Key insights from ChoZan’s brand new 570+ pages report unveiled

It’s no question that the pandemic has brought drastic changes to our lives, be it social distancing, working from home, etc. Many businesses and people’s livelihoods are suffering. Just as we are powering through this difficult time, we turn our attention to it’s a good idea to take a look at China, one of the fastest-recovering countries, to see what drives the country’s rapid recovery, and what 2021 China market trends are in storeto see how they have managed to be back in the game so quickly.

The World Bank expects China’s growth to slow to 1.6% this year and calls it the country’s slowest expansion since 1976. Although China has rebounded, it sees domestic and external demand as fragile. Even though its growth rate will be small, China has recovered quickly and is one of the few countries in the world with positive GDP growth in 2020.

To support digital marketers and ecommerce specialists, China expert Ashley Galina Dudarenok and her ChoZan team have prepared a 570+ pages insights report, covering the most important developments in China’s digital space from the impacts of COVID-19 and top 9 Chinese consumer groups to e-commerce platforms and shopping festivals, 9 social media platforms as well as 8 key China market trends to watch out for in early 2021.

ChoZan report creators have interviewed over 50 experts, from TV commentators and China’s tech giants in-house team to China agency owners, universityies professors, and established book authors and China agency owners, including the CEO and founder of daxue consulting, Matthieu David, to make sure the report is exhaustive and represents the collective wisdom of the China watchers.

So, do experts see what are experts seeing as the top 8 trends businesses shall prepare for in China in 2021 based on China Ecommerce + Marketing Q4 Outlook Report? Here they are.

Key China market trends to watch out for in early 2020

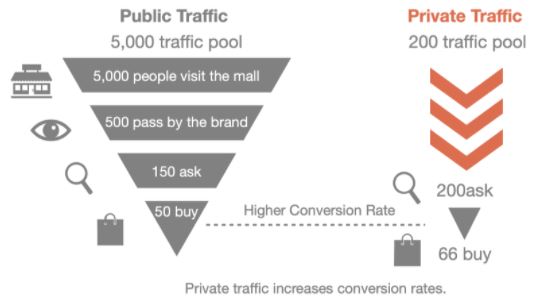

1. Growing your private pool is key

In China, bloggers and other client acquisition channels are expensive. No matter whether you run a banner ad or livestream with a top tier blogger like Viya, you are unlikely to get a positive ROI from an individual campaign, even if the campaign was sales driven. So, how do brands grow? You can start by locking your customers into a 1-1 centralized communication CRM ecosystem, also known as ahisthat is called the private, pool and upsell to customers in the CRM. You are much more likely to receive positive ROI from these campaigns since you have acquired these users from their recent 2 or 3 purchases and they are highly likely to repurchase from you.

Popular in the past year, the concept of private pool is going to be only more important next year. The private pool is about getting your customers to join a CRM system one by one on WeChat, Weitao and the like. It’s about communicating with customers 1 on 1 through private messages, adding them into interest groups, making the customers feel like a brand friend. Private traffic is great for businesses because it systematically reduces customer acquisition costs. With direct communication to customers, brands can also easily achieve higher conversion rates.

![ChoZan Mega Report 2020 [China E-commerce + Marketing Q4 Outlook]](https://daxueconsulting.com/wp-content/uploads/2020/11/daxue-consulting_Ashley-2020-report_2.jpg)

Source: ChoZan Mega Report 2020 [China E-commerce + Marketing Q4 Outlook]

2. Livestreaming is just getting started

Livestreaming is no longer an option but a necessity. Data shows that the market size of livestreaming e-commerce will still double to 961 billion RMB in 2020. The number of livestreaming users in China has reached 560 million as of March 2020, meaning that 40% of the Chinese population and 62% of internet users are livestreaming users. The COVID-19 outbreak has propelled and normalized the livestreaming practices for both merchants and consumers. With the support and training from tech giants and various parties, livestreaming will remain key across various e-commerce, short video and social media platforms.

Source: ChoZan Mega Report 2020 [China E-commerce + Marketing Q4 Outlook]

3. Beware of the KOL bubble and grow your own brand KOLs

Brands need to do better research when it comes to selecting the KOLs to work with. KOLs in China are huge and often expensive. While many are great content creators, many numbers they share are inflated, creating a KOL bubble. For instance, one post on Weibo costs: over 69,000 RMB for one top-tier KOL, over 26,000 RMB for one mid-tier KOL and over 10,000 RMB for one micro KOL. It is reported that up to 80% of KOLs are using one or more fake metrics, especially on Weibo. Apart from blogger fees, advertisers need to pay for posts promotion and advertising to help the blogger to grow.

Smarter brands are building their own KOLs now. They usually take a blogger and offer an employment contract with the company for 2-3 years (the average lifetime of a KOL). The blogger then becomes an in-house content creator, promoting for just one brand while still creating high-quality content for their audience. Brands can therefore achieve a higher conversion rate and repurchasing rate at a much lower cost in the long term.

Source: ChoZan Mega Report 2020 [China E-commerce + Marketing Q4 Outlook]

4. Going local and guochao will enhance further growth

Brands can achieve better business results when they decide to go local and ride the wave of national pride known as “guochao (国潮)” by properly collaborating with local brands. This is particularly helpful in instantly reaching and connecting with young consumers who have a strong sense of national pride. Millennials and Gen Z have a substantially higher consumption of guochao products compared to other generations. Collaborations between apparels or sneakers brands have proven to be the most effective touchpoint to reach young consumers, accounting for over 60% total spending in collaboration products.

5. Cross promotion 2.0 is here

Collaborations are the name of the game in China in 2021. Everyone has seen it all from brands co-creating products with celebrities, a few brands in the same industry coming together to craft a product such as the Ejiao coffee by Dong’e Ejiao (东阿阿胶) and Pacific Coffee. More often, the collaboration is done between 2 completely different industries, like the famous Chinese chilli sauce, Lao Ganma’s streetwear at New York fashion week. There have been lots of very well-received cross promotions between brands and across completely different industries. This trend is ones to watch in 2021 as more innovative collaborations across brands are expected.

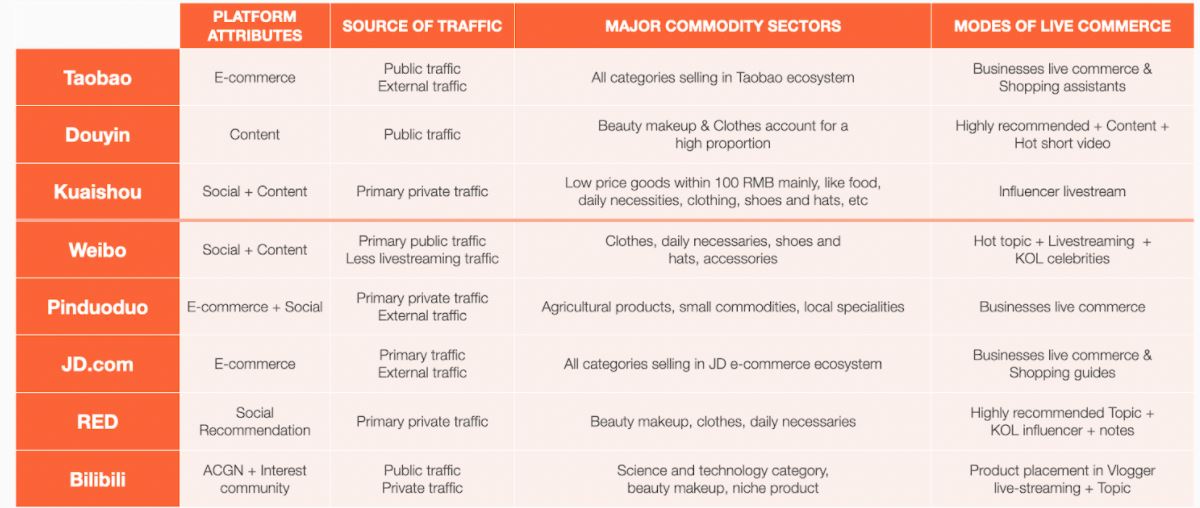

6. E-commerce and social media will become more alike

E-commerce platforms will continue to be developing more content-based functionalities and social media to develop more sales functionalities. Both types of platforms are trying to make their systems more comprehensive so they can out-compete each other and lock in user insights in their own ecosystem. Content platforms such as Douyin, RED and Weibo are introducing their shop functions and restricting external links. E-commerce platforms such as Tmall are focusing extensively on growing its social community through Weitao and Taobao Live.

7. Stay on top of emerging consumer groups and their changes

It’s not enough to target the whole broad customer group as your key audience. You want to be specific and include at least 3 characteristics to your target customers so you can build concrete consumer profiles. For instance, instead of defining your target audience as “Millennials”, you should try to add at least 3 specific characteristics to your target audience by defining them as Millennials in tier 3 cities who are home-cooking enthusiasts. Make sure you are aware that within each big consumer group lies multiple distinctive consumer segments.

8. Always produce amazing content

This is the trend that never gets old. Brands need to produce meaningful, relevant and interactive content at all times. Figure out the optimum types of content that work for your audience on your intended platform. The content brands publish should always be relevant to the hot topics and the big picture. Before COVID-19, China has already been changing so fast. At post-COVID-19 era, the already fast China speed is on steroids. The content cannot only be great, but it also needs to be on top of the ever-changing environment.

This China Ecommerce + Marketing Q4 Outlook Report also goes into detail on 4 e-commerce platforms – Alibaba’s Tmall, JD, Pinduoduo and Kuaishou; 9 social media platforms – WeChat, Weibo, Douyin, RED, Bilibili, Zhihu, Kuaishou, Weitao and Toutiao; 3 most important online shopping festivals – Double 11, 618 and CNY.

Download the ChoZan Mega Report 2020 [China E-commerce + Marketing Q4 Outlook] to be equipped with the latest knowledge right now.