MOFCOM negative list and NDRC negative list: What do all these abbreviations mean?

The negative list of Ministry of Commerce of the PRC or National development and reform commission negative list is a summary of three kinds of lists that are included in the foreign investment law of China. They are denoted as the MOFCOM negative list or the NDRC negative list. The MOFCOM negative list or NDRC negative list is the negative lists for Chinese market access because it provides the guideline to both domestic and foreign investors. In addition, the MOFCOM negative list or NDRC negative list are China foreign investment catalogs which give details to foreign investors on which industries are limited or prohibited to enter and which are encouraged.

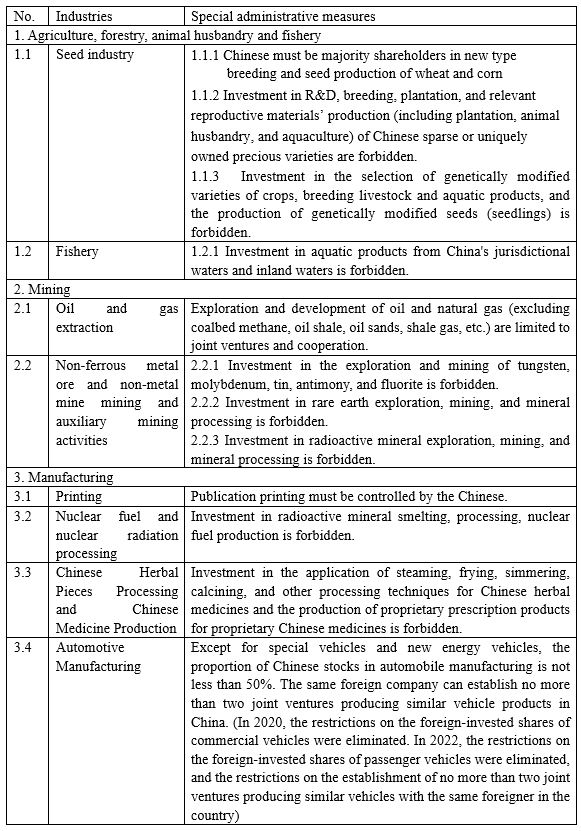

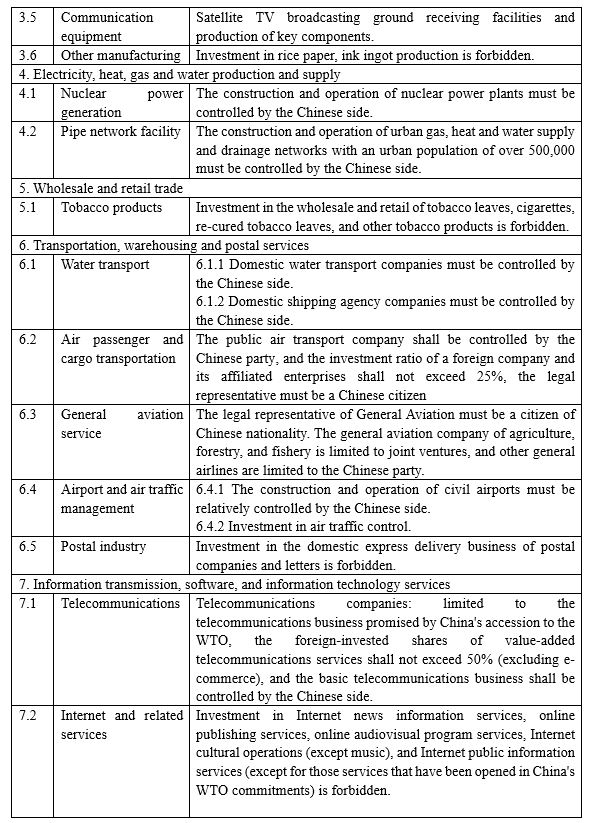

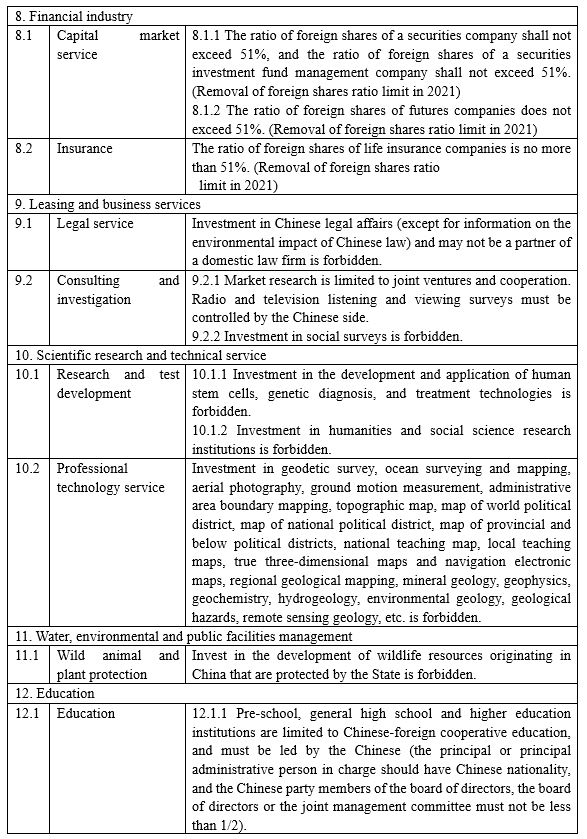

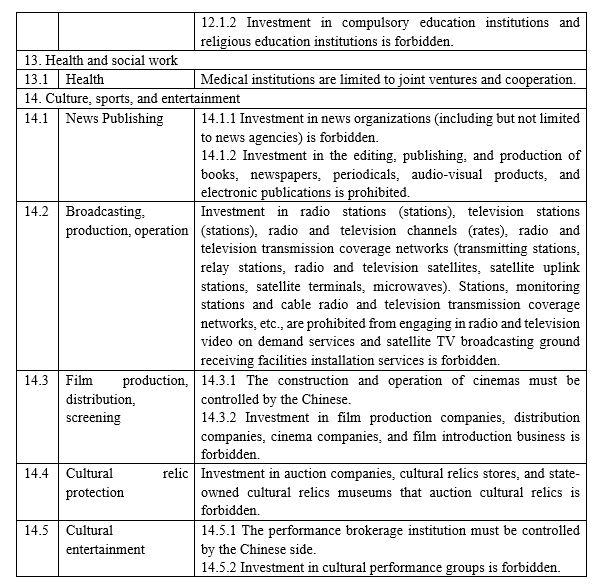

As the table above shows, there are 34 industries have limits or prohibitions for foreign investors to enter the Chinese market. Although Shanghai Pilot-Free trade zones and other similar free trade areas have fewer restrictions, sectors that are limited to foreign investment are almost the same.

Who are the issuers?

China negative list has two names because MOFCOM negative list refers to The Ministry of Commerce of the People’s Republic of China, and NDRC negative list refers to National Development and Reform Commission of China; they are the issuers of China negative list and reserve all the rights of interpretations. Both departments are the central bodies that regulate domestic and foreign investment and business operations, according to the China negative list. Branches of Industrial and Commercial Bureau all around the country help MOFCOM and NDRC to monitor whether companies act by China negative list.

Three kinds of negative lists in China

At first, the MOFCOM negative list or NDRC negative list included only two sub-lists aiming at foreign investors. Now the MOFCOM negative list or NDRC negative list includes three kinds of negative lists in China, according to the information released on the two websites: The Ministry of Commerce of the PRC and the National Development and Reform Commission of China, respectively are The Negative List on Market Access, The Special Administrative Measures for Access of Foreign Investment (Negative List) and The Special Administrative Measures (Negative List) for Foreign Investment Access in Shanghai Pilot-Free Trade Zones.

