Mixue Group (蜜雪冰城股份有限公司) is a freshly-made beverage company. It has two brands: the tea drinks brand Mixue (蜜雪) and the coffee brand Lucky Cup (幸运咖). On March 3rd, 2025, the Group went public on the Hong Kong Stock Exchange and its shares surged by over 40% on the first trading day, receiving global attention. As of June 2025, it has over 48,000 stores in China and over 4,700 stores outside of China, making it the largest fast-food chain in the world by store count, even surpassing McDonald’s, Starbucks, and Subway. The Group was able to achieve such success in the food and beverage industry in China through its competitive pricing, low-cost franchise network, efficient supply chain management, and innovative marketing and branding strategies. Having a large presence in the tea market in China, the Chinese beverage brand Mixue is expanding overseas.

Download our China F&B White Paper

Mixue Group’s history dates back earlier than McDonald’s and Starbucks

Mixue Group’s history dates back to 1977, when Zhang Hongchao, a student at Henan University of Economics and Law, opened a small shaved ice shop named “Cold Snap Ice” (寒流刨冰) in Zhengzhou, Henan province. He started this as a part-time gig to help with his family finances. However, it didn’t turn out well, eventually leading to its closure.

In 1999, however, Zhang opened a second store and formally registered it as Mixue Bingcheng (蜜雪冰城), meaning “honey snow ice city”. This time it sold soft-serve cone treats and rapidly attracted nearby students and locals of low incomes. Over the years, it expanded by building centralized factories in 2012, introducing new products like bubble tea, and launching Lucky Cup in 2017. Since 2018, it started expanding to other countries, opening its first store in Vietnam.

Low costs and prices make Mixue accessible

Tea brand Mixue’s flagship products, such as lemonade and milk tea, are priced between RMB 2 to 8 (about USD 1 or less), making them appealing amid the economic slowdown and accessible to a wide range of consumers.

This pricing strategy is possible due to the company’s ability to keep costs low through supply chain optimization. Mixue Group controls its entire supply chain, from raw material sourcing to production and distribution. 60% of the ingredients it supplies to its franchisees are self-produced. This reduces the costs and ensures consistent product quality. For example, its procurement costs for milk powder and lemon of the same type and quality were 10% and 20% lower, respectively, than the average of its competitors.

Mixue focuses on emerging markets

As of September 30th, 2024, Mixue Group is the largest freshly-made drinks company in China and in the world in terms of number of stores. It has over 48,000 stores in China and nearly 5,000 stores outside of China.

Mixue Group has an extensive presence in lower-tier cities

In China, the Group focuses on emerging-tier cities. Henan, Guangdong, and Jiangsu have become key focus markets for Mixue due to their geographic advantages and urban structure:

- Henan: Home to Mixue’s headquarters, Henan is centrally located in China, making it highly convenient for nationwide expansion.

- Jiangsu: With a stable economy and relatively strong purchasing power in third- and fourth-tier cities, Jiangsu also serves as a strategic base to reach other cities and provinces in southeastern China.

- Guangdong: Similar to Jiangsu in terms of population structure and consumption level, but with a hotter climate that drives higher consumption frequency.

The Group has succeeded in growing in lower-tier cities and rural areas due to the lower operating costs, untapped demand, and rapid expansion. The rent and labor costs are significantly lower in smaller cities, allowing it to keep its low-price strategy. Consumers in these areas have less access to trendy food and beverage options, making it an attractive choice. Moreover, its franchise model allows it to rapidly expand in low-tier cities, often outpacing its direct competitors such as Shuyi, Auntea Jenny, Good Me, and Cha Panda who focus on first-tier and second-tier cities.

Mixue expands into emerging and developed overseas markets

With competition intensifying in lower-tier cities, Mixue Group is expanding to other countries. Most of its overseas stores are in Indonesia (2,667 stores) and Vietnam (1,304), which together generate around 70% of overseas revenue. It also has a presence in other regions beyond Southeast Asia, including South Korea and Australia.

