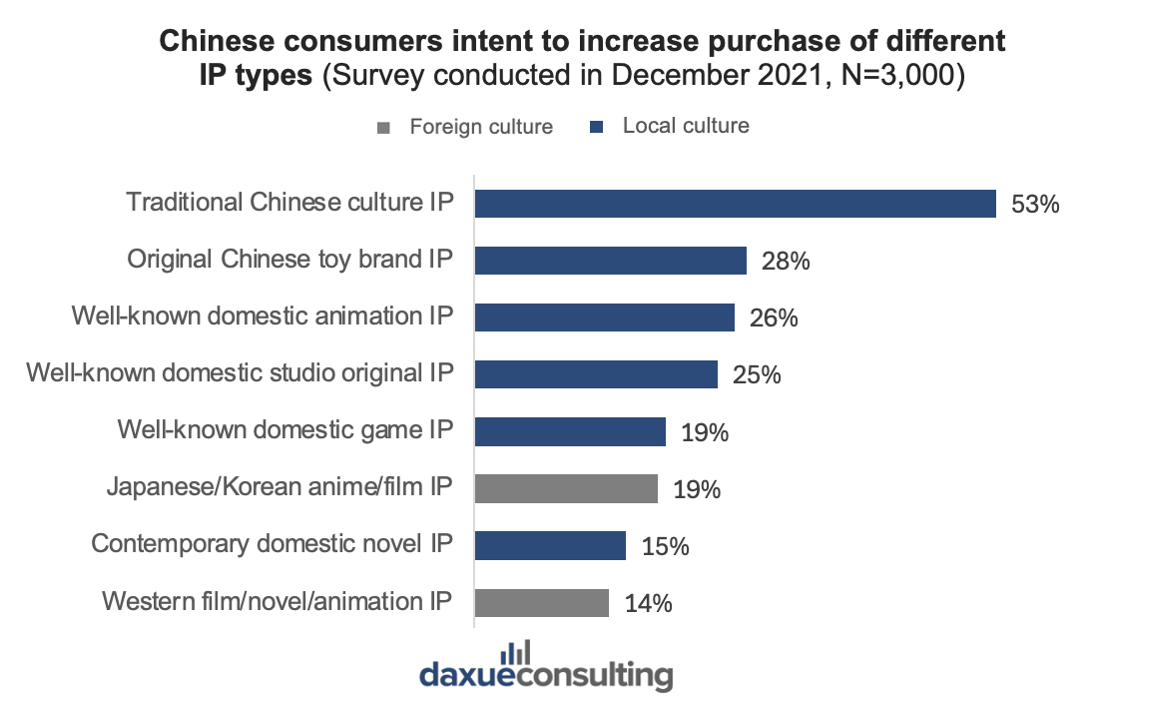

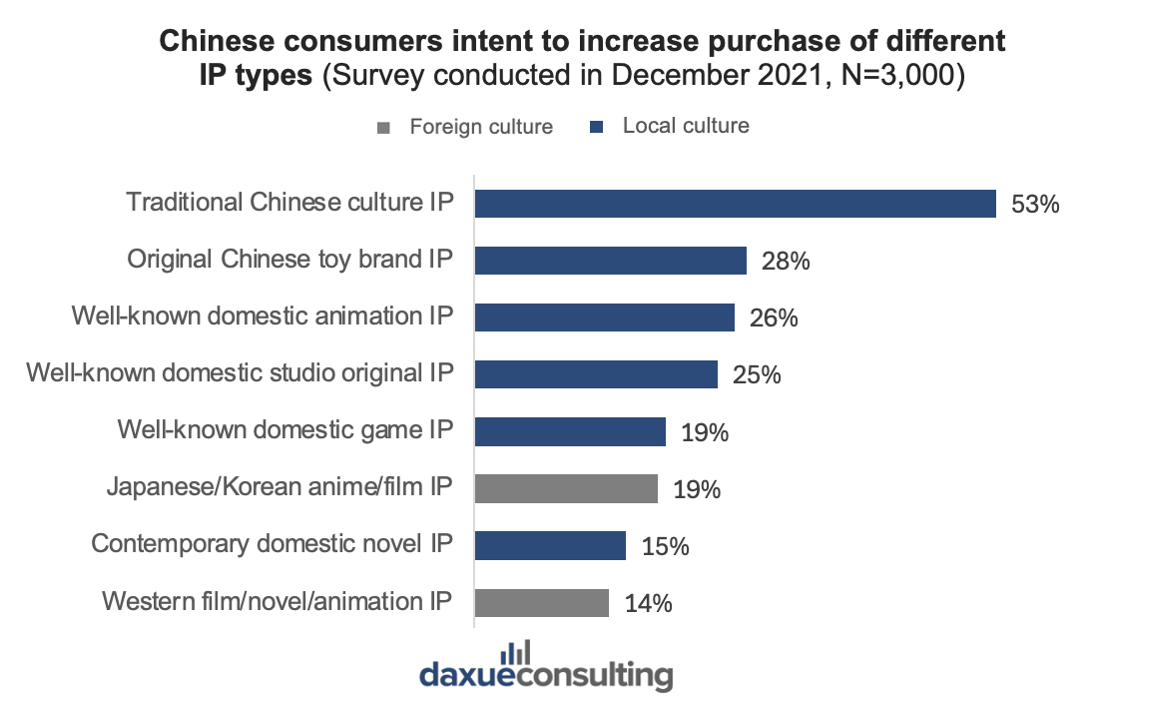

China’s collectible toys market is entering a golden era, with projected growth of 35% annually, expected to exceed RMB 150 billion in 2025. Consumer enthusiasm is rising fast. In 2021, 80% of surveyed buyers out of 3,000 said they planned to increase their purchase frequency in the coming years. The most consumed categories in the past year were figurines, blind boxes and assembly blocks, highlighting a blend of aesthetic, surprise and practical experience as key drivers of demand.

Download our report on the She Economy in China

Young adults are driving demand in China’s collectible toys market

Gen Z and young urban women lead the market, driven by aesthetics and nostalgia

Gen Z (ages 18–24) and Millennials (25–30) drive China’s collectible toy market, comprising over 60% of users in 2021. By 2030, the 31–35 age group is expected to play a larger role due to an aging effect as the market matures. The number of young customers entering the market is projected to stay consistent by then. Furthermore, women dominate this sector, accounting for 60.81% of collectible toy consumers and users are primarily concentrated in the first tier (26%) and new first-tier cities (21%), with lower-tier cities gaining traction.

These young urban women are drawn to collectible toys for their aesthetic design, emotional resonance, and nostalgic value. More than 50% of consumers, in a 3,000 persons survey, spend 1 to 5 hours per week engaging with their collections, assembling, displaying, or interacting with them. The activity bridges leisure, creativity, and emotional satisfaction, positioning collectibles as lifestyle items rather than mere toys.

Community building: Collecting as a social activity

Collectible toys are not just personal items; they are deeply embedded in social culture. Xiaohongshu and Weibo buzz with unboxings, trades, and collection showcases. Younger buyers join fan clubs to strategize limited-edition hunts, turning rare items or full sets into shared status symbols. Many participate in group chats or fan clubs where strategies for acquiring limited editions are discussed.

High perceived value enables premium pricing on low-cost items

IP-driven demand: Labubu and the rise of emotional collectibles

In China’s collectible toys market, the perceived value of items is significantly enhanced through strategic intellectual property (IP) development and artist collaborations. Pop Mart’s Labubu, created by Hong Kong artist Kasing Lung, exemplifies this approach. In 2024, Labubu generated RMB 3 billion in revenue, marking a 726.6% year-on-year increase and accounting for 23.3% of Pop Mart’s total revenue.

One major insight is the rising enthusiasm for IPs rooted in Chinese traditional culture. Over 52.7% of consumers express a growing willingness to purchase toys inspired by domestic cultural symbols. This reflects a broader “guochao” (国潮) trend, where younger generations rediscover and embrace local heritage, reinterpreted through modern design.

