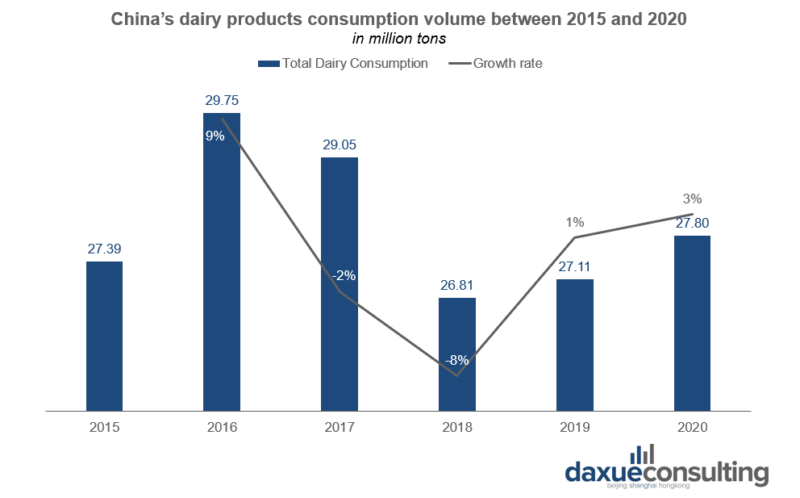

With over 90 billion USD (RMB 572 billion) in revenues and nearly 28 million tons of products consumed in 2020, China is the world’s second-largest dairy market after the US and the world’s largest one by dairy imports. China’s total dairy consumption volume kept on fluctuating in the past five years, but the growth outlook remains positive, especially after the COVID-19 outbreak, which rekindled the need for more nutrition. Nevertheless, according to Statista, in 2021, an average Chinese consumed about 13kg of dairy products per year, which equals less than one-third of the global average.

China’s dairy market has witnessed a steady and substantial growth since the early 90s and even after the 2008 Melamine scandal broke, resulting in an erosion of consumer confidence and damage to domestic production, the market only experienced a short period of turbulence. Meanwhile, the whole industry gradually shifted from scale growth to quality upgrading.

Milk, baby formulas, and yogurt are the top three most consumed dairies by volume, accounting for 39.3%, 27.6%, and 23.6% of the market respectively.

Domestic and imported dairies battle each other with no holds barred

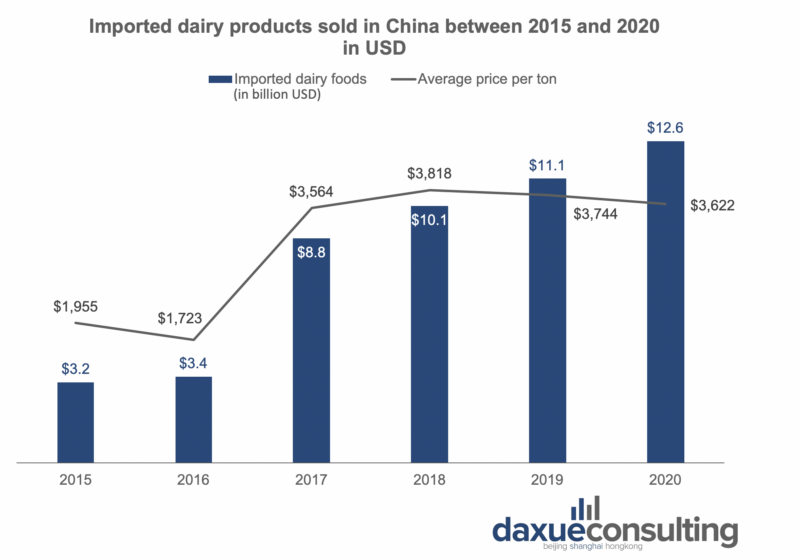

According to a survey carried out by Mintel in November 2017, among 3000 consumers aged between 29 and 49 residing in first-to-third-tier cities, 43% of Chinese consumers prefer imported dairies, compared to 34% who would rather purchase domestic dairy products. Despite the slow-down of the overall Fast-Moving Consumer Goods (FMCG) sector, China’s import dairy market still boasted significant growth, jumping from 1.61 million tons of imported dairies consumed in 2015 to 3.48 million tons in 2020. The competition between domestic and imported brands in China’s dairy market is fierce, both online and offline. In 2018, among all dairy products, milk powder imports contributed to nearly 70% of the import value of dairy products in China. The EU and New Zealand were the main countries of origin of China’s imported dairy products.