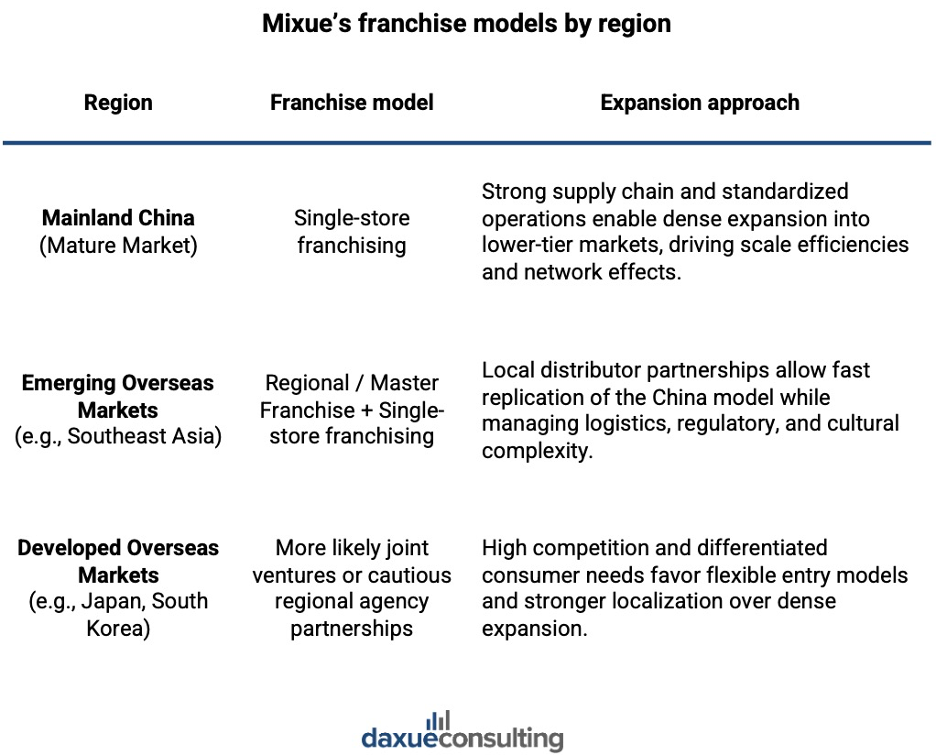

Mixue’s franchise model enables rapid expansion

Mixue Group’s franchise model is a cornerstone of its success. According to Mixue Group’s prospectus, 99% of its stores are franchised as of September 2024. It charges a lower franchise fee, making it accessible to small business owners and enabling it to expand rapidly, especially in lower-tier cities. The initial budget fee is about RMB 210,000, lower than Good Me’s 230,000 for example.

Moreover, Mixue Group’s revenue mainly comes from selling supplies, including ingredients and packaging, and equipment, such as ice cream makers and refrigerators, to its franchisees, not retail sales.

Outside of China, Mixue has another franchise model. In emerging overseas markets like Southeast Asia, it partners with powerful local distributors who are familiar with the market, resources, and channels, allowing Mixue to quickly replicate its model abroad – overcoming barriers in logistics, regulations, and cultural differences to achieve rapid market penetration.

In developed overseas markets, such as Japan and South Korea, it has another approach. Given the fierce market competition and differing consumer preferences, it may avoid its dense domestic strategy, opting instead for flexible models and stronger local partnerships focused on product adaptation and brand localization.

Tea brand Mixue’s mascot “Snow King” builds a fan base

Mixue has built a strong brand identity, particularly through its strong Intellectual Property (IP) strategy and viral marketing efforts. In 2018, it introduced Snow King (雪王), its snowman mascot and developed Snow King-themed stores, merchandise, and animated series. This makes the brand more approachable and helps build a deeper emotional connection with its fans.

One of Mixue’s most recognizable elements is its catchy theme song saying “You love me, I love you, Mixue Bingcheng is so sweet” (“你爱我,我爱你,蜜雪冰城甜蜜蜜”). It became a social media sensation, spreading on platforms like Douyin (Chinese version of TikTok) and Xiaohongshu (also known as RedNote), with netizens creating memes, covers and parodies, effectively promoting the brand for free.

Mixue leverages co-branding in China to refresh its experiences

To expand its consumer base and build a fun and refreshing experience, Mixue engages in co-branding in China. For example, in 2024, Mixue teamed up with Garfield to launch a series of orange-colored drinks like the Cheese Milk Cap Osmanthus Tea and Osmanthus Glutinous Rice Tea, along with a packaging featuring Garfield and Snow King. Additionally, this collaboration introduced limited-edition merchandise like cups, fridge magnets, and Good Luck Machine toy, creating a sense of urgency for people to go to its stores.

This collaboration coincided with the release of the movie Garfield on Children’s Day on June 1st, 2025, appealing to both children and families alike. One RedNote user said, “Mixue collaborated with our childhood friend Garfield, and it looks absolutely stunning!”

Chinese beverage brand Mixue grows from a humble shop to a global beverage giant

- Mixue Group is the world’s largest fast-food chain by store count, surpassing McDonald’s, Starbucks, and Subway. As of June 2025, it has over 48,000 stores in China and over 4,700 stores abroad.

- Unlike its competitors like Cha Panda and Auntea Jenny, it focuses on China’s emerging-tier city markets.

- Its success lies in its low-cost franchise model and supply chain efficiency, innovative branding and marketing, and competitive pricing strategy.

- It follows a low-cost franchise model, making it accessible to small business owners. The initial investment required is about RMB 210,000, which is lower than its competitors. In 2012, it started building its centralized factories, producing 60% of its ingredients in-house.

- Mixue has built a strong brand identity through its mascot Snow King, viral theme song, and co-branding efforts. Its catchy theme song went viral on social media, and it collaborated with Garfield following the release of the Garfield movie.

- Mixue Group is known for its budget-friendly products, which especially appeals to lower-tier consumers in China, who have lower incomes and have less access to trendy food and beverage options compared to higher-tier cities.