ChaPanda (茶百道) made its debut on the Hong Kong Stock Exchange on April 23rd, earning the title of “the second stock of new tea beverages (新茶饮第二股)” after Naixue, and emerging as a major player in China’s freshly-made tea beverage market by 2023. However, ChaPanda’s stock faced a 10.06% drop on its first day, signaling the intense competition in the new tea beverage market as it hasn’t received a positive response from the capital market. This triggered a heated discussion on Weibo over the hashtag #ChaPanda dips over 10% on the first day after its IPO# (茶百道上市首日跌超10%) during the last week of April, garnering over 49 million views.

Download our report on Chinese beauty consumer pain points

Coffee culture on the rise: China’s tea titans market entry

According to iResearch, China’s new tea beverage industry is projected to see a gradual decline in growth rate from 13.4% in 2023 to 5.7% in 2025. With increasing competition, Mixue Ice Cream & Tea (蜜雪冰城) entered the coffee market with its brand Lucky Cup (幸运咖), while ChaPanda launched its coffee subsidiary in December 2023 in Chengdu, seeking new growth opportunities in the food and beverage sector of China. This move might intensify competition in the already fierce coffee industry, implying shifting preferences from tea to coffee culture among Chinese consumers.

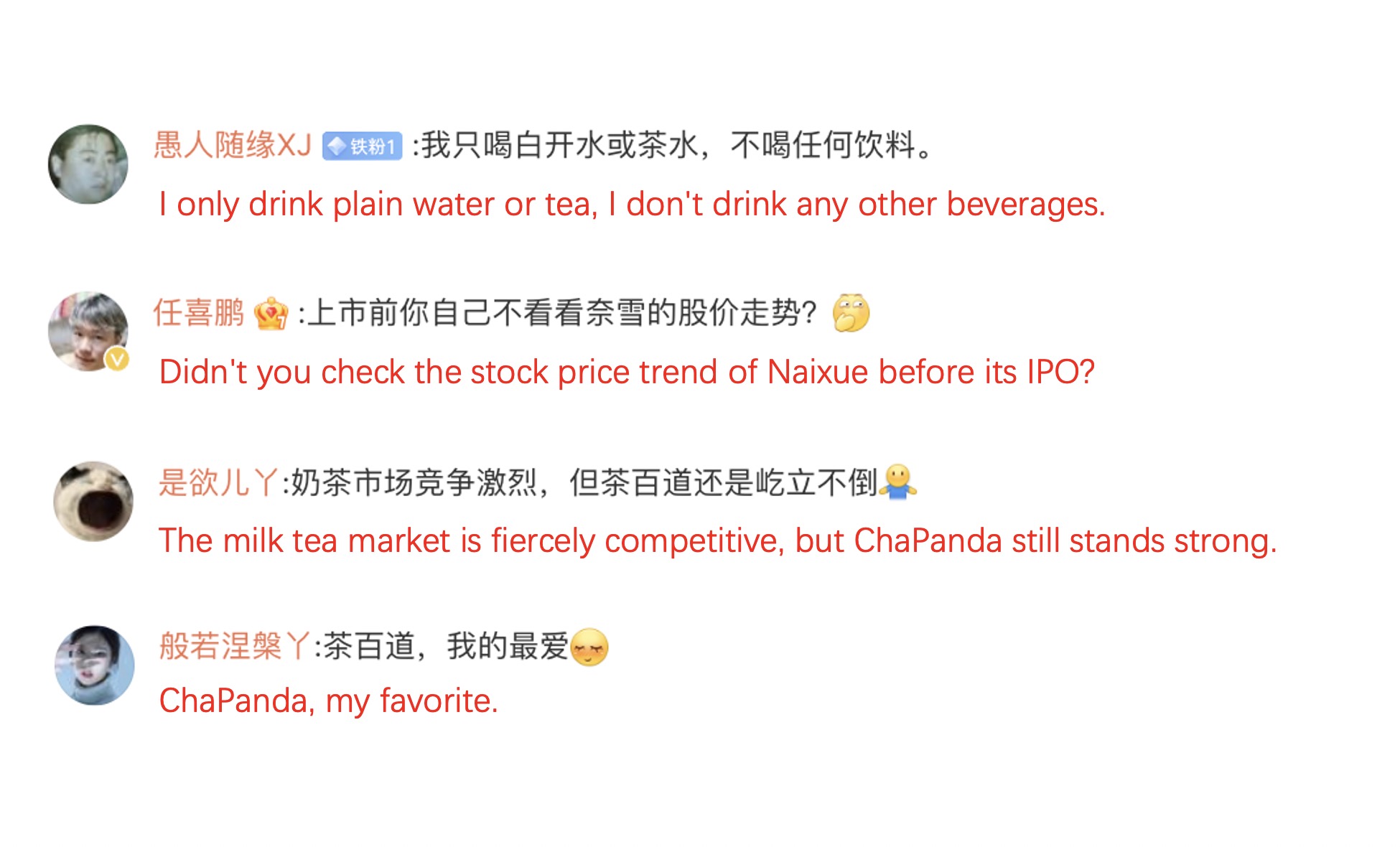

On this matter, many netizens shared their perspectives under the hashtag. On the one hand, some praised ChaPanda for maintaining strong competitiveness despite the stock drop. Alternatively, some expressed relatively negative views on this. “It would soon drop by 40%,” a netizen jokingly said.

ChaPanda dips sparks Weibo firestorm on its IPO plunge

- ChaPanda’s IPO debut takes a hit, triggering a viral discussion on Weibo with the hashtag #ChaPanda Dips, reflecting intense competition in the tea beverage market.

- Mixue Ice Cream & Tea and ChaPanda venture into coffee, aiming to tap into China’s growing coffee culture amidst projections of declining growth in the tea beverage industry.

- Weibo users share mixed reactions to ChaPanda’s stock drop, highlighting contrasting sentiments towards the company’s future prospects.