Among these three lists, The Negative List on Market Access aims to both domestic and foreign investors, and this list has three main enclosed documents:

- A detailed list to demonstrate which industries are forbidden or permitted for investors to enter, what licenses do investors need to have before they operate a business in those industries;

- The clauses of prohibitive actions, which demonstrates the prohibitive actions throughout the business operations;

- An additional revision to the incorporated document – The Directory Catalogue of Industries Restructuring.

The remaining two lists are known as China FDI negative lists, aimed at foreign investors. The lists designate how foreign investors can operate a business in both the general Chinese administrative area and a free trade area in terms of equity requirement, management requirement, etc..

Which sectors are now at risk

The China negative list, also known as the negative industry list in China, is for investors to find out whether the industries they decide to enter is in violation with China’s policies.. Above all, the Special Administrative Measures for Access of Foreign Investment and Foreign Investment in Free Trade Zones are the prior industry references for foreign investors, and these regulations are also deemed as China FDI negative list or China foreign investment catalog. Despite China having eliminated some sectors on the lists to promote an open market, basic industries – including the power sector, transportation, telecommunication, and mining – are still prohibited or largely limited to foreign investors in general Chinese administrative area, as well as broadcasting, the legal profession, and environment-related ones. Exceptions exist for foreign investors who pour their capital into Shanghai Pilot-Free Trade Zones, with fewer prohibited or limited industries and fewer restrictions on shareholding and management level.

