Following the zero-COVID policy, the Chinese economy has developed at a slower pace, growing by 3% in 2022, 2.5% less than the government’s predictions (5.5%). Yet, the Chinese market is one of the most flourishing in the world and offers plenty of opportunities for new companies.

The opportunities and challenges of doing business in China

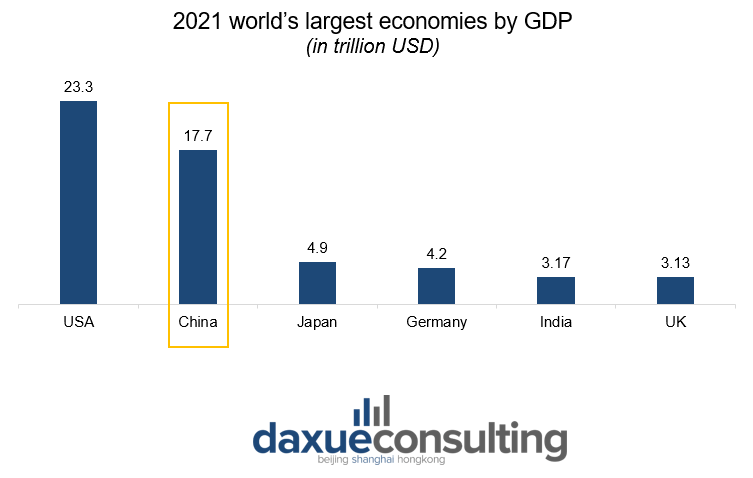

As of 2021, China is the second largest economy in the world after the US, with a GDP of USD 17.7 trillion. In addition, from 2000 to 2018 the amount of Chinese people belonging to the middle class has risen by 47.7%, going from 3.1% share of the population to 50.8%, and it is expected to grow more in the future, boosting the Chinese market capabilities.

An important role in the Chinese economy is certainly played by e-commerce platforms. According to a eMarketer research of June 2022, China’s e-commerce market generated roughly USD 2.9 trillion in 2022, placing itself as the world’s largest e-commerce economy, with 45.3% of its domestic retail sales taking place online.

Although the Chinese market is rich and offers numerous opportunities, it is also hard to develop an effective marketing strategy to successfully enter the market.

The government plays a central role in the Chinese economy

Three main economic systems can be observed in modern China: mandatory planning, indicative planning and a system balanced by market forces. Industries considered to be of national importance – for instance, the tobacco and weapon market – fall within the government’s full control. However, throughout the years, the indicative planning and market forces categories have gradually expanded at the expense of central planning. The easiest way to understand which category a business belongs to is by checking the Catalogue of Industries.

The Catalogue of Industries includes four sections – encouraged, restricted, prohibited and permitted investments – and it is frequently updated. The last update to the catalogue of encouraged industries was on October 26th 2022 and it was enacted on January 1st 2023. The number of encouraged sectors went up from 1,235 in 2020 to 1,474 items. The fact that at each amendment new sectors are added to this catalogue suggests that the Chinese government is growing more interested in opening up to foreign enterprises.

A summary of the available business options

In order to successfully enter the Chinese market, it is essential to decide what vehicle is the most appropriate for your enterprise to use. Do you plan on manufacturing locally or on exporting? Are you interested in selling directly to the consumer or do you prefer licensing third parties? Is your product meant for specific geographic areas?

Direct or indirect investment: what to choose?

An indirect investment consists of the acquirement of public or private company assets. The risk attached to this option is relatively low, as you are free to invest in multiple companies simultaneously, instead of committing to an only enterprise or market share. A foreign direct investment (FDI), instead, involves a stronger presence in the territory, as well as higher exposure to the risks of the market.

Opting for an FDI, you will have to choose whether to build your brand from scratch –this includes the acquisition or construction of work environments, like office quarters or factories (green-field investment)– or to lease already existing facilities and adapt them to your production necessities (brown-field investment).

