Through mobile shopping, e-commerce is expanding into the countryside alongside grocery delivery in China.

Recent news of Amazon.com’s intent to buy Whole Foods Market, an American offline grocery chain, has sparked speculations that the US e-commerce giant is making a move to “catch up” with its Chinese counterparts. With little doubt, grocery e-commerce in China is already far ahead that of the United States.

To this point, however, some may be wondering––Chinese online retail platforms may be running ahead, but to where exactly are they headed? Thus, in the following article, Daxue Consulting presents a road map of Chinese e-commerce’s way into groceries via the mobile platform.

China has been the largest online retail market since 2013, and will remain so into the near future, according to our research. By 2015, for instance, China already accounted for 40.2 percent of global e-commerce sales. Moreover, towards the end of the same year, the country observed 413 million e-shoppers. Thus, the country already has a robust basis for the development of online grocery business.

As recent as 2014, the Chinese e-commerce market is led by Alibaba (阿里巴巴) with a total trading volume of 2.3 trillion yuan, which constituted 81.5 percent of the market, according to our research.

One of the company’s online shopping platforms Tmall.com (天猫) holds almost 50 percent of e-commerce market shares across all categories, said Clément Mougenot, Research Director at Daxue Consulting. A runner-up to the website is JD.com (京东), with a share of approximately 20 to 30 percent.

Although market shares of e-commerce in China is very concentrated in the hands of Alibaba at present, the rise of other B2C platforms may weaken the company’s superiority over the next few years, according to Clément Mougenot, Research Director at Daxue Consulting. Photo credit: Daxue Consulting

Concerning market growth, additionally, our research showed that the Chinese online retail market had increased by 3 trillion yuan between 2010 and 2015, escalating to 3.8 trillion yuan towards the end of the period.

Clearly, China’s e-commerce market displays great potential for businesses and investors. Questions remain, however, as to the precise locales at which opportunities are concentrated in this vast market.

Thus, on the request of a global food retailer which operates more than ten thousand locations in Europe alone, Daxue Consulting conducted a comprehensive research to identify strategies and map key characteristics of online grocery commerce in China.

Here are some of our main findings based on the country’s consumption behavior, demographics, and product preferences. These results are derived from a series of extensive desk research, in-depth interviews, surveys and focus groups.

Why is online grocery delivery in China winning?

Concerning future e-commerce growth points by product category, our research indicated that businesses should pay attention to food and beverage. In 2015, this category had been the second most purchased on the web, following the apparel category. Yet more importantly, it was the most popular category on mobile e-commerce as of the same year.

The estimated compounded annual growth rate for online food and beverage retail between 2015 and 2020 is 22 percent.

This trend is in part a result of mobile e-commerce. According to our research, consumers on mobile devices have a higher tendency to buy grocery online compared to consumers on other devices. The phenomenon may be explained by the relative convenience of buying immediately needed and non-complex products via the mobile phone.

Purchasing groceries, for instance, is often a time-limited activity and generally does not require consumers to have an in-depth evaluation of different products’ unique features. Thus, buyers are easily able to make choices and purchase products anywhere and anytime via their mobile devices. Additionally, e-commerce often offers lower pricing and a greater diversity of options.

It is also important to note that Chinese consumers display a rather high propensity to shop for groceries online. According to reports by a global market research company, 40 percent of Chinese consumers are willing to purchase food online. The same figure sits at ten percent in the US.

