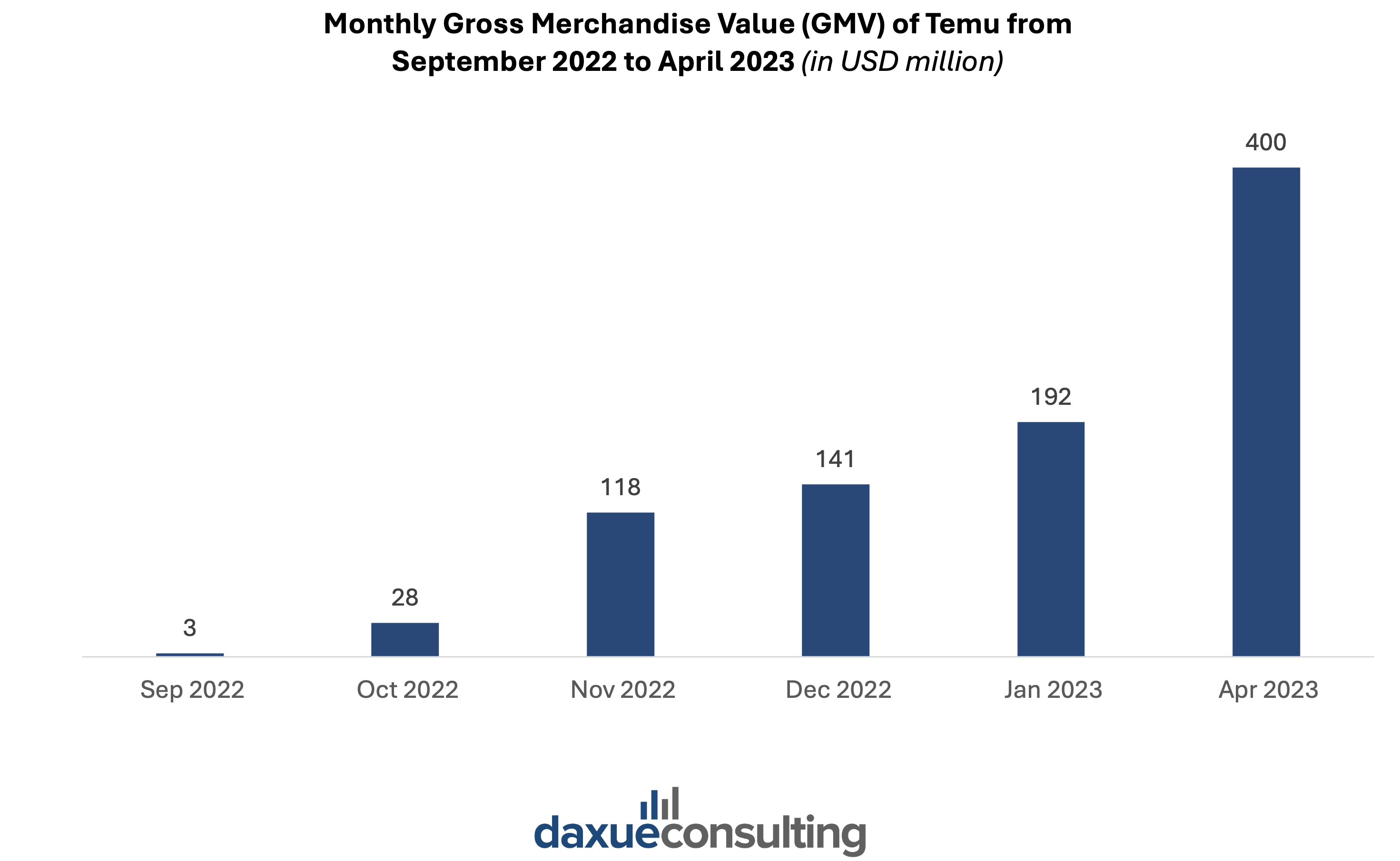

Temu’s worldwide popularity escalated quickly: within just 10 months since its launch in June 2023, the company reached a whopping USD 1 billion in monthly Gross Merchandise Volume (GMV).

