China, as a major emerging market

The role of the agricultural sector in ensuring the sustainability of the Earth’s natural resources has become an increasingly pertinent topic in light of recent demands for the improvement of sustainable practices and environmental awareness across global markets. Emerging markets, in particular, play a crucial role in the global effort to combat deforestation and promote sustainable trade of agricultural commodities. China, as a major emerging market importer and rapidly growing consumer class, could lead this global effort by reducing its environmental footprint of commodity sourcing and buying more commodities from sustainable sources.

Urgent need for a change in commodity sourcing patterns in the emerging markets – Large environmental footprint, food security, etc.

Significant deforestation will occur if the middle-class commodity consumption continues at its current rate of growth with little regard for sustainable sourcing. Thus, there exists a critical need for a mindset change in these emerging markets for more sustainable commodity sourcing. AlphaBeta’s analysis indicates that current Chinese and Indian import demand for soy, palm oil, and beef combined with Brazil and Indonesia’s domestic consumption, contributed to approximately 855,000 hectares of deforestation in 2015. This makes up 11% of the estimated 7.6 million hectares of forest area lost annually according to the Food and Agriculture Organization. In addition, AlphaBeta also estimates that deforestation could heighten to 16% by 2025 – this is equivalent to a deforested area the size of Jamaica.

China can be a major player in addressing tropical deforestation challenges

Continuing down the BAU (“Business as usual”) approach could lead to significant deforestation by emerging markets. If BAU were to be reversed, China could potentially reduce its environmental footprint on commodity sourcing by 55%. Soy, palm oil, beef, and wood products are four commodities driving deforestation. China’s and India’s imports, combined with Brazil’s and Indonesia’s domestic consumption of deforestation-related commodities, could rise by 43% to 264 million metric tons (equivalent to 37% of global production) in the decade through 2025. China and India are the major emerging market importers, while Brazil and Indonesia are the major emerging market producer-consumers. Together, these markets account for around 40% of global demand for some of these commodities, and this share will continue to increase by 2025. China and India’s importance in global supply chains is even more apparent solely in imported demand. By 2025, the share of global raw soybean imports that end up in China and India is expected to increase from 62% to 67%.

Emerging markets are showing signs of interest in sustainably sourced products, but barriers remain

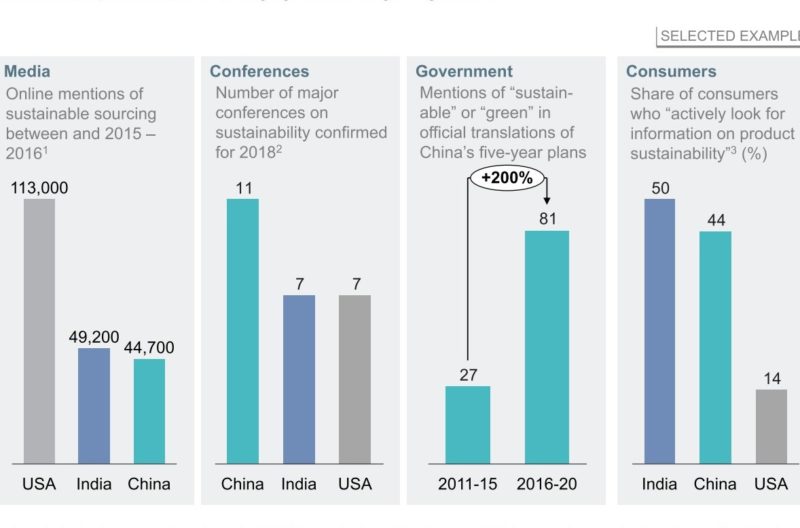

Chinese producers and consumers have shown interest in sustainably sourced, green products. JD’s 2018 report on Trends in Green Consumption Development, revealed that consumers are increasingly turning towards sustainable goods as the total volume of green purchases made increased by 70% after active introductions of more green products on their platform, attributing to a total 15% rise in sales. Online mentions of sustainable sourcing between 2016 – 2015 reached 44,700 in China, though it is still much higher in the US, reaching 113,000 mentions. Official translation of China’s Five-Year Plan of 2016-2020 shows three times as many terms related to sustainability as the previous Five-Year Plan, demonstrating interest from the Chinese policymakers on environmental issues. The Emerging Markets Consumer and Deforestation Report cited a survey revealing that 34% of Brazilian consumers, 44% of Chinese consumers and 50% of Indian consumers surveyed “actively look for information on product sustainability.” Yet, an overall awareness for environmental sustainability and the role of sustainably sourced products still remains low.