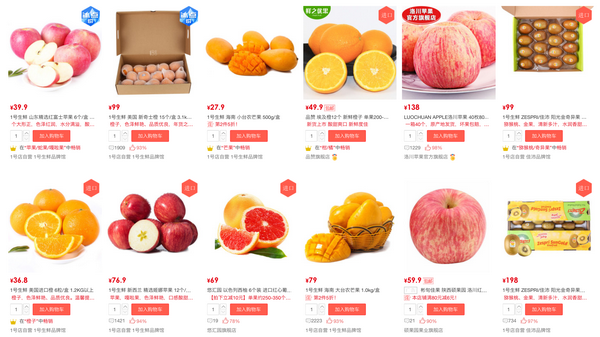

With regards to the market’s major players, on the other hand, our research showed that Alibaba’s Taobao.com (淘宝网) and Tmall.com, alongside Yihaodian (1号店) are consumers’ favorite destinations for e-commerce grocery delivery in China. The following are three winning points by which these platforms are pushing forth against offline competitors.

The demand for convenience

According to Mougenot, e-commerce giants such as Alibaba thrived in the Chinese grocery market because they are convenient. Due to the high frequency at which groceries are needed by consumers, swift delivery and convenience are key to the business.

“Of all product categories, Chinese consumers buy fresh and packaged food with the highest frequency, at 24 and 34 times a year, respectively,” Mougenot said. “Generally speaking, it takes less than two to three days for a customer to receive a product. And in the case of JD.com or Yihaodian, they would receive it on the same day.”

An array of fresh fruit as offered by, Yihaodian, one of China’s most popular online grocery platforms. Source: Yihaodian

In fact, our research showed that due the country’s advancing logistic system, China’s consumers have come to view speedy and reliable delivery as a normal expectation with which they evaluate e-commerce platforms.

The advantage of lower prices

At the same time, a global market research company found that while e-commerce grocery delivery in China have also been winning over consumers through online-only promotions and low prices, China’s offline grocery stores are facing slow growth accompanied by rising rents and labor prices –– both of which contribute to higher product costs.

Last year, for example, the turnover of Lianhua Supermarket (联华超市) decreased by 2 percent, and Carrefour China is continuing to lose money, according to the retail information platform Linkshop.com (联商网). Pressured by competition, some offline supermarkets have begun to set up their own e-commerce windows.

A growing taste for imports

Even so, well-established online shopping platforms are preferable to China’s increasingly cosmopolitan and health-conscious consumers for their wider offering of foreign products.

The search for safety

More and more consumers in China are now willing to pay more for imported foods due to the country’s issues of pollution and numerous food safety scandals.

According to our research, up to 68.3 percent of Chinese e-consumers bought imported food via their mobile phones in 2015. In agreement with this fact, we also found that only ten percent of consumers surveyed believed that products sold by imported food retailers are vulnerable to food safety issues.

In 2015, as many as 53.1 percent of consumers in China purchased imported fresh food online, according to a global market research institution. Additionally, within the fresh food segment, seafood and fruit are most popular, our research showed.

Familiarity with foreign goods

Further reinforcing this taste for imports in China are the country’s increasing number of citizens with overseas experiences. In 2015, as many as 128 million Chinese went abroad, our research found. In the same year, this figure had a compounded annual growth rate of 15.66 percent.

Meanwhile, China’s up to 400 thousand students returning from foreign countries have also brought with them a preference for foreign products they used during their time abroad. According to our research, this group is likely to stick with certain foreign products even after having returned to China.

Therefore, it is clear that a China increasingly open to global connections will see increased demand for imported goods, while the convenience of mobile shopping and improved logistics continue to encourage online grocery shopping.

A market young and changing

Presently, however, no more than 2.5 percent of China’s consumers shop online for groceries, signifying that the business is far from mature, our research found.

This said, the ecosystem of online grocery shopping has yet to settle, and China’s e-commerce giants are engaged in a race to establish integrated supply chains that incorporate grocery businesses both online and offline.

Since 2015, Alibaba has invested more than $9.3 billion in the offline supermarket and department store business, according to a June 22 article by Reuters reporter Cate Cadell

Similarly, in 2016, Alibaba’s rival JD.com also bought a $1.5 billion share of Yihaodian, Cadell added.