Temu’s extremely low-priced products are one of the main reasons for such rapid success. Its tagline “shop like a billionaire” reflects the company’s focus on offering a wide range of products at a low price, allowing consumers to feel like a rich person. The platform encourages netizens to make impulsive purchases of products on sale. However, this is not because they need them but because they are cheap. To maintain low-priced items, the app received substantial initial marketing support from its parent company, Pinduoduo, who is absorbing the losses to facilitate its growth.

Even though Temu falls behind Amazon, it is not being overlooked

The surging figures have revealed that Chinese e-commerce platforms, such as Temu and Shein are challenging American giant Amazon on its own soil: the US market. Admittedly, there are many noticeable differences among the three e-commerce platforms, especially concerning shopping experience, pricing, and shipping. For example, Amazon excels in fast shipments and customer service. Its consumers can also choose among a wider variety of products, which are of better quality. However, having only Chinese suppliers, Temu’s products are remarkably cheaper.

Amidst the rise of its Chinese competitors, Amazon had been facing less daily active users. While in 2023 these losses were still too little to worry, the Seattle-based company, which still had more than twice the users of the Chinese app, seems to have felt the ramped-up stress. In November 2024, Amazon launched Haul. This low-cost online store mirrors Temu’s business model, focusing on unbranded, low-priced items shipped directly from China to the U.S. Consumers can get ultra-low prices at USD 20 or less.

This strategic shift aims to combat Temu’s rapid rise in the discount e-commerce segment and capture price-sensitive customers. The exact outcome of the intensified competitive target is yet to be observed.

Temu’s biggest competitor is another Chinese platform: AliExpress

As the e-commerce giant Temu continues its rapid global expansion, it poses a growing threat to a formidable competitor: AliExpress. Founded by Alibaba in 2010 as a B2B platform, AliExpress has evolved to facilitate not only business-to-business but also consumer-to-consumer transactions.

Both platforms are known for competitive pricing. Yet, in contrast to AliExpress, which charges a commission ranging from 5% to 8% on each sale, Temu operates commission-free, allowing businesses and merchants to offer products at even more competitive prices than their counterparts.

Moreover, Temu often provides free delivery options and boasts faster shipping on average, further enhancing its appeal to customers seeking cost-effective and efficient shopping experiences.

There was initially a significant disparity in user volume between Temu, a relatively newer app, and the more established AliExpress. However, with the latter registering a total number of 800 million visits in August 2023, far exceeding the 267 million visits achieved by Temu during the same period, the gap has been closing. Since February 2024, Temu’s monthly visits have surged dramatically, bringing the two platforms closer in terms of user engagement.

Aggressive advertising and “all-inclusive” marketing strategy are keys to Temu’s success

One of the key factors that contributed to Temu’s rapid increase in popularity is its effective marketing strategy. The platform’s approach involved running an extensive advertising campaign on platforms, such as Facebook and Instagram. In 2023 alone, Temu placed at least 26,000 ads on Meta’s sites, having contributed around USD 2 billion to the group’s revenue, a figure representing a stark 10% of the internet giant’s revenue. Meanwhile, in 2023, Temu also placed around 1.4 million global ads on Google.

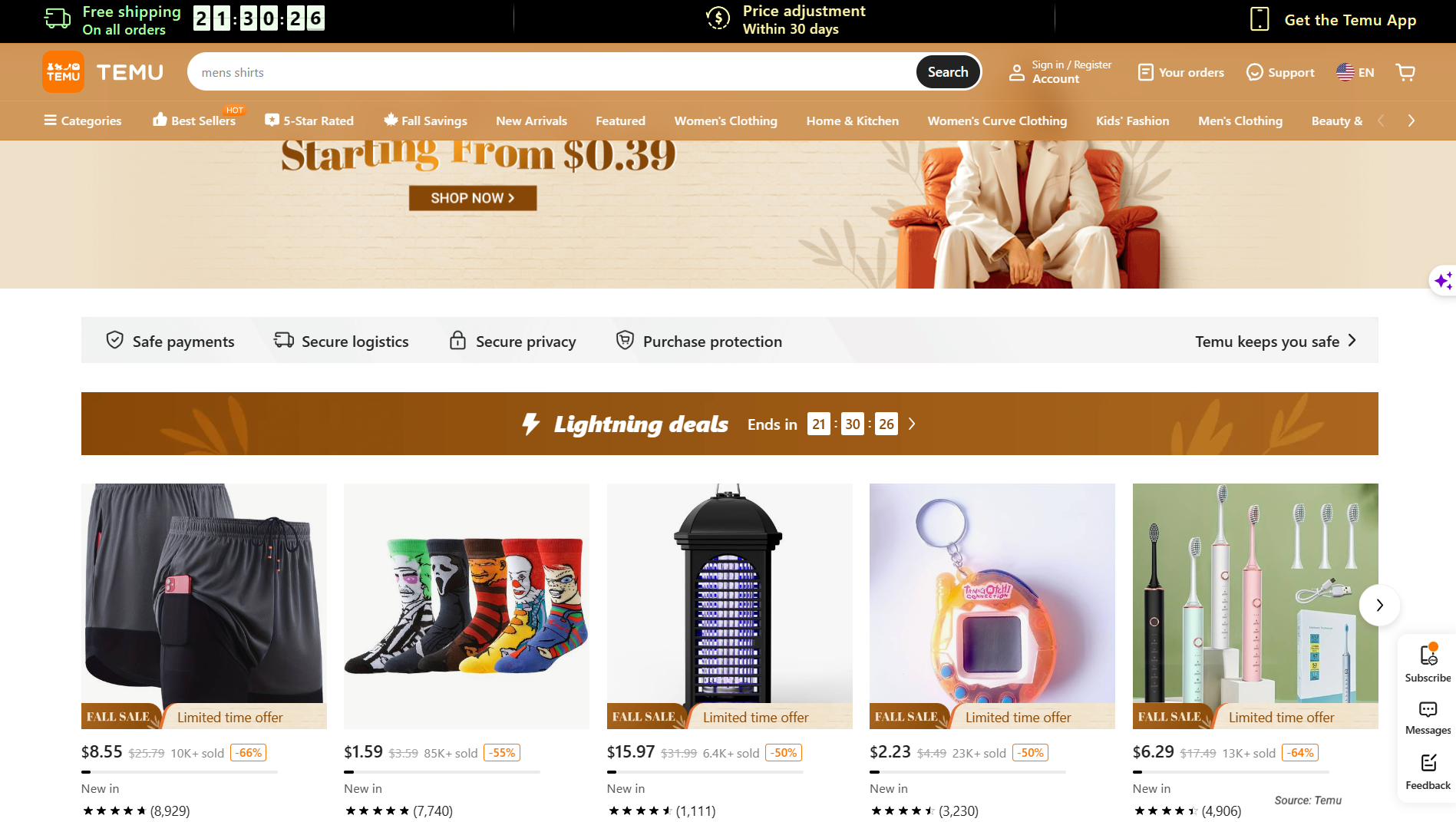

To engage more people to buy products, the platform also promotes limited-time offers every day which are set to disappear shortly after their launch. The goal is to encourage customers to acquire them while they are still available. In 2023, the company reportedly spent a daunting USD 3 billion on social advertising, while a year later in 2024 the projected figure jumped much further to USD 4 billion in the North American market alone. So, it is not a surprise that netizens and consumers have noticed a rapid increase of the platform’s promotions everywhere on the internet.

Source: Temu.com, Limited time offers on the official website of the platform

Temu: the app loved by Gen Z and millennials

Young people, especially Gen Z and millennials are the biggest shoppers on Temu. In 2024, Temu was the most downloaded app by Gen Z in the United States in the first 10 months in 2024. This high level of internet and online shopping penetration created a significant opportunity for the company to deepen its engagement with the North American market. As of March 2024, the average time spent on Temu’s app was 25 minutes per day. Both individual consumers and businesses can shop on the app because it has successfully built a robust B2B supply chain network, making it easier to sell products and manage their shipments.

