This article on Douyin e-commerce was originally published by Azoya

More and more Chinese consumers are accustomed to shopping via livestreaming and the penetration rate of livestreaming e-commerce keeps on increasing. According to iiMedia Research, as of June 2021, the number of China’s livestreaming users reached 638 million, an increase of 47.2% compared to the same period in 2020, accounting for 63.1% of overall Internet users.

Data from research consultancy ASKCI also shows that the pandemic has given rise to a further boom in the stay-at-home economy, stimulating the growth of the livestreaming e-commerce industry. The livestreaming e-commerce market size expanded 121% in 2021 compared to the previous year, reaching 961 billion RMB. China’s livestreaming e-commerce market size is expected to rise by an additional 150.73 billion RMB by the end of 2022.

Recently, fitness influencer Liu Genghong and his wife Wang Vivi sparked a revolution on Douyin. During the streaming, Liu encouraged fans to dance and exercise together, reaching 35 million followers in just 10 days. His most successful livestream attracted up to 44.76 million views, thereby setting a record for Douyin livestreaming in 2022.

Douyin is a booming short-video app in China. According to Statista, as of February 2022, Douyin reported having 86.8% of its users streaming live content in China and spending at least 89 minutes watching videos on the platform each day. In this article, we analyze the main features of Douyin livestreaming, the differences with other platforms, and why Douyin livestreaming is a future trend to watch.

Douyin’s model relies on a perfect combination of short videos and livestreams

Douyin livestreaming is currently growing rapidly. Short videos are its main driver of traffic, and its sophisticated algorithm makes sure the right viewers are watching.

Unlike other platforms, Douyin’s competitive edge lies in its content ecosystem, and its unique short videos + livestreams combination model has already become the marketing strategy of many businesses. Short videos are used as hooks for attracting traffic for livestreaming, effectively stimulating user demand and conversion efficiency.

According to the 2022 Douyin Live Ecosystem Report, Douyin is currently livestreaming over 9 million sessions per month, with gross merchandise value (GMV) growing 3.2 times year-on-year. Douyin e-commerce based on content-driven users’ purchasing behavior is revealing very successful: data show the number of live orders in 2022 increased by 112% compared to last April.

A platform with a personality

Moreover, Douyin’s livestreams do not look all the same, but boast strong distinctive features. Each live streamer has its own style, image and a fixed audience base, and some of them even turned their live into a trademark. For example, Luo Yonghao’s “Make Friends Live Session” vaunts very distinctive and unique features which are actually the main reason why users like to watch it on Douyin. Instead of always dealing with the same goods, Luo Yonghao compares different categories and products according to his personal style.

Between April 2020 and April 2022, the total GMV of “Make Friends Live Session” has reached 10 billion RMB, the total livestreaming time has exceeded 10,000 hours, and generated more than 55.51 million transactions. During the same period, the number of brands collaborating with Luo exceeded 6,500, while the number of advertised products equaled to over 43,000. Since most of the viewers watching his livestreams are targeted audience and fan groups, users tend to trust in the Luo’s promotions and are eager to purchase advertised items.

Douyin Livestreaming is an expanding universe

In addition to live shopping, users can easily find on Douyin livestreams of university classes, sports events, and star music concerts. At the same time, various forms of livestreaming, such as Lianmai (interactive live broadcasts) and group-buying, have increased significantly, which has promoted the vigorous development of the livestreaming ecosystem. Douyin livestreaming has an increasing penetration rate in users’ daily life and has been accepted by more and more users. According to a report by Douyin Live, the number of viewers of popular science livestreams increased by 283% in 2021, and the number of traditional culture livestreams increased by 1 million year-on-year.

Differences in livestreaming on different platforms

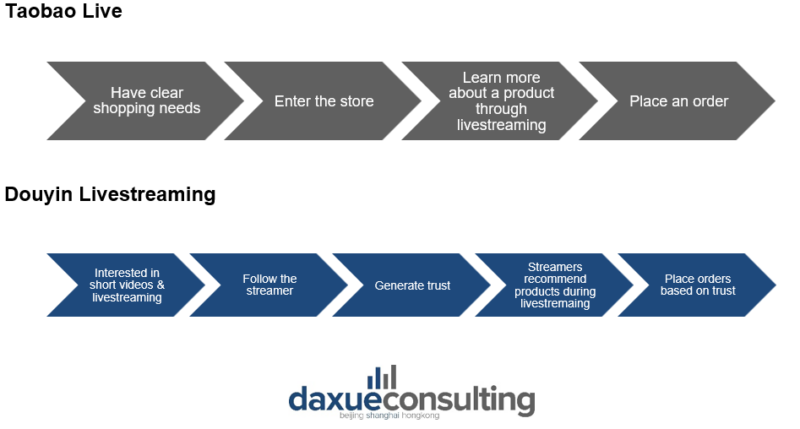

Taobao Live

The biggest difference between Taobao Live and Douyin Livestreaming is that when users go on Taobao Live, they already have shopping intentions. Therefore, they want to be more specific and targeted to understand a certain product, have product introductions and interact with the streamer to learn more about the item.

