China has been experiencing big and rapid change for the past 20 years both economically and ideologically, and so have its tastes. As China gradually evolves into a consumer society, new products, including candy & confectionery, are appearing with increasing regularity. Rising disposable income, increased exposure to Western and international cuisines and a greater array of confectionery goods in supermarkets are all working together to boost China’s confectionery market. Sales are estimated to reach USD 18.8 billion (RMB 127 billion) in 2022, combined with a compound annual growth rate (CAGR) of 3.2% between 2016 and 2020.

Growing market, growing opportunities

The rapid growth of China’s candy & confectionery market in the latest decades has induced more and more domestic and international players to want to get their own piece of the cake. There were 594 domestic candy corporations in 2021, most of which were small and medium-sized players. Nestlé acquired 60% stock ownership of Hsu Fu Chi, the biggest China candy brand in 2021. Following that, Hershey acquired Jinsi Food, another dominant player in China in 2015.

Both the invested capital and the number of foreign brands entering the Chinese confectionery market are increasing. According to the Association of Chinese Chocolate Manufacturers, candy & confectionery consumption per capita in Europe was about 7kg in 2021, while it was only 0.7kg in China. Therefore, the market still boasts great growth potential.

Fierce competition between international and domestic players

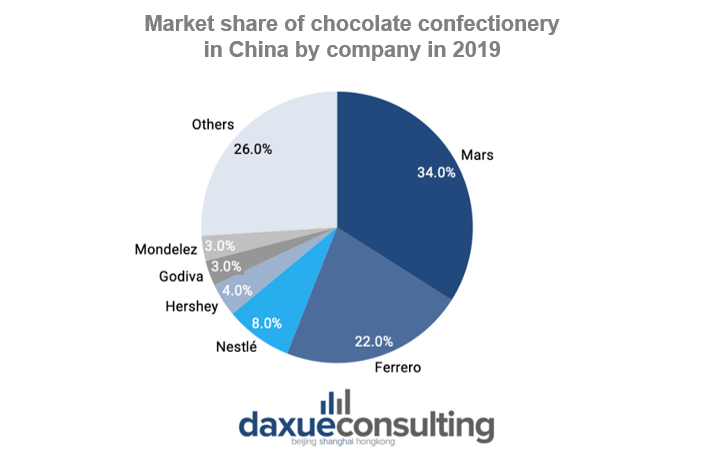

The domestic candy & confectionery industry is expanding, and various international candy brands, such as healthy conscious, low-sugar-oriented, and eco-friendly companies are rushing to enter China’s candy market. Foreign brands like Mars & Wrigley, Ferrero, Nestle, Hershey’s, Godiva, and Mondelēz dominate the high-end segment of the market. For what regards chocolate confectionery in China, these international brands took up over 70% of the whole chocolate market share in China in 2019.

A well-structured brand positioning strategy is a key factor for foreign brands to be successful. Chinese consumers pay increasing attention to raw materials and the origin of candies & confectionery goods, in which the foreign brands, targeting high-end market, are considered ‘premium’. As a result, foreign brands are more welcome than domestic ones.

When we look at domestic candy & confectionery enterprises, the competition mainly focuses on price level and targets low-end consumers. Thus, they are weak in the new product development compared to foreign corporations. High product substitutability seriously hinders the competitiveness of domestic candy brands and favors foreign players.

Moreover, major markets for domestic brands are in 2nd and3rd tier cities, while high-end consumers mostly reside in higher tier cities.

How homegrown players might scale China’s confectionery market

To break through the barriers domestic candy producers might firstly focus on product upgrade as targeting high-end customers would result in higher profits per sale.

Secondly, it is important for brands to expand product categories to cover a wider range of confectionery goods. Tapping into consumers’ taste and emotional needs is also key to building a significant and long-lasting business since nowadays candies & confectionery goods are much more than just snacks in China: they are a way to express someone’s feelings. For instance, Valentine’s Day, is among the best opportunities for confectionery companies to launch campaigns and boost sales.

Last but not least, setting up stronger brand identity and proper positioning could be an effective way to stand out from the crowd. Segmenting customers based on their ages, genders, tastes, and needs, and targeting specific products to each segment is much more efficient than proceeding blindly.

White Rabbit showed that co-branding can be a tremendous tool for attracting Chinese youngsters

White Rabbit candy is a milk-based white candy wrapped in paper-like sticky rice and manufactured by Sheng Yuan Food Ltd. since 1959. Even though the brand has been operating for over 60 years, it was not afraid to expand its product mix, including adding new flavors such as chocolate, coffee, and strawberry.

Beyond product expansion, it actively sought to differentiate from other players by entering other FMCG segments, such as bubble tea. In 2019, the White Rabbit collaborated with Happy Lemon, a leading player in the milk tea market and developed six ‘White Rabbit milk teas’ with different toppings and flavors.

The collaboration was very successful as the sales of bubble tea per store reached 1,000 cups per day. Novelty is an important driver of success in China. Indeed, Chinese young customers were surprised that the same candies they have been eating since childhood could be combined with new-style milk tea.

White Rabbit’s experience illustrated that co-branding can be a powerful tool for confectionery brands to reach audience.

Holiland: the chocolate cake that went viral on Xiaohongshu

Holiland is a Chinese bakery brand established in 1992, with a focus on cakes, bread, and bakery. It developed a popular chocolate cake that received 19k+ notes on Xiaohongshu. Even though Holiland is not a pure confectionery brand, its product strategy can be seen as an opportunity for domestic confectionery brands to learn from.

From the customer perspective, the taste of candy and confectionery goods is no longer the main purchasing driver since today’s customers want to eat with their eyes as well. By developing attractive cakes and relying on famous Chinese Key Opinion Leaders, Holiland gained great popularity among Chinese youngsters.

A similar strategy can be applied to domestic confectionery players. Combining good-looking confectionery goods with online marketing channels is becoming more significant than ever. It is thus a great opportunity for domestic brands to differentiate from other players and eventually charge a higher price for their “viral” product.

5 takeaways from China’s candy & confectionery market

- China’ s candy and confectionery market is booming.

- Foreign brands dominate the high-end market, while the domestic ones concentrate on the low-end market, which gives them lower profit.

- Expanding the product mix, tapping into customer’s emotional needs, segmenting and targeting customers with different products are three main approaches for domestic brands to grow in this highly competitive market.

- As shown by White Rabbit, collaborating with other F&B brands can be a clever way to capture Chinese novelty-loving young consumers.

- Holiland’s strategy of building ‘internet-famous’ products could be another opportunity for domestic players to explore further.