Food-safety issues are the leading concern for Chinese consumers

Additionally, food-safety issues are still the leading concern for Chinese consumers. Other barriers preventing change towards sustainable sourcing in China include additional costs of sustainability standards, the higher retail price of products, lack of clear standards, and challenges in supply chain transparency to ensure compliance with sustainability standards in place. Generally, there exist economically viable and sustainable technologies for more sustainable practices, but barriers to their adoption have yet to be overcome.

Challenges facing global supply chains in the Chinese market

The issue of food security through sustainable supply chains is both a national and global issue for China. The government is reducing the amount of land use for agriculture in China, thus, meeting domestic demands for agricultural commodities affects the international supply chain. Presently, China’s huge demand for soy and palm oil are largely met with imports – around 90%. AlphaBeta shows that increase could develop even further, reaching up to 94% for some commodities in 2025. Sustainability transitions also create risk for firms, as new standards and changes would create disruptions into operational, regulatory, and reputational risks to companies. If stricter industry standards were to be implemented, and firms that agree to follow guidelines and develop more sustainable practices are not able to follow through with these demands, there could be serious risks to these firms. Additionally, Chinese government interest can also be faced with risks, as declaring a national interest with a failure to commit would also pose threats to its national image and undermine their efforts.

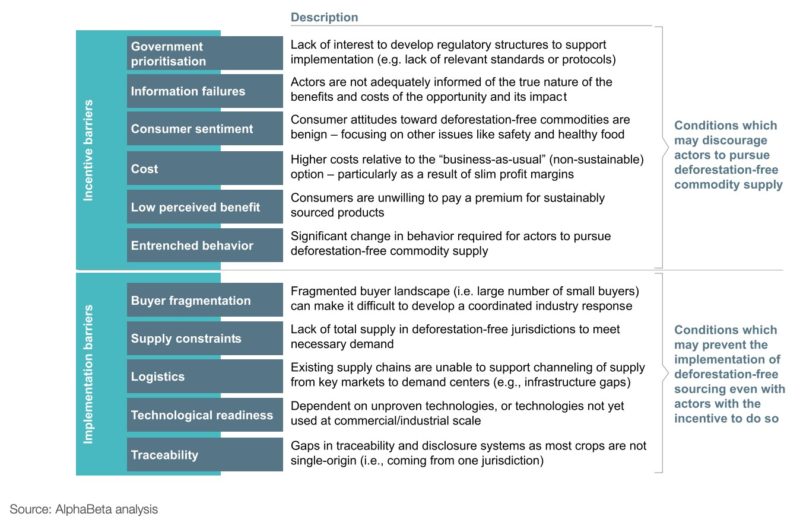

Summarized by the World Economic Forum’s Tropical Forest Alliance 2020, barriers can generally be broken down into two categories: incentive barriers and implementation barriers. Incentive barriers refer to those that discourage actors from pursuing a deforestation-free commodity supply, and implementation barriers are those that may prevent the implementation of deforestation-free sourcing even when actors do have an incentive.

Sustainable sourcing of soy in China is a top priority

China is the world’s largest consumer and importer of soy, making China the largest driver of soy-related deforestation. The Carbon Disclosure Project (CDP) report reveals that “in 2015, Chinese soy imports represented about 65% of the global soy trade, with imports supplying 85% of soy consumption in China.” These rates are still experiencing annual growth. Brazil leads the soy trade relationship in China, with over 50% of soy imports to China coming from Brazil alone. Under the Paris Agreement, China has taken a strong stance in decreasing domestic greenhouse gas emissions. However, additional costs for farmers to produce sustainable soy will be $3-$4 metric ton. Profit margins in China are slim, as processing costs have to be at least $20 to be profitable; thus proving to show an incentive barrier.

“China, the world’s largest producer of goods, causes international concern because of the high emissions embodied in its exports.” – The Carbon Disclosure Report, October 2017

This brings up the conversation of indirect commissions, where China is most relevant given the high emissions created by its exports. Yet it tends to be a sensitive topic given the numerous high-emitting industrial operations that are producing Chinese exports for consumption in other countries. Additionally, non-domestic greenhouse emissions associated with Chinese imports are not addressed in Chinese trade commitments, and there is a general lack of progress on the issue of addressing emissions in third countries in the international community. However, international precedent for deforestation has been studied by the European Commission. The Chinese government departments responsible for timber and wood products have analyzed the EU Timber Regulations[ , and considerations on wood and timber can possibly be used as a basis for potential soy regulations in China.

Business risks to sustainable sourcing of Soy in China

Similar to the challenges facing global supply chains, Chinese companies are faced with business uncertainties when it comes to sustainable sources of soy, acting as big barrier in the sustainability push. Presently, these companies face implementation barriers, such as the lack the guidance at a national level, as well the transparency to ensure buyers are purchasing from sustainably produced soy. In 2017, the CDP interviewed 28 international companies operating in China already having individual policies to address high-risk commodities in 2017 about the risks associated with deforestation and sustainability concerns. The results reveal:

- 82% have risk assessment procedures in their direct operations;

- 57% have systems in place to trace, monitor or track the origin of raw materials;

- 11% have corporate targets to avoid deforestation impacts of their supply chains.

Chinese livestock industry shows significant support for sustainable beef

In 2018, the China Animal Agricultural Association and Solidaridad jointly launched the China Roundtable for Sustainable Livestock. Their cooperation has led to the China Animal Agricultural Association joining the Global Roundtable for Sustainable Beef as the first Chinese member. This signals the Chinese commitment to sustainable beef and a realization of their importance in the role of the global effort. On March 27, 2019, 700 participants across the Chinese beef, lamb, and dairy sectors joined together at the Second Ruminant Conference and 2019 Sustainability Summit. Aims for the second China Roundtable for Sustainable Livestock included setting goals and defining priorities for the roundtable initiative.

Qiangde Liu, secretary general of the beef department at China Animal Agriculture Association, was the leader and moderator for the roundtable meeting. He emphasized that while the industry is focusing on improving domestic production efficiency, China’s beef imports have increased because efforts have not been able to keep up with China’s growing demands for beef consumption. Similarly, for beef, Brazil is also China’s largest importer of beef. Liu has witnessed first-hand the deforestation in China caused by cattle ranching and soy production. He states:

“China, together with the world, has to address issues of greenhouse gas emissions, animal welfare, and environmental protection.”

Sustainable agricultural commodities in China: The ideal emerging market consumer segment to drive sustainability

The Chinese consumer class has undergone rapid expansion, making this large middle class a vital driver for sustainable product demand. McKinsey Global Institute analysis shows that Consumer spending as a share of the country’s GDP is expected to rise from around 36% since 2008 to 49% by 2030. Chinese trade has also grown 83-fold in the past 40 years. This is a clear indication of the major role that China can play in driving global sustainable sourcing efforts.

Demonstrated market demand for sustainably sourced products in China, but a disconnect in sourcing regulation

As mentioned, the 13th Five-year Plan and consumer reports from JD demonstrate considerable Chinese consumers interest for green products. However, awareness or interest does not necessarily translate to reality, for is it not easy for sustainable sourcing to be implemented for these products to be available. For example, although 70% of Chinese consumers are willing to pay a 10% premium for sustainably produced products, the rise in production costs is undesirable and unfeasible. This is a market that is in urgent need for development. Although many issues lie in barriers to supply chains and sustainable sourcing, companies should be aware that the Chinese market for sustainable products is becoming urgently relevant. There needs to be more international development and industry standards regarding sustainable sourcing of deforestation driving products in China. Foreign companies should be aware of the global demand for environmentally friendly products and practices, and emerging market such as China is the best opportunity to address issues relating to sustainable agriculture and sustainable sourcing.

Author: Julia Qi

Make the new economic China Paradigm positive leverage for your business

Do not hesitate to reach out to our project managers at dx@daxueconsulting.com to get all answers to your questions