Temu’s worldwide collaborations: from the Superbowl spot to the “influencer program”

In February 2023, Temu achieved widespread recognition among U.S. consumers, largely thanks to its pivotal collaboration with the NFL. This game-changing partnership featured a high-impact 30-second video titled “Shop Like a Billionaire,” which aired during both the first and third quarters of the Super Bowl finale. This was an extremely bold move for such a “young platform”, especially because a Superbowl ad can cost millions of USD. However, the tactic was completely worth the risk: in the next few days, the platform registered a +43% in downloads and a +23% of daily active users in the same evening of the Superbowl match.

Since August 2023, the Chinese e-commerce platform has launched an “influencer program” to encourage people to promote its products. The app rewards all the influencers who decide to actively support Temu by making unboxing of shipped items or by simply endorsing it. Influencers can earn up to USD 1000 worth of free products and USD 500 in influencer cash bimonthly, as well as up to USD 100,000 in affiliate cash each month. As of September 2023, more than 10 thousand influencers have already signed this collaboration. The effects of this initiative are particularly visible on TikTok, where the hashtag #TEMU has more than 4.6 billion views as of September 2023.

Not all that glitters is gold: customers’ negative feedback

Though Temu offers a valid alternative to Amazon and Shein, it does have its share of imperfections. Some consumers have raised concerns and expressed their complaints about various aspects of the platform, including issues related to shipments. In particular, users in the United Kingdom have been complaining about the extremely long waiting time to get items delivered, which can last up to 20 days, while competitors like Amazon can send the order three or four days later with the standard free delivery.

Other complaints concern products themselves: consumers have often pointed out that the quality of the items sold is extremely low and the products have a poor manufacture. The third and last complaint about it regards its aggressive advertising strategy. Many social media users have voiced negative sentiments regarding Temu’s promotions, as they tend to inundate various online platforms. Additionally, instances have been reported where the advertised product doesn’t align with the actual item, turning this advertising approach into a double-edged sword.

Looking into a rocky future, with Trump’s proposal of tariffs on Chinese imports

As 2024 concludes with Trump’s victory in the US presidential election, the future outlook appears not particularly rosy for Temu. Trump’s proposal of sweeping tariffs—ranging from a 10% to 20% increase on all imports and up to 60% to 100% on goods from China—poses a significant challenge to cross-border e-commerce platforms like Temu.

Temu’s key competitive advantage lies in its ability to offer low prices, made possible by sourcing Chinese manufacturers able to squeeze their costs down. However, with higher tariffs on the horizon, Temu faces a difficult trade-off: either raise prices and risk losing its cost-competitive edge or attempt to further reduce payments to its suppliers in China, many of whom are already publicly voicing dissatisfactions with the platform’s aggressive pricing and tight margins.

While major U.S. competitors like Amazon and Walmart would also feel the impact of these tariffs, Temu’s far greater reliance on Chinese suppliers and the existing unrests among its downstream partners place it in a particularly precarious position.

Temu grew very rapidly but faces pressure from competition and regulatory risks

- Temu’s low prices are tempting more and more consumer to “shop like a billionaire”.

- Despite Temu’s popularity increase in so little amount of time, its numbers are still not enough to worry Amazon and other Chinese e-commerce giants like AliExpress. However, it’s not to be overlooked. In November 2024, Amazon launched Haul, a low-cost store mirroring Temu’s business model.

- Young people, particularly Gen Z, represents the biggest consumer pools of the app.

- Social media advertising is a powerful feature of Temu. In 2023, the platform is expected to invest more than USD 1.4 billion in social media ads, while in 2024 this number will be almost tripled.

- Customers have noticed some problems related to the platform, from the poor quality of the products to the extremely slow customer service. Aggressive advertising has also become an issue.

- Trump’s proposal to implement tariffs on all imports and up to 60% to 100% on goods from China poses a significant challenge to cross-border Chinese e-commerce platforms like Temu.