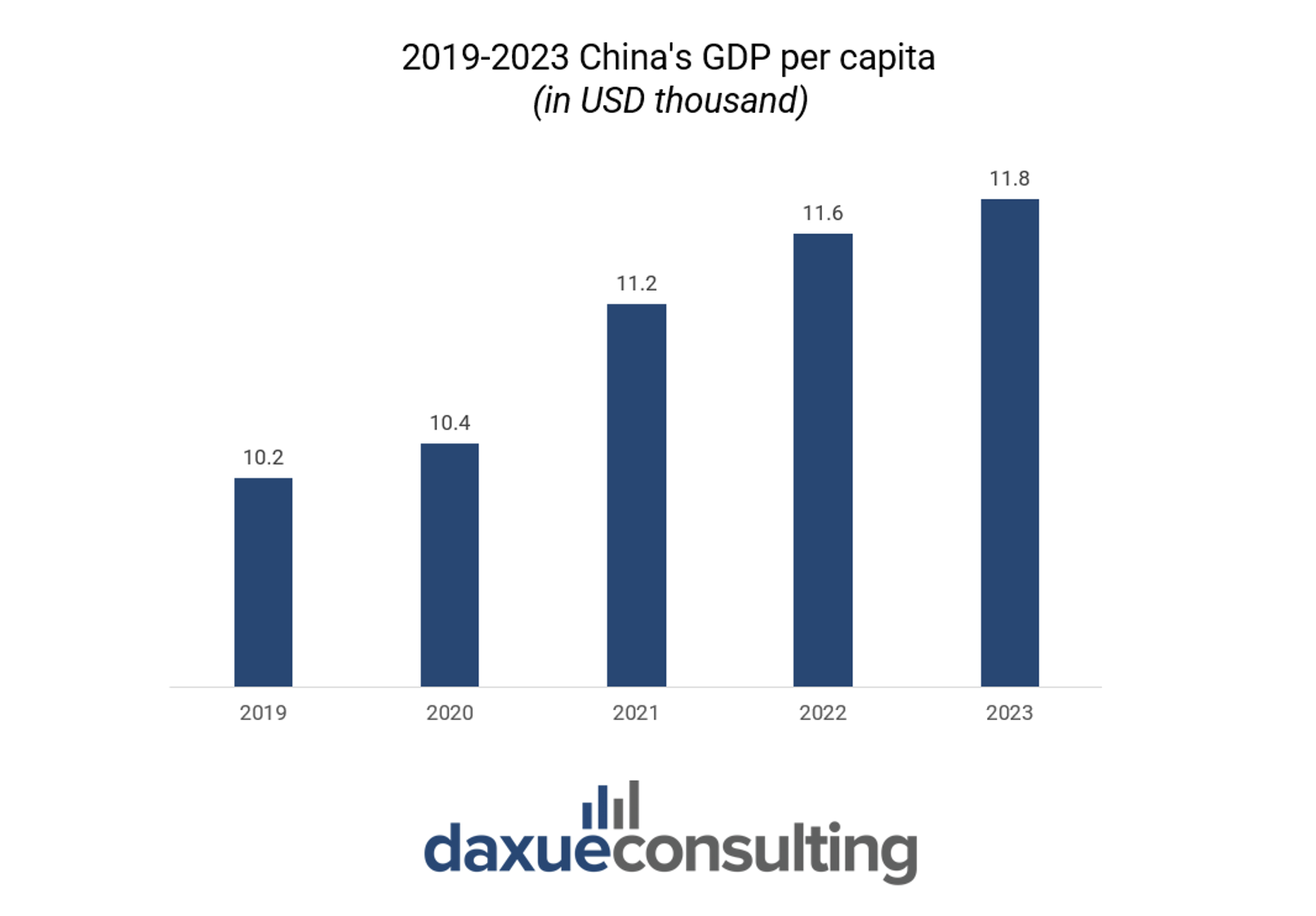

For years, China’s economy has maintained rapid growth, with continuous increases in consumer spending. However, recent macroeconomic pressures have affected the confidence of Chinese consumers. The sluggish stock and housing markets, along with measures taken in the past few years to curb the spread of the pandemic, have added uncertainty to the consumption outlook.

However, despite these challenges, the resilience of the Chinese economy and government policies aimed at supporting consumption could help mitigate the negative effects and foster a sense of optimism among consumers.

According to data from the National Bureau of Statistics, in the first quarter of 2024, the per capita disposable income of residents nationwide was RMB 11,539, a nominal increase of 6.2% over the same period last year, and a real increase of 6.2% after deducting price factors.

Graph Source: Trading economics, designed by Daxue Consulting, 2019-2023 China’s GDP per capita

China’s consumer trends: what drives the shift towards premiumization and local brands?

In understanding Chinese consumers, one must explore the evolving economic landscape shaping consumer attitudes, preferences, and behaviors. With China’s economy propelled by a burgeoning middle class and a robust market for upscale products, notable trends emerge within the consumer market.

Continued growth of the middle class

China stands out globally for its yearly addition of a substantial number of middle-class households. More and more families are seeing their annual incomes surpassing RMB 160 thousand, placing them in the upper-middle-class category. Over the next three years, China is expected to see an additional 71 million upper-middle-class households.

In addition, the share of urban consumers in China is also increasing, from 48.3% in 2009 to 60.2% in 2019. In 2020, the number of Chinese urban consumers reached 848 million, 1.53 times the number of rural consumers. Affected by the government’s urbanization policy, the number and proportion are expected to further increase in the future.

Capturing the premiumization wave

Despite economic challenges, upscale brands continue to outperform mass-market brands. While Chinese consumers express concerns about the economic environment and personal income, the mid-to-high-income consumer groups are still inclined towards higher-end global brands for self-indulgence.

Following the surge towards premiumization, private labels in China emerge as a valuable tool for attracting mid-to-high-income consumers who like to show their social status. A 2022 report examining the private label brands of 28 major retailers in China revealed that each retailer owns an average of five private label brands.

The rising allure of local brands among consumers

The rise of local Chinese companies keeping pace with the Guochao trend has put significant pressure on foreign brands that once dominated the mainstream markets, spanning from sportswear, cosmetics, food, electronics, and beyond. According to Xinhuanet, from 2011 to 2021, the popularity of Guochao has grown by over fivefold, with 78.5% of consumers showing a stronger preference for Chinese brands, and post-90s and post-2000s generations contribute to 74% of Guochao consumption.

