Servicing the largest vehicle market in the world

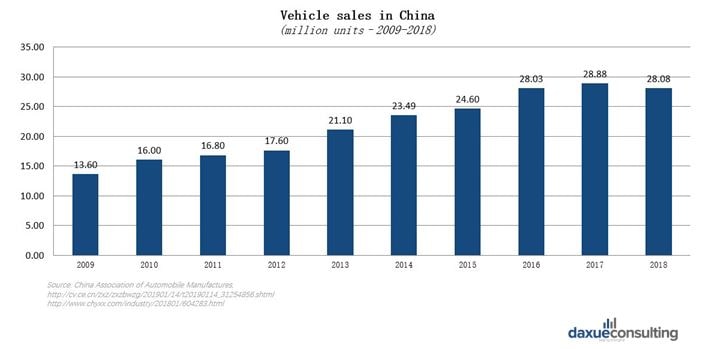

For over a decade, China has been the largest vehicle market in the world. Although 2018 marks the first year of declining vehicle sales (not including second-hand vehicles), China is still the largest vehicle market in the world. The high sales in the vehicle market also boost the development of the car insurance and the extended warranty market in China.

The growing second-hand car market in China

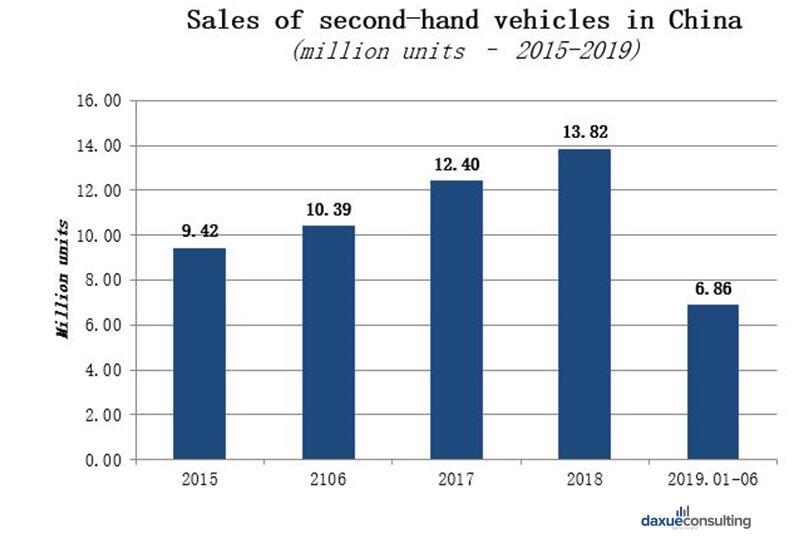

Second-hand car sales are a large part of the future auto insurance market. The second-hand car market in China shows the significant growth. In 2018, the sales of second-hand cars in China grew by 10.3%, despite the new car sales decreasing.

[Data source: China Association of Automobile Manufacturers ‘New vehicle sales in China’]

[Daxue consulting ‘Graph of second-hand vehicle sales in China’]

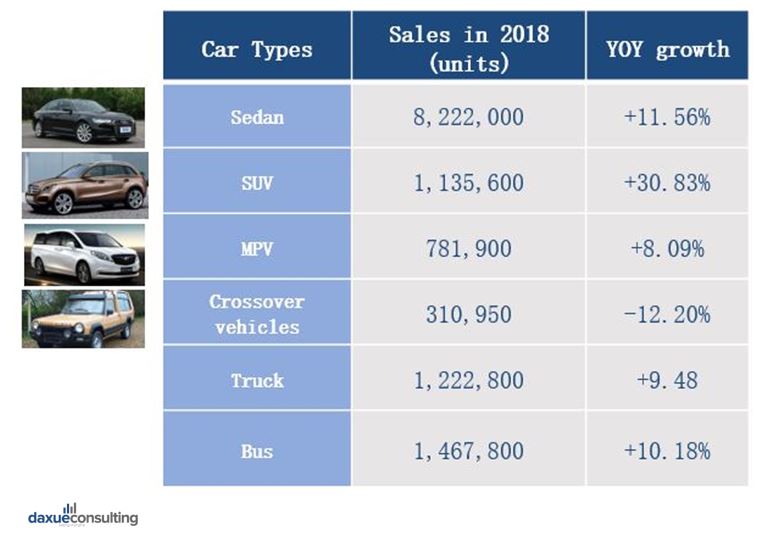

2018 sedan sales in China were 8,222,000 units, and YOY growth of +11.56%. MPV (multi-purpose vehicle) had 781,900 sales and YOY growth of +8.09%. Crossover vehicles had recorded sales of 310,950 units of vehicles and YOY growth of -12.20%