Rural China, the next frontier of e-commerce

Meanwhile, a demographic evaluation by Daxue Consulting showed that––not surprisingly––young and urban populations characterize a large portion of China’s e-consumers. With regards to the next major growth point of Chinese e-commerce, however, it is in fact the countryside that will take a lead through mobile shopping.

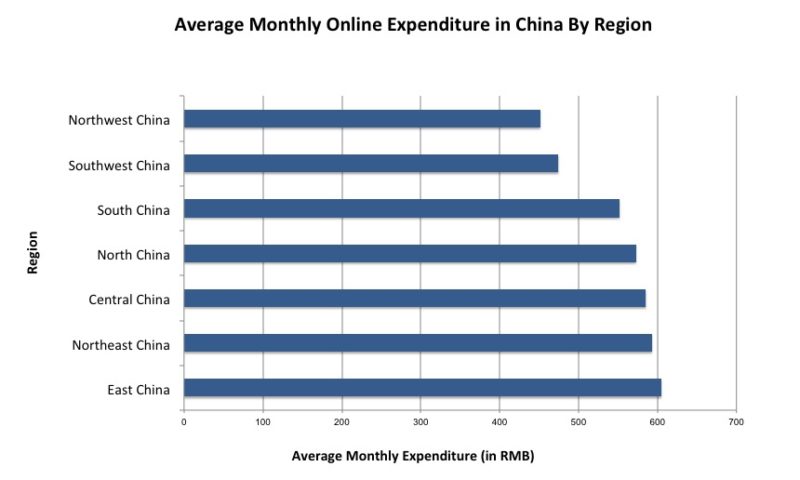

The highest and lowest monthly online expenditures are found in the East and Northwest of China, respectively. Source: Nielsen

At present, the demographic distribution of China’s online consumer pool is dominated by youth below the age of 30, our research found. Owing to their ability to accept fast-changing technologies and explore innovations, this younger generation account for more than 40 percent of the Chinese e-commerce market.

At the same time, populations living in the highly urbanized East China spend the most money shopping online, thanks to well-developed e-commerce infrastructure. According to our research, this group spends approximately $88 per month shopping online.

Residents of rural areas such as Northwest China, on the other hand, tend to spend much less money online. At $66 per month, residents of Northwest China spend the least on e-commerce compared to other regions in China, our research found.

Aside from the two extremes mentioned above, the average monthly online expenditure is $69 in the Southwest, $81 in the South, $84 in the North, $86 in the Central Region and $87 in the Northeast of China.

Daxue Consulting anticipates that the main growth point of e-shopper scale expansion is located in the Chinese countryside. More specifically, this expansion will be characterized mainly by an increase in the rural mobile-shopper scale.

In part, this opportunity is a courtesy of the Chinese government, which has issued multiple policies that will increase Internet penetration and ease e-commerce delivery in the country’s less urbanized regions.

Meet mobile e-commerce––the driver behind online groceries

In terms of user habits, however, it is ultimately the trend of mobile shopping that has lead the way for e-commerce expansion into both groceries and the rural areas.

“(In China,) there are more people shopping on their smartphones than there are people shopping on desktop PCs,” said Daxue Consulting Senior Project Leader Sung, Min Chun.

According to Sung Min Chun, Senior Project Leader at Daxue Consulting, convenience is a major winning point of mobile shopping. Photo credit: Daxue Consulting

According to our research, 82 percent of China’s e-commerce customers in 2015 were mobile shoppers. This figure has experienced a year-on-year growth rate of 20 percent over the previous few years. Clearly, a migration of online retail onto the mobile platform is underway.