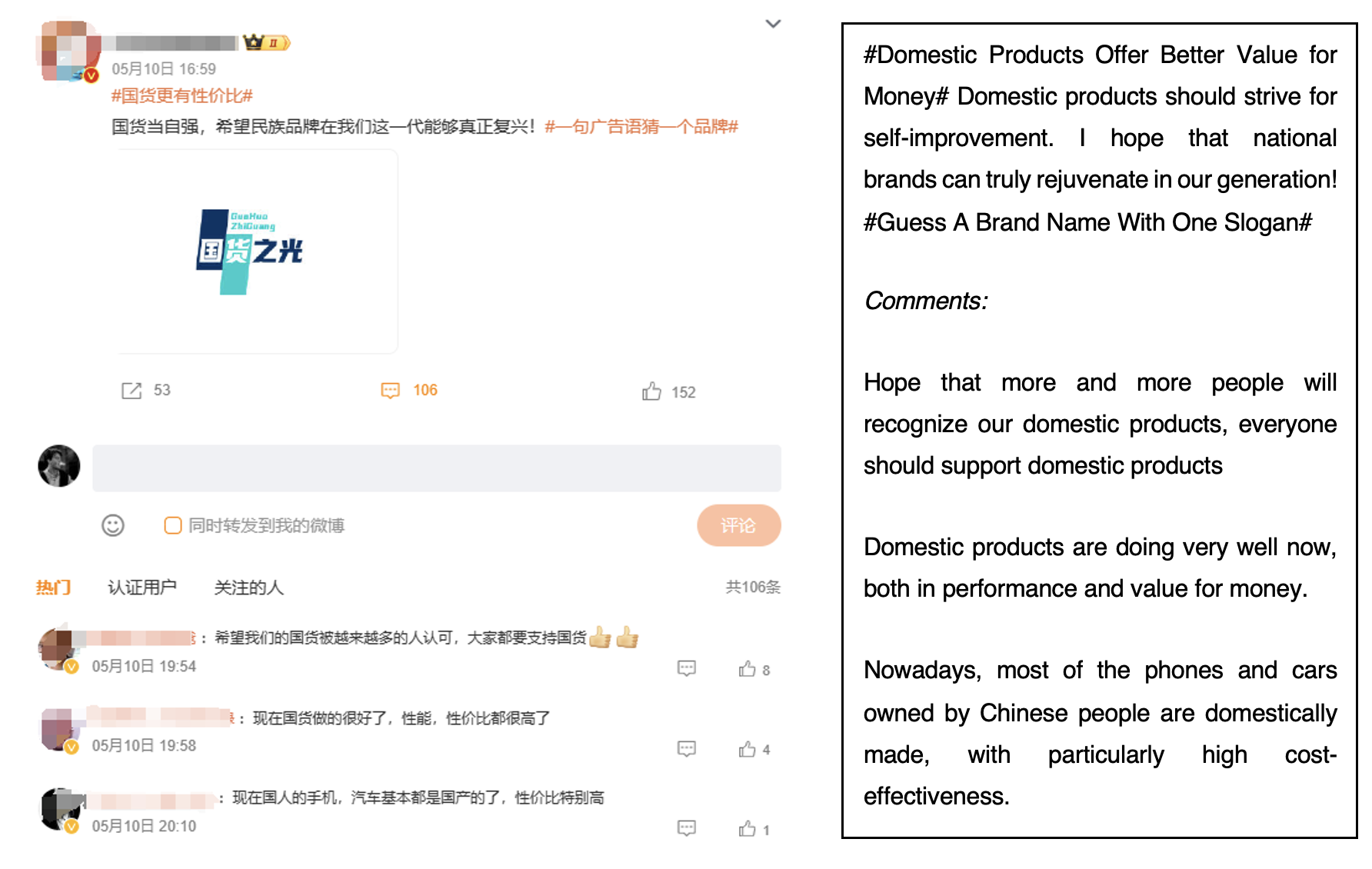

Surprisingly, national pride and the need to embrace the Chinese culture isn’t the sole driving factor. Chinese brands now offer products of comparable or even superior quality to their foreign counterparts. Some consumers express in their positive reviews: “Some hyped brands nowadays offer quality that doesn’t match their price, but some domestic brands truly offer quality that exceeds their price.”

For Chinese consumers increasingly prioritizing value for money, once they encounter domestically-produced goods that prove their quality through validation, many naturally become fans of local brands. As of May 11, 2024, the hashtag #Domestic Products Offer Better Value for Money# (国货更有性价比) has amassed over 1.6 million reads on Weibo.

Source: Weibo, netizens commented in support of local brands under the hashtag #Domestic Products Offer Better Value for Money#

