COVID-19 and the Chinese silver economy

COVID-19 impact on elderly care in China will bring about new markets and consumer concerns. Governments, institutions and private companies have already been working together to reform the Chinese elderly care industry. They have shown great resilience during the health crisis and will surely pick up speed post-pandemic. COVID-19 may threaten the elderly the most, but there is a silver lining: elderly care is getting more attention from the Chinese society, and new opportunities abound in the Chinese silver economy.

Market size for elderly care was on the rise, regardless of COVID-19

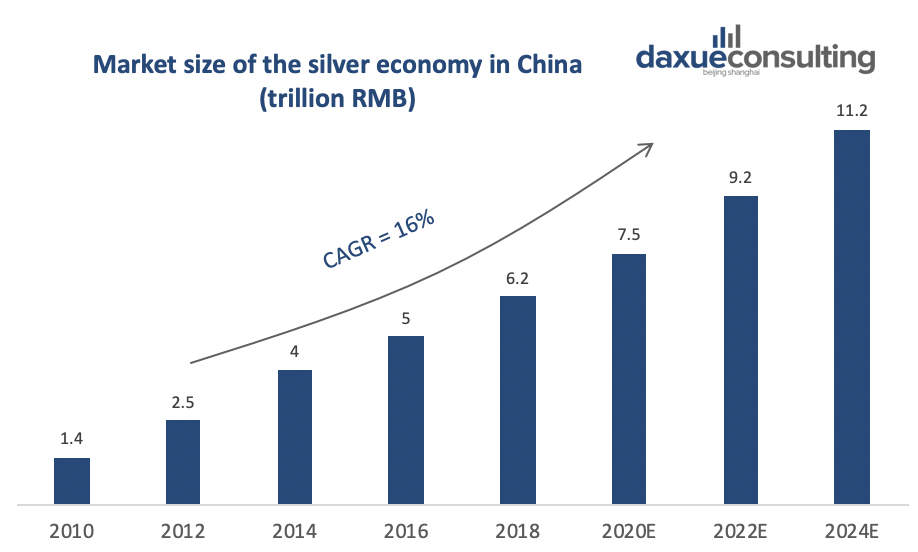

Be it a bless or curse, the next few years will witness a fast-aging Chinese society as the elderly population outnumbers the new-born. As the Chinese population ages, the market size on Chinese silver economy almost doubled from 2015 to 2020. Based on research of Forward institute, the CAGR of silver economy in China is expected to be around 16%.

[Data source: Forward Research Institute, “Market size of the silver economy in China”]

China National Committee on Aging has predicted that by 2050, one third of the GDP in China would come from people aged over 60. What’s more, the market potential for Chinese silver economy might rise from 4 trillion in 2014 to 20 trillion in 2030 and 106 trillion RMB in 2050.

Huisheng Wang, president of State Development & Investment Corporation said to Xinhuanet: “the silver economy in China is a rising industry and we need to keep investing. Without losing money, we need to explore sustainable business models and help inject social capital. The happiness of our citizens and their families is at stake.”

Growing Population

The population of people aged over 60 in China has reached 250 million and is growing every year by 20 to 30 million in the next 20 years. In the near future, opportunities and challenges in the elderly industry in China such as healthcare, lifetime education, tourism and digital-aided lifestyle will give birth to more exciting solutions.

Growing Disposable income per capita

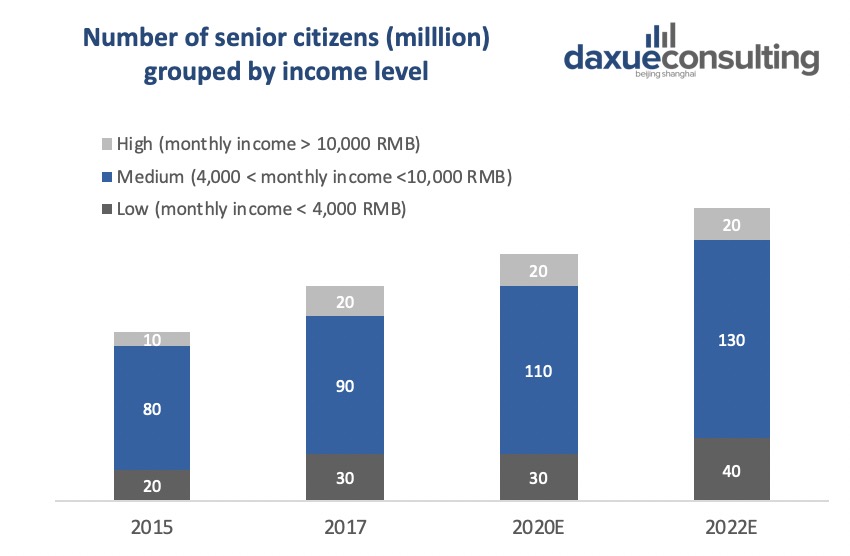

As the middle class enlarges in number, the average income for the elderly rises too. According to iiMedia Research, there will be a growing number of aged people having income over 4,000 RMB.