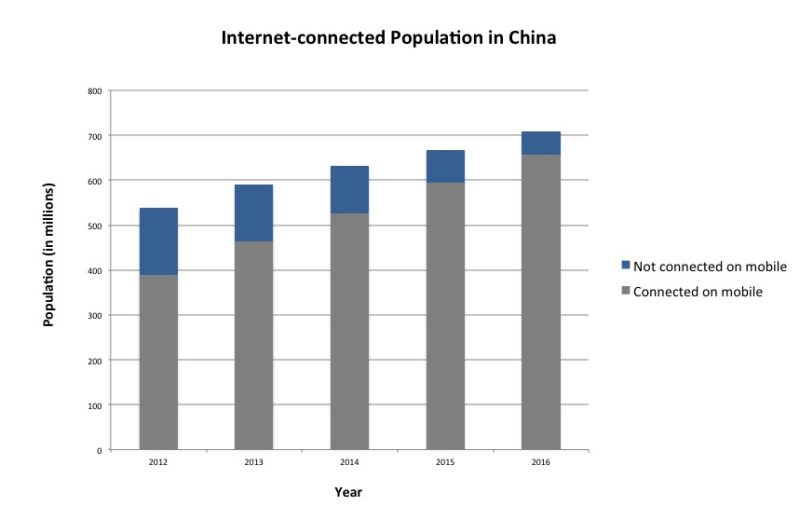

The Internet-connected, and specifically mobile-connected population in China has grown over the past few years. Source: CNNIC (中国互联网络信息中心)

Between 2012 and 2016, the country’s total number of Internet users grew from 537.6 million to 709.58 million, while mobile-connected users increased from 388.25 million to 656.37 million.

In line with this fact, we have also observed that the mobile e-shopper scale in 2015 grew by 43.9 percent, reaching 340 million. Furthermore, the growth of mobile e-shoppers was thrice as fast as the general growth of the e-commerce customer pool.

In 2016, Daxue Consulting also found that the sales scale of online retail through mobile phones constituted 49.4 percent of China’s e-commerce. We estimate that mobile shopping will have become the mainstream means of online retail by the end of the decade.

This rapid rise of business via mobile phones in China may be partially attributed to the country’s considerable advancements in Internet access speed for portable devices.

Also favoring this trend is the increase of smartphone and tablet penetration among the Chinese population throughout recent years. Not to mention, the arrival of mobile third-party payment platforms such as Alipay (支付宝) and WeChat Pay (微信支付) was instrumental to a convenient mobile-shopping experience.

In response to this phenomenon, retailers have begun to migrate onto mobile phones by developing increasingly user-friendly mobile applications and promotional sales exclusive to mobile users, our research found. To keep up with e-commerce, it is now vital for businesses to establish presence on a mobile platform.

Bound to the Home-field: The limitations of Chinese e-commerce

On a final note, despite China’s online businesses are moving fast in their domestic market, they may not necessarily be at advantage on the international playing field.

Access to payment methods is one major challenge. Third-party payment platforms commonly used by Chinese online businesses, such as Alipay and WeChatPay, are exclusively available to those living in China with a Chinese bank account, according to Chun.

Third-party payment platforms such as Alipay and WeChat Pay have become integral elements of e-commerce in China. Source: CHINAZ.COM (站长之家)

“Without a bank account in China, you simply cannot enjoy the services of Alipay and Wechat Pay,” Chun said. “You are required to go through the tedious process of entering credit card details. In this case, you might much rather just buy from the shop downstairs of your apartment.”

It is also important to note that, there currently exist some limitations to online grocery shopping. For one thing, e-shoppers cannot touch or smell food online as they would in a supermarket. And needless to say, some fresh products are not easy to deliver, such as fresh fruit or fish.

Logistics may prove even more difficult for Chinese e-commerce platforms in the process of internationalization, according to Mougenot, adding that it is yet uncertain whether or not these companies can successfully create a system abroad that matches that of China’s in efficiency and profitability.

Chinese players like Alibaba and JD.com may have been first movers in many aspects of e-commerce. Their capacity to maintain this lead on a global level, however, remains under observation.

LEARN MORE ABOUT THE FRESH FOOD MARKET IN CHINA

See also agile methodology china