Since China began to produce cars in 2009, the local automotive market rapidly became the largest in the world, even surpassing the US in terms of sales and production. To this day, Chinese luxury car market is still very profitable, worth more than 160 million USD. In Q1 2022, Chinese car brands accounted for 42.9% of the total market share.

Who the main consumers are and how digitalization is boosting car brands

In 2021, the government has registered more than 443 million drivers in the mainland China. The pool of potential customers is huge. In an interview held by SCMP magazine in 2020, Jens Puttfarcken, the CEO of Porsche in China, declared that the average Chinese luxury car consumer is around 35 years old. Compared to the West, the average Chinese luxury car consumer is relatively young, considering that the average luxury car owner in the US is aged between 35 and 54 years old. Contrary to the rest of the world, in which most supercar consumers are males, he also stated that female luxury car buyers have a key role in Chinese luxury car market, especially concerning Porsche.

Chinese digital consumers are the main target of the luxury car sector. By leveraging the huge base of Chinese netizens, car brands often organize campaigns and advertisements to launch their newest car models, offer online sales of cars and raise consumers’ interest.

Western luxury car manufacturers are drawing attention of the Chinese market

European car brands enormously contributed to develop Chinese luxury car market. More than 4 million western luxury vehicles were sold in China in 2021.

Volkswagen was the first western company to ever build a plant in China. In 1991, the brand started collaborating with FAW, one of the biggest Chinese car manufacturers, to realise a jointed production of vehicles. Not only they produced luxury coaches and trucks, but also jointly built cars. The collaboration with such an important Chinese automaker helped Volkswagen penetrate the luxury car market with their own exclusive vehicles, such as Porsche.

Indeed, Porsche enjoys a dominant role in the local luxury car market. In 2021, The Volkswagen sportscar branch sold up to 95,671 vehicles in China, despite a 16% drop on the same year due to covid restrictions.

Other Western players in China apart from Volkswagen

Following the success of Volkswagen luxury cars in China, other brands have tried to emulate the German group in the Chinese market. In 2003, the joint venture between BMW and Brilliance group was formed, resulting in the BMW Brilliance automotive Ltd. In 2021, it turned into the biggest western premium car manufacturer in China, with a production of more than 815,000 vehicles.

Two years after the establishment of BMW Brilliance, another German competitor tapped into China’s luxury car market. In 2005, the Beijing Benz Automotive (BBAC) joint venture was formed. Their production of passengers and premium cars exceeded 758,000 units in 2021, converting the company into one of the biggest western luxury car manufacturers in China.

Following the Italian “Dolce Vita”: Ferrari and Lamborghini in China’s luxury car market

China, Taiwan (China) and Hong Kong combined represent Ferrari’s 4th most profitable markets. In 2021, the Italian luxury car company sold a total of 899 units in China, doubling the pre-pandemic sales. Their presence is so strong in the country that in 2008, Ferrari decided to create the exclusive “Ferrari owners’ club of China” in Shanghai.

Lamborghini is also another important Italian player in the Chinese luxury car market. In 2021, China was the 2nd biggest market in terms of shipment for the brand. They sold a total of 935 units, with an increase of 55% from the pre-pandemic years. In 2022, Lamborghini also organized the 8th “Lamborghini Esperienza Giro China” for its most loyal consumers. The grand tour consisted in a 1,100 kilometers travel through China during which Chinese Lamborghini customers can enjoy a memorable journey across the landscapes of China. In 2022, the event attracted a group of 40 Lamborghini owners.