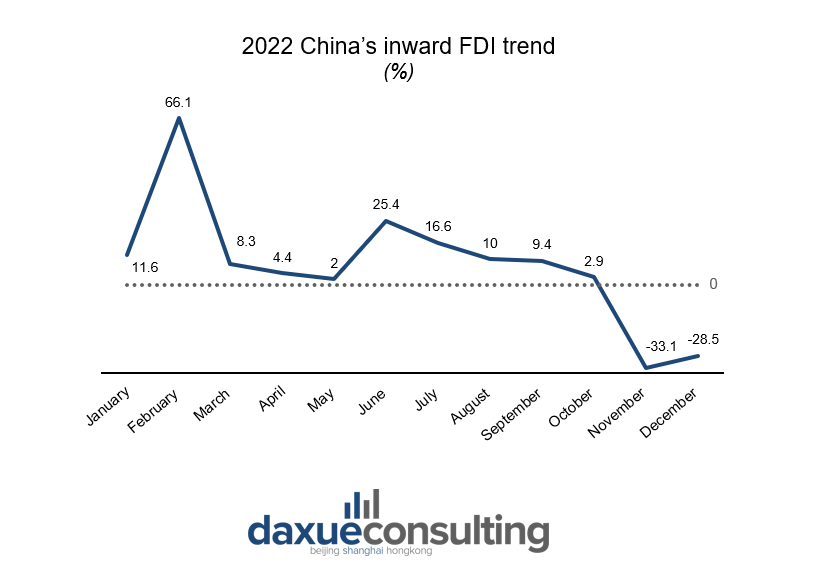

However, as of the end of 2022, green-field investments in China have undergone a significant decrease. This is likely due to the zero-COVID policy, as all the strict regulations enacted by the government seem to have pushed the investors to stall their projects.

It is not yet clear how the situation will evolve in the future. For instance, the Japanese government – the biggest single investor country in the Chinese economy, with a stock of USD 123 billion at the end of 2021 – is encouraging Japanese enterprises to reduce their investments on the Chinese market. Nevertheless, some companies, like the Panasonic Holding Group, are not following the advice.

Despite the political and financial tensions, now that the COVID restrictions are getting softer, it is expected a new increase of FDIs toward China.

Exporting

Exporting is the perfect option to avoid getting involved in local facilities production. There are two ways in which this can be done: directly or indirectly.

To have more control over the product the direct export is the way to go. It consists of the shipment of the goods from the manufacturer – the foreign company – to the consumer and does not rely on third parties. Such a measure is getting easier to realise utilizing cross-border e-commerce platforms.

With indirect export, instead, the product would pass through one or more agents before finally arriving in the consumer’s hands. Despite losing part of the company’s control over the product, leaning on third parties that are more knowledgeable on the Chinese market might in reality be the safest option, especially in the early stages of the brand’s activity in China.

Licensing

Another popular option is delegating the brand’s intellectual property rights (IPR) to third parties, allowing them to produce products under the brand’s name. Although this option seems convenient, the Chinese government is having a hard time guaranteeing brands’ IPR protection. The laws and regulations, despite being numerous, often fall short when it comes to being carried out. In the past, there have been cases of companies’ sensitive information being leaked, or their products being counterfeited and sold abroad.

However, the government is taking action to fight this phenomenon and in 2021 it issued a 15-year programme that aims at strengthening the legal system for the IPRs. China will be deeply involved in cracking down any misuse of the IPR regulations, as well as dismantling private monopolies in the market, especially in the internet and big data sectors. This process has already started in 2020, when the government suspended the Ma’s Ant Group USD 37 billion worth Initial Public Offering (IPO) and applied new regulations to online financial services enterprises like Baidu or Tencent.

Before doing business in China, it is advisable to contact specialised lawyers and to do thorough research on new regulations and on potential licensing partners, as to be sure of their reliability.

Entering first-tier cities’ mature markets might not be an ideal choice

China is not a homogeneous market. When doing business in China, it is of major importance deciding on an optimal geographic area where to locate production.

For instance, a pharmaceutical company might consider targeting the Shanxi province. Likewise, the electronic sector might find fertile soil in the Guangdong and Sichuan provinces.

