Bitcoin had a more than 300% surge since 2020. Naturally, cryptocurrency has gained tremendous attention from various stakeholders in China. Additionally, massive capital is flowing into cryptocurrency market in China. With the heating up value on bitcoin, Chinese netizens debate whether cryptocurrency is a massive Ponzi scheme that produces a meaningless output, or if it is a money revolution that drives people to enter a new era of the virtual finance world. We investigated the Chinese perceptions of Cryptocurrency and including the stances of the Chinese government, miners, investors, and netizens.

Source: 163.com, anecdote on a Chinese woman purchasing bitcoin being sent to the psych ward by her husband.

Chinese government attitude towards cryptocurrency: Cryptocurrency regulations in China

The Chinese government has an ambiguous attitude towards cryptocurrency. In 2017, the government banned initial coin offerings (ICO) because the authority characterized them as an act of unauthorized and illegal public fundraising that is suspected of having ties to criminal activities such as financial fraud and pyramid schemes.

However, the Chinese government has never had an issue with its underlying technology — blockchain, on the contrary, they highly support it. In 2019, president Xi gave a speech indicating that China needs to seize the opportunity of developing blockchain. The government considers the development of blockchain technology as China’s core technology development strategy.

While the government does not recognize cryptocurrencies as legal tender, and none of the banking systems in China accept cryptocurrencies or provide relevant services, to suppress the heat on cryptocurrency in China, the people’s bank of China (PBOC) has done some real-world trials on digital yuan, which is the legal tender backed by PBOC.

Cryptocurrency mining in China

The ways to get cryptocurrency is either mining the cryptocurrency or buying the existing cryptocurrency. Mining for the cryptocurrency requires heavy computer calculations, which costs a considerable amount of electricity: to be specific, the energy that it costs to mine bitcoin is more than the whole of Ukraine.

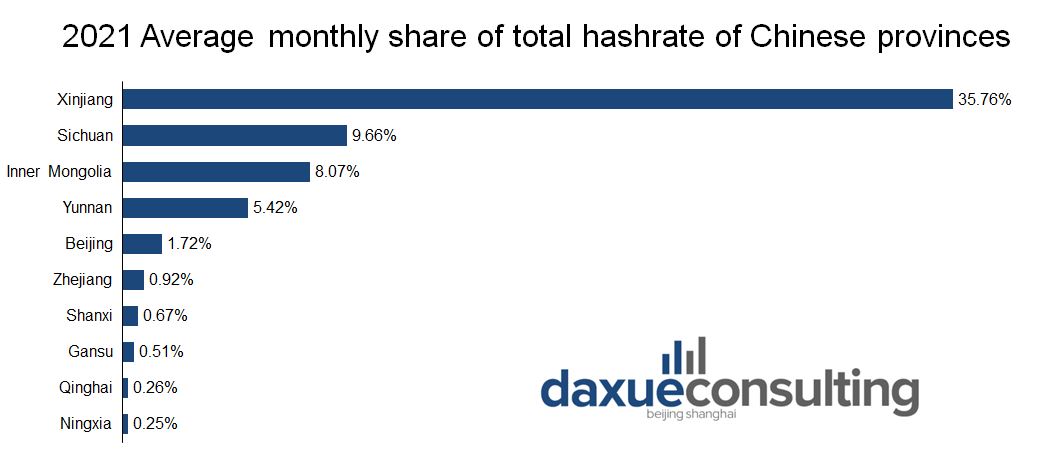

However, China is the largest cryptocurrency mining country in the world. According to Cambridge Bitcoin Consumption Electricity Index, Chinese miners produced about 65% of the world’s bitcoin. This is because of relatively cheap energy costs in China, particularly in rural areas, such as Xinjiang, Sichuan, and Yunnan province. But recently, the Chinese government halted the mining activities in Inner Mongolia due to the high level of energy cost.

Source: Cambridge Bitcoin Consumption Electricity Index, designed by daxue consulting, Average monthly share of total hashrate in China April 2021

Cryptocurrency mining in China could be a highly lucrative activity: the profit margin of mining a cryptocurrency is as high as 90%. As bitcoin and its derivatives have not been fully exploited, an increasing number of Chinese people have devoted themselves to cryptocurrency mining. As mining machine required a massive amount of capital to invest, there is also the option of “cloud mining”, which is renting a quantity of computing power to a company to mine cryptocurrencies.

Chinese investors opinion of cryptocurrency: Cryptocurrency trading in China

Source: zhihu.com, Investment suggestion in 2011

Chinese regulations on cryptocurrency trading are loose. The law does not prohibit people from holding and transferring cryptocurrency. Individuals can easily open accounts and trade online if they upload details of their Chinese identity card. Most Chinese crypto investors prefer to buy cryptocurrencies and hold them for a long time.

