Boohee Health (薄荷健康), which directly translates as “mint health” in Chinese, is a Chinese health app that helps people monitor their well-being and maintain healthy lifestyles, as well as sells a variety of healthy foods. The app mainly targets female consumers, with 75% of them being women in the coastal provinces born between post-90s and 00s.

Boohee’s original core features include:

- Daily record of exercise and diet

- Record of body weight and body fat percentage

- Search for the nutritional information, value, and ingredients of food products

- Offers meal plans and recipes as well as support from dietitians online (members only)

- Community platform for users’ interaction, sharing of posts, and knowledge

- Purchase of dietary replacement meals for weight loss

Boohee initially struggled to monetize its service. As a result, in 2020, the Chinese health app enhanced its business model from being a data tool company into a health consumer goods company with a systematic marketing strategy, yet, still retaining its initial services. As a result, Boohee reset its tracks from downward-sloping revenues to a brand with exponential growth. What is Boohee’s secret to success?

From where it all began to Boohee’s sudden growth

Established back in 2007, Boohee initially focused solely on weight loss by delivering diet and exercise guidance. It quickly became one of the leaders in Chinese weight loss apps and monetized through self-operated e-commerce and paid memberships. However, users complained about a number of issues:

- The interface was inconvenient to register their daily data and they forgot or did not feel motivated to do so

- Paid services were too expensive

- Access to professional nutritionists was not delivered as promised

- Customer service did not meet customers’ expectations

- The community platform did not allow for smooth exchange

In 2017, the Chinese health app added sports content to expand its market share. Moreover, Boohee included an in-app purchase for healthy snacks and ready-to-cook meals. Nevertheless, customers said they preferred purchasing those products elsewhere if possible. As for the sports content, customers also prefer other applications to record sports activities and gather fitness and weight loss information.

KEEP, one of Boohee’s biggest competitors, is an app that greatly emphasizes exercising, which provides tutorials and workout tracking, not only for fat-reducing purposes but also for muscle-building and promotes sports as a lifestyle. In 2019, KEEP recorded five times more active users than Boohee and the average time spent per user on KEEP was 3.5 times longer than on Boohee. While KEEP covered 16.6% of the health and sports industry in China, Boohee only comprised 1%.

Then, the pandemic hit, and Boohee gained momentum. Chinese consumers increasingly started engaging with the brand and the Chinese health app increased its sales by 200% (2020 vs. 2019). So, what happened?

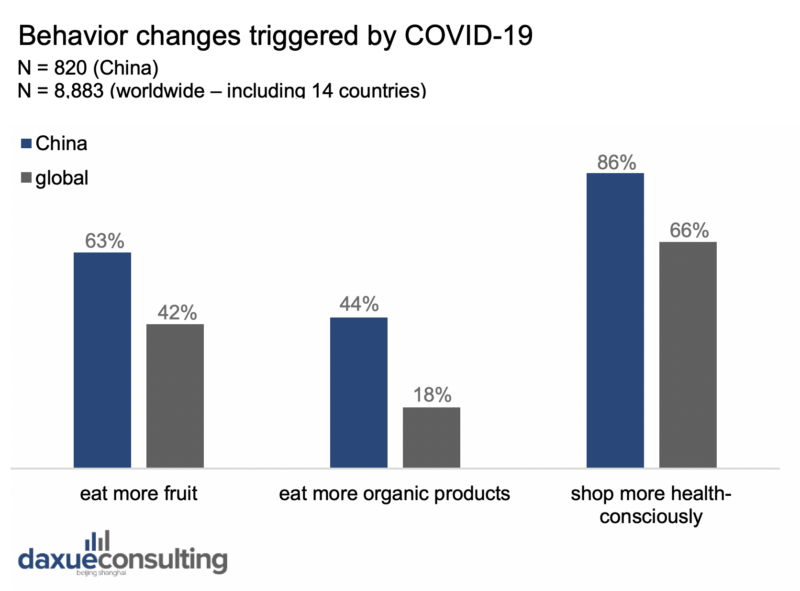

Boohee’s sudden spike at first glance

One explanation for Boohee’s success is that COVID-19 triggered Chinese consumers’ health consciousness. According to a survey by Accenture, Chinese behavior impacted by the pandemic revolves more around the desire to be healthier. Living healthy is associated with a “better ability to fight off the virus” and essentially other infections. 91% say ‘taking care of their health’ has become a permanent change to their lifestyle. To that, a survey by McKinsey in China also shows that 75% of respondents say they want to eat healthier and live a more active lifestyle after the crisis. This emphasis on physical health triggered by COVID-19 manifests much stronger for Chinese respondents in comparison to the global average. As a result, Boohee managed to leverage this side effect of the pandemic.

Was Boohee just at the right time at the right place?

Before COVID-19, not only did Boohee lack in performance in comparison to its competitors, but it also encountered a market ceiling as the app only catered to a limited number of needs and customers. Boohee failed to expand into the sports market and the demand for healthy eating was low prior to the pandemic. The increased health consciousness which triggered dieting and exercising allowed Boohee to pierce through the initial market ceiling as it suddenly responded to the needs of a larger population.

Hand in hand came Boohee’s business restructuring and a new, aggressive marketing concept. The Chinese health app recentered its attention to its products launched back in 2017 and increased its variety to functional foods, child nutrition, bedtime drinks, healthy bacteria composition, and more. Parallel, Boohee released an unprecedented social media campaign which was enhanced by the expansion of its distribution channels.