Although restrictions are evident, the China FDI negative list removes some limits and prohibitions in some industries, downsizing the negative industry list to some degree. The financial sector seems to benefit most in the change, especially for service industries. For example, although the shareholding remains under 51% in total for foreign investors in securities, futures and insurance companies now, these companies will have no foreign shareholding restrictions in China after 2021, according to the clauses on the Special Administrative Measures for Access of Foreign Investment and Foreign Investment in Free Trade Zones.

The automotive industry is also another potential market. Special purpose vehicle and new-energy vehicle sectors are welcomed to foreign investors in any corporate mode. Despite the foreign shareholding restrictions in China on commercial vehicle and passenger car sectors remain, China FDI negative list shows that the limits will be phased out in 2020 for commercial vehicle and in 2022 for a passenger car. Currently, Tesla, the advanced electronic car manufacturer, has been permitted to set up its car production site in Shanghai, China, without any Chinese shareholders.

However, The Negative List on Market Access, the negative list for the Chinese market access, also need to be considered as a part of negative industry list when foreign investors invest in an industry in China, and based on the content of this list, industries related to finance and internet are right now under China government’s severe scrutinization. For example, companies which are not financial institutions or do not operate economic activities cannot name themselves with words related to finance such as banking, insurance, asset management, and etc..

Consequences and developments of the negative list in China

MOFCOM negative list or NDRC negative list brings limits to foreign investors to expand their business empire in China. Except for the industries that are prohibitive to enter, the remaining sectors have limits for foreign investors on shareholding, making them consider the ways of starting their business in China market. Entry mode is one of the elements.

Partnership or Associates as a corporate entry model instead of WFOE?

The China negative list restrains the entry of foreign investors to China. In industries that have limits on shareholding or forms of enterprises, foreign investors may give up on WFOE (wholly foreign-owned enterprises) and turn to other ways of entering China’s market. China FDI negative list, the Special Administrative Measures for Access of Foreign Investment and Foreign Investment in Free Trade Zones, does provide individual instructions or recommendations like partnerships or associates as choices for foreign investors to enter certain industries. However, investors who are inclined to maintain full control of the company would try on different resorts to enter the Chinese market as well as fulfill their ownership without violating the regulations of Negative list for the Chinese market access.

One way to bypass the regulations of China negative list for investors is setting up a subsidiary in China as a Chinese corporation, and use this subsidiary – which is not limited by China FDI negative list – to invest the industries that foreign investors are not allowed to enter. Another way is to leverage the contracts signed by both investors and investees who are in prohibited industries for foreign investors to control the investee and obtain economic benefits, which is a way similar to how Chinese companies to be listed outside mainland China (e.g., Hong Kong). Other than that is is time-consuming, the breach of contracts is a potential risk.

Narrowing scopes and reducing sectors on the China FDI negative list

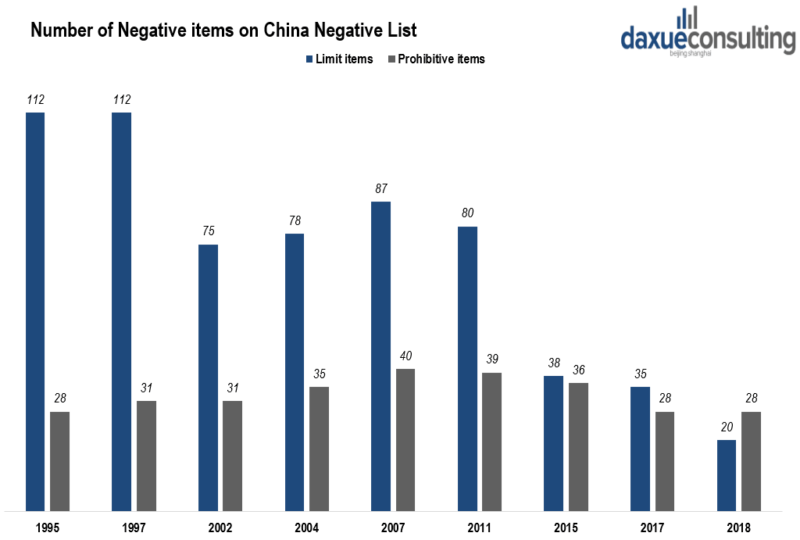

Fortunately, there is good news for foreign investors wanting to get access to the Chinese market directly. The Chinese government now strives to remove redundant restrictions in the negative list for Chinese market access in order to stimulate its economy, and this trend is expected to continue. Below shows the changes of negative list for the Chinese market access, and it reduces the restrictions every year.