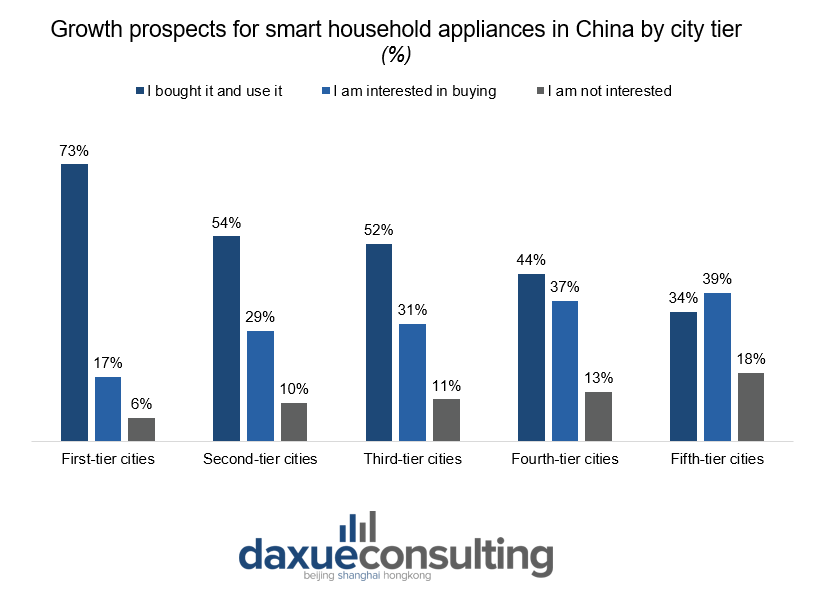

Another factor to consider is which city tier would be the most profitable for you in the long run. Although starting your business in first-tier cities’ mature markets might seem appealing, it is important to note that the competition is extremely fierce, its operational costs are high, and most of the market shares are saturated.

It might be worth considering lower-tier cities instead, as the opportunities of growth are higher and the overall operational costs are lower.

Reaching Chinese consumers’ heart

Once you have decided how to enter the market, you can then proceed formulising a marketing strategy. For this purpose, it is essential to know what Chinese consumers like and how they behave in response to new products in the market.

Chinese consumers love high-tech and are revaluating the “made in China”

In recent years, it has been observed a switch in consumers’ tastes regarding products’ origins. If in the past foreign brands’ goods were perceived as of better quality than local ones (and this perception still lingers, to some extent, in today’s market), now the “made in China” is undergoing a radical change. Unlike in the past, Chinese consumers tend to buy locally – if the price and perceived product quality equals foreign brands’. As of 2018, seven out of the ten most relevant brands in the Chinese market were Chinese.

Chinese people also love technology and are inclined to trying new things. For example, from 2017 to 2021, the market of household appliances – which include smart door locks, smart vacuums, and such – has seen a notable increase. More space for growth can be found in lower-tier cities, where the penetration of such goods is comparatively still low.

Chinese netizens are very sensitive

Last but not least, nowadays key opinion leaders (KOLs) play a key role in boosting sales in China. Although KOLs are essential to promoting products, it might be risky to link the brand’s image to the wrong influencer, as they might be involved in scandals and impact negatively the brand’s reputation.

For instance, on June 2022, Li Jiaqi, a famous Chinese live-streamer, while promoting Unilever’s Viennetta, showed a tank-shaped cake just some hours before the anniversary of the Tiananmen protests, and the livestreaming was quickly shut down.

Brands even face the risk of involuntarily causing scandals, as proves a recent controversy involving the Chinese sportswear brand Li Ning, whose “airport collection” was accused to resemble the design of Japanese military outfits during World War II.

Chinese consumers are extra-sensitive, so it is essential to moderate the business strategy in relation to the local culture and expectations.

The impact of mental health on the Chinese market

Chinese consumers are giving increasingly more importance to mental health and emotional well-being. The main causes of distress are the feeling of tiredness and stress, as well as workloads and financial issues. Moreover, people in the age group 18-29 declare suffering of feelings of loneliness (61%) and low mood (69%), while those in the age group 18-39 are anxious (72%) and short-tempered (52%).

Chinese people living in urban settings try to handle their emotional distress by listening to music (68%), by doing physical activity (66%), or by speaking to their beloved ones (64%).

The rise of health awareness is affecting all the sectors of the market. Just to mention a couple of them, the outdoor sports market and “comfort food” – like fruit or chocolate – markets are growing fast. Such growth in mental health awareness opens up great opportunities for new products that help managing emotional distress and stress issues.

Doing business in China in pills:

- When operating in China, it is necessary to be aware of local regulations: foreign companies are not allowed to enter all sectors.

- You can enter the market by exporting your goods (direct or indirect export) or by producing within the Chinese borders (FDI, licenses). You could also consider indirect investments in favour of multiple local enterprises, if you are not interested in directly selling your goods in China.

- Nowadays lower-tier cities are plenty of opportunities, competition is milder, and the operational costs are lower.

- Chinese people are starting to face towards “made in China” products. They love trying new things and are enthusiastic towards technology.

- KOLs are necessary for promoting products in China, but potential scandals might ruin your brand image.

- Chinese people are paying more attention to mental issues and emotional well-being. This is opening up more opportunities in the market for products that help with distress management.