KOL and social media define Boohee’s success

The Chinese health app doubles its presence on numerous social media platforms by cooperating with celebrities and KOLs. Boohee’s investment in social media increased by 2,400% between 2019 and 2020. Since 2020, Boohee has been extensively promoting its products on Weibo, Xiaohongshu, Douyin, Bilibili, WeChat, as well as its public account. For instance, Boohee posts up to ten times a day featuring KOLs on Weibo which include integrating lotteries, games, celebrity chats, live interactions, and product placements. Boohee publishes videos as often as every two days on Daoyin, at least two in-depth, professional articles about healthy foods on Bilibili, and the focus lies on user exchange and experience on its public account.

Boohee’s main tool of communication is KOLs. Since 2021, Boohee collaborated with actor Yin Zheng (尹正) in creating weight loss recipes, Wu Yucheng (吴宇恒)in recommending meals, as well as Yi Wen (怡文) as a professional nutritionist and a KOL respectively for Boohee.

Chinese consumers’ perception does not match Boohee’s success

Our social listening on the app reveals that Chinese consumers still very much associate Boohee with its initial features of health data functions. We looked at Baidu Index, where popular words searched related to Boohee’s Health app include “calorie counting”, “calorie calculator” and “calories for fried rice”.

However, the attitude among Chinese consumers shows a preference for KEEP and other brands.

- KEEP additionally provides sports videos on the app’s front page, supporting users in their fitness journey

- Boohee users complain that it only provides nutritional data (e.g. calories, fat) of food intake, while KEEP and other brands such as Meituan and Elema, also recommend users the optimal meal plan and guide them better in their health journey.

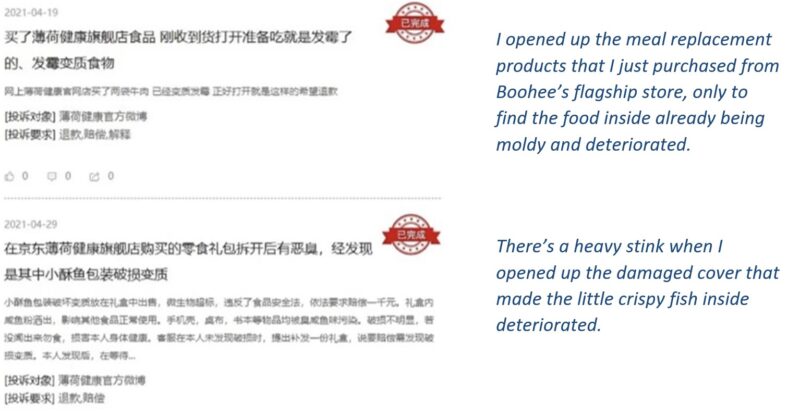

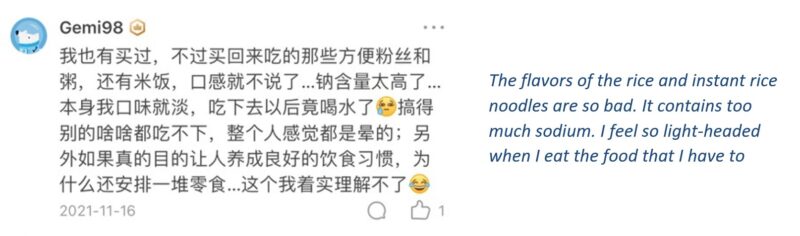

Regarding the healthy food products, the results from our social listening illustrate an overwhelmingly negative perception of Boohee’s products by Chinese consumers, including:

- Consumers experience side effects like constipation with the pregnancy meal

- The flavor is bad and the products are too salty

- The price is too high and the quality is lacking

- Products are delivered in a state of deterioration

- Products cause side effects such as muscle loss, weakened immune system, and period disorder

- Products have no scientific foundation but cause hunger

On the other hand, the positive feedback is less dominant, evaluating the products as having a good taste and being sufficiently filling.

Will Boohee’s sudden success last?

In terms of recording health data, it appears that Boohee did not alleviate the issues it struggled with pre-pandemic. On top of that, competitors such as KEEP innovated their services amid the pandemic. As a result, Boohee continues to lag behind in its service content as well as quality, whilst consumers continue to choose its competitors’ applications.

Boohee has successfully implemented an extensive marketing strategy and generated substantial engagement of Chinese consumers with the brand on social media. Subsequently, sales skyrocketed. From a short-term perspective, the case is a success. However, considering the predominantly negative feedback on the healthy food products, from a medium and long-term perspective, the brand’s success does not seem to be sustainable. Boohee’s growth is only a temporary hype unless the Chinese health app addresses relevant problems.

Key Takeaways

- Boohee extended its business model from a data tool app to a health consumer goods company.

- Sales increased 200% between 2019 and 2020.

- The brand benefited from the increased health concerns of Chinese consumers impacted by COVID-19.

- It successfully implemented a new marketing strategy in 2020 by leveraging engagement with KOLs on many social platforms

- However, this abrupt success does not seem sustainable unless Boohee addresses major issues in its health data monitoring services as well as the offering of its healthy food products.

Author: Lucia Toth

Download our whitepaper on China’s wellness market