Customer experience in China is defined by an exceptional level of after-sales services and sophisticated loyalty programs that are integrated into both e-commerce channels and social media. WeChat has long been the main channel for customer experience and retention in China. Customers can learn about brands’ events and new releases through WeChat mini-programs, public accounts, video accounts, and even the chat function.

However, in addition to WeChat, many brands also took advantage of new technologies to offer personalized, responsive, and immediate interactions with customers. Moreover, they kept on looking for creative ways to appeal to new and old customers as well as to make their buying process more convenient and pleasing.

Digital integration allows a smoother customer experience in China

Chinese consumers prefer to use technology when shopping. Mobile payment solutions took down cash and credit cards and imposed themselves as the most used payment methods in China. Beyond making the purchasing process more convenient and faster on the customer side, the adoption of e-payments also allowed merchants to generate more sales opportunities. Nowadays, people are not used to carry large amount of cash with them. Therefore, customers might turn their back on restaurants which only accept cash.

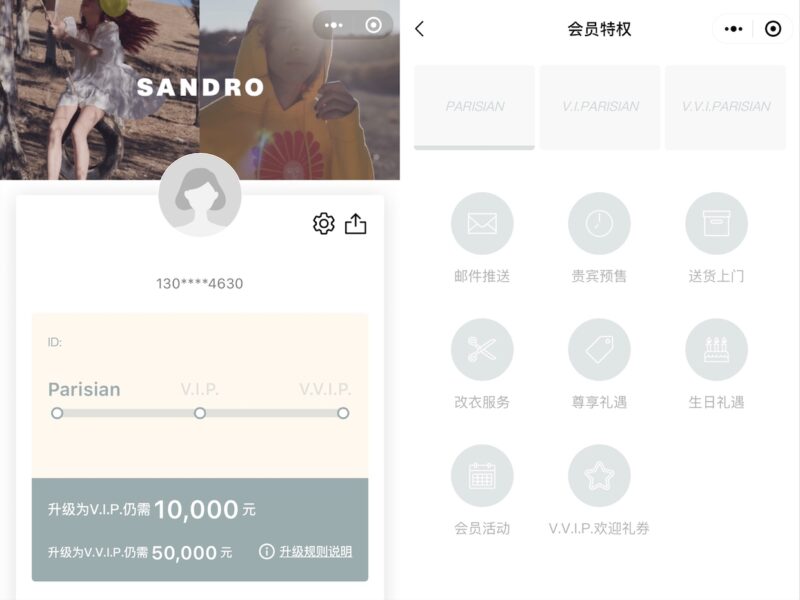

Furthermore, digital integration reduced waiting time for customers. SMCP – the fashion group owning Sandro and Maje – increased the efficiency of its VIP registration process by using mini-programs. It usually took 3 minutes to record consumer information manually. Now it takes less than half a minute to register a new member, and premium customers can accumulate shopping rewards by simply showing their VIP QR code. They can also view how much they have spent and their tier benefits, such as birthday gifts and priority choice during special events.

Starbucks heavily relied on digital tool to enhance its customer experience in China as well. Indeed, the US coffee brand allowed customers to order drinks from various platforms beyond the Starbucks app, such as WeChat, Alipay, and even AMap (高德地图), thereby drastically reducing queuing time and maximizing customer utility.

Drawing from Chinese culture can be a double-edged sword

Personal luxury sales experienced a 48% growth between 2019 and 2020 in mainland China since travel restrictions forced Chinese customers to buy domestically. Considering that China’s luxury market is bound to become the world’s largest luxury market by 2025, it is essential for international brands releasing new products featuring local elements to show their commitment to the Chinese market. Chinese Spring Festival and Qixi Festival, that is Chinese traditional Valentine’s Day, are popular great opportunities for brands to engage with their Chinese customers.

Dior was very wise in choosing the right Chinese influencer to promote its Chinese Spring Festival campaign. Chinese singer and actor Wang Junkai’s video showing him wearing items from Dior’s year of Ox collection generated over 2.6 million interactions on Weibo thanks to his young and devoted fan base. However, misrepresenting the Chinese culture can also lead to bad publicity. Dolce & Gabbana’s 2018 ad offers a valid example of how not to do a marketing campaign for the Chinese public: because of this PR mistake the Italian brand was banned from all e-commerce platforms in China.

Brands are making the buying process more entertaining

Technology has enhanced customer experience in China by introducing live streaming and virtual fittings.