[Source: Daxue consulting, ‘Second-hand car sales in China’]

Second-hand vehicle purchasing channels

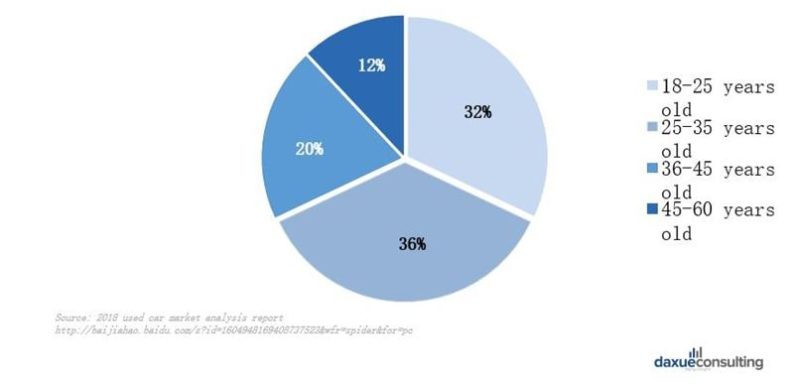

The main purchase channels of second-hand vehicles include offline and online. Offline channels which still dominate the second-hand vehicle market in China; however, online platforms have gradually been accepted by consumers. 4s stores only have around 12% market share, since their relatively high price and they cannot meet the personalized requirements of customers. Also, 18-35 years olds are the main consumers of online second-hand car platforms (B2B, B2C, and C2C)

[Data source: 2018 used car market analysis report, baijiahao ‘Second-hand car purchase by age’]

China’s license plate policy

The license plate policy in China was implied by both vehicle owners and Second-hand vehicle buyers. According to the Regulations on the Registration of Motor Vehicles (机动车登记规定) in China, all vehicle license plates (except truck and small van) should follow vehicle owners and license plates are not allowed to sell to other people. However, license plates can be transferred to car owners’ immediate family members After car owners sell their cars, their license plates will be recycled by local government or original car owners apply to remain license plates for a while, depending on local province laws.

On the other hand, for second-hand vehicle buyers, they must apply for new license plates after they purchased second-hand vehicles. If second-hand vehicle buyers purchased second-hand cars in different cities, they will have temporary license plates (usually allow to drive in 60 days) after purchasing and they need to apply official ones after they return their cities

Policies regarding car warranty in China

A car warranty offsets the cost of repairing or replacing certain parts of vehicles. It comes in handy if consumers are not prepared to pay the costs of vehicle repairs. In China, vehicle manufacturers/brands provide warranty services at least in three years or driving less than 60,000 km. Warranty services in China often only include vehicles’ core parts such as Engine System, Gearbox, and driving system. However, wearing parts (car parts other than core parts) usually have a shorter warrenty period, these include; Air filter, Air conditioning filter, Oil filter, fuel filter, clutch plate, spark plug, brake lining, tier, bulb, battery, Fuse, Remote battery and wiper blade.

In China, based on the “guarantee and maintenance booklet” (保修保养手册, which is in every new car), there are 3 conditions that consumers can’t have warranty services from vehicle manufacturers when they purchased new cars. Consumers don’t follow the requirement of brands when they maintain their cars. If consumers didn’t go to 4s stores or maintenance stations designated by car brands to repair their cars, then they won’t have a warranty service. Also, consumers retrofitted their cars privately after they purchased cars. Almost all car manufacturers in China refuse to provide warranty services to those cars that have been retrofitted. Furthermore, Damage to the car results from misuse. If the damage of vehicles is from man-made reasons or traffic accidents, car owners only can get payment from commercial motor insurance.