[Data source: iiMedia Research, “Growing number of senior citizens grouped by income level”]

Jin Wang, Chief Commercial Officer at HiNounou, a vision-driven startup in Chinese elderly care said to Daxue Consulting: “There is huge potential for the silver economy in China. Never before has there been more disposable income for people over the age of 60 and the data show a positive outlook for more growth to come.”

Zoom in on elderly care in China

Market size

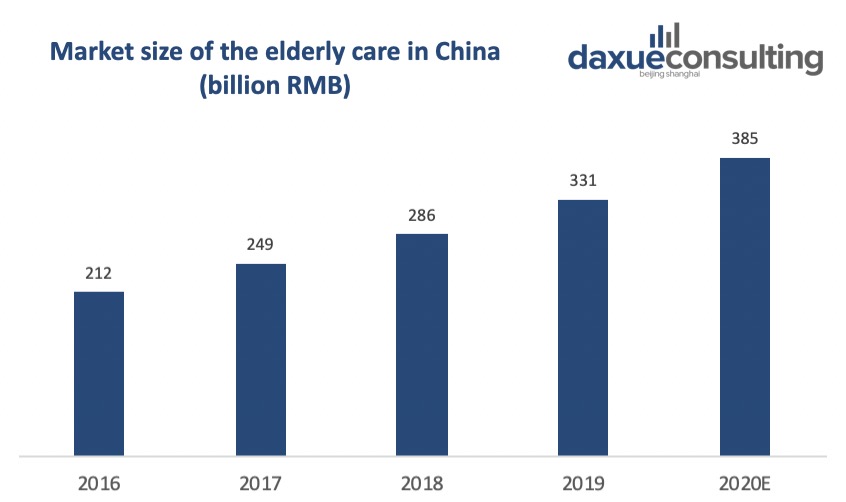

Elderly care industry is defined by State Council as a service industry that aims to satisfy the living and spiritual needs of the elderly. According to the sixth National demographic census, the number of senior citizens in China who live alone has risen 40% from 1990 to 2010. Based on analysis from iiMedia research, there are going to be 30 million seniors living alone by 2020. As a consequence of intensified mismatch of demand and supply currently at play, a variety of services and products is expected to surge.

[Data source: iiMedia Research, “Market size of elderly care in China”]

The “new Chinese seniors” are more educated and open to digital technologies

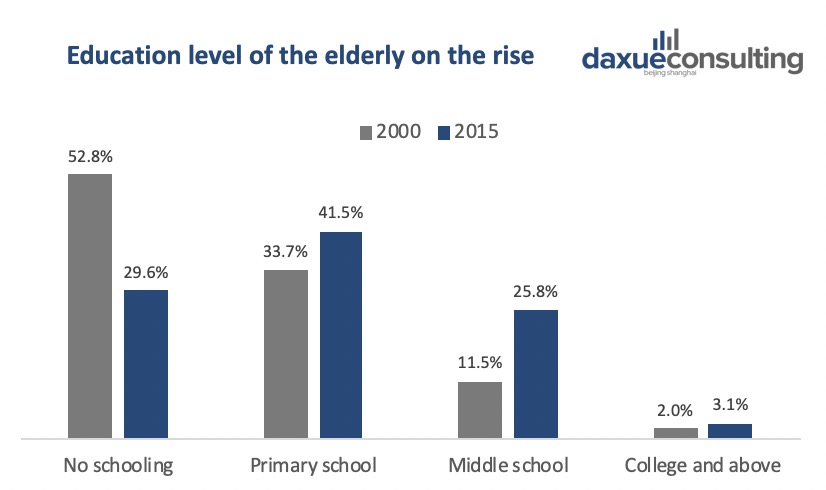

The improved human capital, a better quality of life, and a more reliable social welfare system all contribute to forging the “new Chinese seniors”. Before, the Chinese elderly give the impression to be excessively frugal and only trust the goods they can touch. Over the recent years, however, the retired Chinese are using mobile payments to spend on beauty and fashion just as their grandchildren do. According to Chinese Research Center for Aging, the percentage of Chinese senior citizens never being in school has dropped 43.9% from 2000 to 2015. There is a general improvement in seniors’ education level, which is expected to improve even further.

[Data source: Chinese Research Center for Aging, “Education level of the Chinese elderly on the rise”]

Chinese senior citizens are embracing digital advancements and spending for self-entertaining activities. According to Cyberspace Administration of China, internet keeps spreading into the middle-aged and aged groups. By June 2019, Chinese netizen population reached 854 million, of which over 6.9% are over 60 years old. This means that more than 1 out of 5 senior citizens in China goes online frequently. According to iiMedia research, more than 85% of the seniors think that mobile payment is easy and secure. The upgrade of consumer behaviors makes it more attractive to target the Chinese seniors.

Elderly care will only be temporarily impacted by COVID-19

A parallel can be drawn between COVID-19 and SARS in 2003. By May 2003, fast moving consumer goods had cut growth in half; transportation, tourism and other service sectors all suffered greatly. Similar outcomes have been produced in the beginning of 2020 in the service industries again. Being deeply service oriented, the Chinese elderly care industry also took a big hit, as care givers cannot visit and accompany the needed. What’s worse, the timing of the epidemic outbreak coincided with spring festival when workers started to migrate domestically. This means that the much-needed labor is likely to be displaced and quarantined in a different city.

However, when it comes to positive differences, COVID-19 is more contagious but less fatal. Also, this time the government reacted with more experience and agility. Even though the present-time China faces deeper economic pressure from abroad and home alike, the country has shown great determination to put an end to the pandemic. Government and social aid have come to the industry’s rescue, online courses have been set up, family members have been more responsible. Everyone is working hard to transition through this difficult period for their beloved elderly. As the long-term prospect of elderly care industry in China is robust and prosperous, COVID-19 will only be a short-lived grey episode of the long march into the future.

COVID-19 impact on 4 subcategories of elderly care industry in China

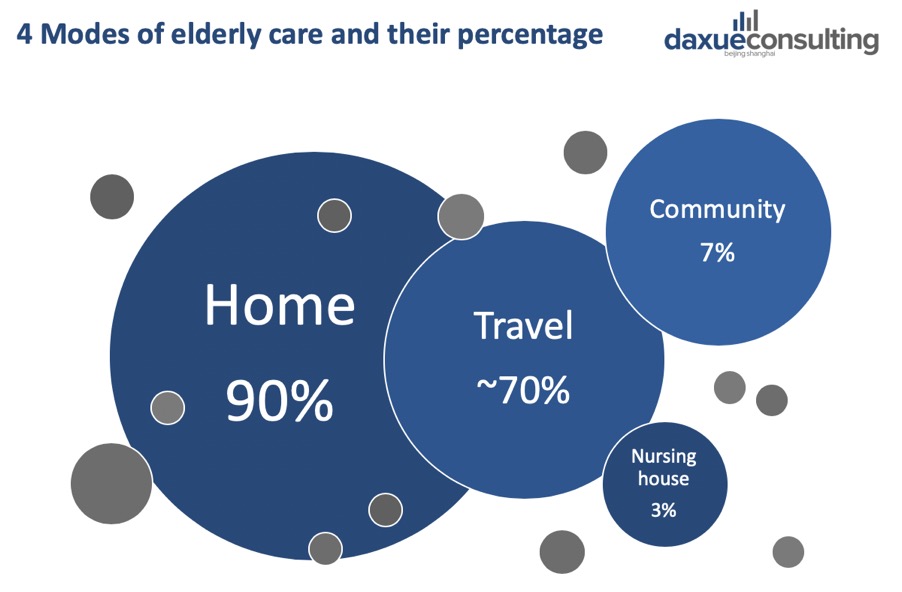

There are three major ways people pass their retired life and one trend adopted by a majority of the elderly. The graph below illustrates the relationship between the four subcategories.

[Source: Daxue Consulting, “4 modes of elderly care in China”]

Shanghai government first coined the notion of “9073”, where 90% of the elderly spend their life at home, 7% at community care center and 3% in institutions. For home care, the elderly rely on family and friends, or sometimes hired caregivers. For community-based care, there are day-care centers and short-term nursing homes, mostly very close to the homes of the elderly. The institutions are mostly frequented by elderly who need full-time health and medical attention.

Travel-based elderly care, on the other hand, don’t fit into the “9073” model, but are adopted by a majority of the retirees. With the senior consumption upgrade, over 65% of elderly take long trips at least three times a year according to leading trip booking platform Ctrip. Most of the retirees in the 60-70 bracket regard the medically equipped resorts in a beautiful city an attractive alternative to the traditional models of retired life.

COVID-19 impact on Institution-based care in China

The Ministry of Civil Affairs has issued guideline in February to strictly limit the movement of elderly living in institutions. Thanks to the effective execution, very few cases of COVID-19 were reported in institutions across China. However, 100% of the Institutions are facing severe challenges. According to the Ministry of Civil Affairs, the institutions took a 20% loss in revenue and 30% increase in operational costs, compared to the same period last year. According to a report on COVID-19’s impact on elderly care institutions in China, the increased costs come from:

- Spaces need to be restructured as the elderly and caregivers have to be quarantined individually;

- Catering is individualized, and attention to personal hygiene is record high;

- Employee payroll increased as 31% of the institutions are short on labor and had to hire interim workers;

- Acquisition cost for pandemic-specific medical equipment soared for 62% of the institutions.

- 93% of the institutions put in place psychological consultancies and entertaining activities to maintain a positive mindset for their elderly.

The government has been sympathetic to the struggles of the institutions. Beijing injects 100 million RMB to cover the operation costs. Wuhan will subsidize 30% more to the elderly care institutions. Fortunately as the quarantine measures take effect, institutions gradually opened after two months of strict lockdown. Interestingly, Baidu searches for elderly care dropped by half during the pandemic, possibly because some of the senior citizens were sent back to nursing homes or stayed at family homes.

It’s highly likely that direct harm from COVID-19 will be short-lived, but there are long-term reflections on institution-based care

These operational difficulties do not pose deep-rooted threat to the industry. On the contrary, reports from Forward Research Institute show that institution-based care will be an important pillar for elderly care in China. As more and more families reduce into 4-2-1 structure (4 grandparents, 2 parents and 1 child), traditional home-based elderly care is put to severe test. This is why, the public and private sectors are adopting “state owned, privately managed”(共建私营) model to tackle the issue together.

Currently, there are 250 million senior citizens in China and 7.6 million beds in various institutions. As institution-based care is likely to be embraced gradually, if 4% of the elderly opt for institution-based care, China still falls short of 2.4 million beds. The government is well aware of the huge inadequate supply in terms of elderly care. As a result, the Ministry of Civil Affairs removed the application for elderly-care institution since 2019, in a hope to expedite the establishment of institutions.

For Chinese elderly care institutions in the post COVID-19 era, the operation efficiency and risk control capacity will be emphasized. There are already private companies offering big-data-enabling, cloud-based, information-integrated systems for such institutions. We may owe it to the COVID-19 that more viable solutions will come to light in the near future.

Home-based care

COVID-19 made returning to nursing homes more difficult, even impossible, which triggered a demand for home care. Family members were advised to communicate more often with their seniorcounterparts. Seniors living alone could still return to nursing homes, but under strict rules of quarantine and observation.

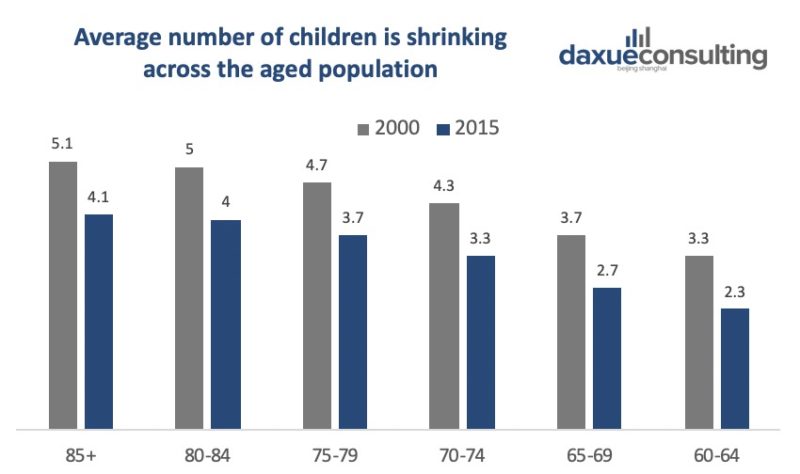

Like with institution-based care, COVID-19 highlighted the need for home-based care. According to China National Committee on Aging, the need for catering ranks the highest at 42.2%, followed by housekeeping (33.3%), health recovery (21.4%) and long-term care (20.6%). Unfortunately, home-based care runs a big risk of understaffing of children over the long run. According to Chinese Research Center for Aging, the average number of children of the Chinese elderly reduced by 1 from 2000 to 2015 and will keep reducing because of the single child policy which lasted for about 2 generations.

