Douyin (抖音) and TikTok are often used interchangeably, largely because both are under the Chinese multinational internet company ByteDance and share a reputation as popular short video content platforms. However, they are distinct platforms. The most obvious difference is that Douyin is only available in China, while TikTok is available in many countries outside of China.

Download our China F&B White Paper

Douyin vs TikTok: Journey timeline to the top

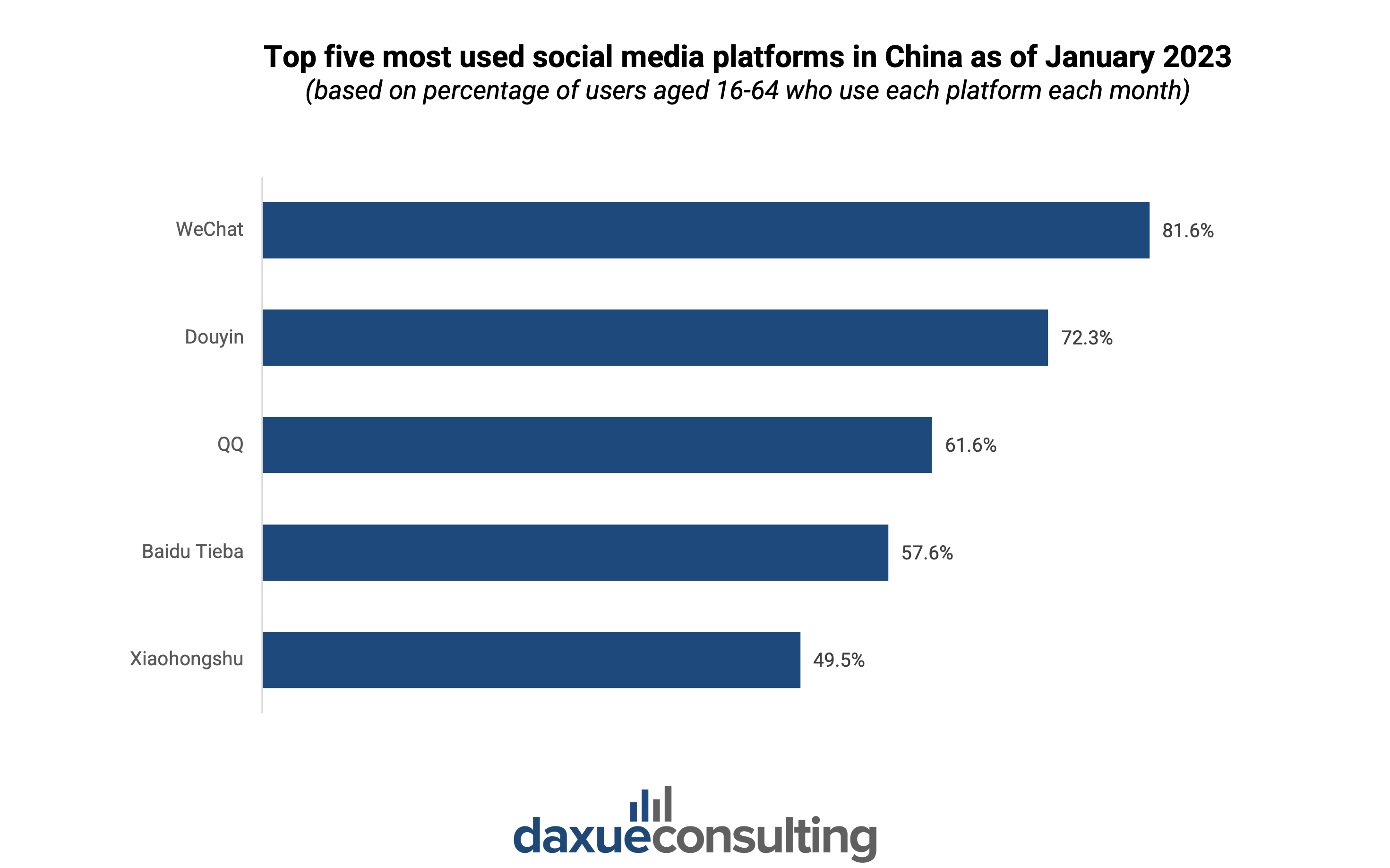

In September 2016, ByteDance launched Douyin, which rapidly gained popularity and became one of the most popular applications in China. Among China’s one billion people, nearly three-fourth use social media and Douyin secured the second position in terms of user count.

Meanwhile, TikTok, having launched internationally a year later after Douyin in September 2017, had also risen to become the sixth most popular social platform globally by the same period.

Contrasts in accessibility, content, and demographics

Douyin is exclusively available in China, while TikTok is available in over 150 countries outside of China. The countries with the most TikTok users include Indonesia, the United States, and other Latin Americana and Asian countries.

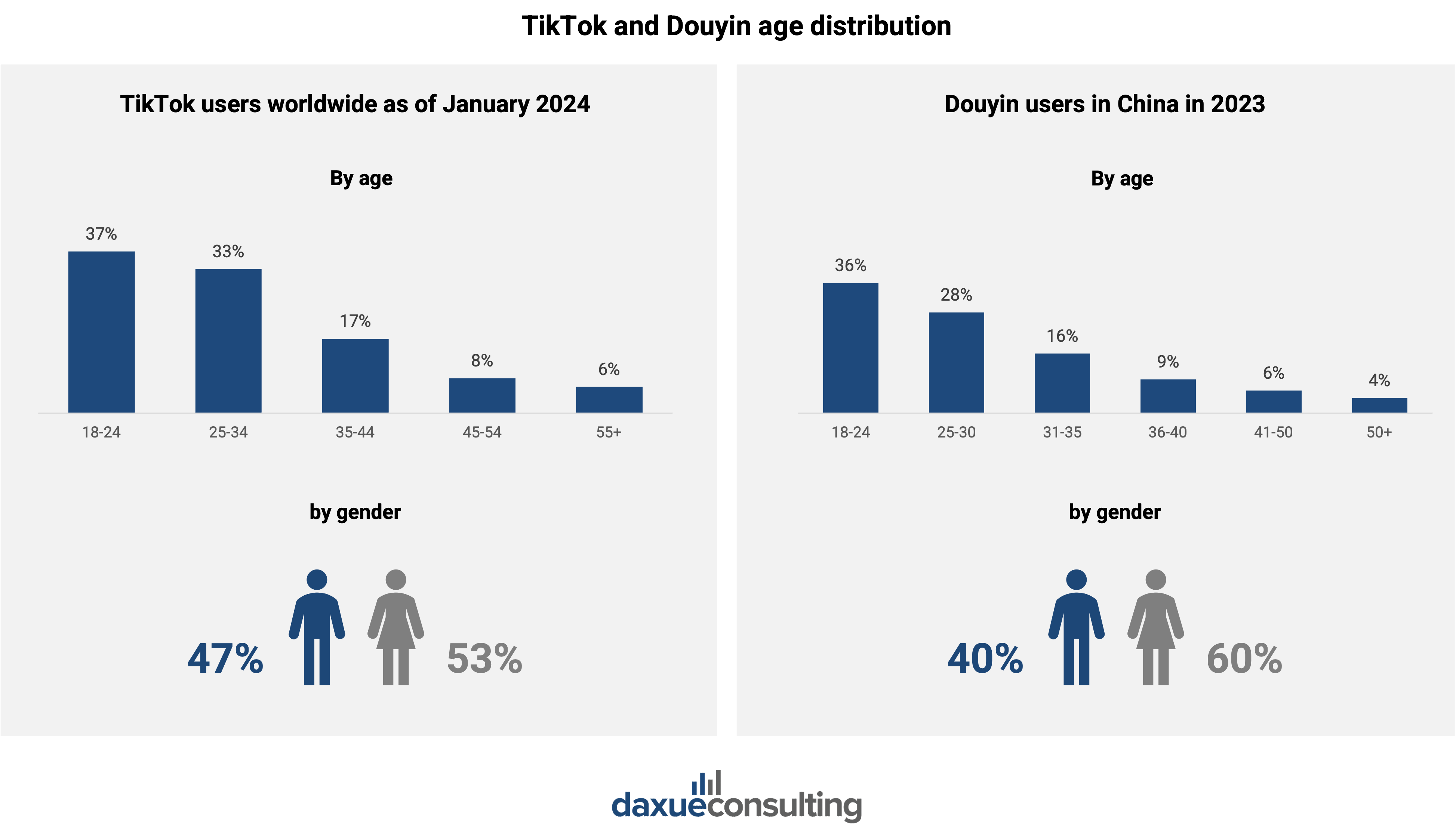

While both platforms’ users tend to lean on the younger side, Douyin’s users are generally younger with people aged 18-35 representing 80% of the total users while TikTok’s users aged 18-34 make up 70% of the total users. Women made up the larger percentage of both TikTok and Douyin users.

Moreover, videos on Douyin can be longer than those on TikTok. On Douyin, users can create videos lasting up to 30 minutes, whereas TikTok imposes a maximum duration of ten minutes for videos that they record on the platform. In 2022, Douyin announced that users are allowed to upload videos longer than 30 minutes and that it encourages content that includes more authentic and objective life experiences, guides, reviews, and niche interests.

Douyin vs TikTok: Diverging paths in e-commerce and marketing

Douyin and TikTok also significantly differ in their e-commerce ecosystem.

TikTok Shop and its challenges

Currently, the TikTok Shop is exclusively accessible in select regions. As of September 2024, it can be found in the United States, the United Kingdom, and several Southeast Asian countries including Indonesia and Singapore. Users can purchase products directly through shoppable videos and live streams embedded in their “For You” feeds. TikTok Shop includes several key features:

- Shoppable Videos and LIVE Streams: Buy products featured in videos and live streams directly from the content they engage with.

- Product tagging: Creators can tag products in their videos, making it easy for viewers to find and purchase items.

- Brand portfolios: Businesses can create product portfolios accessible from their TikTok pages.

- Dedicated shop tab: A new tab on the home feed provides a centralized shopping experience.

- Shoppable ads: Advertisements within the app are now fully shoppable.

- Fulfilled by TikTok: This logistics solution offers packing and shipping services, allowing TikTok to handle product deliveries directly.

Within the US region, TikTok Shop has already seen substantial growth, with over 500,000 merchants selling to American users by the end of 2023. TikTok is also reportedly planning to launch the e-commerce feature in Mexico, France, Germany, Italy, and Spain. However, this expansion comes with stricter criteria for merchants, such as requiring locally registered entities and limiting certain product categories like food and jewelry.

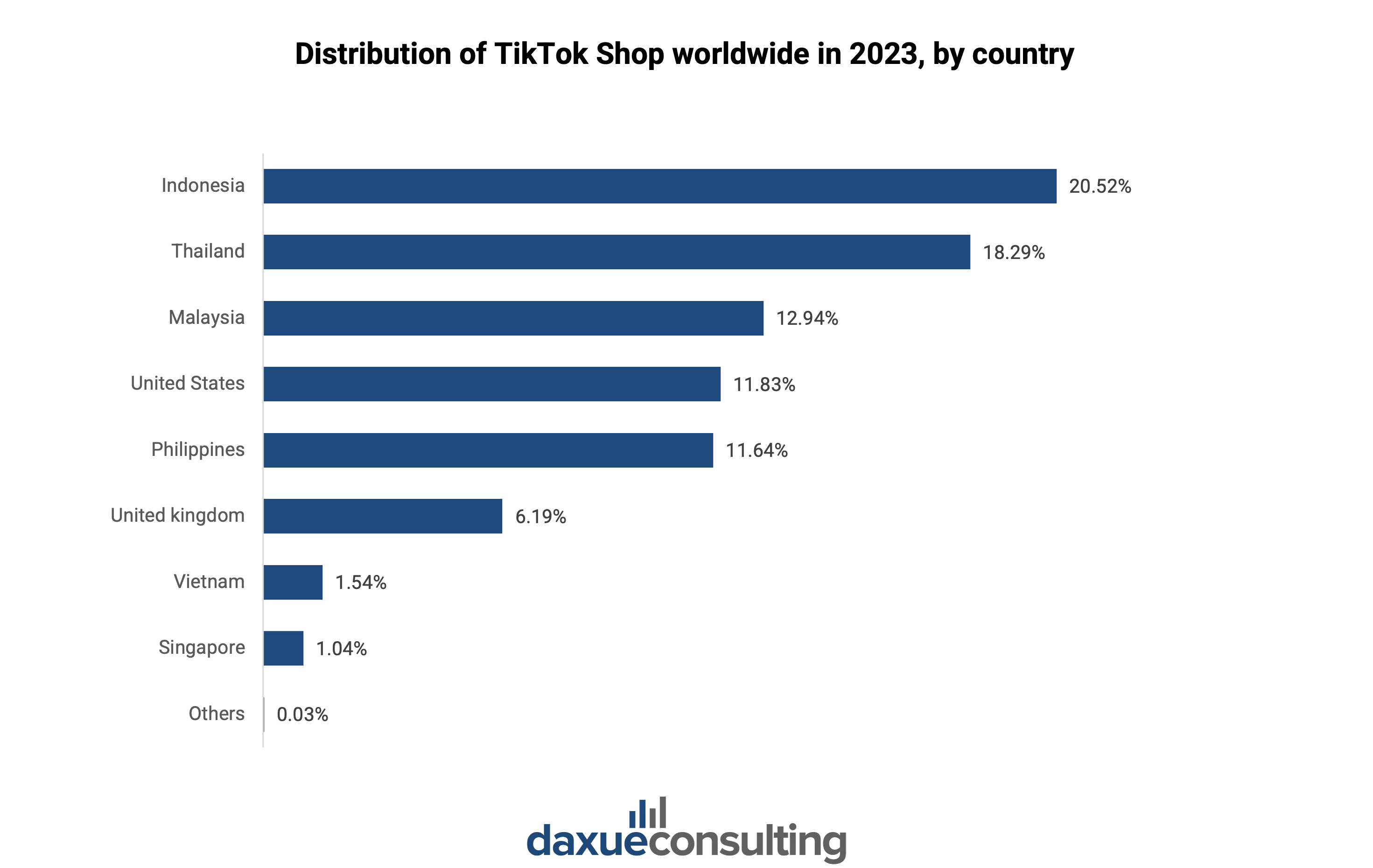

TikTok Shop is most popular in Asia, particularly Indonesia (20.5%), Thailand (18.3%), and Vietnam (17%). The US follows at 11.8%, with the UK trailing behind at 6%.

While TikTok Shop shows great promise, it faces significant challenges. In the US, regulatory scrutiny and potential bans pose threats to its operations. TikTok and ByteDance are currently fighting a federal law that could force them to divest or face a nationwide ban. Additionally, the European Union is investigating TikTok for potential breaches of online content rules, which could impact its operations.

Douyin taking a further step with food delivery

On 2023’s 618 festival, Douyin expanded its e-commerce offerings within the app, introducing multiple self-operated businesses. On January 28th, 2023, the platform launched its “Douyin supermarket” (抖音超市) and a self-operated beauty products store, allowing users to purchase items promoted during the event directly on the short-video app.

In addition to beauty items, the the short-video platform now offers a fast-fashion shopping section called “飞云织上” (Feiyunzhishang), as well as a section dedicated to selling wine, called “抖音电商酒类旗舰店” (Douyin e-commerce alcohol flagship store).

Taking a step further, in early 2021, Douyin entered China’s local services market, dominated by Meituan and Ele.me. Douyin offered group-buying discounts for restaurants and hotels, charging merchants a lower commission than competitors. They also launched mini-programs for food delivery (Heartbeat Takeaway) and travel booking (Mangosteen Travel).

Douyin partnered with existing delivery platforms (Meituan, Ele.me) to offer takeaway options within the app. They also experimented with in-house delivery through partnerships like MissFresh.

By July 2022, Douyin’s local services expanded to 33 cities and offered various services including food, massage, supermarkets, and travel. They created a “same city” channel where local businesses could promote themselves. Douyin’s success led competitors like Kuaishou to enter the local services market as well. Kuaishou partnered with Meituan but hasn’t achieved the same GMV as Douyin.

The difference in popularity of live shopping and KOLs

Douyin also maximizes its leverage of in-app sales power. Brands in China partner with celebrities (KOLs) and everyday influencers (KOCs) to sell directly on Douyin’s robust e-commerce platform. This Douyin marketing approach thrives because Chinese users are accustomed to in-app purchases. In Asia, and especially China, live shopping is especially popular.

On the other hand, TikTok lacks a robust in-app e-commerce network, relying mainly on famous influencers for product promotion. In the first half of 2022, TikTok attempted to introduce live commerce in the UK and other European countries. However, the initiative faced challenges as influencers did not support the project, resulting in a flop. This was primarily due to the fact that Western users are not accustomed to this type of purchasing method, especially considering that the TikTok user base predominantly consists of younger individuals with lower purchasing power.

Adapting to regional preferences: Lessons for TikTok

Western platforms can enhance in-app purchasing capabilities and product tagging to streamline the shopping experience. Partnering with local service providers offers a range of in-app services, increasing the platform’s value and relevance to users. Understanding and adapting to user preferences in different regions is crucial for tailoring content and features that resonate with diverse audiences. Utilizing a mix of famous and everyday influencers to drive sales can leverage the trust and authenticity these influencers build with their audiences Additionally, proactively addressing regulatory challenges is essential for ensuring smooth operations and maintaining compliance with local laws.

Douyin vs TikTok: A tale of two platforms

- Douyin launched in September 2016 in China and became the second most used social media platform in China by January 2023. Meanwhile, TikTok launched internationally in September 2017 and rose to become the second most popular platform globally by January 2023.

- Douyin is accessible beyond China but primarily has a Chinese user base while TikTok is inaccessible in China.

- Douyin has a robust in-app e-commerce platform with partnerships with KOLs and KOCs, and it has expanded into local services and food delivery.

- TikTok Shop is available in select regions and includes features like shoppable videos, product tagging, brand portfolios, and fulfilled by TikTok logistics.

- TikTok Shop is most popular in Asia, particularly in Indonesia, Thailand, and Vietnam.