Now Taobao Live has been integrated into various segments of the Taobao ecosystem and plays an important role in many campaigns, such as shopping festivals. However, compared to Douyin livestreaming, Taobao Live’s content and entertainment properties are weak.

In fact, the entertainment features of traditional e-commerce platforms like Taobao and JD.com are not strong. Since users’ motivation to open the app is very clear – to do shopping – watching livestreaming is not a frequent behavior. On the contrary, users’ motivation to open Douyin is entertainment, so users are attracted and stimulated to make a purchase by high-quality content. Since content is core on Douyin, it is not surprising that users spend a longer time on this platform.

Douyin Livestreaming services are designed to suit all tastes

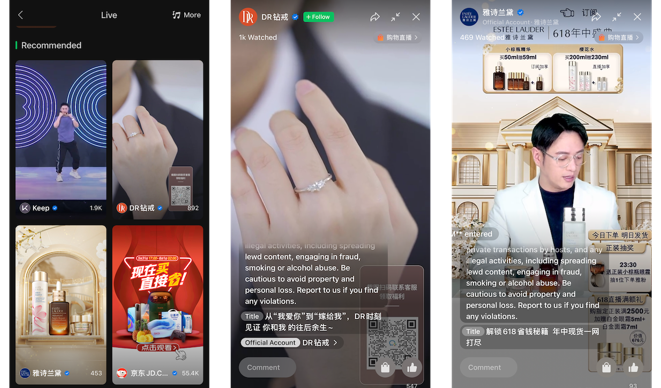

Live streaming offer on Taobao and Douyin is different too. On Douyin, there are livestreaming rooms with different positioning, such as brand livestreaming rooms, corporate livestreaming rooms (for example, China Post EMS uses a wide range of offline outlets to do livestreaming), Key Opinion Leaders (KOLs) and Key Opinion Consumers (KOCs) livestreaming rooms. Douyin users have access to a wide variety of live streaming rooms. This led to a broad selection of advertised items as well: Douyin e-commerce data shows that in the past year, 1.8 million new merchants have entered the platform, and 3.86 million influencers have advertised goods.

This is very different from Taobao Live, where the vast majority of traffic is concentrated in the top streamers. According to Xiaohulu data, the total sales of Taobao Live’s top 2 streamers in September 2021 exceeded the sum of the 3rd-30th. Therefore, Taobao’s mid and micro streamers do not have sizable traffic and fan bases, and the overall number of anchors is relatively small compared to Douyin.

WeChat Channel

As a social e-commerce platform, WeChat Channel has two major advantages that other e-commerce platforms do not have: offering the chance to rely on private traffic (a marketing method where communication with customers is funneled into private pools on platforms that allow brands to have full control without costs of third-party platforms) and accumulating users’ data. For creators of WeChat Channel, private traffic will become long-term assets for sustainable operation.

In addition, the livestreaming function of WeChat Channel is constantly improving, and the system is gradually maturing. WeChat Channel has a livestreaming reservation function, which allows users to make a reservation and watch the livestreaming through the system reminder after the time is up. At present, the viewing rate of WeChat Channel livestreaming with reservation is over 50% and the repurchase rate exceeds 60%.

Compared with other platforms’ livestreaming, WeChat Channel livestreaming has a clearer strategy. It opens up a new closed loop of WeChat ecosystem, closely connected with WeCom, public accounts, WeChat groups, WeChat moments and mini-programs, which can conveniently help businesses import target users into the private traffic pools and lay the foundation for accurate marketing and refined operations. WeChat Channel livestreaming allows to combine both public and private traffic. Lin Qingxuan, a domestic beauty brand, has seen its GMV grow by 570% in just 4 months of livestreaming on its WeChat Channel account.

In general, the WeChat Channel is now more focused on social and interpersonal relationships. This is also very different from the strong entertainment properties of Douyin, and users’ loyalty to WeChat streamers is currently not as high as on Douyin.

Douyin livestreaming e-commerce

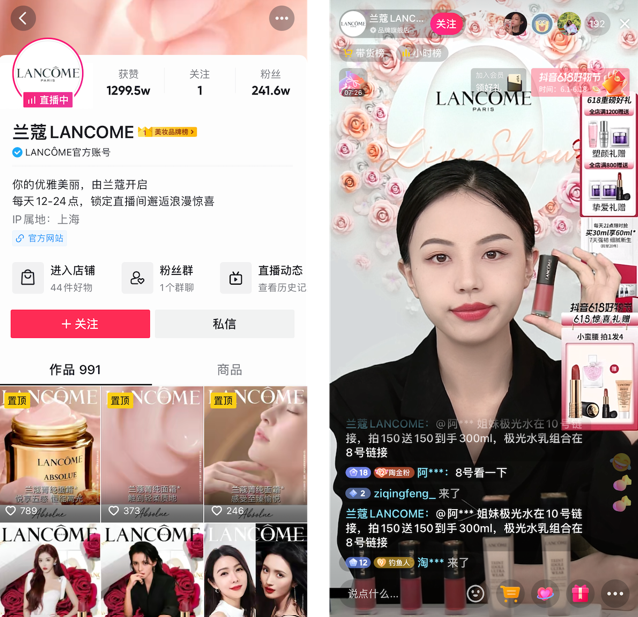

On May 13, the internationally-renowned beauty brand Lancôme officially set up a Douyin account. Within a month of opening, Lancôme sold more than 1 million RMB in 10 days and 10 million RMB in cumulative sales. In the just-concluded “Douyin 520 Confession Season,” the total transaction sales reached 5 million RMB.