In 2021, with a high number of unconventional monetary policies implemented by the local central banks to save the economy, people are afraid that traditional currency will loses its intrinsic value. Therefore, some Chinese people regard cryptocurrency as an alternative investment to diversify the risk on their investment portfolio. They think that cryptocurrency is digital gold because of its decentralized character. Thus, they stash their money on the blockchain-based digital asset during a turbulent time.

The Chinese government puts strict regulations on foreign exchange control. To prevent domestic currency flight to overseas, the personal exchange quota is $50,000 per person per year. Also, because of its decentralized character, in China cryptocurrency has been used to conduct money laundry and capital flight. Chinese nationals, however, can buy and sell unlimited amount of cryptocurrency to move their money out of the country. In 2020, $17.5 billion worth of digital assets flowed out of Chinese exchanges to foreign venues, with a year-on-year increase of 53%. Chinese investors have a strong preference for Tether over other cryptocurrencies in doing such activity because Tether is pegged to the US dollar.

Chinese Netizen’s perception of cryptocurrency: Online comments on cryptocurrency in China

When discussing cryptocurrency, Chinese netizens use the phrase “cutting leek” (割韭菜). It is a metaphor stating that newbie investors, following the current influencing trend, always end up losing their money. They would grow back by the time new naïve newcomers spring up and replace them.

Some Chinese netizens perceive that cryptocurrency works just like the pyramid scheme.

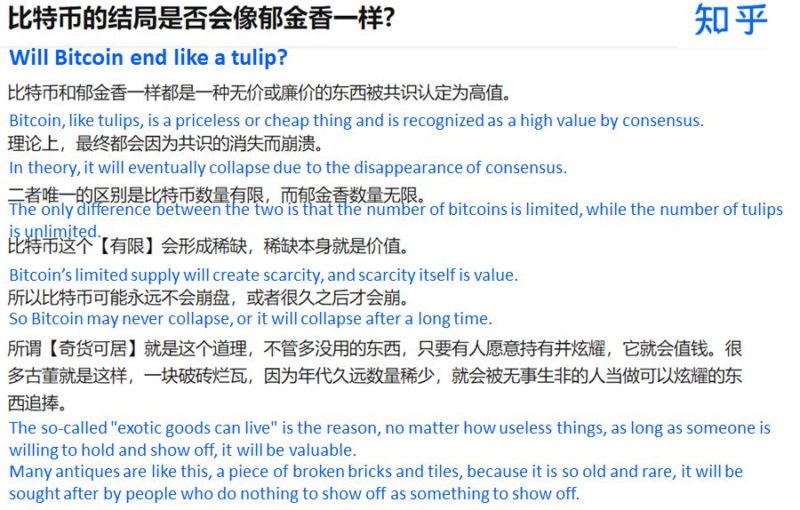

Source: zhihu.com, Discussion on the future of bitcoin, what Chinese netizens say about Bitcoin, Chinese perceptions of cryptocurrency

Chinese netizens also believe that many fictitious transactions are going on behind the trade of the cryptocurrency market. As the market lacks regulations, the trade of cryptocurrency can be interpreted as a game between bookmakers and individual investors. It is highly volatile and Chinese netizens think that people who gain massive profits from cryptocurrency are purely speculators. An early digital currency investor shared on Zhihu: “I was a speculator. Although everyone can say that cryptocurrency is such an idealized concept, the truth is that once you participate in the game, everyone has become a speculator. Short-term speculators in the cryptocurrency industry, miners, mining machine manufacturers, mining machine chip manufacturers, trading platform operators, and traders have all become participants in this short-term game.”

Chinese perceptions of cryptocurrency

Cryptocurrency is sustainable in the long run only if it is broadly accepted and creates security and trust. Any currency itself can be viewed as a Ponzi scheme. The more people trust the currency, the more likely people use it in daily life. Cryptocurrency is working on its way to become broadly accepted. The Chinese government does not accept cryptocurrency as a legal tender, but the authority frees individuals to possess and exchange cryptocurrency legally. Due to its volatility, bitcoin is a vehicle to speculate. It will not function as a standard currency to trade goods, but it is an alternative investment to trade and hold.

Takeaways of how Chinese view cryptocurrency

- The Chinese government banned ICO but does not prohibit people from owning and trading cryptocurrency.

- Most cryptocurrency mining is done in China in rural provinces because of the cheap energy cost. In the face of ever-tighter government regulations, engaging in mining activity in China is still a highly lucrative business.

- Cryptocurrency has no regulations. Thus, money laundry is possible via cryptocurrency. Tether, a cryptocurrency pegged to the US dollar, is used for the Chinese to move their capital out of China.

- Chinese netizens think that everyone who is involved with cryptocurrency is a speculator. Indeed, individual investing in cryptocurrency is like participating in a game with bookdealers.

Author: Tong Zhu

Learn something new? Stay updated on the Chinese market by following our WeChat, scan the QR code below, or subscribe to our newsletter

Other finance news: The Chinese M&A market

Listen to over 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast