Consumer Relationship Management (CRM) systems are widely used to interconnect customer and client data to better operate companies. This concept was first introduced to China in early 2001 after China entered into the World Trade Organization. Nowadays, with the development of the internet and the rise of social media, more and more Chinese entrepreneurs are looking for CRM systems that support business models, capture customer demand, and more importantly, help their companies grow. The CRM market in China is concentrated on the east coast and will continue to mature with the development of the economy. Driven by cloud computing technology in China, the domestic CRM software companies are rapidly expanding in the market.

The CRM market in China is still maturing

CRM systems ares used in many departments such as sales, marketing, and customer service. International giants in the CRM industry include Salesforce, Oracle, and SAP. Chinese CRM companies have also been popping up in the market.

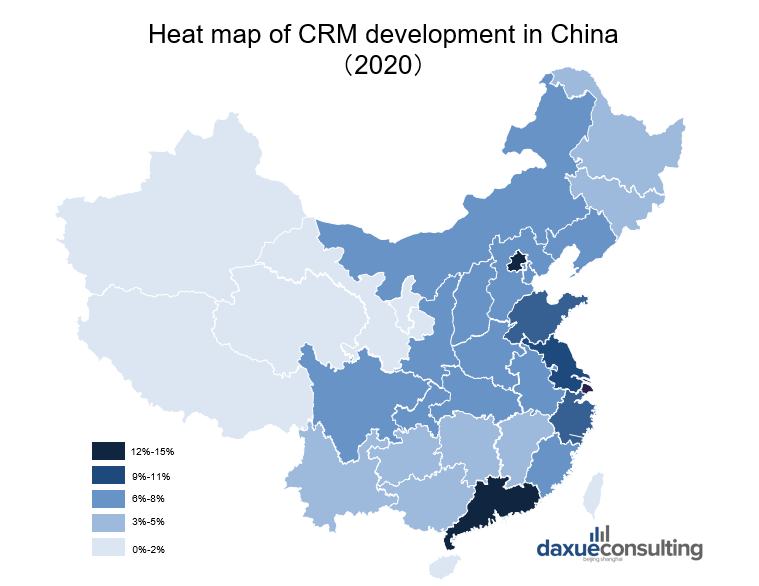

Source: cniteye.com; designed by Daxue Consulting, heat map of CRM penetration and usage in China

In China, the development of CRM software started around 2007, with Kingdee International Software Group Limited’s independent system, Kingdee CRM, as a pioneer in the CRM industry. But the Chinese CRM system at that time was only an extension of the sales function of the ERP system. Compared with the international mature CRM systems, there was a great disparity. Thus the domestic market’s response was not encouraging. After 2014, SaaS-based (Software as a service-based) CRM software began to emerge in China’s market, represented by platforms such as Fxiaoke (纷享销客) and Xiaohouyi (销售易). During the same period, international CRM software vendors, like Zoho, became been known in China as well.

Cities in southern China, such as Shenzhen and Guangzhou, are influenced by Hong Kong, which had a developed economy earlier. While in recent years, with the booming of e-commerce in the Yangze River Delta region, such as Shanghai and Hangzhou, CRM systems are now more frequently used in small and medium size enterprises (SMEs) to provide online customer service.

Domestic companies take up most of the small CRM market

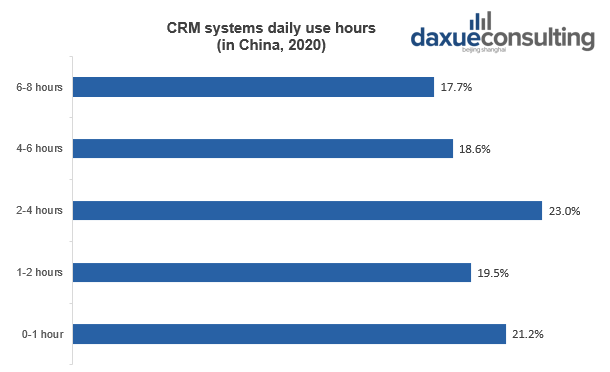

The concept of customer relations developed later in China than in the west. Thus, some enterprises focus on how to expand the size, cut costs and improve efficiency, but not how to improve customer relationships. According to T research, Chinese CRM users spend an average of 3.1 hours per day in the CRM systems, of which 40.7% are within 2 hours. Chinese companies rarely rely on CRM systems for customer management and business optimization. This also becomes an obstacle for foreign CRM implementation to succeed in China.

Source: T research; designed by Daxue Consulting, CRM systems daily use hours in China

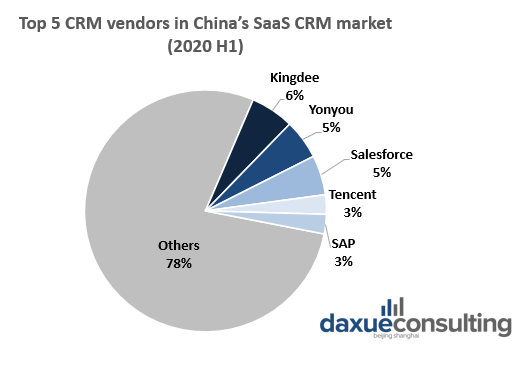

Until 2017, domestic brands accounted for 70.4% of the CRM companies China, but the market share of domestic brands is far less than that of international brands. This is due to the gap between domestic brands and international brands, mainly in product technology, such as product design, framework design, and technical architecture. Besides, since CRM concepts, like customer lifecycle (CLV), are still yet-to-mature in China, it leads to competitive disadvantages of domestic brands with large companies, especially with multinationals corporations.

However, the advantages of China’s CRM software suit small and medium sized companies with local service and cheaper prices. With the development of online sales and mobile sales in China, most small and medium companies are also paying attention to efficient and internet-based customer management. Compared to international standard CRM, Chinese CRM systems are more flexible in the market and at a lower cost.

Main providers in China’s CRM market

Source: designed by Daxue Consulting, domestic companies in China’s CRM market

Fxiaoke (纷享销客)

Fxiaoke, an important part of Kingdee’s cloud CRM systems, has the biggest share in the enterprise-grade SaaS cloud services industry in China. The Chinese CRM company provides services to more than 600,000 famous enterprises in China, such as Jinmailang Foods, Mengniu Dairy, Tenda Technology, covering various industries.

Xiaoshouyi (销售易)

Established in 2011, Xiaoshouyi is a pioneer in China’s CRM field. Its clients include Lenovo, the Commercial Bank of China, Didi, and many industry giants in China. In 2019, when Alibaba announced an exclusive partnership with global CRM leader Salesforce, Tencent invested $120 million in Xiaohouyi.

Yonyou CRM (用友CRM)

Yonyou is one of the biggest information technology companies in China. It offers a broader range of products in management systems, including CRM, software, ERP software, HRM (human resources management) software, OA (office automation) software, and other related software.

Waiqin 365 (外勤365)

Waiqin 365 is a CRM software based on SaaS, particularly for the management of the offline sales team. Its customers are mainly in foods, beverages, and commodity industry.

Tencent Qidian (腾讯企点)

Tencent’s SCRM (social customer relationship management) product, Tencent Qidian, is a cloud CRM platform that integrates Tencent’s ecosystem. It helps companies centralize data from QQ, WeChat, Tencent Cloud, and other platforms. Companies are able to reach customers through social channels, under the absence of email channels in China.

Cloud-based SaaS CRM has a fast growth in China

Particularly in cloud-based SaaS CRM. CRM has the largest share of the enterprise application SaaS market in China at 59%, and is expected to continue to grow at a rapid CAGR of 36% in the following years.

Source: IDC; designed by Daxue Consulting, Top 5 CRM vendors in China’s SaaS CRM market

On the one hand, the mobile networks make it easier for cloud-based SaaS CRM systems to collect customer information and deliver it to enterprises via the cloud. Enterprises do not need to purchases additional hardware devices. Without the deployment and installation process, it saves time and cost for the companies.

On the other hand, the Internet of things (IoT) and cloud computing technology have also driven the development and application of SaaS CRM systems in China. IoT can track the transportation and sales of goods in real-time; while cloud computing can deal with more user data, which helps companies analyze user behavior.

“CRM in China has to be SCRM”

Compared with traditional CRM, SCRM (social CRM) focuses more on social media. With the mobile internet’s explosive development in China, social network apps, such as WeChat, QQ, Weibo, have become the main ways of communication. Through major social platforms, brands can directly talk with customers. In 2017, the development speed of SCRM in China has surpassed SFA and Waiqin365, which is the most potential branch of CRM system, according to Analysys. There is a saying that “CRM in China has to be SCRM”.

SCRM is a consumer-centered and social-focused system. Based on the social network, companies are easier to describe customer profiles. It can provide personalized services and guide customers step by step, which helps companies transform new customers into loyal customers. It also can reduce customer acquisition costs through viral marketing.

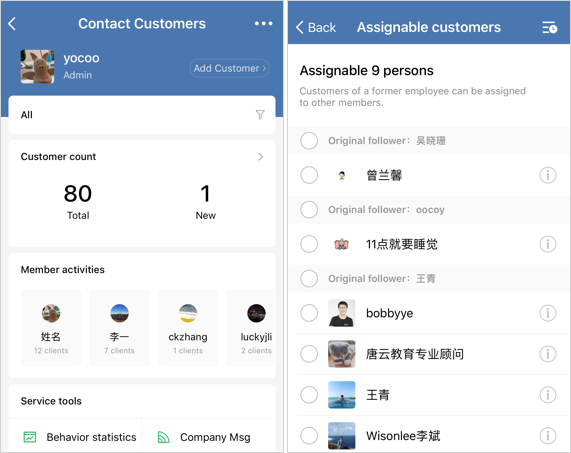

Source: WeCom official websites; contact customers feature in WeCom

Many luxury brands have done so in WeChat CRM, a popular SCRM in China. Dior offers customer service, as well as sells gift cards, on WeChat Mini Program. It allows brands to collect consumers’ basic information, and more importantly, valuable feedback about products through the WeChat platform. There are many third-party SCRM systems that can generate data from the WeChat platform, such as Zoho. WeCom (or WeChatWork), launched in 2019, is the most commonly used in Chinese SMEs.

Chinese enterprises demand CRM systems that blend with social media

Due to the trade friction and the spread of the global pandemic in 2020, the CRM market in China has also been seriously affected, especially in industries with high CRM demand such as manufacturing, travel, and restaurants. However, software development and the Internet industries are showing growth. SaaS SCRM systems that focus on customer connection and social networking have become the trend in China’s CRM market during 2020. Enterprises are also paying more attention to the internet marketing function in the CRM system.

Learn something new? Stay updated on the Chinese market by following our WeChat, scan the QR code below, or subscribe to our newsletter

Learn more about China’s digital ecosystem, see our report on WeChat mini-programs

Listen to over 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast