Since the pandemic, the total retail sales of consumer goods in China have been greatly affected. From January to May 2022, the total retail sales of consumer goods amounted to 17.2 trillion yuan, a year-on-year decrease of 1.5%. The local epidemic has spread in many places, affecting most provinces in the country, and the operation of the consumer market is under pressure. The mainland market is the largest market for most Hong Kong brands. Due to the impact of the epidemic and the continuous emergence of new brands, established Hong Kong brands have begun to transform themselves.

In the mainland Chinese market, Generation Z is becoming the leading consumer group and the backbone of social development. Today, China has over 342 million active Gen Z internet users. As a result, established brands have gradually begun to focus on brand rejuvenation transformation and move closer to the younger demographics.

For established local brands in Hong Kong, they have taken different measures to capture the young Chinese market. Mainly divided into two categories, one is to expand the diversity of business, and the other is to increase the richness of marketing, especially social media marketing. This article selects four leading and established Hong Kong companies in the cosmetics retailing, jewellery, F&B, and hospitality industries for analysis of how they sustain in the Chinese market and ‘do business with young people’.

Watsons (屈臣氏)

Founded in 1828, Watsons is a pharmacy health and beauty care chain in Hong Kong, operating nearly 8,000 stores and 1,500 pharmacies in 14 markets in Asia and Europe. Watson’s shopping guides have become the beauty enlightenment tutors of young people of the previous generation in China with their enthusiastic service.

At present, more and more young Chinese people have anxiety or ” social fear” (社恐, fear of socializing with other people) as they rely on the Internet to learn about cosmetics, therefore, not wanting to be “disturbed” by shopping guides. Under this trend, a large number of new beauty boutiques have emerged in mainland China, such as HARMAY, COLORIST and so on. These boutiques have the characteristics of “store space aesthetics”, “free shopping without guide”, and how “orders can be placed both online and offline”, which have become rising competitors of traditional beauty store Watsons. According to offline research by iResearch, the average daily passenger flow of a new-style beauty collection store in 2021 is 750, while that of a traditional beauty collection store is only 480.

Watsons, which started as an offline retailer, has expanded to online sales channels. E-commerce is the most essential and prevalent platform for beauty consumers in China. Over 62% of Gen Z consumers choose to shop online; whereas 30% of beauty shoppers buy products offline. Watsons began to launch the “Cloud Store Mini Program” on WeChat, combining online mini-programs, livestream, communities, etc., with offline stores across the country, and more than 40,000 BA companies and micro-enterprises to form an “O2O” system (offline to online).

On February 28, 2021, Watsons signed Chinese singer, Cai Xukun (蔡徐坤), as the brand spokesperson and launched the brand advertisement song “You who love 105°C”. However, despite the song being popular, the brand did not receive the same positive feedback as few people recognize that it is a Watsons brand song.

Chou Tai Fook (周大福)

Chow Tai Fook Group is a privately held conglomerate headquartered in Hong Kong, principally engaged in the gold jewellery business. At present, Chow Tai Fook has become the number one gold jewelry retailer in China. In the “Global Powers of Luxury Goods 2021” released by Deloitte, Chow Tai Fook has become the world’s tenth largest luxury goods company with a total sales of about 45.9 billion yuan and is the only luxury group in China to enter the top ten. This list also includes other brands such as LVMH, L’Oréal Group, Hermès, and Chanel. In other words, Chow Tai Fook is currently the most competitive Chinese luxury brand.

Gold has been loved by Chinese consumers since ancient times. Hong Kong and domestic brands align with consumer preferences and have channel and supplier advantages. They account for most of the top ten brands in China’s gold jewelry market. People tend to choose gold jewelry with investment value preservation in times of economic downturn. Likewise, Chinese people have a tradition of purchasing gold jewelry when getting married, so young people’s enthusiasm for gold consumption continues to rise. According to the China Gold Association, gold consumption in China was 1,120.90 tons in 2021, a year-on-year increase of 36.53%.

Chow Tai Fook released the 2022 fiscal year performance report from April 1, 2021, to March 31, 2022. The data shows that the group’s 2022 fiscal year turnover increased by 41% to HK$99 billion (approximately ¥87.74 billion and US$12.62 billion) compared to the previous year, and the profit attributable to shareholders of the company (i.e. Net profit) rose by 11.4% to HK$6.7 billion (approximately ¥5.94 billion and US$0.85 billion), the highest profit attributable to shareholders since 2014. In the fiscal year cycle of 2022, the group’s share price rose from HK$10.84 per share to HK$14.26 per share, an increase of 31.5%.

Chow Tai Fook’s success is predominantly attributed to its rejuvenation and branding strategy. The younger generation of consumers today pay less attention to the purity and weight of gold and care more about the design and aesthetic elements of the jewelry itself. After realizing this, Chow Tai Fook jewelry removed the heavy feeling of traditional gold jewelry and chose relatively smaller and simpler designs. So far, Chow Tai Fook’s co-branded brands and IPs including famous singer Jay Chou (周杰伦), Ultraman, HELLO KITTY, British Museum, Disney… have all been recognized by the public. In addition, Chow Tai Fook set up offline pop-up stores, which gave full play to the brand value.

Maxims (美心)

Founded in 1956, Maxim’s Group is the largest and most diversified high-quality catering group in Hong Kong. It owns more than 70 well-known brands, including Hong Kong Maxim’s Mooncake, Jade Garden, Maxim’s Mooncake, PAPER STONE, Maxim’s Bakery, Shake Shack, Star Miller, Cheesecake Factory, Genki Sushi, Ippudo, Dondonya, Senryo and Yakiniku Like etc.

Maxim’s Group grasps the quality of its products by establishing its own factories in mainland China. At the same time, there are thousands of chefs from over 70 brands to ensure innovative iterations of the taste in food.

Maxim’s mooncakes were first renowned in mainland China and became one of the most popular products. In order to maintain its market share, in addition to its continuous innovation in taste, Maxim’s mooncakes have been topping the sales list of major e-commerce companies for the past two years.

Maxim’s announced Julian Cheung (张智霖), a famous singer and actor in the mainland and the Greater Bay Area, to become the spokesperson and even launched a short film for Mid-Autumn Festival in 2022. The film focuses on the alienation in intimate relationships, marital and family conflict, and parent-child companionship. Receiving over 10 million views on television, the hashtag #Your heart knows the moon# (#你的心意月亮都知道#) also attracted over 120 million views and 90 thousand discussions on Chinese social media Weibo. Maxim’s mooncakes resonate with young consumers through content marketing that is close to their life.

Mandarin Oriental (文华东方)

Mandarin Oriental Hotel Group is an international hotel investment and management group, which owns top luxury hotels and resorts all over the world’s famous tourist destinations.

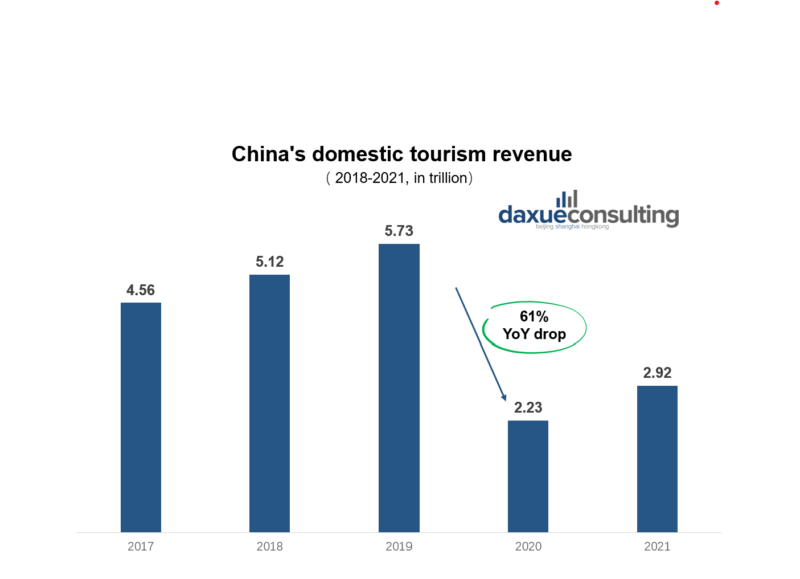

In 2019, China’s domestic tourism revenue reached 5.73 trillion yuan. However, in 2020, the COVID-19 pandemic caused domestic tourism revenue in China to plummet by 61%. Although looking more optimistic, China’s domestic tourism revenue in 2021 was still only half of the level pre-pandemic, at 2.92 trillion yuan.

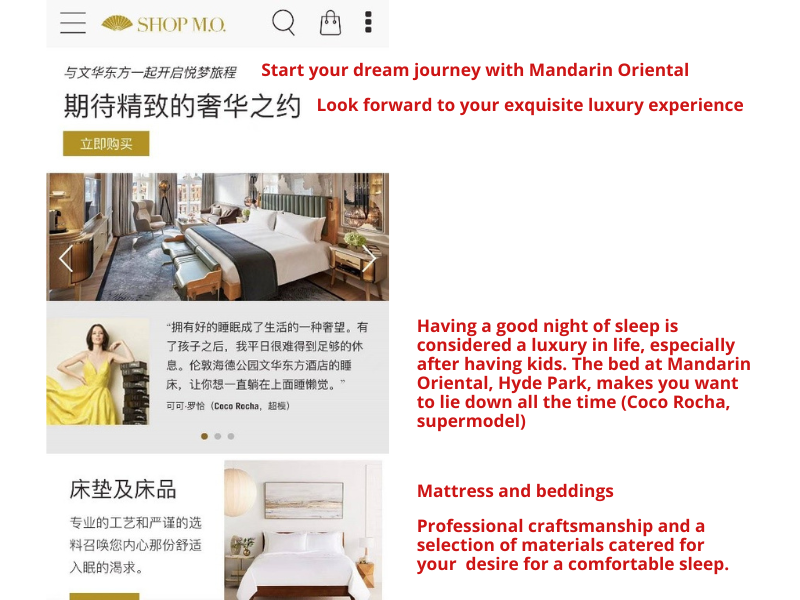

The hit in tourism from the pandemic has also affected the hospitality industry. Mandarin Oriental has expanded its operations and increased its revenue amid a recovery in tourism. The hotel has continuously launched “mini trip” packages, and through a full set of dining, drinking, and entertainment services, it has attracted a group of young people who cannot travel abroad. In addition to this, Mandarin Oriental has developed an online retail platform, “MOve in Home”, to provide guests with a selection of high-quality experiences at home. This platform sells lifestyle products such as beddings, spa, and bathroom products, as well as custom-made products from its hotels around the world to create the comfort of a Mandarin Oriental hotel at home.

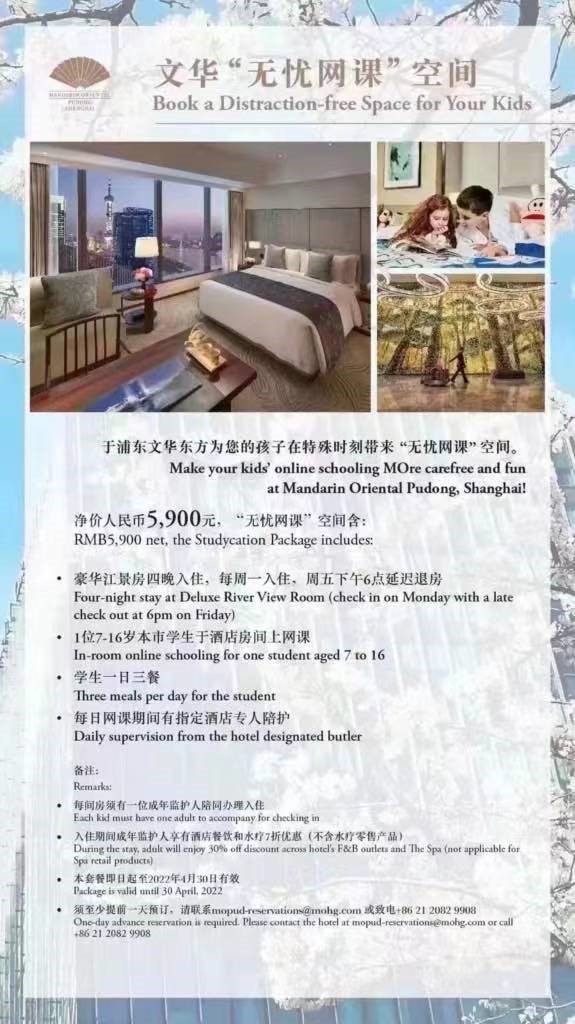

During the 2022 lockdown in Shanghai, Mandarin Oriental Hotel also launched a “studycation” package, providing a supervision service and three meals a day for children who are unsupervised during online classes on weekdays. According to an interview from Tatler, most of the customers who purchased the “studycation” package at Mandarin Oriental in Pudong had children at the age of twelve or thirteen years old, with a few as young as seven to eight. Children in each room also receive at least one full-time hotel caregiver. In addition to monitoring children’s learning progress, a nutritional-based diet was created for cultivating children’s eating habits and soothing parents during the pandemic. Such a move by Mandarin Oriental Hotel is an out of self-help under the current situation.

Key takeaways of how traditional brands kept up with the evolving consumers of China

- Due to the continuous local spread of the epidemic across China, the total retail sales of consumer goods during the first two quarters of 2022 experienced a year-on-year decrease of 1.5%.

- As a result, established brands in Hong Kong have begun to transform themselves, such as Watsons, Chou Tai Fook, Maxims, and Mandarin Oriental.

- E-commerce is the most important consumption channel for beauty consumers in China, with over 62% of Gen Z consumers choosing to shop online.

- Young people’s enthusiasm for gold consumption continues to rise. China’s gold consumption in 2021 is 1,120.90 tons, a year-on-year increase of 36.53%.

- In 2020, due to the impact of the new crown pneumonia epidemic, domestic tourism revenue plummeted to 2.23 trillion yuan, a drop of 61%. In 2021, domestic tourism revenue is 2.92 trillion yuan, still only half of the level before the epidemic.

- As travelling abroad remains relatively difficult for Chinese people, hotel groups such as Mandarin Oriental are offering a variety of services to cater to consumers of different age groups.