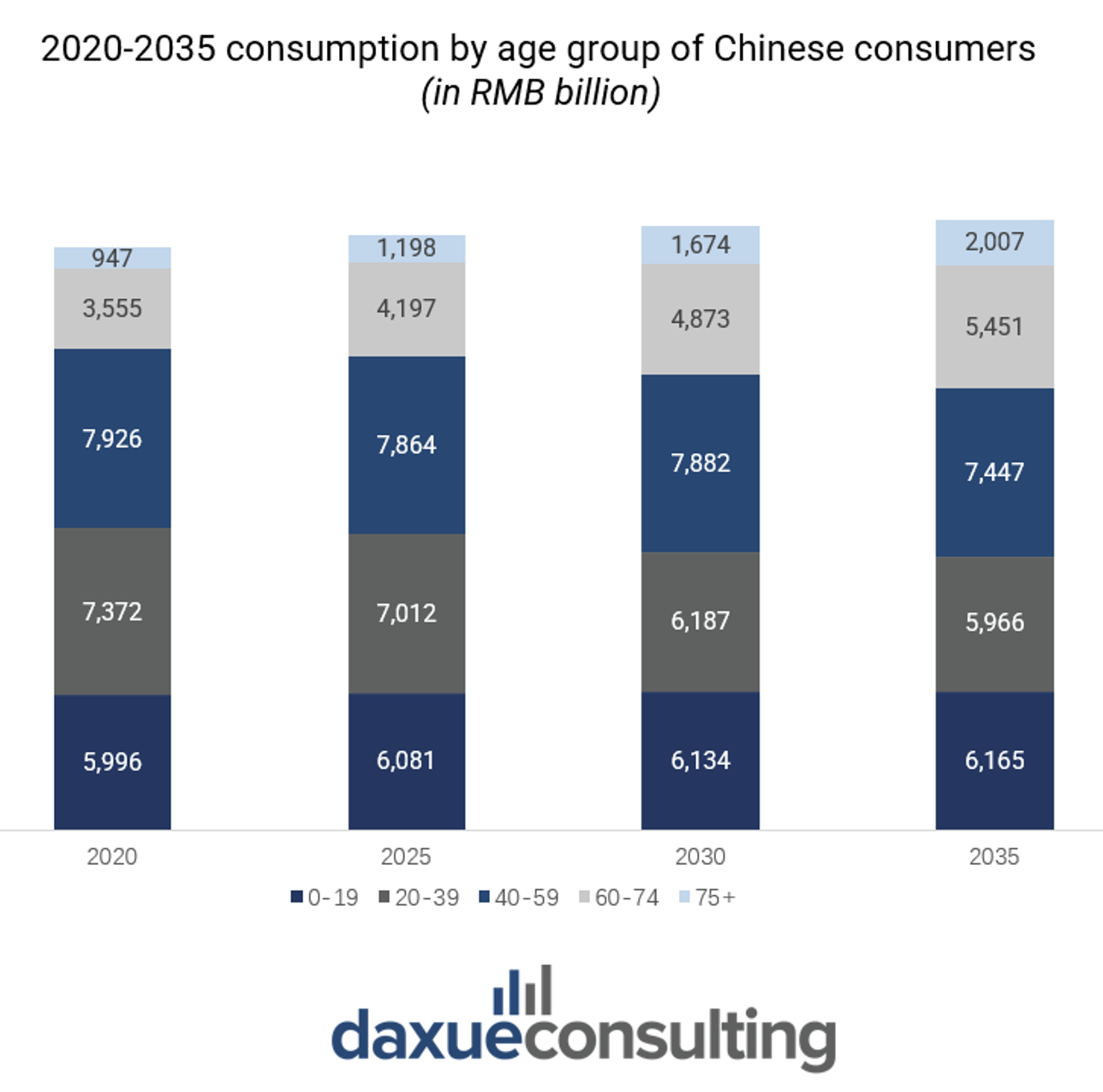

Generational shifts: China’s diverse consumer landscape

As China’s consumer landscape continues to evolve, each generation brings its own set of consumer preferences and priorities to the market. From the silver economy, representing the growing influence of older generations, to the tech-savvy Gen Z cohort, the diversity in consumer behaviors, preferences, and perceived cultural value of purchased products is more pronounced than ever.

Graph Source: Chinese Family Panel Studies, designed by Daxue Consulting, 2020-2035 consumption by age group of Chinese consumers