Purchasing behavior depends on consumers’ age and geographical location

Consumer behavior changes according to age and geographical location. Generally, young white-collar workers sporadically purchase and consume 1-2 bottles per time, and they are keen to choose slightly more-expensive-than-average products. Instead, families flaunt a more regular consumption pattern, and they tend to opt for larger-sized products, favoring fruit-flavored or calcium-rich products for children and paying more attention to promotions. For what regards consumers’ propensity to introduce dairy foods into their diet, China’s Northwest records the highest figures in terms of milk production and per capita consumption. Per capita consumptions in Beijing, Tianjin, Yangtze River Delta region, and Pearl River Delta Region are remarkable as well, due to their highly globalized economies. Nevertheless, consumers in Northeastern China, Southern China, Central China, and Southwestern China rarely add dairy products to their diets.

Online platforms play a critical role in facilitating the efficient distribution of dairy products in China. Dairy foods boast a penetration rate of over 90% in first-tier cities, where consumers are more inclined to shop online, whereas only 20% of the households consume dairy products on a regular basis in lower-tier cities and rural areas. In addition, cross-border commerce as well as purchasing dairy products via Daigous are becoming increasingly more popular, especially among young urbanites.

Why are Chinese not avid consumers of dairy foods

China is not just a land of milk and honey for dairy producers since there are several factors hindering the development of China’s dairy market.

First, Asian people are genetically predisposed to lactase-deficiency: around 92% of adults suffer from lactose intolerance in China. Nonetheless, as Chinese babies keep on drinking milk as they grow up, it is likely that they are going to carry on producing lactase, the enzyme responsible for breaking lactose down and digesting it. Moreover, drinking a cup of milk every day is not enough to run into big gastrointestinal troubles, so people are usually willing to take the risk.

Second, in order to satisfy the growing demand for dairy products, China needs more farms and, above all, new cows. Importing heifers is the fastest way to set up a new farm, that is the reason why China imported about 200,000 heifers from Australia and New Zealand in 2020. However, once imported, cows are not immediately milkable, representing a cost for farmers, especially as feed price increases.

Last but not least, milk and derivates are not common ingredients in Chinese cuisine and they do not look fitting into traditional recipes.

Chinese government as an important driver of dairy consumption

On the other hand, there are elements boosting the growth of China’s dairy market. The rise in per capita disposable income and the improvement of living conditions granted consumers a higher purchasing power and increased their exposure to international trends, resulting in a shift in lifestyle.

The Chinese government is playing an important role in promoting dairy consumption in China. In the early 2000s, the government launched a program aimed at providing each child with a cup of free milk at school. According to the 2021 China Dairy Top 20 Summit attended by the Vice-Minister of Agriculture and Rural Affairs, milk producers should improve cow breeding and feed quality in order to obtain high-quality milk; enhance milk safety by strengthening comprehensive supervision; boost the development of cheese and other dried dairies adapted to the tastes of Chinese consumers.

Meanwhile, the government is acting to regulate and curb dairy imports so as to promote domestic production.

Growing health awareness accelerates dairy consumption in China

Another driver of growth for dairy consumption in China is growing health awareness, especially after the outbreak of the Covid-19 pandemic. Chinese consumers are aware of the nutritional benefit of dairy products: such foods are rich in calcium, facilitate digestion and boost the immunity system. Nevertheless, Chinese consumers tend to be less knowledgeable of other qualities such as types of bacteria contained in yogurt and consequent benefits. As a result, yogurt has experienced explosive growth fueling the overall demand for dairy products in China.

Powdered milk is gaining popularity

In 2020, about 34.4 billion tons of milk were produced in China according to the National Bureau of Statistics. Drinking milk is the most popular dairy category in China, but its growth outlook in terms of volume is estimated to be less than 1% and its share as a category is expected to start dropping. UHT milk is way more popular than pasteurized milk in China since the latter is fairly limited to coastal cities due to its relatively short storage period and costly logistic expenses.

After the outbreak of the global pandemic, the online market for adult powdered milk in China doubled and reached a market size of about 3 million USD (RMB 19 million). Adult milk powder is a functional product aimed at addressing the specific nutritional and digestive needs of certain adult groups. The strength of such category of milk is that it is easy to consume and carry around. 70% of purchasers are women, but seniors represent a suitable target group for this product as well. Nonetheless, compared to drinking milk, powdered milk is less popular in China due to the misconception that fresh milk boasts higher nutritional value.