Overview of the extended warranty market in China

Extended warranty in China is a service that continues to protect consumers’ vehicles after factory warranty ends, it provides similar coverage beyond those time or mileage limits. The extended warranty market in China covers mainstream vehicle types: Sedan, SUV, MPV, Crossover vehicles, etc. Extended warranty in China is usually divided into 2 types which are, EW for the whole vehicle and EW for any single vehicle part, the Chinese EW suppliers provide EW services by different car parts, mainly include engine system, vehicle gearbox, driven system, exhaust system, cooling system, steering system, electronic control fuel injection system, braking system, air conditioner, electric system, and vehicle body. The time period of EW services are from 1 year (minimum we found from PICC) to 8 years (maximum we found from Vango). In 2017, the market size of second-hand vehicles EW in China 3 billion RMB The market penetration of second-hand vehicle EW in China was less than 10%. The market penetration of second-hand vehicle EW in China was less than 10%

Car insurance focuses on car damages and injuries of drivers and passengers from external reasons, such as traffic accidents, theft, flood, fire, etc. Insurance companies pay the fee for car repairing or medical treatment from car accidents after consumers purchased their products. While Car extended warranty is for automobile fault from no-external reasons or quality problems, such as engine failure. The EW providers give free services of replacing/fixing car parts that no longer working after consumers purchased their EW products.

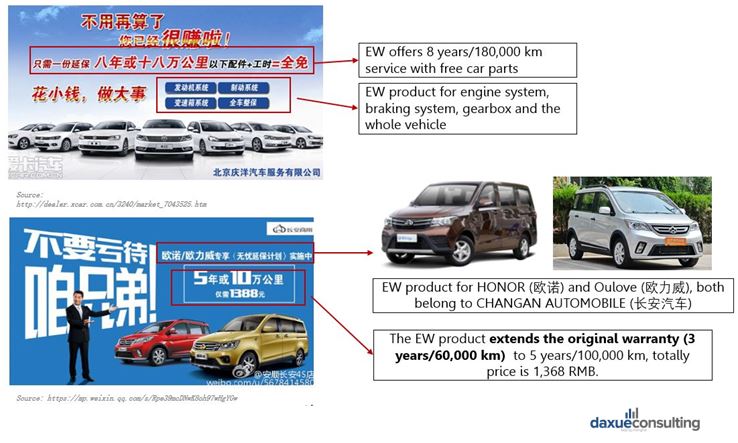

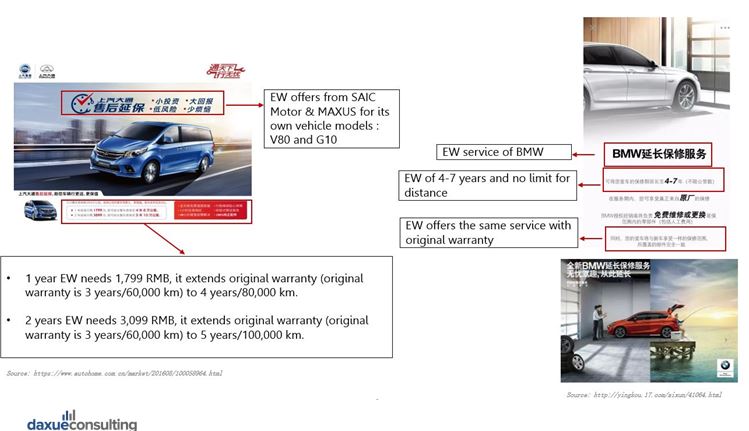

Advertisement analysis of extended warranty in China

Advertisements usually highlight the terms of EW offers (years and km), they also give price to show how cheap they are.

[Source: Daxue consulting ‘Changan Auto Ad for extended warranty in China’]

[Source: Daxue consulting ‘BMW and SAIC Ad for extended warranty in China]

Consumer perceptions of extended warranty in China

A small sentiment analysis study on Zhihu shows the questions and concerns of Chinese consumers. Zhihu is a Q&A platform that reaches higher-, well-educated Chinese netizens. On Zhihu, the most common opinions about the extended warranty market in China consist of the following: Some EW products have many limits, for instance, consumers must go to places (such as 4s stores) designated by EW suppliers for vehicle maintenance. Consumers believe those limits bring bad consumption experience.

Consumers think EW products are not suitable for some situations, such as they plan to switch cars in 2-3 years, some car parts are not easy to damage, etc. Some of the questions posted on Zhihu include; Why EW is not very popular in China, and How to pick suitable EW for vehicles. On Zhihu, the most common opinions about extended warranty consist of the following: It is important to pay attention to the terms in EW contract, especially the disclaimers and EW is more recommended for luxury cars and original EW for whole car could be the best choice for car owners.

On Zhihu, the most common opinions about extended warranty consist of the following: “information asymmetry” makes consumer think EW is tricky and not worth to buy; Not worthy, more like a stunt, A few of Chinese car owners know EW, Not useful for mainstream car brands, Could be useful for some niche car brands and “Wool comes from the sheep’s back”, sometimes it could be more worthy to fix the car by yourself than buy EW.

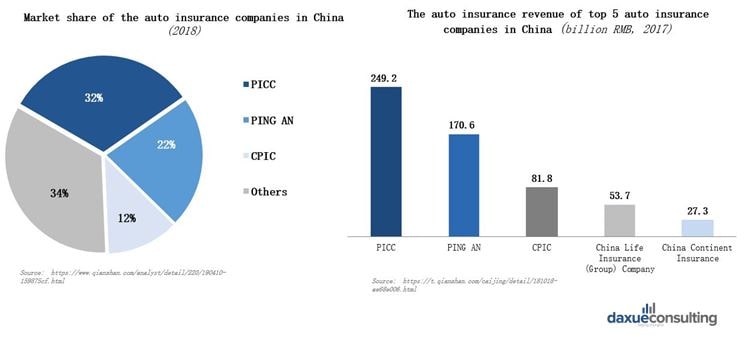

Extended warranty companies in China

Extended warranty companies in China comprise of both domestic companies and international players. Local Players include Ping An, PICC, Zhongqigouhui, Autocare, Lizhen and Vango. While International Players include, , Allianze, Mapfre Group, and AMC. However, China’s auto insurance market is dominated by large domestic brands. Due to the scarce insurance licenses and fierce competition, small and medium-sized companies are difficult to grow through the traditional business model.

[Source: Daxue consulting ‘EW top companies’]

Business models of extended warranty companies in China

Zhongqiguohui – 中汽国汇

Zhongqiguohui’s Business Model is based on Partnership in both Up-stream and Down-stream. Under Up-stream cooperation, Zhongqiguohui partner with Insurance companies such as PICC and Ping An, which provide insurance coverage back-up for them. While under Down-stream cooperation, Zhongqiguohui partners with 4s stores around the nation, which can help with product promotion and provide direct maintenance and payment. The Core business of the company includes; Customized EW services, Road rescue, Risk control consulting. However, the comparative advantages the company is; In-time reaction, intelligent detection system, wide cover of cooperation with 4s stores with value proposition in user experience. EW Package Provided is 8 years / 200,000 kilometres (including original warranty), with the Service option that includes Basic service which covers 2 basic systems (Engine system, Gearbox system). Selective service which cover 6 core systems (Engine system, Gearbox system, Transmission system, Brake System, Fuel system, Electrical system) and Premium service which cover all 12 systems (Engine system, Steering system, Suspension system, Brake system, Gearbox system, Transfer case, Axle and drive system, fuel supply system, Cooling system, electronic system, air conditioner system, Subsidiary system).

Zhongqiguohui’s WeChat account

Offer online purchase service for EW various payment methods, which begins with Fill out the vehicle information and get the valuation. Then, Submit the order and complete the payment (support various methods includes Wechat, AliPay, UnionPay, Apple Pay, etc.). Lastly, Upload the picture of ID card, driving license, odometer and the car.

[Source: Zhongqigouhui Wechat ‘Zhongqigouhui Wechat Interface’]

PICC – 中国人民保险

PICC’s Business Model is based on Partnership with Strategic cooperation in car brands which provide EW to all new cars under Brand and used cars with official authorization, and Strategic cooperation with 4s store and repair shop which provide product promotion, direct maintenance, and cover insurance payment. The Core business of the company is EW services and Road rescue. Also, the comparative advantages of the company are on High cost-effective, flexible transferred warranty, wide network around the nation, with Value proposition on User experience. EW Package Provided is 1-3 years (on the top of the original warranty), with the Service options that include, Comprehensive approach which provides a guarantee for engine, gearbox system, control unit in engine transmission, fuel system, intake/exhaust system. Original warranty in which the whole car excluded consumable items listed by regulation

PICC’s WeChat account

The WeChat account of PICC is developed to Promote user satisfaction by offering online support and in-time reaction and convenient access to buy insurance. In PICC’s WeChat store, there are three types of insurances are provided: travel, accident, and family insurance

In the “Bestsellers” section, Car insurance is ranked second. If the list is organized by popularity, it might show that more people in China are tending to buy car insurance online.