The rising power of senior consumers

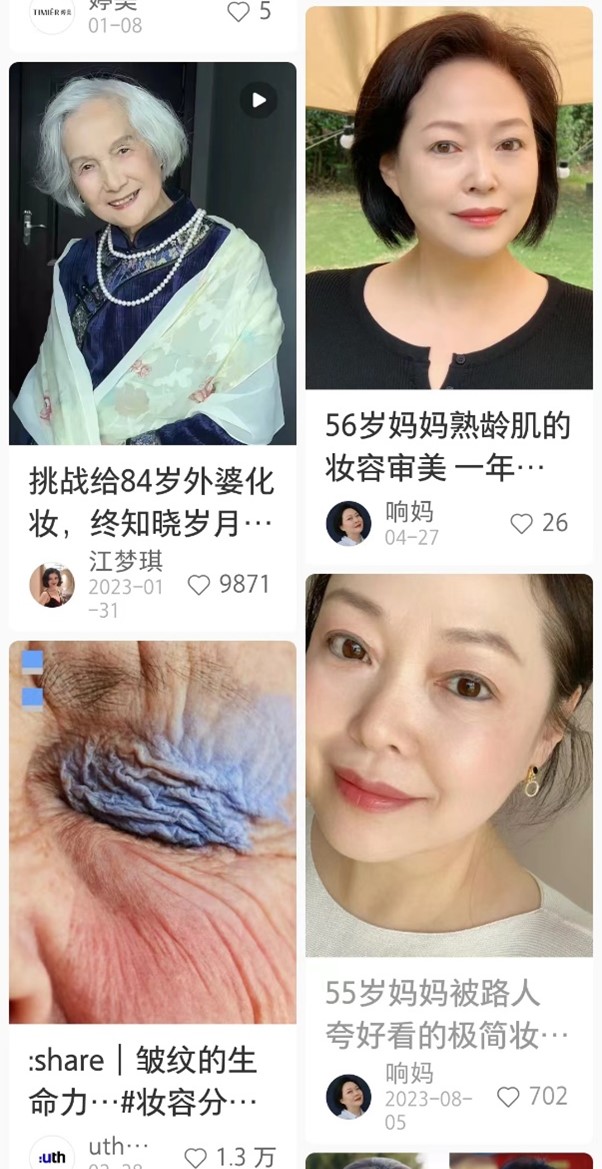

According to the National Bureau of Statistics, as of the end of 2023, there were 296.97 million people aged 60 and above in China, accounting for 21.1% of the total population. From consumer goods that meet basic living needs to service products that provide health protection, the silver economy offers investors broad market space across multiple dimensions.

For instance, markets like elderly beauty and healthcare products are experiencing rapid growth, as the desire for beauty is no longer exclusive to the younger generation. The silver-haired group is actively expressing themselves, caring about their appearance, teeth health, and skin issues. Compared to younger generations, with financial stability and leisure time, they can enjoy a wider range of activities that also affect their purchase decisions. As of May 13, 2024, the hashtag #Middle-aged and Elderly Beauty Bloggers# (中老年美妆博主) has garnered 57.55 million reads on Weibo.

Source: Xiaohongshu, the silver-haired group is actively expressing themselves on the social media platform

Furthermore, there’s a noticeable trend of upgrading consumption among elderly tourists. According to China Tourism Research Institute, in 2021, the 45-64 age group made 902 million trips, accounting for 27.80% of the total, becoming the largest source of tourism market consumers.

Unlike previous budget group tour routes, elderly travelers now prefer high-quality, personalized, and fee-inclusive deep travel experiences. They are willing to pay higher prices for better travel quality, with outbound travel orders for those aged 55 and above more than five times higher since 2023 compared to the same period last year, and the prices of group tours increasing by more than 30% compared to the same period in 2022.

Gen Z shaping China’s new consumption trends

With the increase in per capita disposable income in China, young people are gradually becoming the main force of consumption in the new era. According to QuestMobile data, as of July 2023, the size of the new middle-class group aged between 25 and 40, living in third-tier cities and above, with online consumption capabilities of over RMB 1,000 has reached 245 million, with a year-on-year growth of over 6%.

Contemporary young people, mostly only children, grew up enjoying family resources and broad exposure to the internet, ultimately forming consumption values that are inclined towards novelty and domestic brands.

Due to their love for novelty, Gen Z often plays the role of trendsetters and popularize new consumption behaviors across society, including internet behaviors such as short videos, Weibo, online food delivery, sharing transportation, as well as new consumption behaviors like new-style tea drinks and specialty coffee.

Additionally, new forms of cultural consumption such as talk shows, dressing experience halls, themed cafes, trendy toy stores, pet cafes, street dance studios, and escape room scripts are constantly emerging, gaining popularity among Gen Z consumers, especially in large cities.