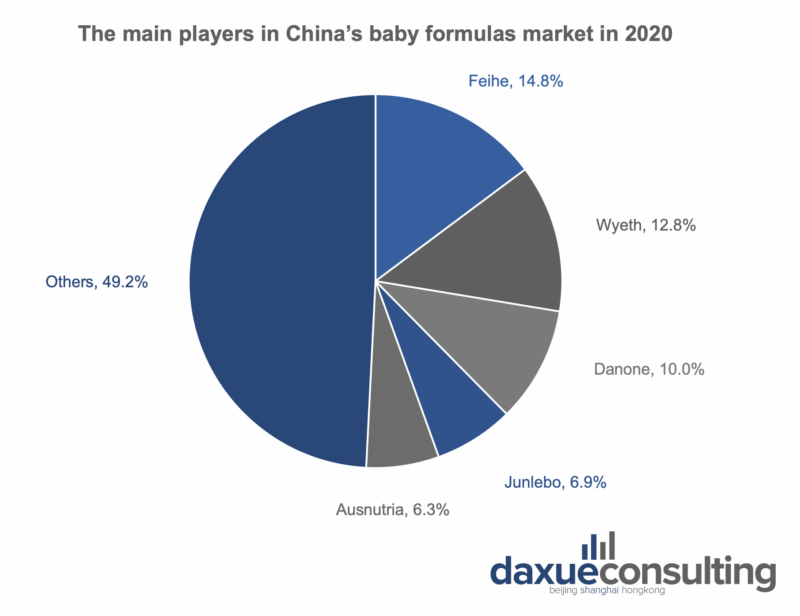

Domestic brands dominate again after recovering from the food safety scandal

In 2008, the melamine scandal destroyed consumers’ trust in domestic brands and allowed foreign brands to dominate China’s baby formulas market for 10 years despite premium pricing. Indeed, in 2019, the top 4 foreign brands accounted for 50% of the overall market. However, starting from 2019, baby formulas import volume dropped at double-digit rates as domestic brands rebuilt their quality and regained consumer confidence, leading domestic brands to conquer two-thirds of the market. The Chinese government actively intervened to curb the imports of baby formulas as well, by obliging foreign producers to register their formulas in China and asking them to renew their registration every four years. Moreover, foreign brands failed to expand in lower-tier cities due to distribution issues, allowing domestic players to thrive.

Although goat milk accounts for less than 10% of baby formulas sold in China and tends to be more expensive than its cow milk counterpart, it is growing fast because of Chinese young consumers’ propensity to try new products as well as its high digestibility and low allergenicity.

Health awareness untaps new opportunities in China’s yogurt market

According to Mintel, about 40% of surveyed Chinese consumers take yogurt at least once per day, while 17% opt for probiotic drinks once a day. In 2013, those figures were just 15% and 11% respectively. What makes yogurt so popular in China’s dairy market is its low amount of lactose and high nutritional value. Unlike the West, room temperature yogurt has been growing faster than chilled yogurt since China’s refrigerated distribution network is still lacking and room temperature yogurt is usually cheaper than chilled one, albeit vaunting similar nutritional value.

Owned by the dairy giant Yili, Ambrosial dominates China’s yogurt market partly due to its Greek yogurt, which combines flavorful taste and health benefits. Chunzhen and Mengniu are the second and third largest players, holding 10.6% and 6.2% of the market respectively. It is worth mentioning that Yili is the main sponsor of the Beijing 2022 Winter Games and as a way to celebrate the upcoming event, the dairy brand launched an exclusive NFT collection of 17 milk bottles, betting on the metaverse as a new channel for promoting its products.

The next window of opportunity in this market could reside in functional yogurt aimed at addressing specific health needs, such as stress-induced digestive issues, especially as health awareness grows among Chinese consumers.

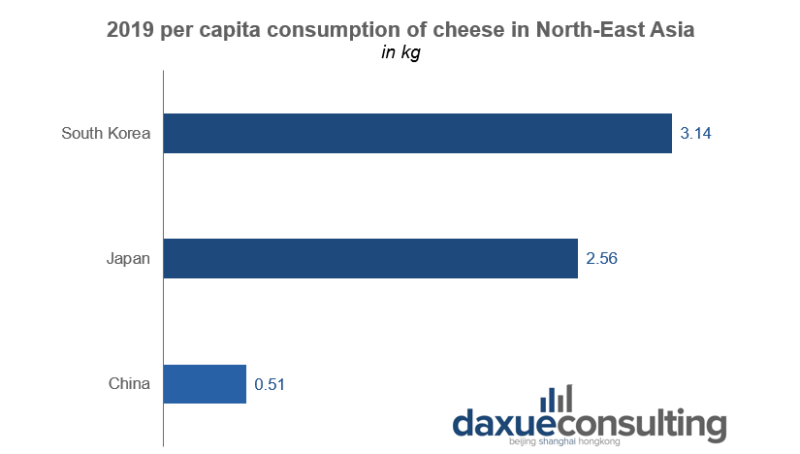

Cheese vaunts a sustained growth in China

Despite accounting for a meager 1.4% of total dairy consumption in terms of volume, both cheese production and consumption have experienced steady growth between 2015 and 2020, attracting the attention of leading domestic dairies. Indeed, in 2020, Yili launched a new cheese brand, while Mengniu took a controlling stake in the cheese brand Milkground. Currently, China’s cheese market relies heavily on imports, and the import volume increased steadily throughout the years. New Zealand, Australia, and Denmark were the top three cheese exporters to China in 2020.

Despite growing sales, the per capita consumption of cheese is still lagging compared to other Northeast Asian countries. In fact, even though Japan and South Korea have similar dietary habits to China, they found their own way to incorporate cheese into their cuisines, illustrating that this could be feasible in China as well. Moreover, cheese for kids has been gaining strong popularity in the latest years, equating to about 50% of overall B2C sales. In order to change Chinese perception towards cheese, dairies should educate consumers on how to use cheese when cooking as well as to adapt flavors and formats to the local context. With this aim in mind, some brands have already started holding cheese tastings in tier-1 cities and it is not uncommon that the largest producer countries organize cheese workshops at their embassies and consulates premises.

A glimpse at future trends on China’s dairy market

In general, China’s dairy market has entered a slow-speed development stage and is shifting from scale growth to product upgrades. Dairy consumption in China has been fluctuating in the past decades, yet the market’s total value and volume are huge. Low loyalty is a macro trend in FMCG as consumers have a wide selection of options to choose from. As a result, dairy players need to identify and cater to the diversified yet changing needs of Chinese consumers, as well as embrace the corresponding marketing strategy.

Plant-based milk are considered as more natural but less rich in proteins

Between 2015 and 2017, sales of plant-based milk in China increased by 17%. After the great success of the Swedish oat milk brand, Oatly, more and more companies are tapping into the vegan milk segment in China. Chinese consumers tend to regard plant-based drinks as more natural than animal milk and derivates, thus brands could surf growing health awareness triggered by the global pandemic and target consumers willing to purchase more natural products. Nevertheless, consumers consider plant-based milk less rich in proteins than mainstream milk and soymilk, hence producers would better adjust their communication strategy in order to better educate their potential customers.

Chinese pet owners fuel sales of pet milk

Although the household penetration rate for pet-ownership in China is still very low compared to that of Western countries, as the population ages and people settle down later, the growing demand for companionship is bringing about a surge in the pet economy. In 2020, there were about 63 million pet owners in China and the number of people raising cats rose faster than the number of dog owners, which however still account for 57% of households having domestic animals.

Chinese pet owners are willing to purchase pet milk when they believe that their four-legged companions are not getting enough nutrition from regular meals. They prefer to avoid feeding their pets with human food since it could not taste appealing to them and reduce potential health risks related to lactose intolerance. Nonetheless, pet milk costs on average between RMB 2.3 and 21 per 100ml, revealing to be way more expensive than lactose-free milk for humans. It is likely that firms will start providing specialized milk products for each type of pet animal in the future.

China’s dairy market in a nutshell

- China is the world’s second-largest dairy market after the US and the largest one in terms of dairy imports. Despite its tremendous growth, per capita consumption remains low.

- Widespread lactase-deficiency, insufficient supply, and low compatibility of dairy foods with Chinese recipes are some of the drivers slowing down the growth of China’s dairy market.

- Nevertheless, Chinese government and growing health awareness among consumers are powerful drivers of dairy consumption in China.

- Milk, baby formulas, and yogurt are the top three most consumed dairies in terms of volume, holding 39.3%, 27.6% and 23.6% of the market respectively. Despite accounting for a meagre 1.4% of total dairy consumption, China’s cheese market kept on growing steadily between 2015 and 2020, and is expected to continuously increase its size in the future.

- Plant-based milk and pet milk are going to untap new opportunities for dairy producers and retailers, allowing them to meet the needs of Chinese health-conscious consumers and Chinese pet owners.