More services provided than WeChat, The APP covers more services but still includes online store, Property and car insurance are listed as a separate section in APP, in the car insurance section, the EW service is listed and The purchase process looks quite similar with that of finance products.

[Source: PICC ‘PICC WeChat Interface’]

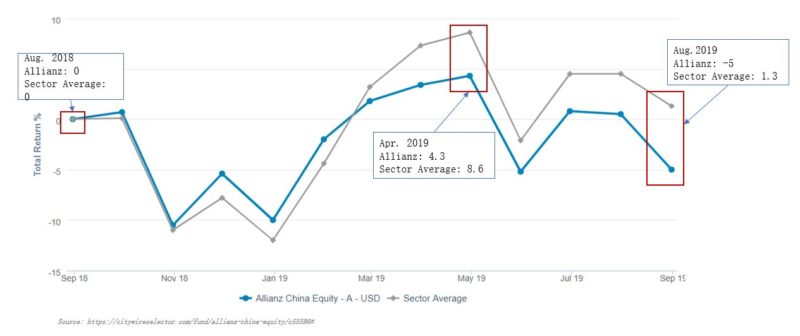

Allianz – 安联保险

Allianz’sBusiness Model is based on Partnership with JD as joint venture: which has a combine insurance and risk management with digital technology and e-commerce ecosystem. Strategic cooperation with financial institutions: that offer favourable terms for the credit card clients of UnionPay, Visa, Bank of China and SPD Bank. The company channels its product through Offline store, official site, self-operated Online store, Tmall, and JD store. The Core business of the company includes, Life and health insurance, Property and liability insurance, Asset management, Travel insurance and assistance (outbound tourism-focused), with the strong Value proposition in technology-oriented insurance company, with data as base and driven by technology and customer satisfaction.

Mapfre assistance – 路华救援

Mapfre’s wholly-owned subsidiaries in China and MAPFRE aspires to lead in all markets where it operates, harnessing a proprietary and differentiated management model founded on profitable growth, with clear and purposeful client orientation that encompasses both individuals and businesses, featuring a multichannel focus and unrivalled vocation for service. They Partner with Down-stream cooperation to develop close relationships with global automakers like Renault and dealerships to promote brand value worldwide. The company channel itself through Official site, offline store, and email. The Core business of the company includes Road rescue, EW service, Travel rescue, and other value-added services. EW Package Provided is 1-3 years (on top of original warranty), with Service coverage that includes, Free repair service using original parts, Flexible service for different models, different brands, and different driving regions Value-added service includes nationwide road rescue, scooter, dealer information inquiry. However, Mapfre’s s WeChat account doesn’t include an online store and online services and the WeChat account of Mapfre doesn’t include any digital services but only normal articles. The article about EW offers was published in 2015 and got 2590 reads in total.

Ping An – 中国平安

Ping An–only provides EW service and their Business Model is based on Partnership through Strategic cooperation with The Warranty Group, Ping An introduced EW service jointly with The Warranty Group, but no information about this cooperation can be found. The Core business is EW services and road rescue, with the Value proposition in User experience. The company’s Touchpoint include Offline store, official site, hotline, WeChat, mini-program, Weibo, app, email. EW Package Provided is year/20,000 kilometres or 2 years/40,000 kilometres (on top of original warranty), with Service option in the Basic package which provides a guarantee for Engine assembly, Transmission case assembly, Precursor assembly, and Rear axle assembly. Platinum package which provides a guarantee for the whole car (compliance with China’s manufacturing standards) exclude parts didn’t provide by the original supplier.