Source: Xiaohongshu, new forms of cultural consumption including script murder capture the hearts of Gen Z consumers

Learn more about young Chinese consumer trends

Tailoring marketing strategies for diverse Chinese consumer demographics

China market segmentation by demographics

Segment Chinese consumers based on demographics, psychographics, and behavioral characteristics. Tailor your marketing strategies and product offerings to meet the specific needs and preferences of different segments within this demographic.

For example, when targeting the silver generation in China, one segment might consist of retirees seeking travel experiences. Marketing strategies for this group could focus on luxury travel packages tailored for seniors, emphasizing comfort and leisure.

Meanwhile, for Gen Z in China, marketing efforts for young people who value personalization and innovation could include customized products and personalized experiences, as well as marketing activities related to new technology and social media. On the other hand, for those who prioritize environmental sustainability and social responsibility, the focus could be on sustainable products, and spreading related values through social media and offline activities.

Co-branding opportunities

To effectively target different consumer groups, research-focused strategies can include identifying strategic co-branding opportunities tailored to specific demographics. For instance, Luckin Coffee‘s collaboration with Maotai tapped into the shared preferences of younger consumers for trendy beverages and luxury experiences, enhancing brand perception and driving engagement within this demographic.

By researching potential partners with similar values and target audiences, businesses can maximize the impact of co-branding initiatives, expanding market reach and driving consumer engagement aligned with the interests of each group.

Source: China Daily, Moutai-Luckin coffee partnership sells 5.42 million cups on launch day

Long-term relationship building

Focus on building long-term relationships with consumers by actively engaging with them through community-building initiatives such as hosting events, workshops, and online forums. The significance of this approach lies in cultivating a sense of belonging and loyalty among consumers, fostering deeper connections with the brand.

For instance, Beijing Aranya exemplifies this strategy by organizing events and workshops where consumers can interact with each other and the brand, fostering a community-driven environment that encourages user-generated content and facilitates meaningful interactions, thereby solidifying brand loyalty and advocacy.

Source: Aranya, the 2023 Aranya Theatre Festival received nearly 40 thousand spectators and 300 thousand visitors

What do you need to know to understand Chinese consumer behavior?

- Despite recent economic challenges, China’s consumer spending remains resilient. Government policies support consumption, with per capita disposable income increasing by 6.2% in Q1 2024.

- Understanding Chinese consumers involves navigating their evolving economic landscape, characterized by a growing middle class and a preference for upscale products.

- The surge in middle-class households, urbanization, and premiumization trends shape consumer behavior, while the rise of local brands challenges foreign dominance.

- Generational shifts in China’s consumer landscape highlight the rising influence of seniors, constituting 21.1% of the population. Silver economy trends include beauty and healthcare product growth and increased tourism spending.

- Gen Z drives China’s consumption trends, influenced by disposable income growth, online exposure, favoring novelty and domestic brands, pioneering new behaviors.

- Tailor marketing strategies for diverse Chinese demographics via segmentation analysis, co-branding, and long-term relationship building, ensuring targeted engagement and growth.

Deciphering Chinese consumer behavior: insights from case studies

At Daxue Consulting, we utilize diverse research methodologies to delve into Chinese consumer behavior. For instance, in optimizing a beauty brand’s gifting strategy, we conducted in-depth interviews with both consumers and corporate gift buyers, alongside competitor benchmarking. Similarly, in understanding Chinese haircare consumers, we employed online diary interviews and individual interviews to analyze their routines and purchasing triggers. These insights enabled our clients to tailor their strategies effectively to meet the specific demands of the Chinese market.

We specialize in understanding Chinese consumers. Leveraging our deep insights into this dynamic market, we offer tailored solutions to optimize your strategies for engaging Chinese consumers effectively.

Whether you’re a global brand expanding into China or a local startup seeking to scale your operations, we have the expertise and resources to support your goals. Contact us today to initiate or review your consumer-focused strategies and unlock growth potential in the Chinese market.

Read one of our Chinese consumer reports: The She economy in China