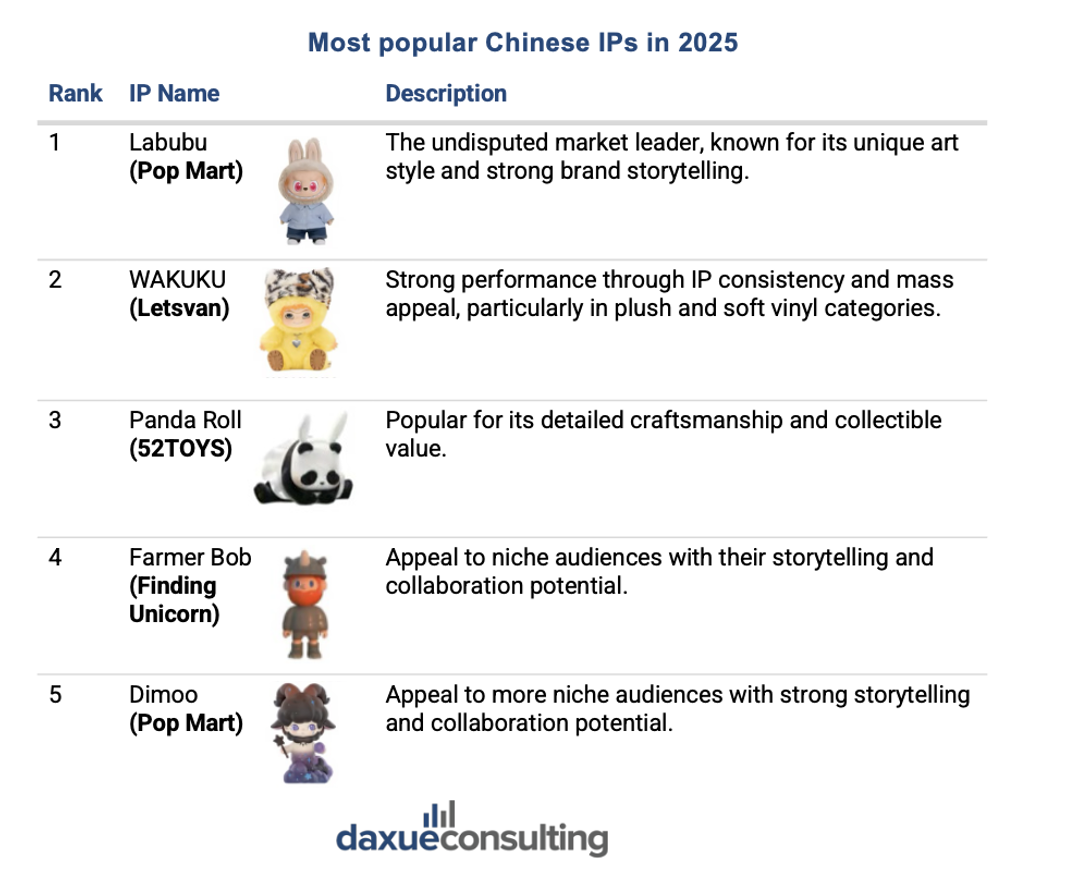

In terms of popular characters, the Chinese market is dominated by a mix of domestic and cross-sector IPs.

Cross-sector collaborations: Expanding brand reach

Pop Mart leverages cross-sector collaborations to enhance brand visibility and appeal. By partnering with entities in entertainment, fashion, and art, the company introduces limited-edition collectibles that attract diverse consumer segments. For instance, collaborations with brands like KFC have resulted in unique product lines that blend popular culture with collectible appeal.

These partnerships not only create buzz but also position collectible toys as lifestyle products, further increasing their perceived value and allowing for premium pricing strategies.

The resale market: Speculation and scarcity

The speculative nature of the resale market significantly contributes to the high perceived value of collectible toys. Limited-edition items, such as rare Labubu figures, often sell out quickly, leading to substantial markups in secondary markets. Some Labubu dolls, initially priced at around RMB 99, have been resold for up to RMB 2,000 in 2025.

Blind boxes drive repeat purchases through emotional design

Scarcity and surprise: Emotional strategies that fuel loyalty and repurchase

Blind boxes, sealed packages with random collectible figures, are one of the most powerful tools for driving repeat purchases in China’s collectible toys market. The core of their appeal lies in scarcity, surprise, and social comparison. Consumers are drawn to the excitement of not knowing what figure they’ll receive. As such, they often return multiple times to complete a full set or chase limited editions.

Limited runs and exclusive drops amplify this behavior, creating a planned obsolescence model that pressures consumers to “buy now or miss out.” This emotional rollercoaster encourages high-frequency purchases, making blind boxes a cornerstone of lifecycle strategies for brands like Pop Mart and Top Toy.

Price sensitivity and fatigue: The limits of the blind box model

Blind boxes face fatigue as some consumers grow wary of price and repetition. 43% of consumers who previously purchased blind boxes say they plan to reduce their buying in the future, citing repetitive designs and rising prices.