Chinese digital economy experienced a 15% growth before the outbreak of the COVID-19 pandemic and was still able to generate a turnover of about 39.2 trillion RMB in 2020, 66.7% of which were generated by live commerce. Live streaming became one of the most popular channels for engaging with customer in China. Many brands have surfed this new trend and established ties with famous live streamers to sell their products via live commerce. On occasion of the Double eleven shopping festival in 2021, Jiaqi Li, China’s most influential live streamer, generated about 22 billion RMB in sales.

In contrast, some brands prefer to train in-house live streamers to cut the cost of hiring a famous one as well as due to the growing need for tailor-made offers, and the potential bad buzz generated by professional streamers. Self-produced live streams are more popular among brands because they have more control over product details and audience data. Moreover, launching self-produced live streams on their Taobao flagship store makes them rank higher on the platform. Last but not least, live streaming is a good way for brands to promptly answer any questions customers may have and ensure they are treated fairly.

AR helps customers choose the right size

Some brands also used Augmented Reality (AR) to bring some freshness into the purchasing process. This is the case of Berluti, who collaborated with JD.com to release an AR Shoes Try-on program allowing customers to try their shoes on from the comfort of their own armchair. Similarly, Armani’s virtual try-on powered by WeChat mini-program enabled users to try on different lipstick shades all with a click. This feature was even more convenient during COVID, since customers could try makeups on contactlessly and freely.

Both customers and brands can benefit from virtual influencers

Virtual Key Opinion Leaders (KOLs) are also an increasingly popular way to engage with Gen-Z consumers– the most novelty-loving consumer group in China. According to a 2019 report released by iQiyi, 64% of Chinese Gen-Z follow virtual KOLs.

Virtual KOLs usually have a very strong personal style. Thus, they especially fit products of a certain type. For example, Ling is a Chinese Artificial Intelligence (AI) influencer who is proud of and loves traditional culture, from Peking Opera to calligraphy. Such combination of classic and modern elements allowed her to feature with tea producers and even international jewelry brands like Bulgari.

Virtual influencers can mitigate the risk linked to celeb endorsement in China

Some brands, instead, opted for creating their own metahumans. Luxury brands are usually considered creative and stylish, so it makes sense for them to embrace virtual KOLs. By using virtual influencers, brands can also accessibly engage with the younger generations. For instance, Dior introduced Angela 3.0, a digital representation of Angelababy, at its 2021 Fall Ready-to-Wear show. The post of the event on Weibo generated about 21 thousand interactions. Followers of Angelababy and Dior commented that Angela 3.0 was really pretty and they were looking forward to her next presentation. In contrast, Mr. Ou is a virtual Chinese French entrepreneur created by L’Oréal working in the beauty industry. His good-looking appearance and international background resemble a lot to the main characters in comics young people like to read nowadays.

The main reason for preferring a virtual KOLs over flesh-and-blood ones is that brands can have a better control over the former. Virtual KOLs cannot behave unethically or make inappropriate statements. This can mitigate the risk of “Cancel Culture” in China. When Zheng Shuang, a Chinese actress, was blamed of surrogacy, planning to give away her babies, and tax evasion, her personal and professional accounts were frozen and all brands had to rush to terminate collaborations with her.

Metaverse grants a tailor-made customer experience in China

Metaverse is a virtual platform where customers can interact, socialize, and conduct transactions. Among Chinese young people, owning a Non-Fungible Token (NFT) is an increasingly popular symbol of art appreciation and tech-savviness.

Taobao adopted metaverse to promote its Double eleven shopping festival in 2021. For the occasion, it featured with AYAYI, a famous Chinese virtual KOL, to display products. Burberry was one of eight brands exhibited in the campaign. For the event, the British brand created a digital baby deer mascot and released 1,000 units of NFTs of such deer wearing a limited-edition scarf sold at RMB 2,900 each. Customers could access their NFT product via Alipay mini-program. The reasonable price made the NFT art accessible to a larger audience.

How brands are enhancing customer experience in China

- Electronic payment is highly valued in China for its convenience and high efficiency.

- While appealing to Chinese culture could generate a lot of buzz around the brand, it can also be very risky.

- New technologies can help brand maximize customer experience as well as grant customers a smoother and more entertaining journey.

- Virtual KOLs can be a powerful tool for brands to catch the attention of novelty-loving Chinese Gen-Z.