What are unreliable entities list in China?

In early June, The Ministry of Commerce of China stated that China would issue the “Unreliable Entities List in China” to safeguard national security, public interest, and Chinese enterprises’ legal interest. Four factors are put forward as the consideration of putting any foreign individuals or enterprises on the list. The unreliable entities list is seen as a new part of the MOFCOM negative list or NDRC negative list, and as a signal that foreign capital is even harder to enter the Chinese market.

Standards and target entities of unreliable entities list in China

The unreliable entities list in China is somewhat different from existed negative list of Ministry of Commerce of the PRC or China negative list. MOFCOM negative list or NDRC negative list can be seen as the negative industry list, and it sets up the limits and prohibitions on industries and shareholdings, which are denoted in the clauses of MOFCOM negative list or NDRC negative list . However, the targets of unreliable entities list in China are more specific: instead of industries or shareholding limits and prohibitions, China would ban foreign individuals or enterprises if they don’t obey market rules, violate contracts and block, cut off supply for non-commercial reasons or severely damage the legitimate interests of Chinese companies.

Is it harder to enter the Chinese market now?

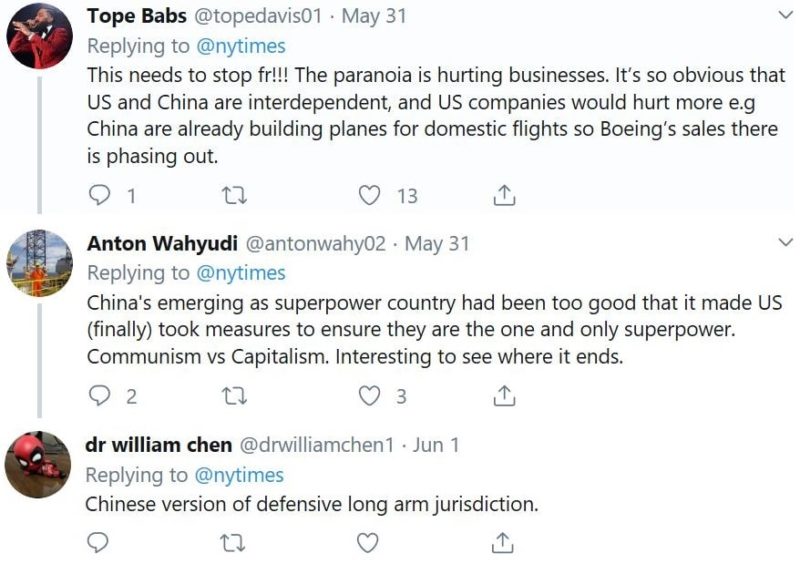

On Twitter, reactions are different for the issue of unreliable entities list in China. Some only express the desire to see the result of this incident; others oppose or satirize Chinese unreliable entities list.

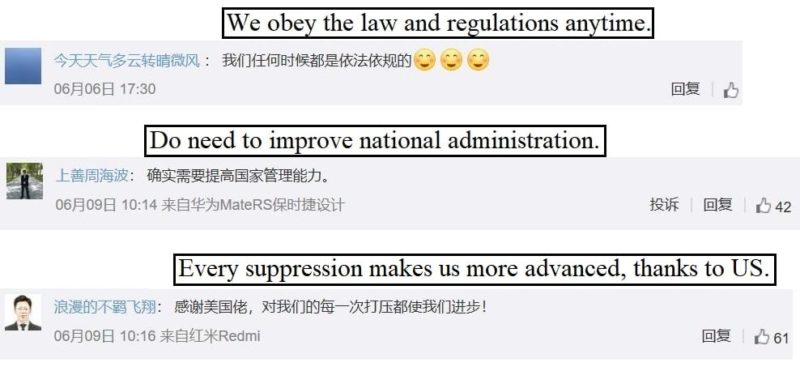

When it comes to the reactions of Chinese netizens, comments are more unified and official as they support this countermeasure in response to Huawei ban.

The reactions of netizens look like the small picture of the incident of unreliable entities list in China. Most believe that the unreliable entities list in China is a response to the Huawei ban. Whether this policy will be enforced permanently and effectively depends on the following reactions and policies of the U.S. government. Considering this situation, it seems investors from the U.S. may encounter potential risks due to the changing trends of US-China trading relationships than investors from other areas.

Author: Dennis Deng

Make the new economic China Paradigm positive leverage for your business

Do not hesitate to reach out our project managers at dx@daxue-consulting.com to get all answers to your questions