The rise of electric vehicles in the luxury car market

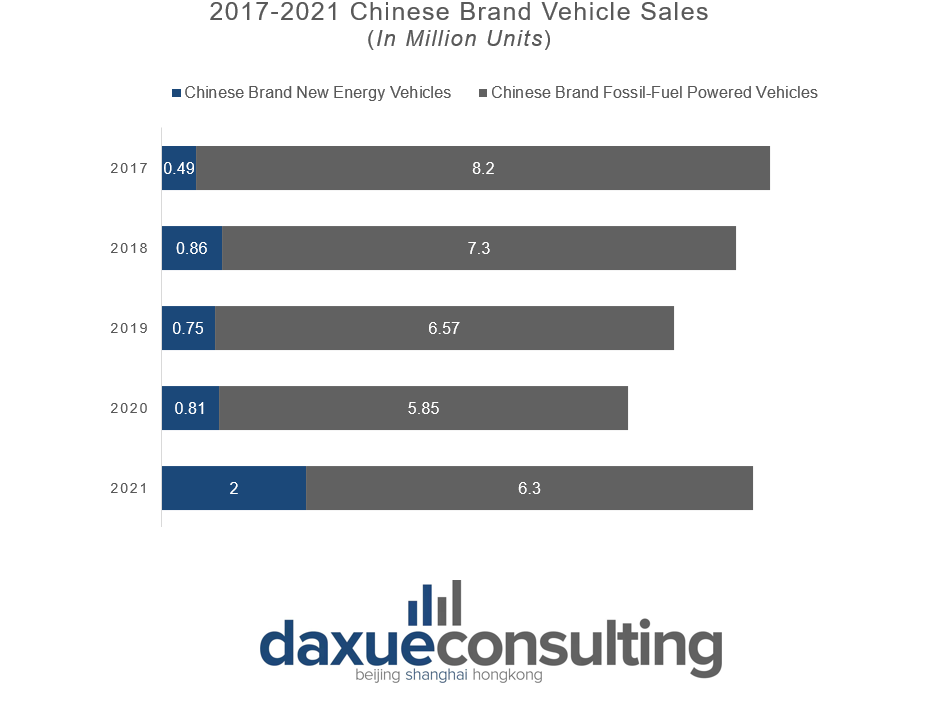

Electric Vehicles are a relatively new market segment which is attracting the attention of many consumers in China, even in the luxury cars’ world. In Q1 2022, the domestic Chinese sales of EV were 1.257 million units, and the sales of the brand-new energy vehicles surpassed 679 million units. The American company Tesla, specialized in electric cars, gained lots of popularity in China as a luxury vehicle. However, BYD surpassed the US brand in the sales ranking doubling Tesla’s sales and reaching 282,000 vehicles sold in Q1 2022.

To keep up with the competitors, Tesla has opened a Gigafactory near Shanghai which started functioning in 2020. Since then, it has produced more than 120,000 cars per year.

Lately, the perception of Tesla as a luxury car has changed. At the beginning of 2023, the American company decided to cut the prices of their cars in China to create more affordable vehicles for the market. In this way, Tesla would have not been seen as a luxury car anymore, making the brand more accessible to the average Chinese consumer. As an example, the model 3 went from 39,000 USD (265,900 RMB) to 33,400 USD (229,900 RMB). This strategy is fundamental for the company to keep up with the lower prices of the inland EV manufacturers such as BYD.

Western petrol-headed players are launching their premium EV in the Chinese market

Even companies which base their entire history on the petrol engine have started developing their own electric vehicles in China. In June 2022, the BBAC has started the production of its fully electric EQE for China’s luxury car market. The production chain is totally based in China, even the batteries are manufactured by BBAC in Beijing’s main factory. The first model of the line which went out of the factory represented the 4 millionth vehicle produced by the German and Chinese alliance company.

BMW is also another western brand which in 2022 has launched its fully electric car, the i3. However, the brand had to face a severe competition against other EV producers. BMW’s main weak point is the high price, so the vendors offer discounts of more than 80,000 RMB. Another reason for the decrease of prices is to get rid of the old models before the announcement of the new i3, which was due to January 2023, but hasn’t been confirmed yet.

The rise of Chinese brands in the luxury car market

Chinese car manufacturers are determined to conquer the luxury car market. There are many automakers in China which are developing their own premium cars and their electric vehicles to defy well-established international names. On the other hand, homegrown brands tend to be weaker in the traditional car market as having a car is often considered a status symbol, and the average Chinese consumer prefers buying more expensive cars rather than economic domestically manufactured ones.