Moreover, blind boxes are the category where consumers show the highest price sensitivity. As prices rise, willingness to purchase drops significantly. In contrast, consumers are more price-tolerant with figurines (手办), building block toys (拼装积木), and model kits (拼装模型), likely due to their perceived craftsmanship, display value, and tangible assembly experience.

Still, 41.41% of consumers say they plan to increase blind box purchases, indicating a polarization within the market: newcomers are eager to explore, while seasoned buyers may shift to higher-value, more transparent collectibles. Overall, blindbox is still a growing segment as new users are still able to offset veteran fatigue.

Pop Mart dominates the collectible toys market in China, but many other players are emerging

Omnichannel reach and digital loyalty: Pop Mart’s scalable success model

Pop Mart leads China’s collectible toys market through a combination of operational scale, omnichannel retail, and digital engagement. With 215 physical retail stores and 1,477 Robo Shops across China, the company offers accessibility and brand visibility in high-footfall urban centers. Complementing this physical network, Pop Mart also runs robust digital channels, including e-commerce and a “blind box machine” mini program on WeChat. In the first half of the year, online and app-based revenues grew by over 100%, slightly surpassing offline sales.

A key component of Pop Mart’s strategy is its digital membership ecosystem, which boasts 11.42 million registered users, with 4.02 million new sign-ups in just six months in 2022. These members account for over 90% of total sales, with a remarkable 49% repurchase rate. This highlights the brand’s ability to foster loyalty and build recurring demand. This seamless integration between retail and digital channels has enabled Pop Mart to scale quickly while maintaining a close relationship with its fan base.

The rise of challengers: differentiated IPs and niche positioning

While Pop Mart leads the market, other brands are emerging by offering specialized products and distinctive IPs tailored to diverse audience segments. Companies like 52TOYS, Top Toy, Finding Unicorn, and Letsvan are carving out niches through unique storytelling and alternative aesthetics.

Brands recognition differs between demographic segments. For example, 52TOYS and Mattel’s Fisher-Price (孩之宝) have higher brand awareness among men and working professionals. On the other hand, Pop Mart and Top Toy dominate with female and younger consumers. Notably, Lego remains the most recognized brand across all demographics, with 86-89% recognition rates in 2021.

These challenger brands often tap into underrepresented themes, such as mecha design, cultural nostalgia, or indie creator content. Meanwhile, their fan bases are cultivated through social media interaction, convention booths, and limited product drops. Rather than scale aggressively, their strength lies in deepening emotional loyalty within specific subcultures, such as anime fans, sci-fi enthusiasts, or toy customizers.

Digital collectibles and gamification are the next growth frontier

Pop Mart leads the shift toward hybrid physical-digital products

As metaverse and blockchain technologies evolve, digital collectibles are beginning to complement physical toys in China’s collectible market. Companies like Pop Mart are leading this trend with products such as the MEGA Collection 1000% Space Molly, which features NFC chips and unique digital IDs for authentication. The company is exploring ways to integrate these digital assets into new online platforms. They aim to offer a more immersive, hybrid collecting experience. High-potential categories for this shift include transformation mechas, dolls, and superalloys. However, given that cryptocurrency trading is currently banned and blockchain applications are closely monitored in China, the future of digital collectibles remains uncertain.

New platforms and gamified experiences engage younger generations

In parallel, startups like Phantom Core, Sleepie, and platforms like IP Station are introducing gamified and interactive toy experiences, leveraging AR and VR. These platforms allow users to trade, evolve, or interact with their collectibles in virtual spaces. Gen Z and post-2000 consumers, already accustomed to gamified environments, are leading adoption. This trend points to a future where storytelling, interactivity, and ownership are blended across both digital and physical dimensions.

The evolution of China’s collectible toys market

- China’s collectible toys market is rapidly evolving into a lifestyle-driven industry shaped by emotional engagement and aesthetic appeal.

- Young urban consumers, especially Gen Z women, are turning collecting into both a personal hobby and a social activity.

- Strong IPs, particularly those tied to Chinese culture or artist collaborations, allow brands to charge premium prices on low-cost products.

- The blind box format continues to stimulate purchases through surprise and scarcity, although buyer fatigue is emerging.

- Meanwhile, digital integration and gamified collectibles signal new opportunities for deeper consumer interaction and market expansion.