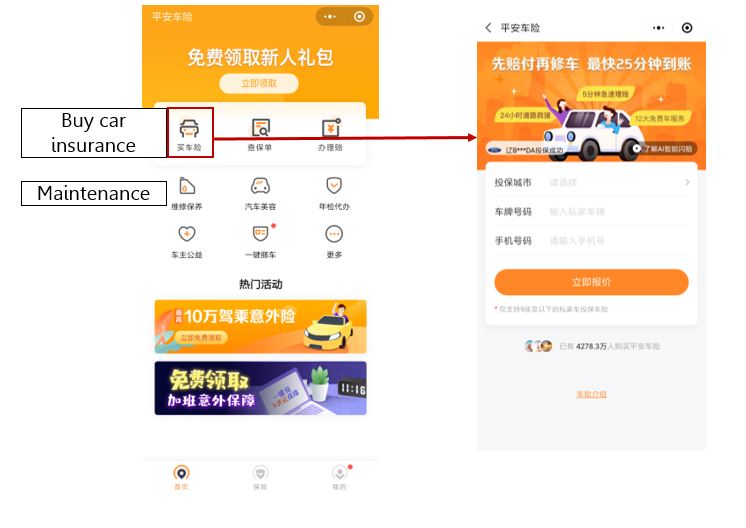

Ping’An’s WeChat Account

Ping’An WeChat account for car insurance in online service + store and market communication Provide basic and daily service for car owners. No car insurance products provide in Ping An’s Wechat store, although this account provide service for car owners. Also, Ping An’s mini-program for car insurance Provides car insurance purchase service and is generally has similar to the function of the WeChat account, but includes car insurance online purchase. It includes “maintenance” in the service list but nothing provides internal, it seems some promotion will be done later, Extra benefits are offered on this platform and No service about EW is provided in this mini-app.

[Source: PingAn ‘minibus App’]

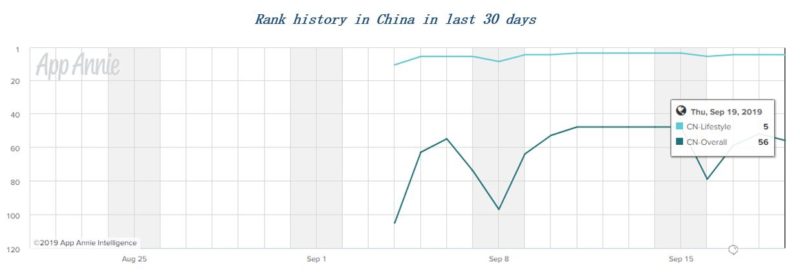

Based on the rank on iPhone in China and According to the data provided by App Annie based on Appstore, it has stable performance in the lifestyle sector, ranking the top 10th generally. Much better performance than PICC’s app, which might be related to the social function and marketing strategy.

[Source: APP Annie ‘Ping’An Performance’]

In China, EW offers can be transferred along with the ownership of the car. However, it could be various in different service providers. Generally, seonc-hand car owners can buy the EW as long as meet some specific requirements of service providers. Your rights and obligations in this service contract can be transferred directly from you to the new buyer within 15 days by paying a transfer fee of 280 RMB. This service contract cannot be transferred to any entity engaged in the car selling of the renting industry. However, the following requirement need t\o be satisfied; At least 1 month before the end of the original warranty, More than 2,000 kilometres remains (in the guaranteed distance offered by the original), and Non-operating vehicle with authorization from China mainland brands.

Pain points and incentives of the extended warranty market in China

The first pain points of extended warranty market in China comprise is the lack of publicity. Many Chinese consumers/car owners are unfamiliar with extended warranty or believe it is just another insurance. Secondly, EW products and services are not yet perfect. For consumers, they have limited options for EW products (time and km). Some EW suppliers can’t provide good service experience. In order to attract more clients, many car brands started to offer longer original warranty services. It makes the EW supplier hard to have more consumers.

Incentives include the fast-growing of second-hand vehicle sales in China. The developed internet and social network make EW suppliers can advertise their products and engage consumers more effectively. Policy support. The Chinese government further opened the market to international companies.

Additionally, China’s car market is transitioning to green energy and electric vehicles. Extended warranty products in China should take this transition into consideration to gain market share.

Let China Paradigm have a positive impact on your business!

Listen to China Paradigm on iTunes