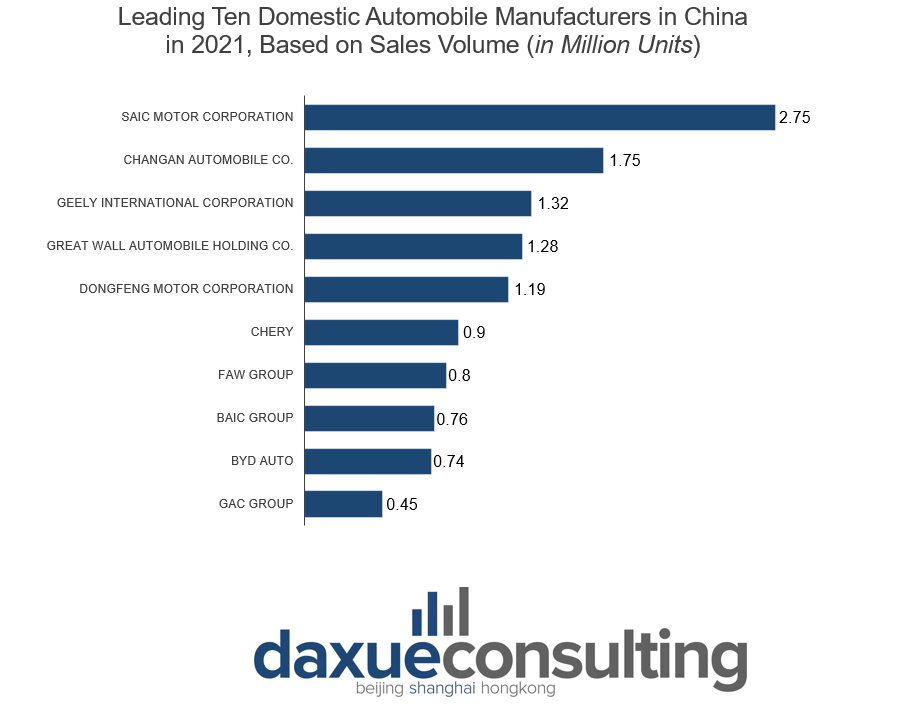

In 2021, Saic motors was the largest car manufacturer in China, selling approximately 2.76 million vehicles. The same year, Changan Automobile ranked second, with about 1.76 million vehicles sold. In 2022, Saic Motors was reconfirmed as the leader of the Chinese car market, with 5.3 million units. Some of these enterprises started to separate their mass and the luxury market lines by creating a sub-branch of more exclusive vehicles. In 2022, Changan Automobile launched Zhuge intelligence, the new Artificial Intelligence of the company which works as a data provider. The AI is characterized by 3 important technologies: intelligent interaction, intelligent driving and ecological cooperation. The first 3 luxury electric cars equipped with Zhuge Intelligence have been already announced in 2022, but they won’t be launched on the market until 2025.

FAW car company, another important luxury car manufacturer, has also announced their brand-new luxury supercar. In June 2022, the factory leaked some photos of what will be one of the most exclusive vehicles in China’s luxury car market: the Hongqi L90. The fame of the luxury car company also arrived in Europe. In January 2022, Hongqi first entered the Norwegian market with their luxury electric SUV, the Hongqi E-HS9. In December of the same year, the luxury car was also launched in the Netherlands. FAW unveiled the SUV during the 2022 Masters Expo, one of the most important and exclusive European business fairs.

The vast world of China’s luxury car market

- The luxury car market in China is one of the world’s biggest markets and represents a huge part of its economy.

- Since the 90s, many luxury car brands from all over the globe have tried to enter the Chinese market. BMW, Porsche, and Mercedes are only few of the manufacturers which created a huge business in the country.

- Chinese luxury car consumers are also developing a rising interest in Italian supercars such as Ferrari and Lamborghini, which have seen their sales rise after the pandemic.

- Electric vehicles play a key role in the luxury car market. Foreign brands such as Tesla and domestic automakers are the main players of this market sector whose popularity is increasing.

- Western players in China must withstand the competition of the domestic luxury carmakers. Domestic manufacturers are constantly innovating and announcing premium vehicles with the latest technologies, and already have a huge consumer base across China.

- Western brands are not the only ones trying to enter the Chinese market, but it is also the other way around. Chinese luxury car companies, such as Hongqi, launched their exclusive products in the European market, starting from Norway and the Netherlands.

Author: Lorenzo Linguerri