It is worth mentioning that, in the first livestream of the store opening, Lancôme cooperated with Top KOLs, such as “Xianmu”, “Yizhi Nannan”, and “One is a Black Cat”, and gave hints to watchers about what products to choose and how to improve their makeup routine. The livestreaming attracted more than 200,000 viewers and exceeded one million likes.

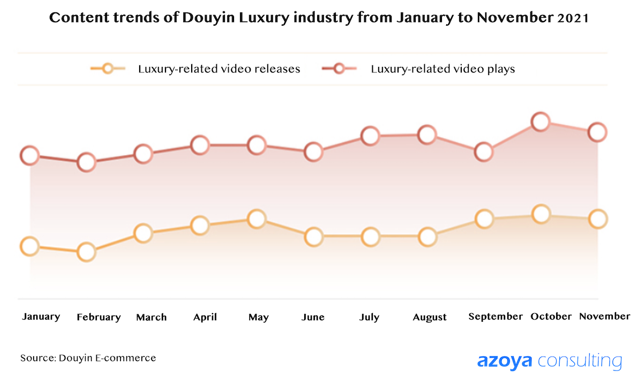

Luxury brands tap into livestreaming

In addition to beauty brands, luxury brands tapped into Douyin. American fashion maison Michael Kors became the first luxury brand to set up an account on Douyin in November 2017. Many other big names followed suit, including Louis Vuitton, Gucci, and Dior.

On July 24, 2021, celebrity Qi Wei and COACH cooperated to launch a livestream in Douyin, bringing COACH X BAPE 2.0 co-branded limited edition to fans. The livestream lasted for 6 hours, attracting countless users, with a peak of 102,300 people online at the same time, and a total of 8.9 million people watching the livestream, helping the new product gain massive exposure. According to the data, the GMV of this special livestream reached 5.97 million, and all the COACH X BAPE cobranded items sold out.

Shopping festivals

In addition to brands flocking to Douyin, livestreaming also played an important role in Douyin’s shopping festival activities. According to the Douyin livestreaming e-commerce research report, more than 98% of the GMV of Douyin’s three large shopping events in recent years were generated by live e-commerce (8.18 Shopping Festival in 2020, 6.18 Shopping Festival in 2021, and 8.18 Shopping Festival in 2021). In Douyin’s 2021 8.18 campaign, the top 20 KOLs livestreamed a total of 242 sessions, generating over 2.8 billion RMB in sales, with average sales of 11.82 million RMB. Overall, the spending power of Douyin users on shopping festival activities still maintains strong growth momentum.

In the 8.18 promotion campaign in 2021, the brands with the top 20 sales all developed in-house livestreaming capabilities. 75% of the brands partnered with more than 100 KOLs in their campaigns, using high-quality KOL resources to bring them strong exposure and improve sales conversion. In addition, the top 20 brands in terms of sales all adopted the combination strategy of “short video + livestreaming”.

According to data, Douyin livestreaming is a key driver of traffic. In addition, tools such as the cloud platform “Volcano Engine” launched by Douyin can also help brands choose suitable streamers for cooperation. In the long term, in China’s highly competitive market, no one is sure how long Douyin’s competitive edge will last, but current data shows that brands should continue to choose to pay attention to the platform’s marketing and sales potential.

Livestreaming is a rapidly growing channel

The function of livestreaming e-commerce demonstrated that it is not only a new marketing channel, but also represents a growing sales channel via professional streamers or influencers, whose sales-driving potential cannot be underestimated. According to Research And Markets, China’s livestreaming market is expected to reach $76.42 billion US in 2025, experiencing growth at a compound annual growth rate (CAGR) of 35.29% during the period spanning from 2021 to 2025.

For brands looking to succeed in China’s retail market, livestreaming e-commerce is already an integral part of the omnichannel marketing strategy that cannot be ignored. However, in the face of such a promising market, merchants also need to master the characteristics and marketing strategies of emerging platforms beyond mainstream e-commerce platforms, such as Taobao and JD, in order to maximize business growth.

Although livestreaming still has many unknowns, what we do know is that live shopping is currently thriving. We will continue to pay attention to this market and provide more valuable insights to help guide U.S. and global brands’ marketing strategies.

The untapped potential of Douyin livestreaming

- More and more Chinese consumers are accustomed to shopping via livestreaming.

- Douyin livestreaming is currently growing rapidly. Short videos are its main driver of traffic, and its sophisticated algorithm makes sure the right viewers are watching.

- Unlike other platforms, Douyin’s competitive edge lies in its content, and its unique short videos + livestreams combination model has already become the marketing strategy of many businesses.

- The main difference between Douyin and other platforms is that Bytedance affiliate company utilizes engaging content as a hook for attracting potential customers for its e-commerce ecosystem.