[Data source: Chinese Research Center for Aging, “Average number of children is shrinking”]

While COVID-19 put a temporary pause on to-door elderly care services in China, the trend is not to be reversed by the pandemic

If anything, more third-party services such as shopping, hair-cutting, hospital accompanying will sprout out after the social distancing is lifted. To-door services will make up a big pie in elderly care in the years to come.

Increased acceptance of internet and mobile payment will diversify the digital entertainment and online-to-offline services the elderly get access to. Imagine an app that allows the elderly to purchase online and get delivered offline by their community-care center. Firstly, it takes care of the “last mile” issue in the logistic chain. Secondly, that app can also integrate online theater, online dancing, short-video channels that spices up the indoor life of senior citizens. As more professional caregivers supplement family members in home-based care, post COVID-19 era will see intelligent solutions merging with to-door elderly care services in China.

Community-based care

Community-based elderly care is strategically important in Prime Minister Li Keqiang’s report. According to China National Committee on Aging, 84.2% of the elderly wish to be taken care of in a hybrid of home-and-community-based care. An employee at a day-care center in Beijing told xinhuanet: “after visiting over 2,000 residents, we found a growing percentage of senior citizens living alone. They have a strong attachment to the streets they’ve lived in, also a big fear of judgment from acquaintances. Those reasons kept them away from going to institutions. Day-care center is a great middle ground for them to be taken care of when their children are not around.”

Similar to institutional care, community-based care suffered from strict quarantine measures during the COVID-19 pandemic. But this is just one episode in the Government’s long-term support to community-based care. In the post COVID-19 era, infrastructures to facilitate elderly care in residences and communities will receive tax cuts and various subsidies. More labor will flow to this sector too.

Travel and tourism care

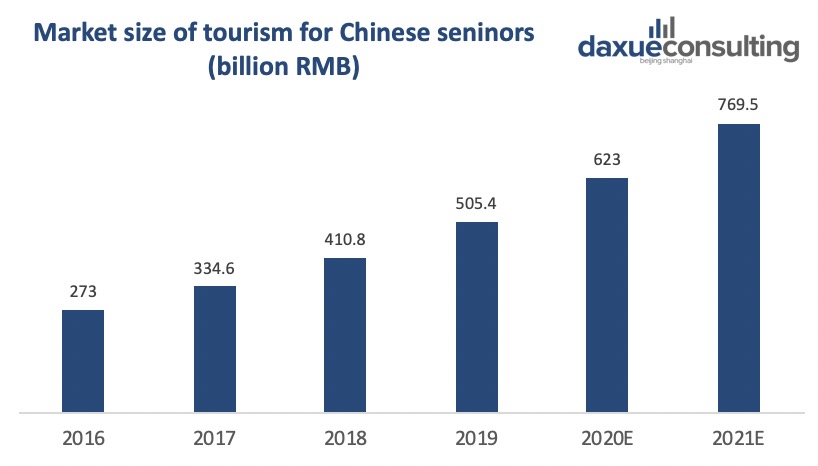

Tourism, an important part of senior consumption upgrade and elderly care in China was put to a halt due to COVID-19. But once the havoc on tourism smooths out in less a year, the elderly will take up the joy of self-sufficient travels. After all, seniors make up more than 20% of China’s tourists every year. Suppose every Chinese senior citizen travels three times a year, spending 1,500 RMB per trip, that means the market is potentially as big as 1 trillion RMB.

[Data source: iiMedia Research, “Market size of tourism for Chinese seniors”]

In summary, COVID-19 had a detrimental but temporary impact on elderly care in China. As the Chinese society ages, both the public and private sectors are working together to close the gap in demand and supply of elderly care. Rather than worrying about COVID-19, of which China is gradually recovering, it’s more important to plan ahead for the booming elderly care ecosystem in terms of infrastructure, labor quality, real estate investments, and digital solutions.

Author: Della Wang