Now is the prime time to start your travel retail market strategy, and this report shows why.

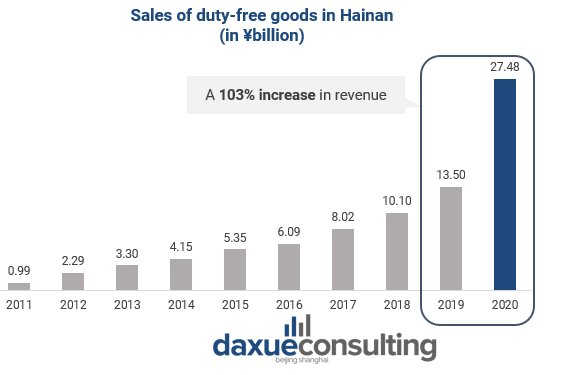

The new duty-free policies boost domestic travel retail shopping in China, including a cancellation of the 8K RMB / person spending limit for each item. Sales of Duty-Free goods in Hainan increased 103% YoY in 2020. Lastly, Brick and mortar duty free stores and pop-ups are becoming tourist sites themselves, brands ranging from Uniqlo to Prada are tapping into this opportunity.

To learn more China travel retail facts and strategies, download our report!

After absorbing Chinese tourism consumption that previously belonged to other countries, the travel retail market in China is expected to reach ¥150 billion by 2025.

New opportunities for the travel retail market in China under COVID-19

The new duty-free policy under COVID-19 boosted Hainan duty-free sales

As travel to other countries was impossible during China’s Covid-19 outbreak, the annual duty-free shopping allowance increased to ¥100,000 per person for travellers in Hainan. Moreover, the categories of duty-free goods available for consumption increased from 38 to 45. As the demand was very high, the Chinese government raised the purchase limits on cosmetic products from 12 items to 30 items, indicating travellers can purchase more duty-free cosmetics in Hainan than before. This resulted in a surge of duty free sales in Hainan, doubling sales revenues in 2020 compared to the previous year.

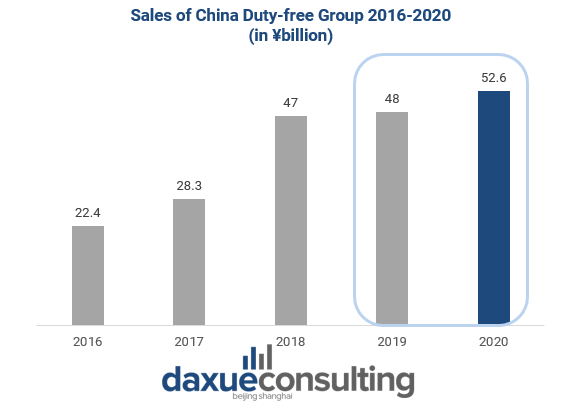

The CDF Group launched a membership service “CDF 会员购”

“CDF 会员购” is a new Chinese E-commerce platform launched in June 2020 that experienced significant growth during COVID-19. The CDF Group had a 9.5% sales volume growth and 35% net profit growth in 2020. The sales increase is due to new online channels and effectiveness of the new duty-free policy.

Although customers cannot enjoy duty-free price on it, with CDF Group’s strong purchasing and bargaining power, CDF 会员购 offers a lower price than other non-duty-free channels like Taobao.

The CDF Group also allows tourists to order online: it means that travelers to Hainan can enjoy duty-free prices without physically visiting retail stores.

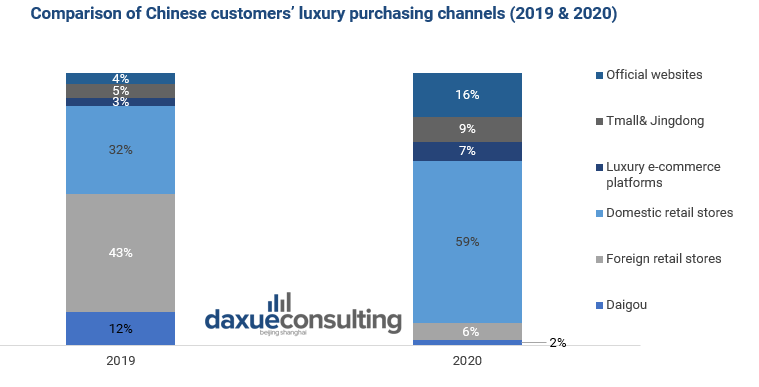

COVID-19 changed Chinese luxury consumers’ buying patterns

In 2020, sales through online and offline domestic channels increased while those through overseas channels decreased. Due to the restrictions on international travel and the release of China’s new offshore tax-free policy, sales through domestic retail have increased 27%. However, sales through Daigous – expatriates buying duty free goods abroad for Chinese customers – decreased by 10% as travel restrictions and interruption on global supply chain have limited them from transporting luxury goods either in person or through mail.

Currently, brands are heavily promoting their online channels driving the cross-border e-commerce market. It led to the fact that sales through brands’ official websites increased from 4% to 16%.

The role of brick-and-mortar channels for travel retail market in China

One emerging trend is brick-and-mortar stores creating memorable experiences to become tourist destinations. For example, in 2019, fashion brand IGFD opened its first self-owned department store, LE TEMPLER ON THE BUND, in Shanghai. IGFD turned the retail stores to ‘insta-worthy’ photo points that are almost tourist attractions within themselves. Therefore, brands can ride the hype for Instagrammable spots -which can be as simple as an interesting wall by leveraging the “check-in” trend on social media. Besides, global travel restrictions provide an opportunity for brands to recreate reminders of famous destinations for consumers and play on customers’ nostalgia.

Offline channels offer premium experience to customers

Some brands are focusing both on online and offline channels. For instance, Winona, a renowned skincare brand in China, has integrated offline and online features. Winona consultants, in-store, build ties with customers and then direct them to make purchases on brand’s WeChat platform.

In general, brick-and-mortar channels provide a means for brands to stand out in a market increasingly saturated with online options. Chinese consumers shifting to value experiences, and not just product ownership: they are more likely to make a purchase if personalization services are offered. Such service includes in-store complimentary treats (eg: champagne).

Pop-up shops are attractions to Gen Z and Millennials

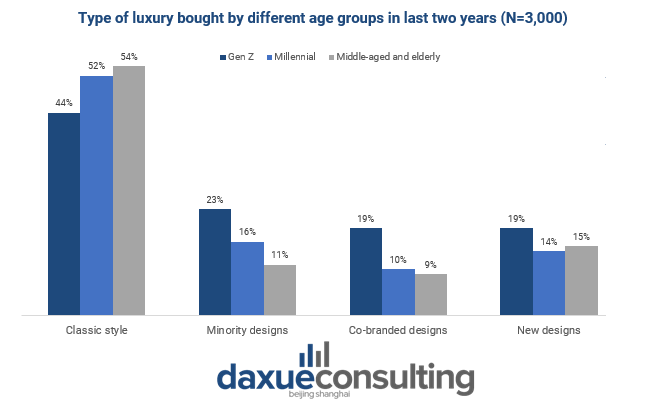

Data Source: Bain Company & Tmall, designed by daxue consulting, Type of luxury bought by different age groups in last two years (N=3,000)

Some brands are using limited time exclusivities and co-branding as selling points to appeal to Millennials and Gen Z. The latter are the most willing to try minority, co-branded and new designs. Pop up stores create excellent user experience through online-offline integration by allowing users interact with elements in the pop-up store through their smartphones to create an immersive experience. Brands release information online to attract users to join the activities in the pop-up stores, allowing users to combine the brand image with the featured offline pop-up stores, creating unique experience.

Luxury flagship stores are generally considered high-end and exclusive and therefore, they may not be able to reach a wider range of customers with purchasing power, such as Gen Z and Millennials.

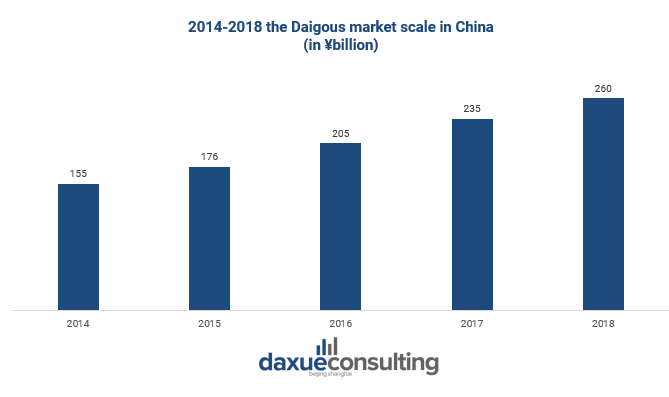

Daigous, a travel retail disrupter in China

China’s daigou market has developed rapidly in recent years. It reached ¥260 billion in 2018. However, after 2018, the E-commerce Law came into effect, requiring e-commerce practitioners to become compliant and pay taxes. At the same time, with the emergence of various cross-border e-commerce and brand websites, Daigous’ market share started to shrink.

China’s crackdown on Daigous is part of its moves to strengthen E-commerce regulations and better control the rapidly expanding sector. Although, with the opening of the tax-free policy in Hainan province, Daigous are still rampant.

How luxury brands can continue to thrive in the travel retail market in China

There are many ways for brands to stay successful in the travel retail market in China. For example, they can explore having more “mainstream” luxury products to market to the masses who hope to own their own piece of luxury item. Alongside with mass marketing, brands should also cultivate more exclusive lines of products while offering customization. Namely, emphasizing upon Haute Couture could be a way for brands to preserve their exclusivity.

Another way is “Always-on” marketing which can include brands livestreaming from Hainan duty-free stores with the goal of tempting consumers to pay a visit to stores in person, and hence generate constant publicity and hype. Brands can also engage Key Opinion Consumers (KOCs) with a strong presence on social media, in order to further cultivate ‘brand envy’ and a sense of aspiration among consumers to own luxury products.

What to expect from the travel retail market in China

- According to the research institute CEPII, China’s 14th 5-Year Plan will attempt to ensure greater investment in human capital in all regions. Yet, with the concurrent investment in innovation and technology, China’s north-south divide is also widening.

- Brick-and-mortar stores and brands that are hoping to leverage the pop-up store concept should be aware of the characteristics of each Chinese city – whether they feel that their brands and stores would do better in well-established Chinese cities, or that they are well-placed to leverage their first-mover advantage.

- China’s ultimate goal is to “restore the Middle Empire at the centre of Asia” according to CEPII. Such nationalism is likely to also be pronounced in the travel retail market in China, hinting that the Guochao trend is only likely to get stronger.